A reader asks:

I’m anticipating needing to replace both the roof on my house and a car five years from now. I would like to have $100,000 set aside for these expenses. Five years out feels like an investment no man’s land. Stocks seem to be a bit risky at that time frame, and high interest savings, while attractive now, will likely have rates dropped if the Fed drops interest rates in the future. I’ve also considered doing something like a target date fund through a robo advisor and having it manage the stock and bond allocations, decreasing risk over time. I plan to dollar cost average throughout the next five years as I have funds available to save. Do you have recommendations for how to allocate savings given this time frame? Are there other options I should consider?

If we were looking at a lump sum the answer would be pretty simple right now. Put your money into a 5 year U.S. treasury bond yielding 4.5% or so and call it a day. That’s a pretty good return with a perfect asset-liability match for the future.

The fact that you’ll be saving money periodically until you reach you goal changes the equation a bit but we can still use that 5 year time horizon to think about investing in the stock market for this kind of intermediate-term goal.

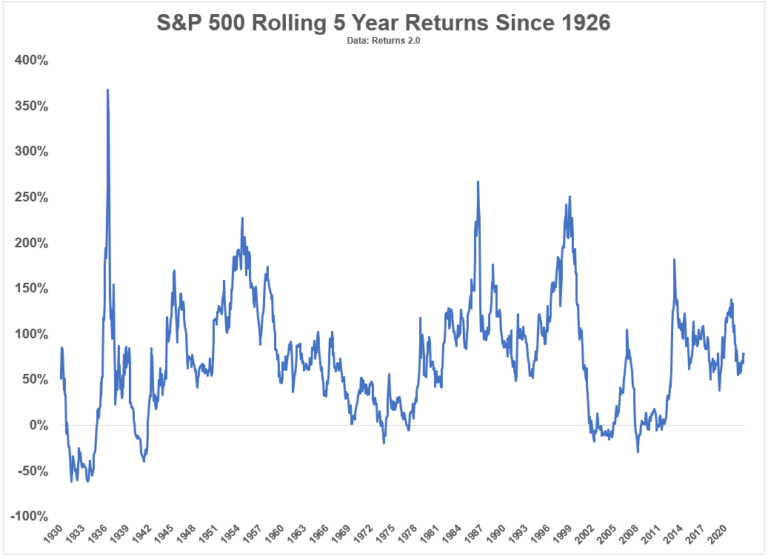

These are the rolling 5 year total returns for the S&P 500 going back to 1926:

