A reader asks:

What’s the incentive here to buy AAA Corporate debt vs. just buying U.S. T-bills that are yielding slightly higher and are risk-free? Is this normal?

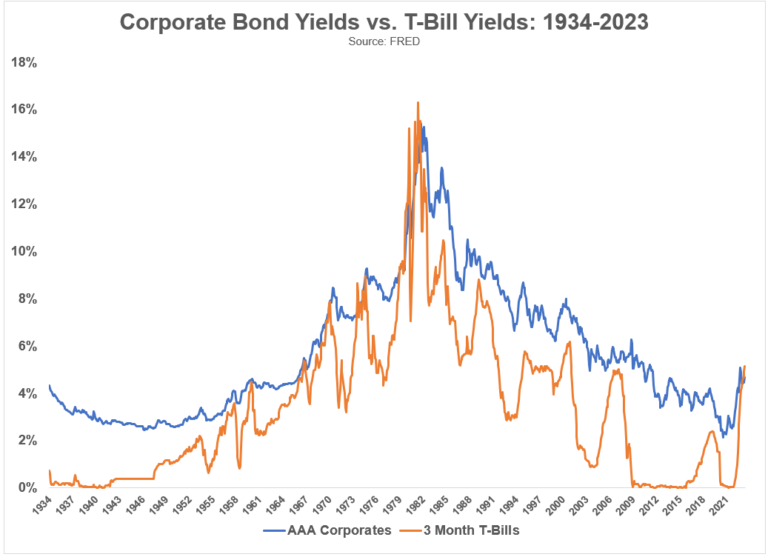

I have good data from the Federal Reserve on AAA-rated corporate bond yields and 3-month T-bill yields going back to 1934.

No, it is not normal for T-bills to yield more than corporate bonds:

Out of the nearly 1,100 months in this data, T-bill yields were higher than corporate bond yields in just 33 months. So we’re talking 3% of the time.

The other times this happened — in the early-1980s and 1970s — were also periods of rising interest rates and high inflation.

The average spread of AAA corporate bond yields over t-bill yields over this time frame is 2.4%.1

There is a reason for this spread.

Corporate bond yields should be higher than T-bill yields because corporate bonds are riskier.

Treasuries are risk-free in the sense that the U.S. government can print its own currency. There is far less risk of default — save for a gigantic mistake from Congress — in government bonds than with corporate bonds.

Corporate bonds default rates aren’t all that high but it can happen. Companies run into financial trouble all the time. You also have the risk of credit downgrades in corporate bonds which can impact their price.

