Kerala is a coastal state in India with a large fishing industry.

Beginning in 1997, mobile phones were introduced to the region. By 2001 more than 60% of the fishers and traders were using phones to coordinate sales and set prices for the fish.

Robert Jensen used data from this market in a research paper called The Digital Provide to show how the addition of more information impacted fish prices in the marketplace.

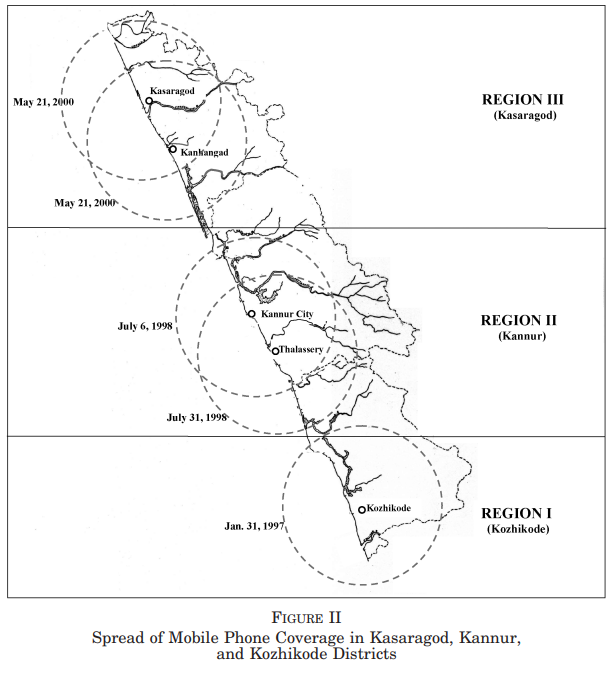

You can see the timing of the rollout of cell towers by different sections of the region (the circles show the radius of the cell towers for phone coverage):

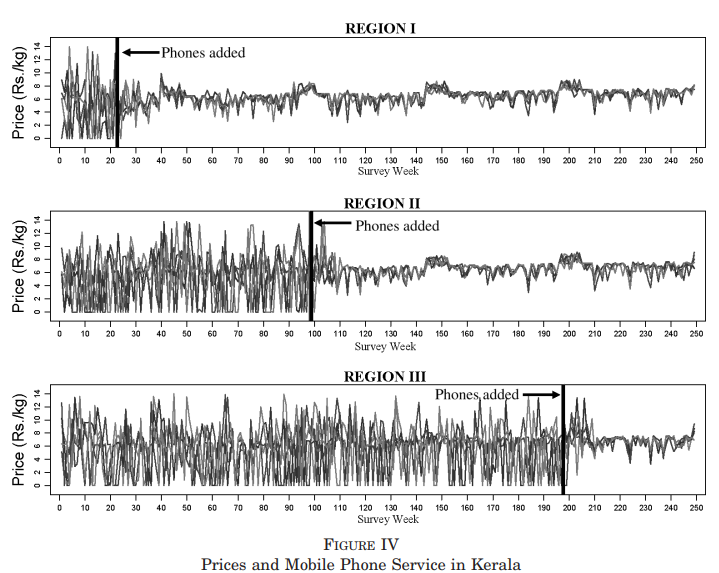

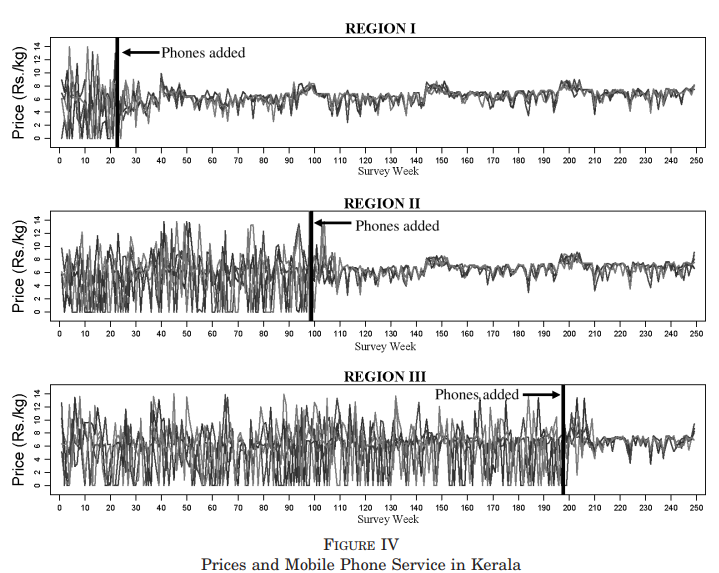

Before information was easily accessible, there was a high degree of price dispersion. That dispersion fell in short order once information became plentiful:

These charts are remarkable.