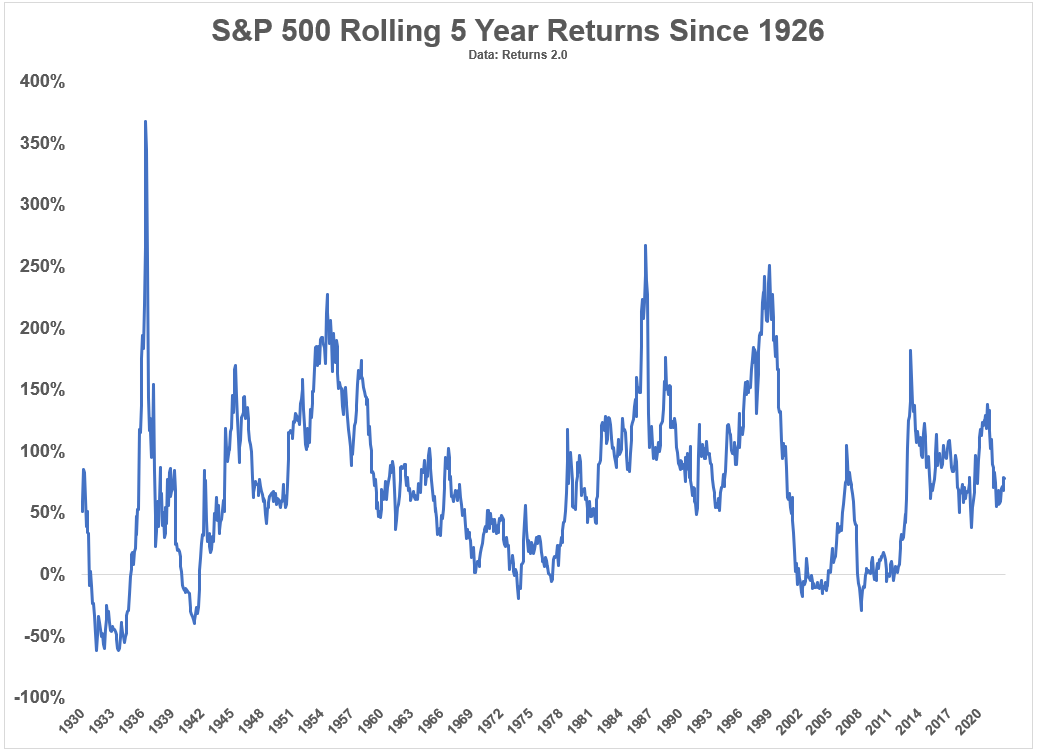

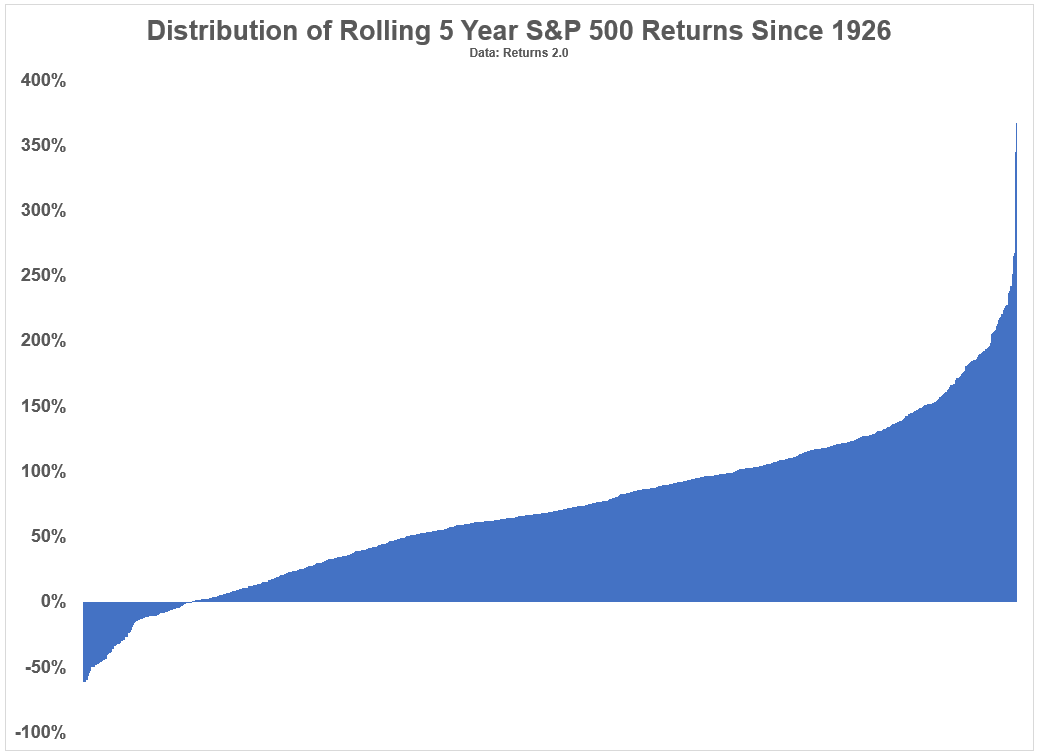

And here’s another way of looking at these returns ranked from worst to best:

The good news is the majority of the time stocks have been up on a 5 year basis. Returns were positive on 88% of all rolling 5 year windows.1

The bad news is the range of returns from best to worst has been quite wide:

- Worst 5 year return: -61%

- Best 5 year return: +367%

To be fair, both of these 5 year windows occurred in the 1930s but even if we look at post-WWII data, there is still the potential for a wide range of outcomes:

- Worst 5 year return: -29%

- Best 5 year return: +267%

I have a relatively high tolerance for risk. But if I’m investing for a specific goal in the future and I know how much I’m going to need and when I’m going to be spending the money the stock market is too risky for me unless we’re talking 5+ years or so.

