A lot of investors assume once you amass a large fortune that you’re welcomed into some secret club that unlocks the holy grail of investment opportunities.

Sure, there are plenty of really rich people who invest in excluding, expensive, complex strategies but the majority of the wealthy class has most of their money in normal asset classes like stocks and bonds.

Here’s a piece I wrote for Fortun about how the top 1% invests their money.

*******

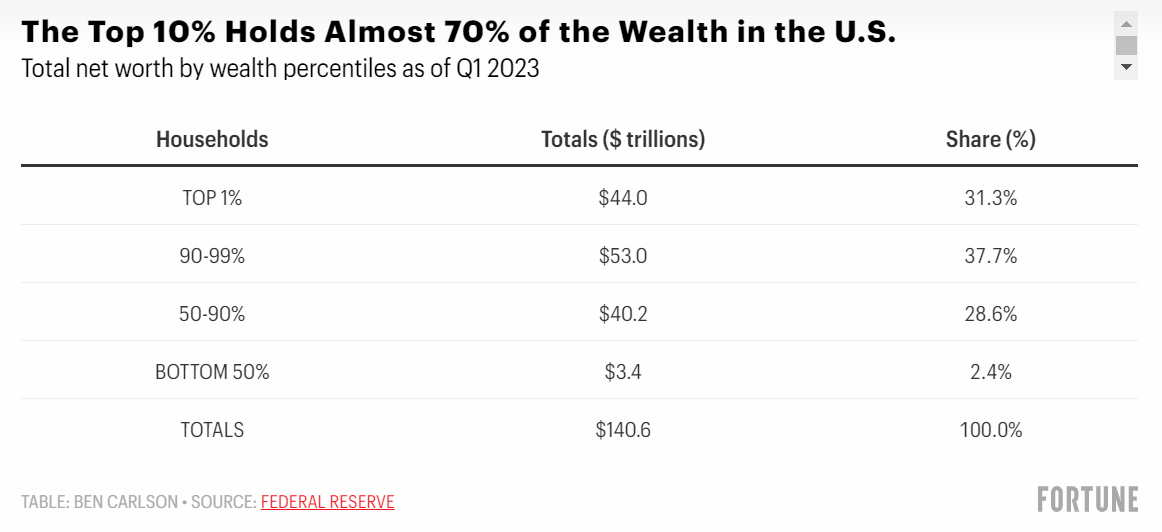

In 1989, the top 1% of households in the United States controlled a little less than 23% of the wealth in this country. That number has now reached nearly 32%. By contrast, the bottom 90% have seen their share of wealth drop from 40% in 1989 to 31% today.

The rich have gotten richer, and they are extending their lead.

You could explain this rising inequality on various government policies but there is an investing component here as well. Many people assume there must be secret investment opportunities reserved for the wealthy. Surely, once you make more money there are exclusive deals, alternative investments, and superior investment managers at your disposal?

This may be the case for a handful of investors, but if we look at how the top 1% and top 10% allocate their assets, it shows a much simpler path to wealth.

The top 10% holds nearly 70% of U.S. wealth:

These numbers from the Federal Reserve are broken down by net worth, which is simply calculated by taking the assets and subtracting the liabilities.

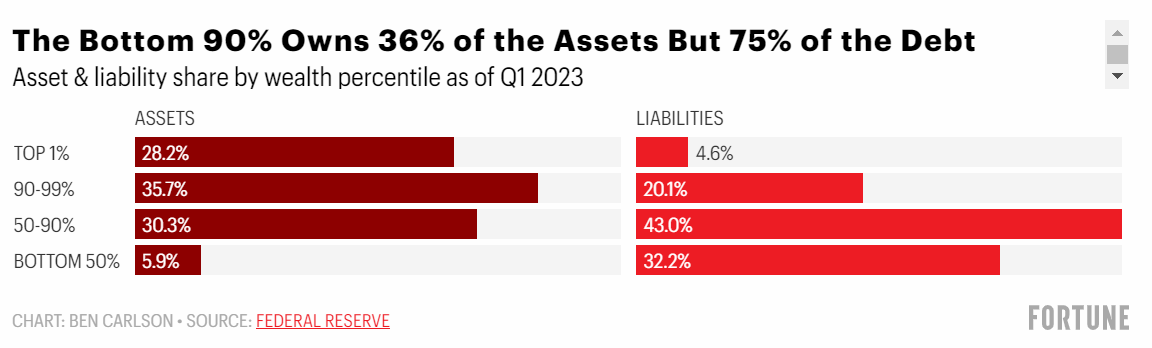

When we break things down by assets and liabilities, you can see that while the top 10% controls 70% of the assets, the bottom 90% holds 75% of the debt:

The bottom 50% by wealth percentile owns just 6% of assets but a whopping 32% of liabilities.

