There are two rules when it comes to stock market aphorisms:

(1) They have to be easy to remember.

or

(2) They have to rhyme.

Some classic examples:

Be greedy when others are fearful and fearful when others are greedy.

Buy when there’s blood in the streets.

The trend is your friend.

Don’t try to catch a falling knife.

Let your winners ride and cut your losers short.

Buy low, sell high.

Buy the rumor, sell the news.

Buy what you know.

Buy the dip.

Sell in May and go away.

Don’t put all your eggs in one basket.

Concentrate to get rich. Diversify to stay rich.

Skate to where the puck is going.

I’m sure I missed a few but this plays most of the hits.

One thing you should notice right away is many of these rules of sayings are in conflict with one another. I guess that’s what makes a market.

But it’s also important to understand that nothing works all the time. That includes rules of thumb, pithy one-liners and rhymes that make you feel all warm and fuzzy.

Here’s another one for the list that seems to be in a state of flux this year:

Don’t fight the Fed.

There was this idea in the 2010s that stocks were only going up because of the Fed. There was the Fed put. And the Fed was printing money. And the Fed was providing liquidity. And the Fed was blowing bubbles yet again.

If it wasn’t for the Fed the stock market would crash just like 1929!

Listen, I’m not here to tell you the Fed had nothing to do with the bull market of the 2010s. The Fed certainly made things easier on risk assets by taking interest rates to 0%.

But rates were even lower in Japan and Europe and they didn’t get a raging bull market during the previous decade.

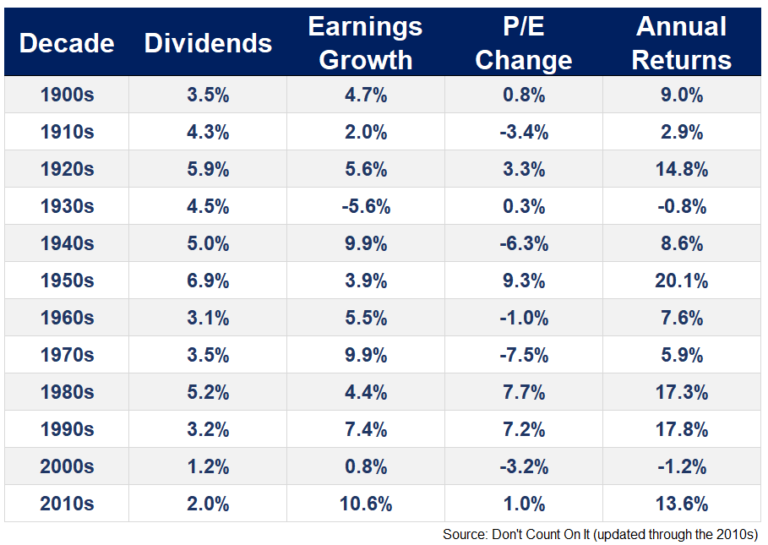

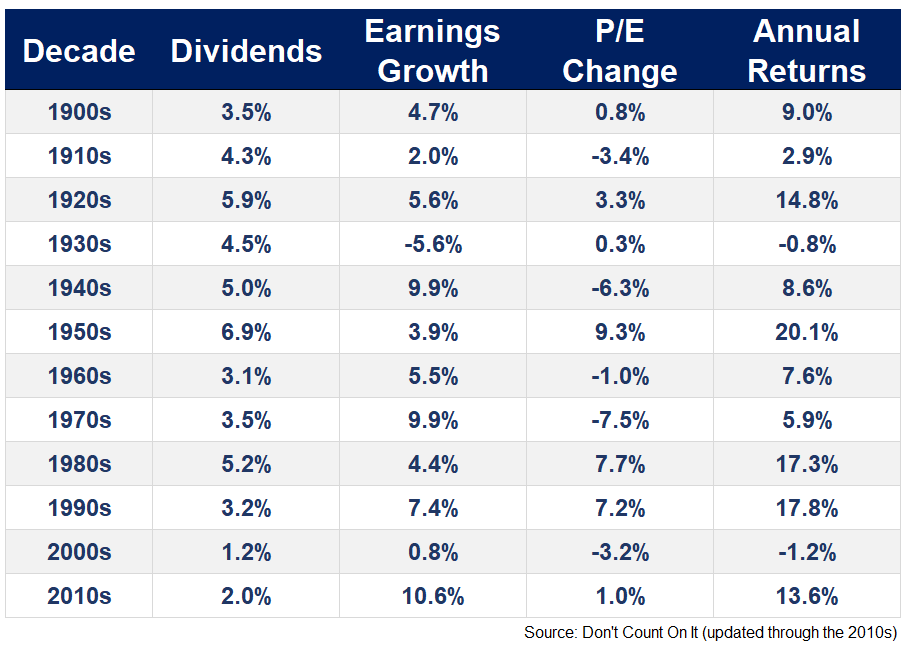

Plus, we have the John Bogle return formula that shows how fundamentals helped power the stock market in the last decade as well:

Low rates helped but so did the fundamental driver of long-run stock market returns — earnings growth.

Last year don’t fight the Fed made a lot of sense. They raised rates at a feverish pace and we had a bear market.

But a funny thing happened this year — the stock market started fighting back.

And not just any stocks. The biggest winners this year are tech stocks, the very companies most people assumed would have the biggest problem with higher rates.

The Nasdaq 100 is up almost 40% this year. The biggest tech stock in all the land — Apple — is up nearly 50% in 2023.

This is despite the fact that the Fed has continued raising rates, will likely raise them even more at the next meeting or two and they have shrunk the size of their balance sheet.

Most things in the markets (and life) exist in a state of gray, not black or white.

Rules of thumb can be helpful in certain areas of life.

But most of the time the stock market doesn’t conform to a phrase that sounds nice or seems like it should make sense.

The stock market doesn’t always need to make sense.

Sometimes that means the Federal Reserve doesn’t matter as much as you think when it comes to stock price movements.

Further Reading:

Are Rising Interest Rates Bad For Tech Stocks?