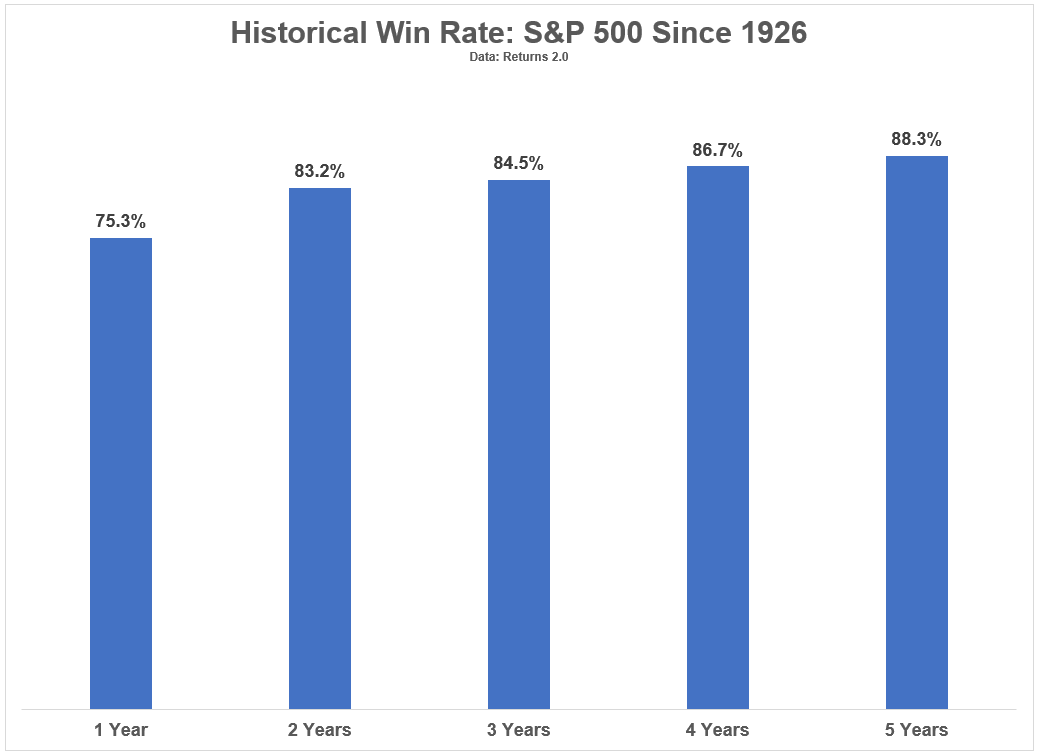

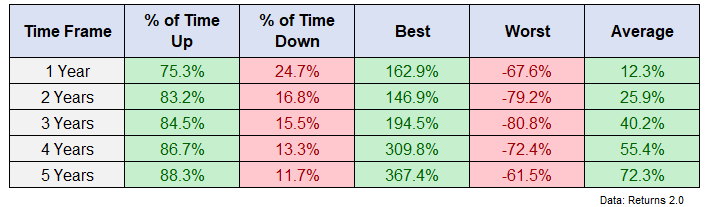

And since you’re going to be saving this money over time as you approach your end date to spend on that new roof and car the stock market is going to get even riskier. Here are the historical win rates over 1, 2, 3, 4 and 5 year time horizons for U.S. stocks:

The odds are still in your favor but the range of outcomes and the potential for loss increases the shorter your time horizon goes:

If you could just bank on those average returns2 year in and year out you would be set but the risk of seeing a loss at the exact moment you need your cash seems unappealing. It’s an unnecessary level of financial stress to add to your life.

The idea of utilizing a targetdate fund or robo-advisor makes more sense than putting all of your money into stocks because you have the ability to diversify and have some say over your risk tolerance and the timing of that goal.

The Vanguard 2030 targetdate fund is currently 65% stocks and 35% bonds. The 2025 fund is more like 60/40.

