A reader asks:

I’ve also always wanted to do my own “not to brag” so here goes. I’m 33, I have $300k spread between a Roth IRA, Roth 401k and taxable account all in VTI and VOO. I also own my own home and have $75k in cash. I don’t really understand bonds other than when rates go up, they go down in price and vice versa. When looking at TLT, the 20 year bond ETF, it has crashed since rates started going up in 2022. Assuming we are nearing the end of the rate increase cycle, even if rates stay higher for longer, why shouldn’t I take $50k and put it in TLT? If I hold it for a few years, it stands to reason rates will be cut at some point when inflation concerns are behind us or the FED has to respond to a true recession. How high can rates actually go from here? This just doesn’t seem long-term risky.

As always, risk is in the eye of the beholder.

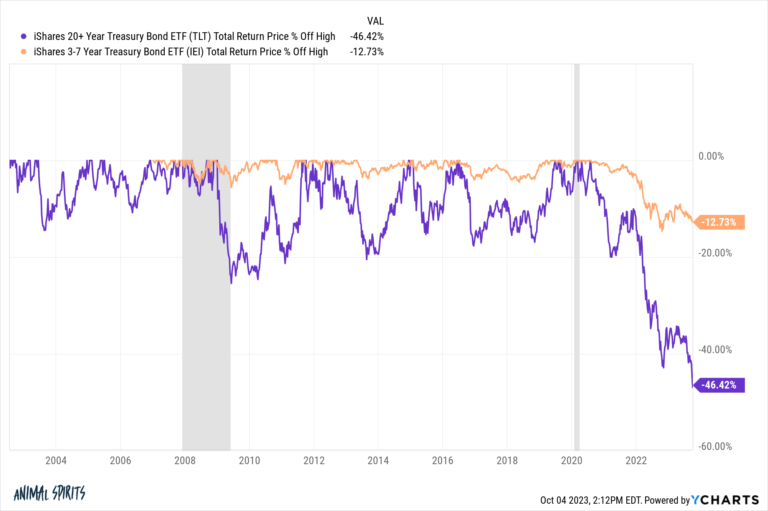

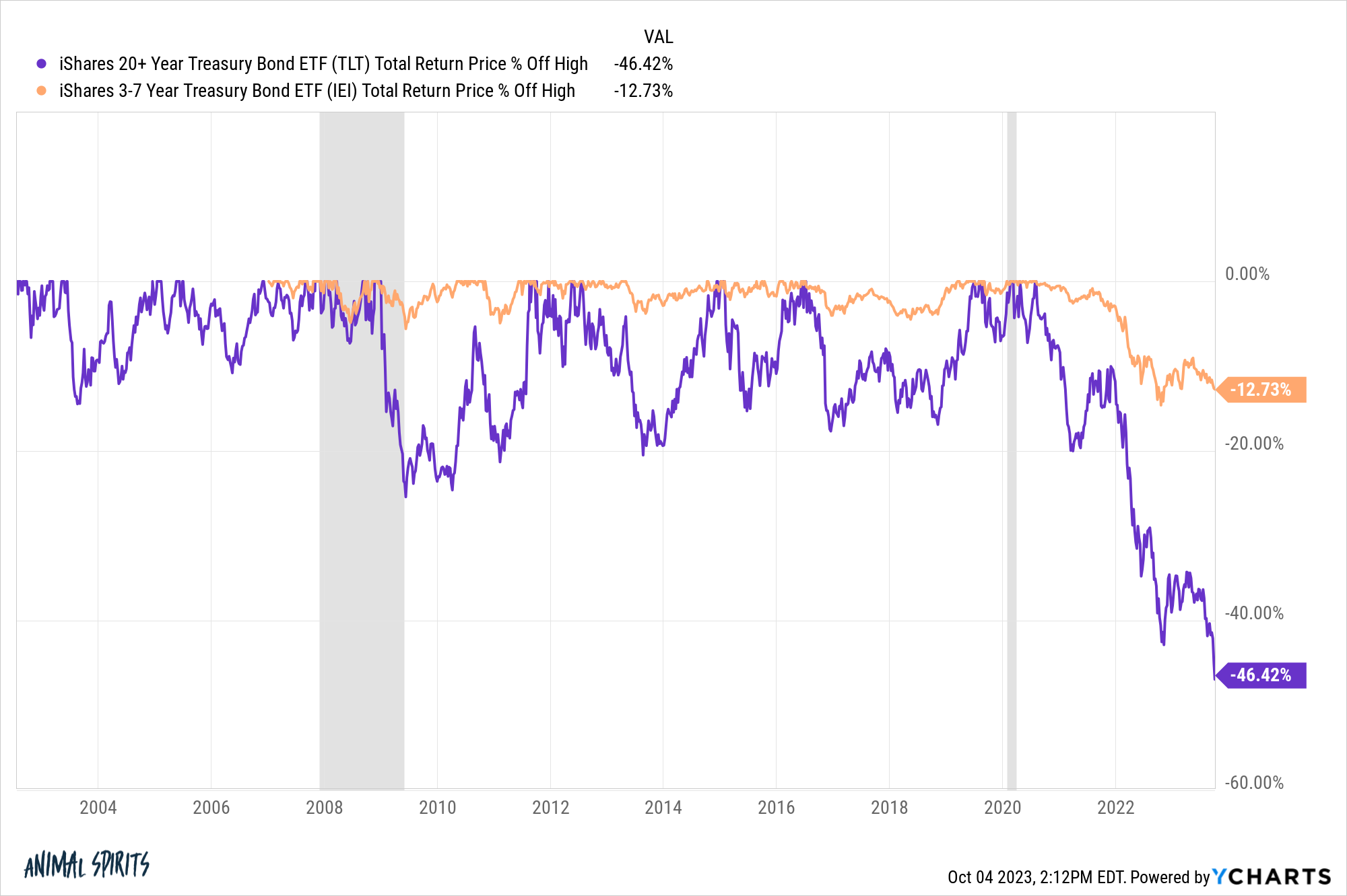

Long-term bonds have crashed in a big way:

I count seven separate corrections of 10% or worse since the inception of this fund in the early-2000s. And interest rates were falling for much of this period.

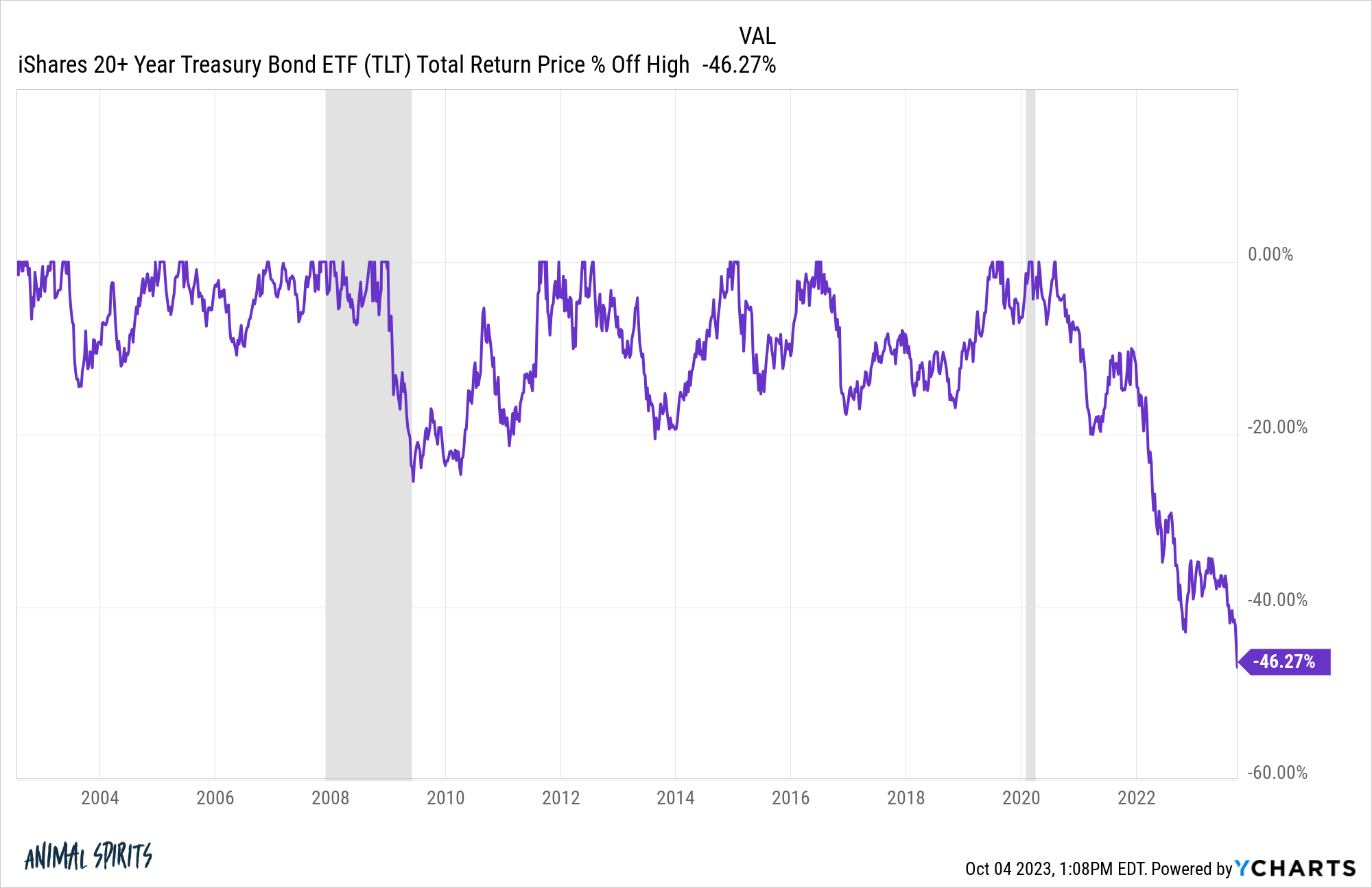

The latest drawdown is a full-fledged crash.

Another way of saying this is long-term bond yields have gone up a lot in a short period of time.

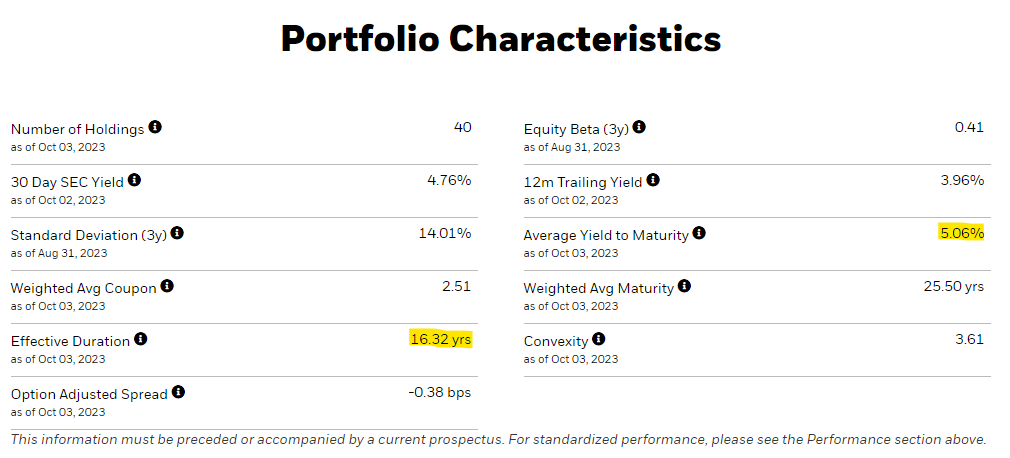

These are the portfolio characteristics of this long-term Treasury bond ETF:

I’ve highlighted two variables here that are important.

