Today’s Talk Your Book is brought to you by Direxion:

On today’s show, we spoke with Ed Egilinsky, Managing Director and Head of Alternatives to discuss the use of leverage in a portfolio and investing in China.

On today’s show, we discuss:

- How leveraged strategies are created

- How the timing and path of the underlying ETF affects compounding

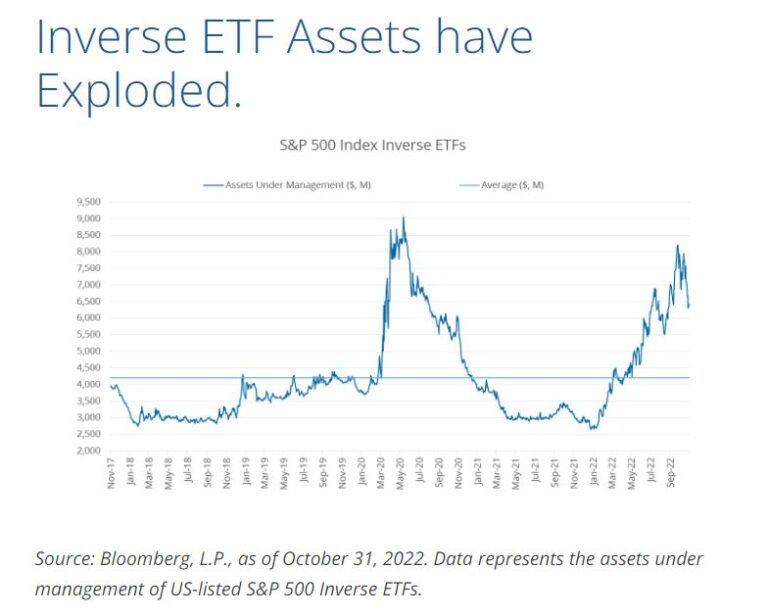

- Using flows as a trading signal

- Looking at the China trade with leverage

- Why leveraged ETFs aren’t for buy-and-hold investors

- Direxions tactical commodity ETF

- Diversifying Nasdaq 100 exposure with equal-weight ETFs

Listen here:

Charts:

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There are risks to investing in Leveraged and Inverse ETFs, please see https://www.direxion.com/ for more information.