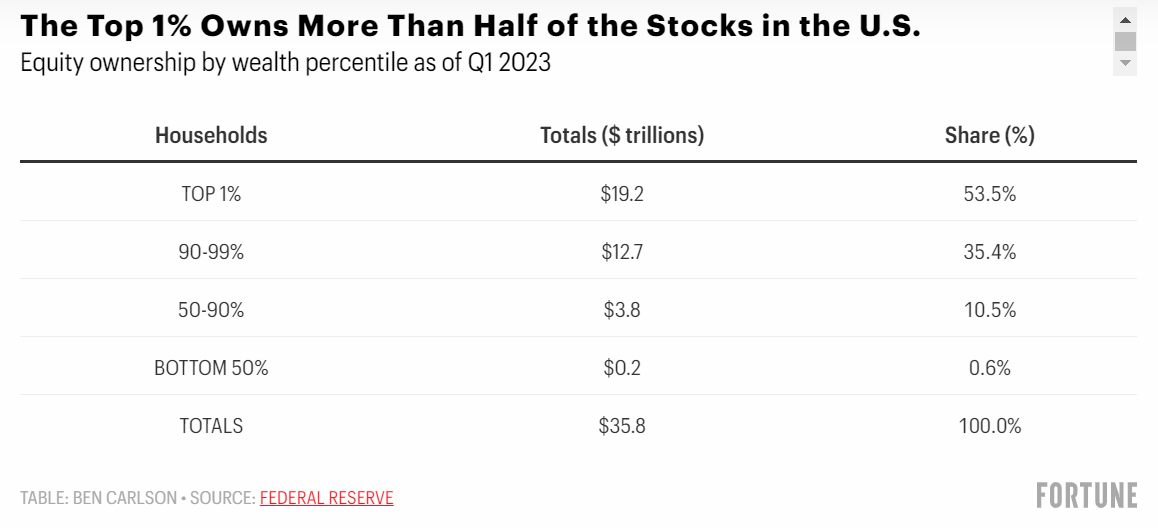

Ownership in the stock market is still more uneven. The top 1% owns more than 53% of stocks while the top 10% holds 89% of the total:

Stocks are the asset class that historically has the highest long-term returns so it makes sense that the gap between the haves and the have-nots has grown.

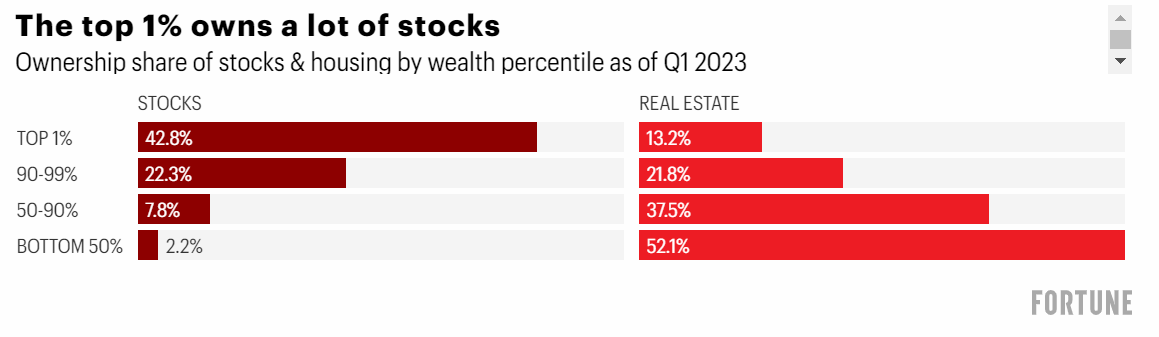

Things are far more equal when it comes to the housing market:

While the bottom 90% by wealth holds just 11% of the stock market, they control 56% of the housing market. The bottom 50% owns less than 1% of the stock market but nearly 12% of the housing market.

This helps explain why the liabilities for the bottom 90% are so much higher since most of these households have mortgage debts to repay.

You can get a better sense of the differences between the various wealth percentiles by looking at their allocations to stocks and housing relative to their total assets:

Housing makes up more than 52% of financial assets for the bottom 50% bu just 13% of total wealth for the top 1%.

The top 1% also has a higher share in things like cash, bonds, and private businesses. But you can see from the chart that most of their wealth is invested in the stock market, while housing is by far the biggest asset for those in the bottom 90%.

So what can we learn about investing like the 1% when it comes to how they allocate their assets?

Don’t concentrate your investments. While the bottom 90% has most of their wealth concentrated in a single asset–their home–the top 1% has a more balanced approach. A house will likely always be the biggest asset for the majority of Americans, but it’s important to diversify your money into other assets like stocks and bonds.

Don’t go into a lot of debt. There are good and bad forms of debt. Most of us need to utilize mortgage debt because not many people have that much money lying around in cash. But it’s important to note that debt compounds against your net worth much like stock returns compound in your favor.

Buy stocks. Not everyone has the ability to own their own business, but you can own a share of corporate profits by investing in the stock market. The stock market remains the simplest way to build wealth over the long term by riding the coattails of the biggest and best companies in the world.

This piece was originally published at Fortune.