A reader asks:

Noob question here…With the possibility of interest rates dropping in a year or so, should a long term investor looking for reasonable yields plus capital gains be looking to buy some bonds right now? And if so, what would you look at? Thanks!

Not a noob question in the slightest.

Most investors don’t pay much attention to the bond market but I think bonds have been far more interesting than stocks these past few years. It’s always worth revisiting the basics when it comes to fixed income because bonds can be tricky at times.

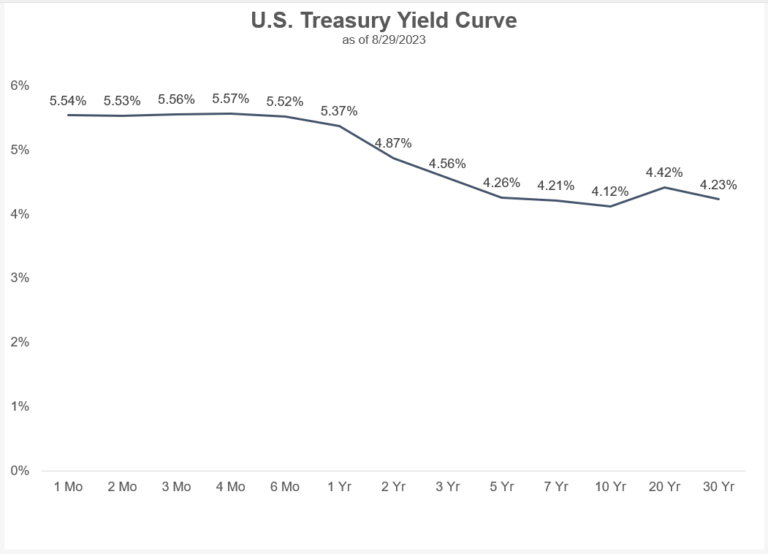

A few months ago I wrote about how T-bills were the biggest no-brainer investment to me with yields of around 5% and the yield curve looking like this:

Whereas the Fed had forced income investors out on the risk curve since the Great Financial Crisis, now investors were being punished for duration risk in a rising rate environment. Plus, short-term T-bills had a higher yield to boot.

T-bills still look pretty darn attractive, as those yields are still above 5%. If the Fed raises rates again, those yields will continue to go up. But you do face reinvestment risk in T-bills since the duration is so short.

If the Fed keeps raising rates and that throws the economy into a recession, they’re going to be forced to cut interest rates. Unfortunately, you can’t lock in these 5% relatively safe T-bill yields for an extended period of time.1

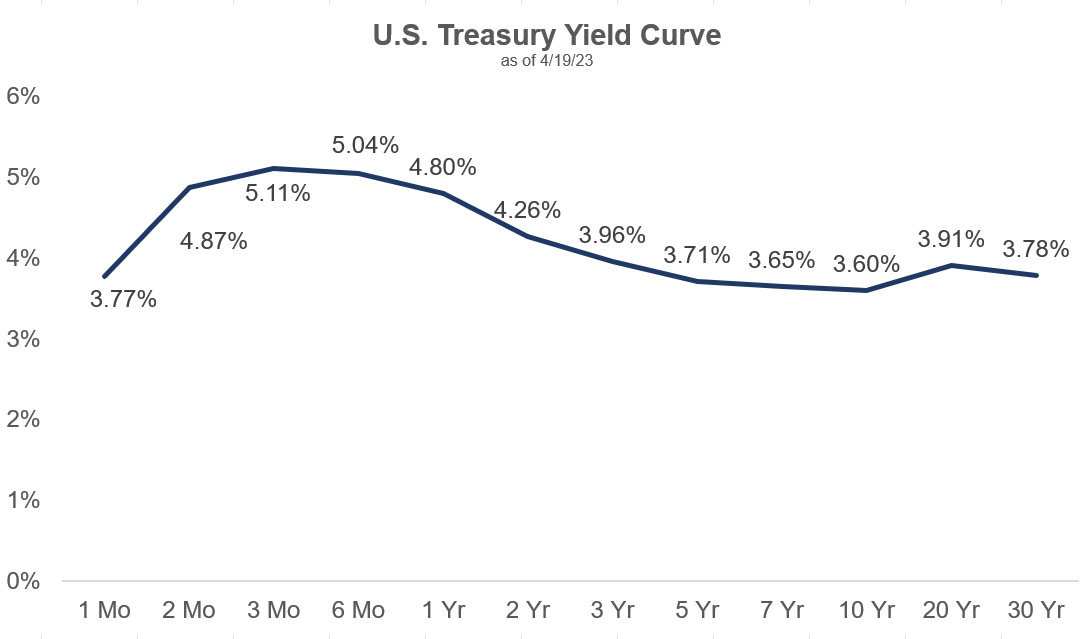

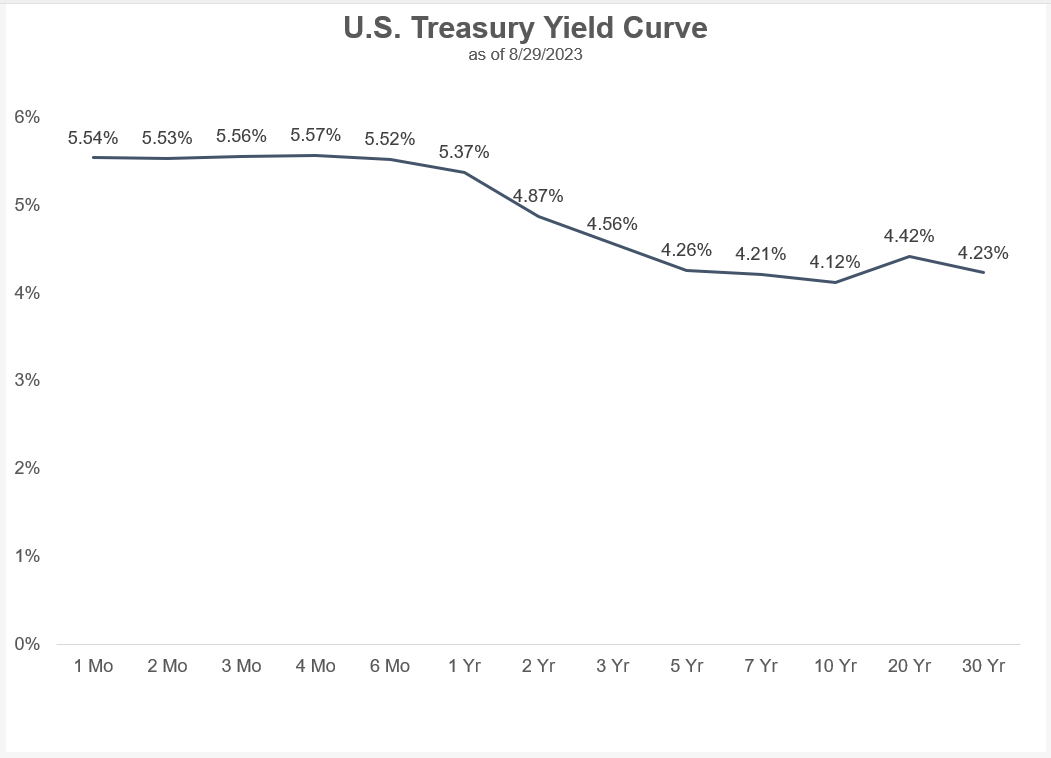

Now take a look at the updated yield curve through this week:

The long end of the curve has caught up a little bit. You can still earn a premium in T-bills but the gap has narrowed.

Intermediate-term bonds are looking more interesting from a combination of higher yields and falling inflation.

I’m not a bond trader but let’s look at the case for adding some duration here.

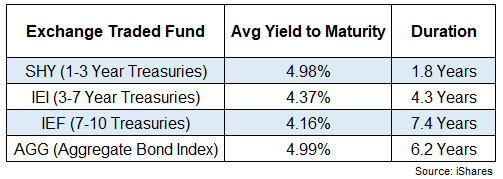

Here are the duration and average yields to maturity for various bond ETFs:

A total bond index fund (AGG) now yields about the same as 1-3 year Treasuries (SHY). That’s still lower than T-bill yields but much better than where things stood just a few short years ago.

As a reminder, duration is a measure of interest rate sensitivity on bond prices. A good rule of thumb is every 1% move in rates will cause an inverse move in percentage terms of the duration figure.