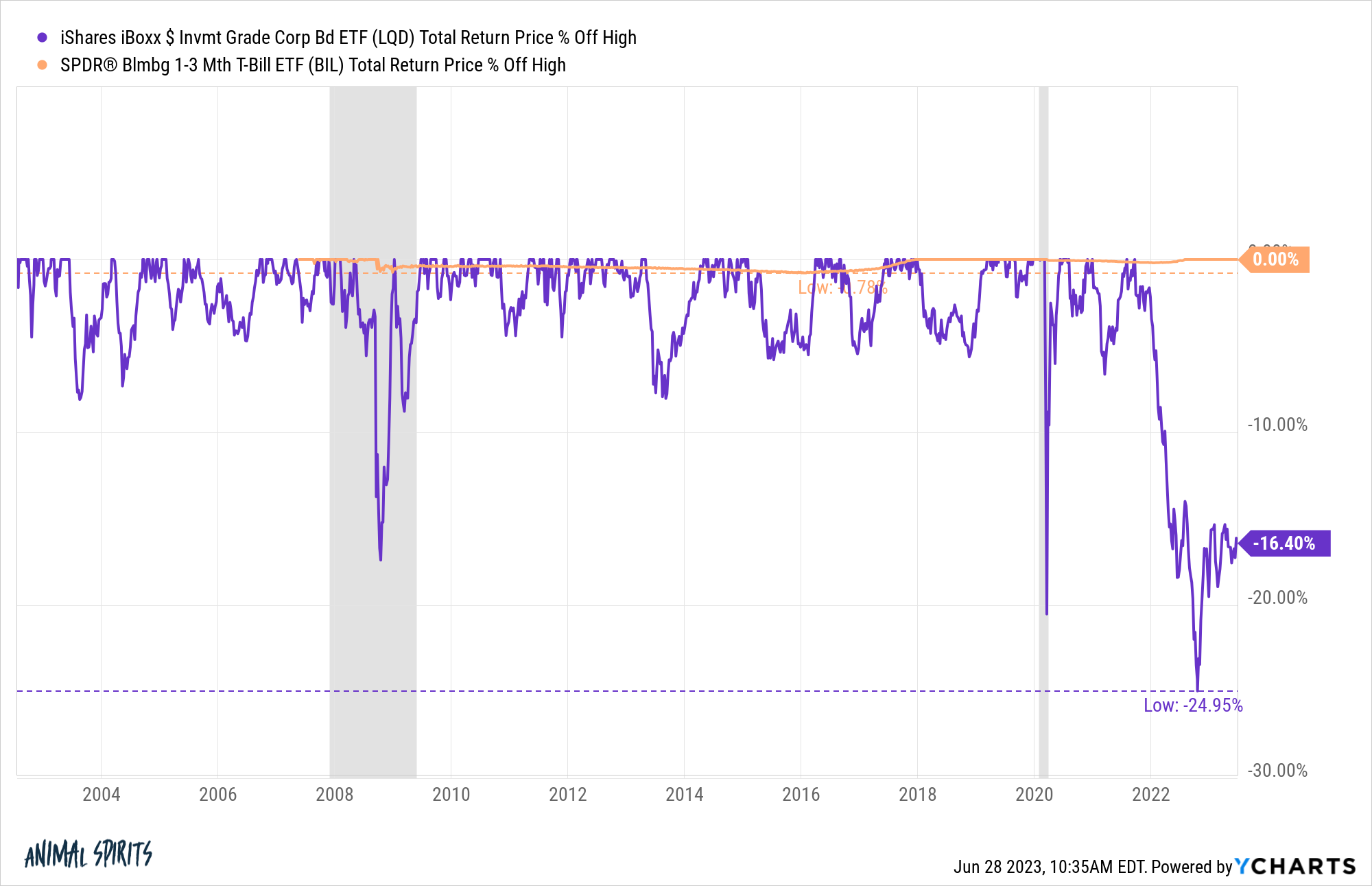

Plus, corporate bonds have a much higher drawdown risk in a recession or financial crisis situation. Just look at the drawdown profile of corporate bonds and ultra-short-term government paper:

Corporate bonds fell more than 17% during the 2008 crisis. They fell 20% during the Corona panic in March 2020. Then they crashed 25% last year during the Fed’s aggressive rate hiking cycle.

This is not exactly stock market risk but compared to T-bills this is a nightmare in terms of volatility.

Investors should get paid to accept default risk, credit rating risk and the risk of increased volatility.

But now we find ourselves in a situation where you get higher yields on T-bills than corporate bonds plus the expected volatility to changes in interest rates or investor panic is far lower.

It would be hard to make a compelling case for owning corporate bonds over T-bills right now, at least in the short-term.

However, I would still expect better long-term returns for corporate bonds. This abnormal situation brought about by the pandemic, government spending and Fed tightening won’t last forever.

Eventually the relationship between risk and reward will come back into balance.

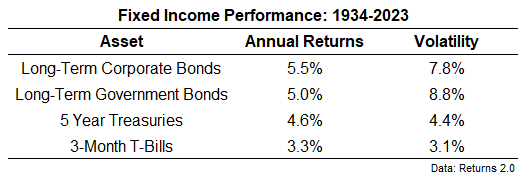

Here are the long-term returns for corporate bonds, long-term treasuries, 5 year treasuries and 3-month T-bills going back to 1934:

The order of these performance numbers makes sense both intuitively and in terms of finance theory.

Corporate bonds have experienced higher returns than long-term government bonds which have experienced higher returns than 5 year government bonds which have experienced higher returns than T-bills.

The shorter-term fixed income instruments have lower returns but also lower volatility.2

So right now, no it does not seem to make a whole lot of sense to invest in corporate bonds over short-term treasuries. You’re getting paid a higher rate for taking on less risk in T-bills. The Fed is giving savers and fixed income investors a gift.

The tricky part here is how to allocate the fixed income side of your portfolio going forward. Life will not always be this easy for the bond side of your portfolio. This T-bill yield premium cannot last forever.

It really depends on your appetite for risk and allocation changes.

Some investors are comfortable moving things around with their investments to earn the best risk-adjusted yield at any given time.

Others would rather keep a static allocation regardless of the market environment.

I don’t see a clear right or wrong answer when it comes to these kinds of portfolio management quandaries. You just have to do what works for you.

Risk and reward are inextricably linked over the long-run. But sometimes that relationship hits a rough patch in the short-run.

Risk and reward might take a break on occasion but that relationship always finds a way in the end.

We discussed this question on the latest edition of Ask the Compound:

Barry Ritholtz joined me this week to talk about questions on student loans, making financial decisions when you feel paralyzed, the housing market and more.

Further Reading:

The Biggest No-Brainer Investment Right Now?

1That spread hit more than 5% once ZIRP kicked in and spreads blew out in the financial crisis.

2I was a little surprised to see long-term treasuries slightly higher volatility than long-term corporate bonds but they’re not too far off.

Podcast version here: