There’s a great scene in Midnight in Paris about nostalgia that I think about a lot:

Some people always think the past is better than the present because of this golden age line of thinking.

I always see memes like this going around Twitter:

Life would be better is this was true. Unfortunately, it’s not (see here and here).

Another social media trope these days is showing a picture of an old castle or church and asking why we don’t build stuff like this anymore. As beautiful as some of that old architecture is, I prefer buildings with electricity, indoor plumbing, air conditioning and wifi.

Things are far from perfect these days and they never will be but reading a history book or two will set you straight pretty quickly when it comes to a longing for the past.

I’ve written a number of pieces over the years on the history of retirement in the United States because it’s such an important and fascinating topic.

Retirement planning is difficult for a number of reasons.

No one knows precisely how much to save for multiple decades into the future. No one knows what financial market returns or interest rates or inflation will be going forward. No one knows how their spending habits or lifestyle or incomes will change over the course of their career. And no one knows when life will invariably throw them a curve ball.

You also only have one shot at retirement planning. There are no mulligans.

Leisure itself is still a relatively new concept for humanity that’s only been around for a few generations.

I’ve been reading The Evolution of Retirement: An American Economic History, 1880-1990 by Dora Costa and it paints a pretty bleak picture of the world for most elderly people in the past.

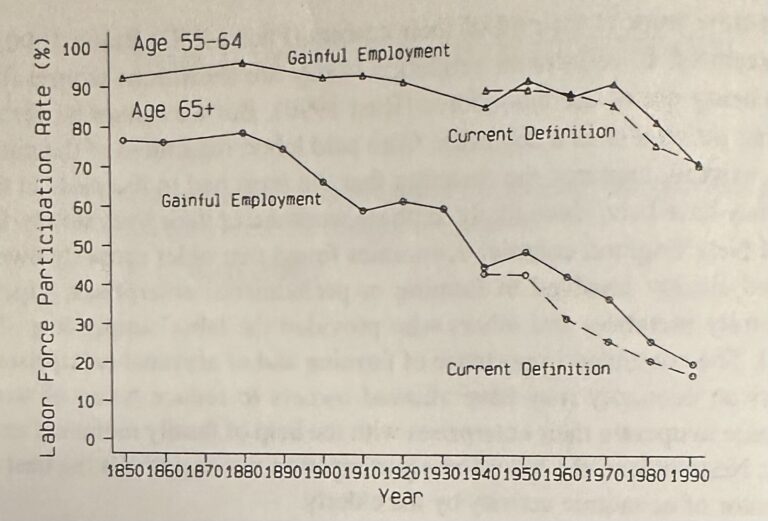

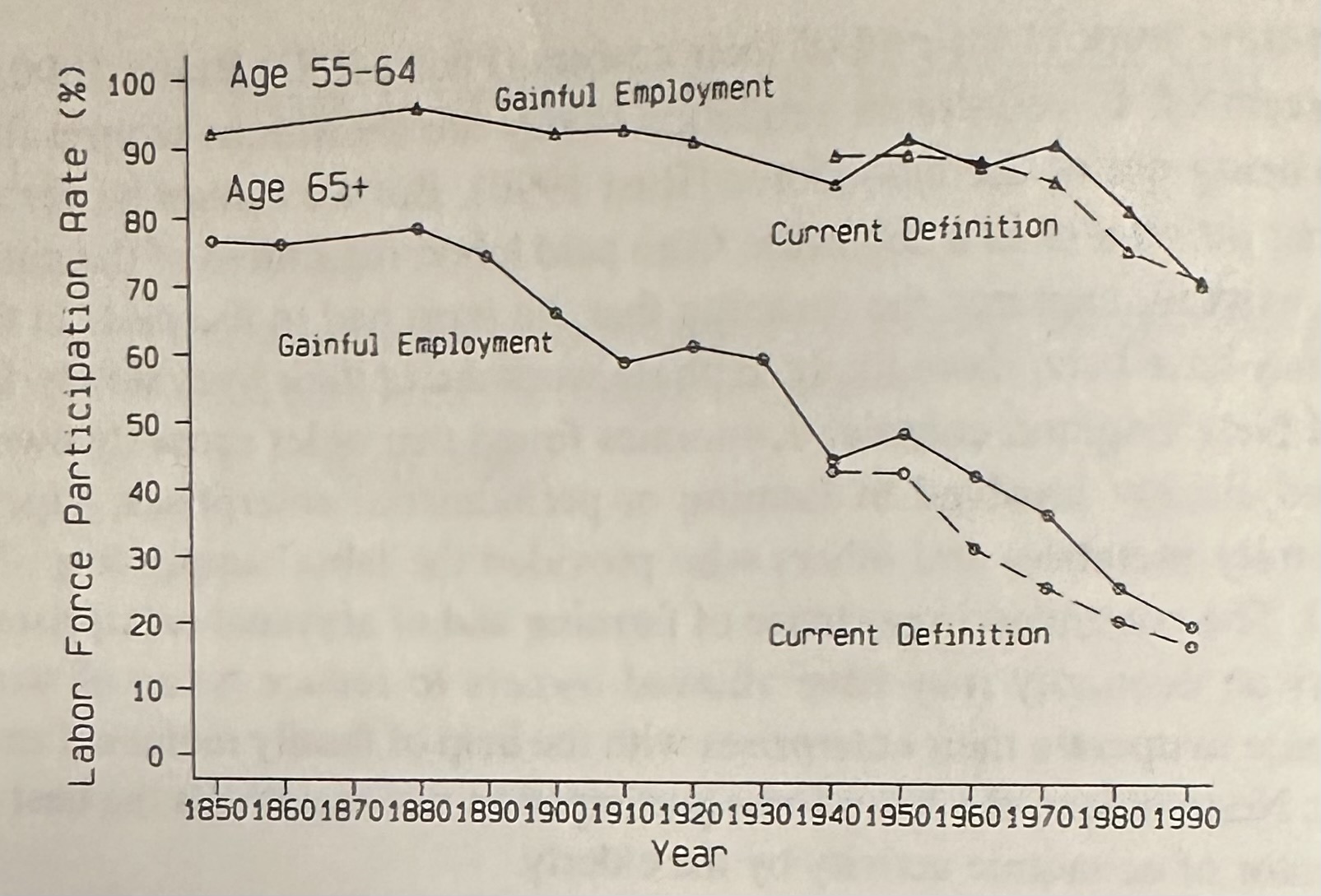

Look at this chart on the labor force participation rate for men going back to 1850:

In 1880, more than three-quarters of men older than 65 were still in the labor force. It was nearly 50% still in 1950. Today, it’s more like 19%.

For those 55-64, the labor force participation ratio was 95% in 1880. There was no such thing as early retirement. FIRE did not exist in the 19th century.

Most people simply could not afford to retire. In the early 1900s, 40% of elderly people in the United States relied on their children to support them in old age.1 That number fell to 22% by 1940 and 5% by 1990.