For example, IEI has an effective duration of 4.3 years. If rates fell 1%, you would expect that fund to rise around 4.3%. Conversely, if rates rose 1%, you would expect the fund to drop 4.3%.

But that’s just prices.

Now that yields are a little more than 4.3%, you would expect to break even from that rise in rates in a year from the yield. In 2020, 2021 and 2022 the starting yields on bonds were much lower. You didn’t have that built-in cushion from higher starting yields.

So while bonds could experience further downside risk in prices if rates continue to go up, there is now a bigger margin of safety since yields have already risen so much.

And if rates did rise another 1%, sure, you’ll experience some loss in price with a higher duration but now your starting yield is 5.3% and you’re going to make up for those losses much faster.

Starting yield explains roughly 90-95% of returns for high-quality bonds going out 5-10 years into the future. So you don’t really need yields to fall to earn a respectable return in bonds.

You should actually want rates to stay where they are or move a bit higher from here so you can lock in higher yields for longer.

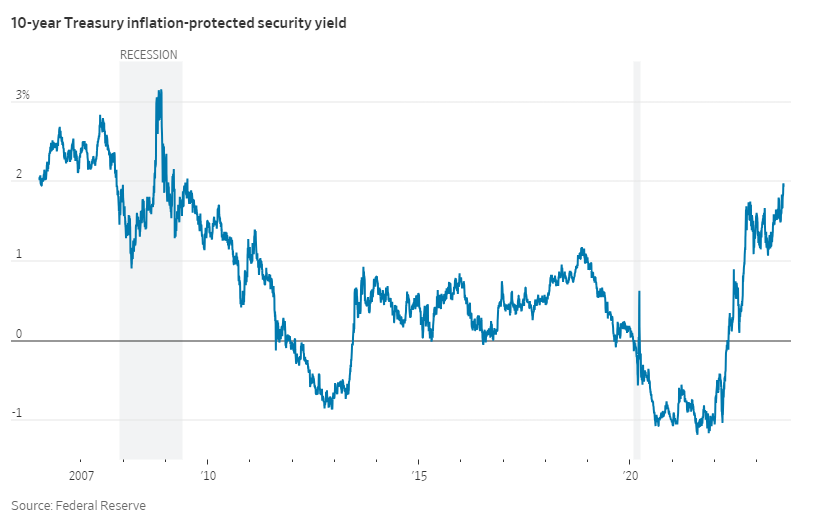

Another positive development for bond investors is positive TIPS yields:

I was taught early in my career that anything in the 2-3% range for yields on Treasury Inflation-Protected Securities is a good deal. You can see on this chart that TIPS yields were negative for much of 2020, 2021 and 2022.

Now you get 2% on 10 year TIPS plus the inflation kicker. Not a bad deal.

I don’t pretend to have the ability to predict where interest rates or inflation go from here. I prefer to look at the bond market in terms of risk and reward.

I was terrified of the bond market in 2020 when rates dropped to their lowest levels in history. The risks outweighed the rewards by a wide margin.2

Now you have options galore as a fixed-income investor.

If you’re worried about rising rates or inflation, T-bill yields are the highest we’ve seen in 20 years or so. The Fed is gifting you 5%+ for your safe assets.

If you’re worried about deflation, falling interest rates, a recession or the Fed cutting short-term rates, you can actually lock in yields in the 4-5% range on intermediate-term bonds.

And if you’re worried about your purchasing power, you can earn 2% yields plus inflation on TIPS.

Each of these bond instruments has its own risks.

For T-bills it’s reinvestment risk. For intermediate-term bonds it’s rising rates and inflation. For TIPS it’s rising rates and deflation.

There are no free lunches.

It took some pain to get here but fixed-income investors finally have some options after years of paltry bond yields.

We spoke about this question on the latest edition of Ask the Compound:

Jonathan Novy, one of our advisors and insurance experts at Ritholtz Wealth, joined me this week to discuss questions about emergency funds, investing when you don’t have a 401k, annuity yields and long-term care insurance.

Further Reading:

Why I’m More Worried About the Bond Market Than the Stock Market

1The same is true of CDs. I looked at 5 year CD yields at Marcus today. They’re 3.8%.

2Although I certainly did’t foresee a year like 2022 where yields would rise as quickly as they did.