Today’s Talk Your Book is brought to you by J.P. Morgan Asset Management:

See here for more information on JPMorgan Equity Premium Income ETF.

We had Hamilton Reiner, MD, PM, and Head of US Equity Derivatives at J.P. Morgan Asset Management on the show to discuss their popular covered call strategy ETF.

On today’s show, we discuss:

- How the strategy is constructed

- Why getting called away on a stock-by-stock basis is too much risk

- How volatility affects the yield

- How $JEPI is as tax efficient as it can be

- What challenges this strategy

- Why $JEPI has been such a popular product

- How often income is paid

- JPMs stock selection process

J.P. Morgan ETFs are distributed by JPMorgan Distribution Services, Inc. is a a member of FINRA. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co., and its affiliates worldwide.

Listen here:

Charts:

Investment process:

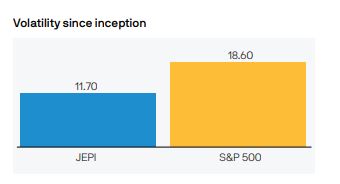

Data as of 6/30/23. Chart source: Morningstar, J.P. Morgan Asset Management. Data as of 6/30/23. Inception date of JPMorgan Equity Premium Income ETF: 5/20/20. Past performance is not necessarily a reliable indicator for current and future performance.

For more information, please click here for JEPI fund story.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship, or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.