The average yield to maturity is now more than 5%. At the depths of the pandemic, long-term rates were around 1%.

It seemed unfathomable as little as 2-3 years ago that investors would be able to lock in such high yields for such a long time frame. Yet here we are.

The other variable is the effective duration.

Bond duration measures the sensitivity of bond prices to changes in interest rates. For every 1% change in rates, you can expect bond prices to move inversely by the level of duration.

For example, if interest rates on long-term bonds were to fall 1%, you would expect TLT to increase by 16.3% or so. If rates rise 1%, TLT will fall 16.3%.

These are price returns only so you could net them out by the yield as well. With an average yield to maturity of 5%, there is a much bigger margin of safety than there has been in the recent past.

If we get a recession or the Fed cuts rates or bond yields fall from higher demand or changing economic conditions, TLT could make for a wonderful trade.

It makes sense yields should fall eventually but I can’t guarantee they won’t rise even more in the meantime.

What if yields rise to 7% before dropping back down to 3-4%? Can you sit through a 35% drawdown while you wait?

Or what happens if yields don’t go anywhere for a while? Are you content to invest in TLT just for the yield and not the price gains?

And what happens when yields do begin to drop? When do you get out? How much money do you plan on making in this trade?

I understand the thinking behind this trade but it’s not as easy as it sounds.

In his classic Winning the Loser’s Game, Charley Ellis highlights the work of Dr. Simon Ramo who made a critical observation about the two types of tennis players –professionals and amateurs.

Ellis explains:

Professionals win points; Amateurs lose points.

In expert tennis the ultimate outcome is determined by the actions of the winner. Professional tennis players stroke the ball hard with laserlike precision through long and often exciting rallies until one player is able to drive the ball just out of reach or force the other player to make an error. These splendid players seldom make mistakes.

Amateur tennis, Ramo found, is almost entirely different. The outcome is determined by the loser. The ball is all too often hit into the net or out of bounds, and double faults at service are not uncommon. Amateurs seldom beat their opponents but instead beat themselves.

So how do you avoid beating yourself as an investor?

I like having rules in place to help guide my actions to minimize mistakes.

I try to minimize mistakes by avoiding market timing, short-term trading and investments that aren’t a fit for my personality and investment plan.

For instance, I’ve never been a fan of owning long-term treasuries. Yes they performed phenomenally from 1980-2020 or so. And if we get double-digit yields on long-term bonds again I would be happy to own some.

But I prefer to take risk in the stock market and keep the safe side of my portfolio relatively boring. That means short duration bonds and cash. I already get enough volatility by owning stocks.

You can earn high yields in short and intermediate-term bonds right now as well. Those bonds will rally if rates fall, just not as much as long duration bonds.

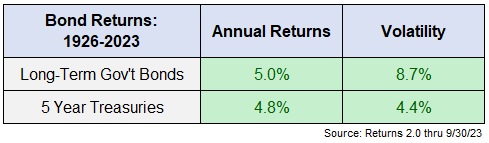

If you look at the long-term returns in long bonds, the case becomes far less compelling outside of a bond bull market or short-term trade. These are the annual return numbers for long-term Treasuries and 5 year Treasuries:

You get basically the same return but with much higher volatility in long bonds.

Just look at the difference in the drawdown profile of 20-30 year bonds versus 3-7 year bonds:

I’m not going to try to talk you out of a trade as long as you go in with your eyes wide open. It’s entirely possible long bonds are setting up for a wonderful trading opportunity at the moment.

But you really have to nail the timing for a trade like this to work.1

The good news is that you don’t have to participate in every trade or investment opportunity. You can pick your spots.

For most investors, defining the stuff you won’t invest in is far more important than trying to nail every single trade.

We discussed this question on this week’s Ask the Compound:

Nick Maggiulli joined me again this week to talk about questions on dollar cost averaging, locking in higher bond yields and how much leverage is enough for your personal balance sheet.

Further Reading:

The Bond Bear Market & Asset Allocation

1Maybe I would change my mind if long-term rates ever get to 7-8%.