There are three things people in the finance world hate to admit:

- I don’t know.

- I was wrong.

- I didn’t expect that to happen.

A master-of-the-universe mentality is pervasive in finance because it’s a group of highly educated, competitive people. They see it as a sign of weakness if you admit you don’t know what’s going to happen next.

The problem is finance people (all people, really) are very good at telling you why something that just happened was obvious in hindsight. They are terrible at telling you what will happen in the future.

I’ve been surprised by a lot of what’s transpired in the markets and the economy these past few years.

Here are some things I wouldn’t have expected to happen even after knowing what we now know:

I’m surprised the economy has been so resilient. It’s been 18 months since Russia invaded Ukraine, sending gas and food prices (that were already moving up) skyrocketing.

Here’s a question I was asked at the time:

Here’s what I wrote back then:

Inflationary spikes don’t cause every recession but every inflationary spike has only been alleviated by a recession.

Each time inflation went over 5% in short order there was a recession either right away or in short order.

In the ensuing year-and-a-half, the Fed has gone on one of the most aggressive rate hiking campaigns in history, stocks and bonds both went into a bear market, we hit $5/gallon in gas and inflation reached 9%.

But we never had a recession.

Inflation fell. The unemployment rate never spiked and actually went down. Economic growth accelerated.

Considering we’ve been debating a possible recession for 18-24 months now, it feels like we’ve already had a soft landing in some respects.

Maybe the Fed keeps rates higher for longer and that finally slows things down but the ongoing strength of the U.S. economy is something basically no one saw coming after all that’s been thrown at it.

I’m surprised nothing has broken yet. These are the lowest closing Treasury yields during the onset of the pandemic:

- 1 year 0.04%

- 2 year 0.09%

- 5 year 0.19%

- 10 year 0.52%

- 30 year 0.99%

Government bonds went from risk-free to return-free.

Here are those same yields as of this writing:

- 1 year 5.45%

- 2 year 5.02%

- 5 year 4.57%

- 10 year 4.53%

- 30 year 4.68%

We have the highest yields since 2007 basically across the yield curve. Yes, I know we’ve had higher yields in the past but there was a decade-and-a-half for people to get used to lower yields.

And then yields just took off like a rocketship.

I’m surprised we haven’t had more blow-ups from this.

Sure we had a 3 day regional banking crisis and the housing market is more or less broken but nothing has broken like most people would have assumed with rates rising this much this fast.

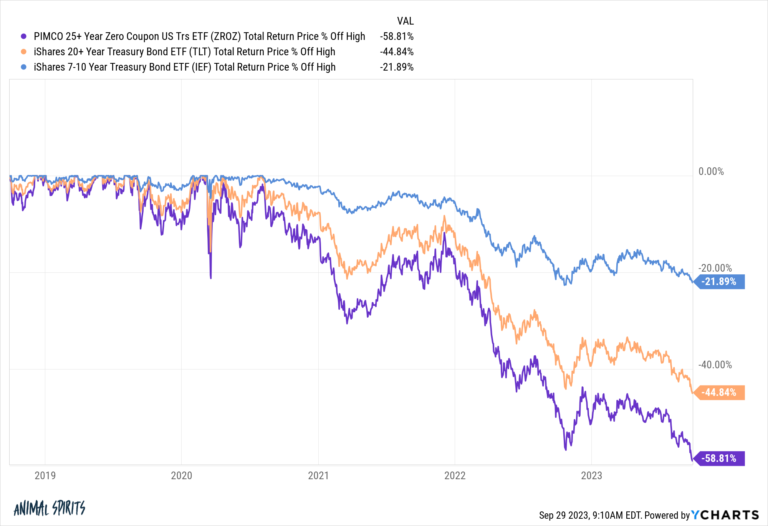

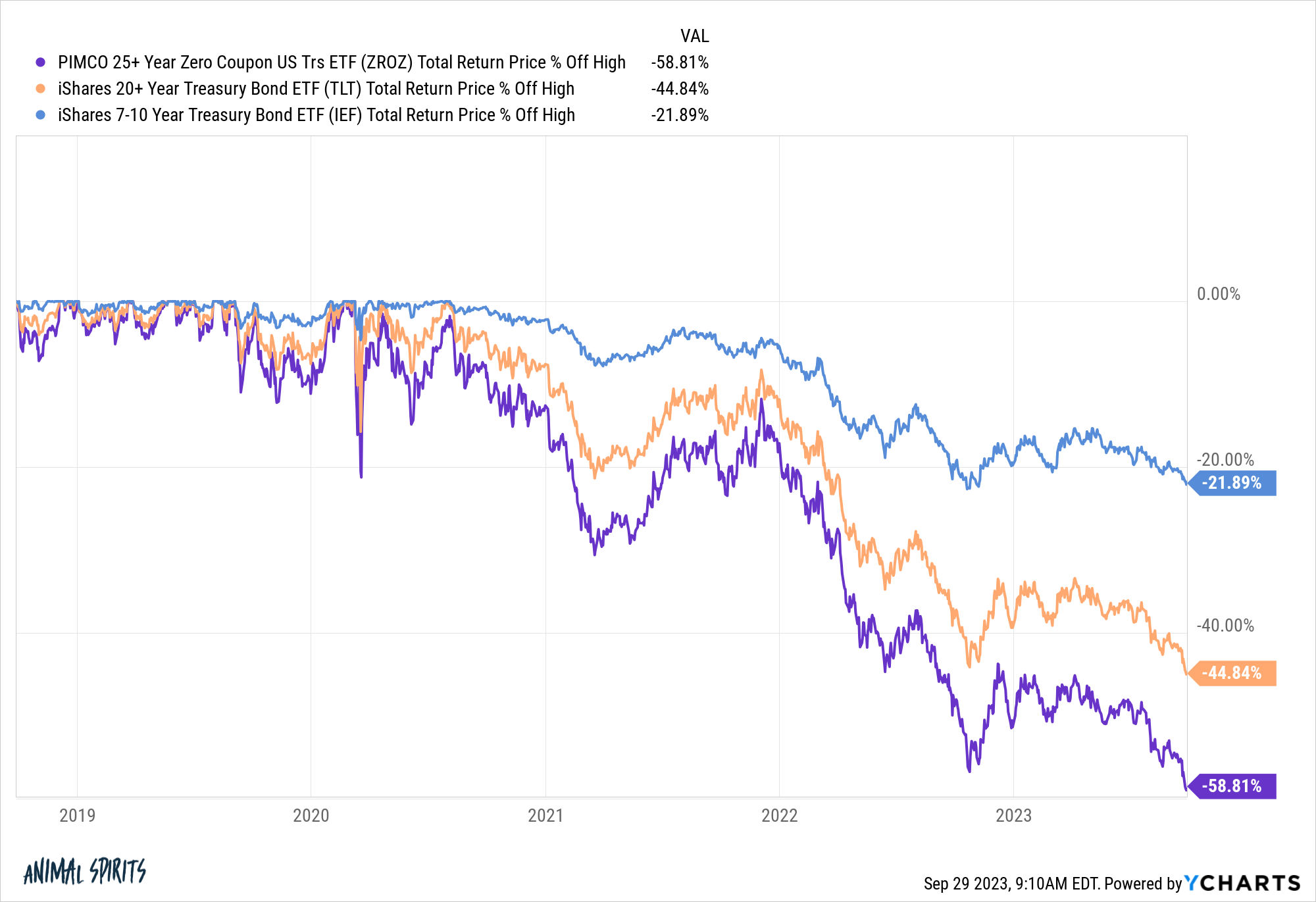

Just look at the losses in longer duration fixed income:

Somehow the market has (so far) digested higher yields even though long duration bonds have gotten pummeled.1

It’s surprising we haven’t seen any fund blow-ups or other unintended consequences from these losses yet.