Jensen explains:

Before any region had mobile phones, the degree of price dispersion across markets within a region on any given day is high, and there are many cases where the price is zero (i.e., waste). However, within a few weeks of mobile phones being introduced in Region I, there is a sharp and striking reduction in price dispersion. Prices across markets in the region rarely differ by more than a few rupees per kilogram on any day, compared to cases of as much as 10 Rs/kg prior to the introduction of mobile phones. In addition, the prices in the various markets rise and fall together and the week-to-week variability within each market is much smaller, since catchment zone-specific quantity shocks are now spread across markets via arbitrage. Further, there are no cases of waste in this region after phones are introduced.

More information led to a more functional market for both suppliers and consumers. Profits increased and consumers experienced far less volatility in the price of the fish they were eating. Plus there were fewer fish going to waste.

Everybody wins.

More information makes markets more efficient in a hurry.

After reading about the Kerala fishing industry, I couldn’t help but think of the stock market.

Don’t get me wrong — the stock market is still quite volatile, even in the information age. Since the internet became a part our lives in the 1990s we’ve experienced plenty of crashes, bear markets and volatility.

The stock market still isn’t perfectly efficient by any means. There are still wild swings in both the market and the individual securities that make it up.

But there are fewer and fewer informational advantages today because information is so readily available to every investor.

It becomes harder to outperform in a world with more information for all investors. Since Reg FD was introduced, alpha in the hedge fund space has all but vanished.1

You could also make the claim that the past couple of decades has been one of the hardest environments ever to outperform.

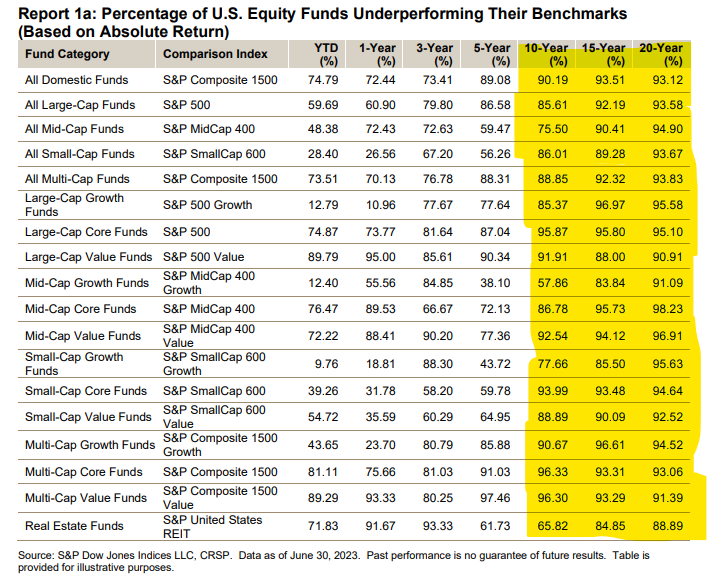

Just look at the long-term performance numbers for active fund managers on the latest SPIVA report:

It’s basically been impossible to outperform over the past 10-20 years across equity fund categories.

The index fund debate was settled long ago, but looking at these numbers through the lens of “average” returns is interesting. Yes indexing gives you the market’s average return, but the average return for active fund managers, net of fees, is almost always lower than the benchmark.

Indexing doesn’t provide you median returns. Over longer time frames, it almost guarantees you’ll end up in the top quartile or decile of performance.

Owning index funds has always been a winning strategy when it comes to outperforming professional investor for the simple fact that active investors are the market. When you net out their higher-than-index fund fees, they have to underperform, collectively.

Sure, some will outperform but the odds of you picking those active managers ahead of time are slim.

The information age has made it even harder to outperform because there are fewer informational advantages. And the fact that so many retail investors are now choosing to index, means there are fewer suckers at the poker table — it’s pros competing against pros, which makes for a more difficult game.

The good news for individual investors is you don’t have to compete against professionals. You can take a low cost, longer-term approach and beat the pros.

The hardest part for most people is keeping that long-term midset so you don’t underperform the funds you own by making behavioral mistakes when markets inevitably go haywire.

Michael and I talked about the speed of markets and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Would You Rather Outperform During Bull Markets or Bear Markets?

Now here’s what I’ve been reading lately:

Books:

1Regulation FD was a fair disclosure rule implemented in 2000 that forced public companies to disclose all material nonpublic information to everyone at the same time. No more favors or inside information.