In the 1910s, fewer than 30% of male wage earners reported having a vacation (and it certainly wasn’t a paid vacation). Workweeks averaged 55-60 hours for manufacturing workers, while homemakers worked even longer hours. Only the richest of society had the time and money to enjoy themselves.2

A 20-year-old in 1880 could expect to spend an average of just 2.3 years in retirement (or less than 6% of their lifespan). Today, retirement could last one-third of your life or longer.

In the 1940s, only 3% of men who retired said they did so because they were looking for a life of leisure. Most retired for health reasons or worked until they were close to kicking the bucket. That number rose to 17% by 1963 and 48% in 1982.

In 1940, only about 40% of the elderly had a net worth of $4,000 or more (roughly $87,000 in today’s dollars).

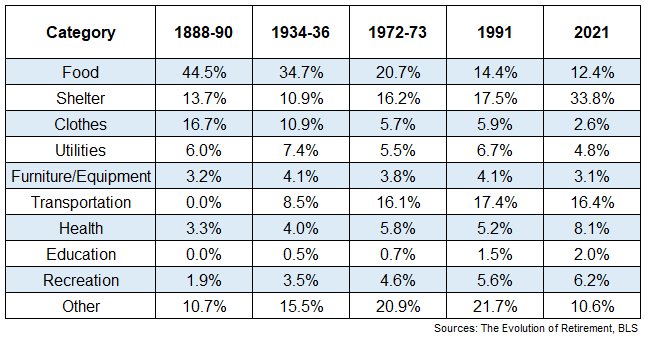

Household budgets were mainly spent on needs in the past, not wants:

Around 75% of household budgets were spent on food, housing and clothing in the late 19th century. That number dipped below 40% by 1991. The cost of housing has risen precipitously in the past 30+ years but spending on these three items is still down to 48% of spending.3

You can also see spending on recreation has tripled since the first reading.

People in the past didn’t really have time on their hands to be nostalgic about the past. They didn’t obsessively watch cable news to hear bad news all day. They didn’t get to spend time on social media when they were bored. They didn’t complain about rising vacation prices because no one really took vacations.

I’m not saying you shouldn’t worry about saving for retirement. Of course you should! It’s a big deal.

But you should consider yourself lucky if you’re able to live a life of leisure in your later years.

Most of our ancestors weren’t so lucky.

Further Reading:

Golden Age Thinking

1Ironically, now it’s the grown children relying on their retired parents to support them.

2Rich people today still enjoy themselves but it’s also interesting that they tend to work the longest hours now.

3Transportation was left blank on the 1888-90 column, so I’m guessing that one fell into the ‘other’ category.