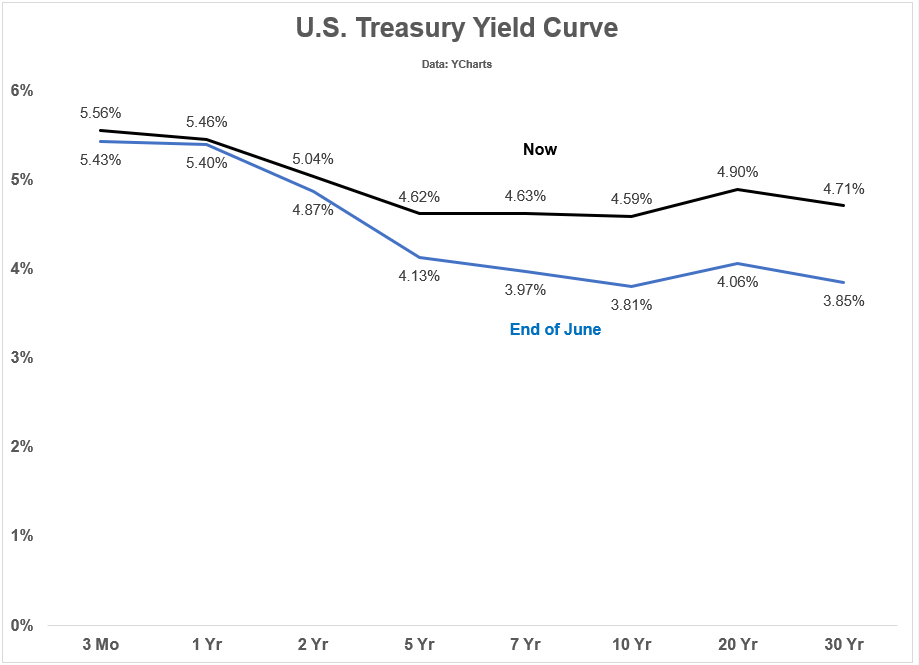

I’m surprised the yield curve is steepening like it is. The Fed controls short-term interest rates but not necessarily long-term rates.2

When they jacked up short-term rates, yields on longer-term bonds rose but not nearly as much, which led to an inverted yield curve where short rates were higher than long rates.

It’s hard to know exactly what the bond market is thinking but most market pundits assumed this meant bond traders didn’t believe high growth or inflation were here to stay.

Most people also assumed it would take the Fed lowering short-term rates to uninvert? disinvert? vert? steepen the yield curve.

In fact, the market has been predicting rate cuts for some time now…until recently. Now long-term yields are rising.

Look at the changes in the yield curve over the past 3 months:

It’s long rates that are causing a steepening of the curve, not short rates as everyone assumed.

No one knows for sure why the long end finally woke up. Maybe it’s the Fed signaling higher for longer. Maybe the bond market is worried about inflation or higher economic growth.

But certainly now no one predicted this.

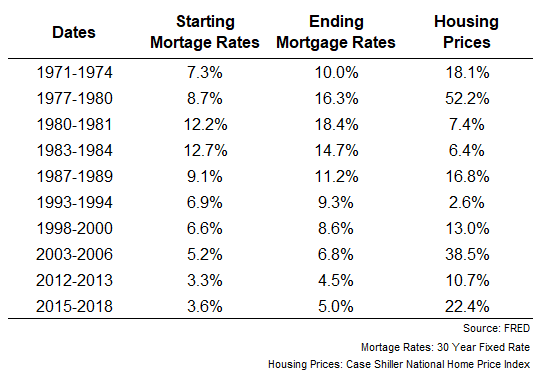

I’m surprised housing prices didn’t fall further. I wrote a piece back in January 2022 about the historical impact of rising mortgage rates on housing prices. Here’s the chart I used:

In the past rising mortgage rates didn’t crush the housing market. Quite the opposite. Prices haven’t fallen once in the past 50 years when mortgage rates rose.

When I wrote that piece the 30 year fixed mortgage was a little more than 3%.

I never would have predicted they would go all the way to 7.5%!

No one did.