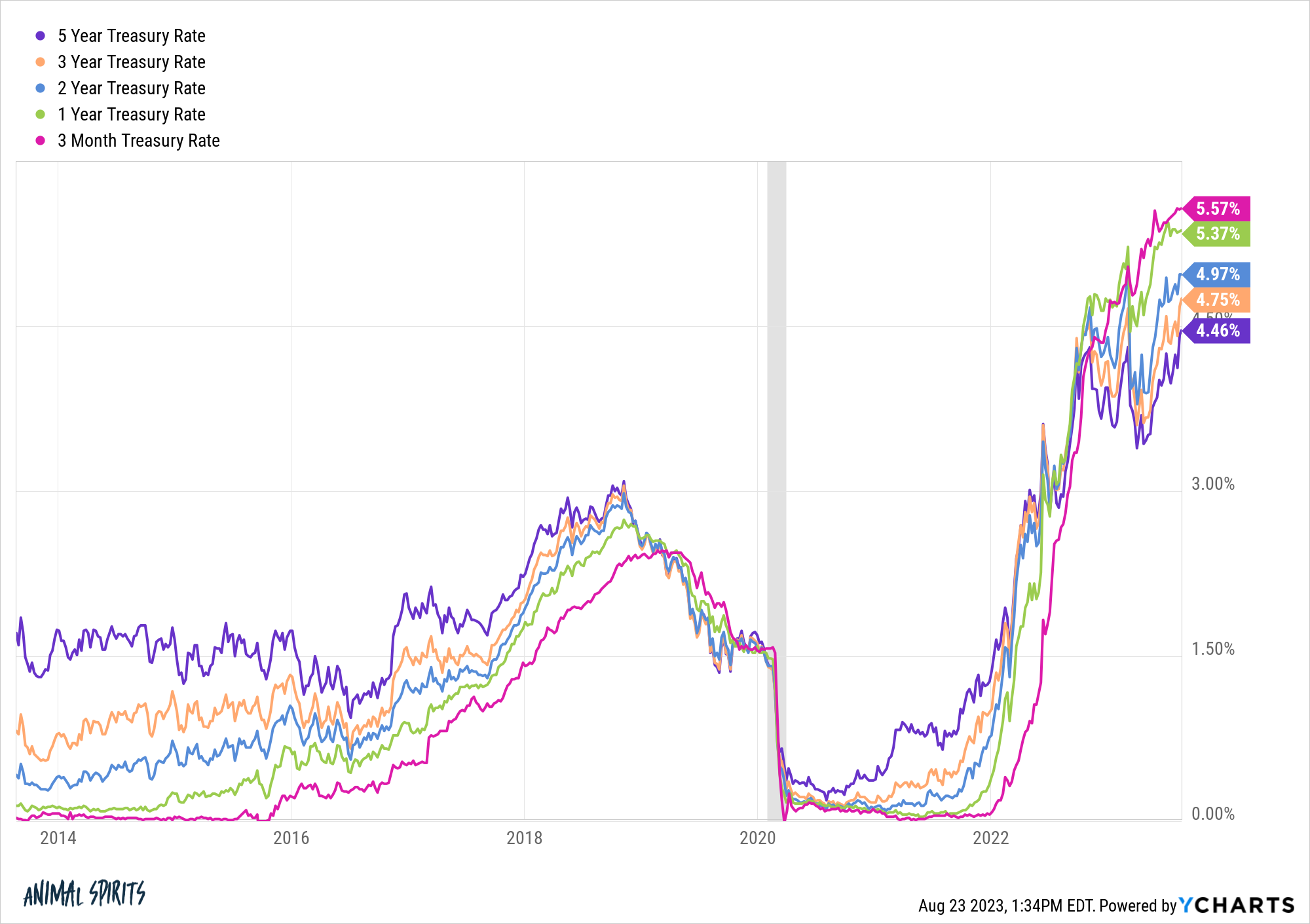

Some people have a higher appetite for risk than I do when it comes to these things but I wouldn’t overcomplicate it if I had a goal like this. Just look at the rates you could lock in on short-term Treasuries at the moment:

Could rates fall again? Sure. That’s a strong possibility in the coming years but you have the ability to lock in higher rates for longer now that the longer end of the curve is catching up.

When it comes to short-to-intermediate-term financial goals I have 3 simple rules:

1. It has to be liquid.

2. I’m not willing to accept much volatility.

3. I don’t want the possibility of large losses when I need to spend it.

You could make more money by investing your savings in riskier securities. But the downside of having less than you need when the bill comes due far outweighs any additional gains you could get by taking on more risk.

We discussed this question on the most recent edition of Ask the Compound:

Kevin Young joined me on the show again today to talk about questions on early retirement, spending money on your financial goals, consolidating multiple HSAs and how to pay for a renovation on your house.

Further Reading:

Rolling the Dice in the Stock Market

1As usual, I’m using monthly total returns (with dividends) for these performance numbers.

2I used simple arithmetic averages here, not geometric for the quants scoring at home.