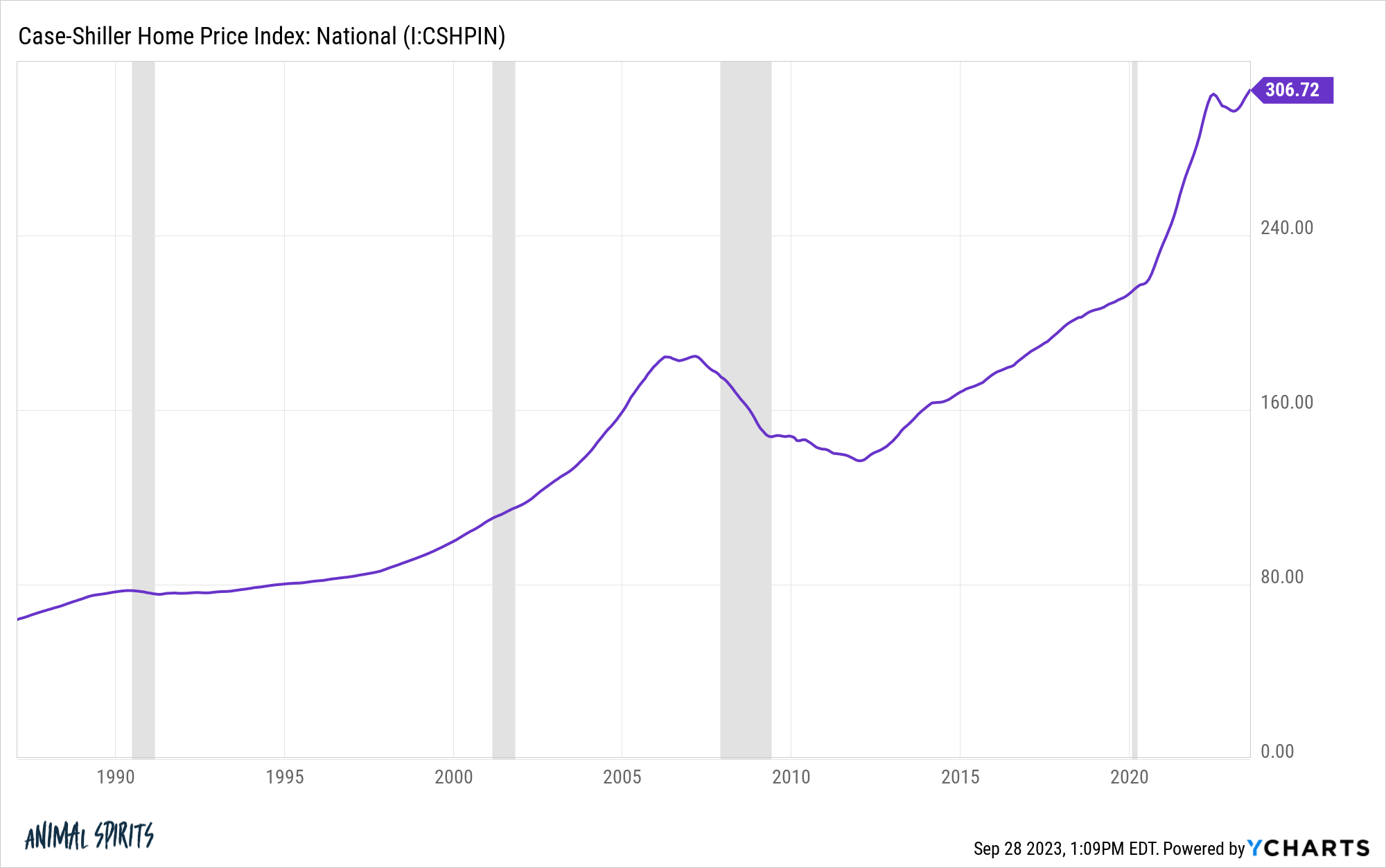

Yet even armed with this data, I would have assumed housing prices would have to fall 10% or more from the combination of a doubling in mortgage rates and the 50% pop in housing prices from the pandemic.

Instead housing prices fell a little less than 3% and are now right back to all-time high levels nationally:

Like all of these surprises, there are perfectly reasonable explanations after the fact (lack of supply, 3% mortgage lock-ins, household formation, etc.).

The thing is no one was making any of these predictions ahead of time and now everyone wants to pretend like this was all obvious.

It’s OK to admit you don’t know what’s going to happen.

It’s OK to admit when you were wrong.

It’s OK to admit you were surprised by what happened.

A little humble pie and self-awareness make it easier to survive this crazy world we live in.

Michael and I talked about all of the unexpected things that have happened and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Are We Heading For a Recession?

Now here’s what I’ve been reading lately:

Books:

1To be fair, yields going so low in the pandemic led to outsized gains in long duration bonds leading up to this massacre.

2Unless they buy Treasuries to control rates, but they don’t set those rates like they do with the Fed funds rate.