In 1950 long-term U.S. government bonds yielded a little more than 2%.

By the end of that decade they would hit 4.5%. Yields jumped to 6.9% by the end of the 1960s and 10.1% by the end of the inflationary 1970s.

Then they skyrocketed in the early-1980s, going from just over 10% at the end of 1979 to nearly 15% by the fall of 1981.

In a little over 30 years, bond yields went from 2% to 15%.

Surely, the bond market crashed…right?

Surprisingly no.

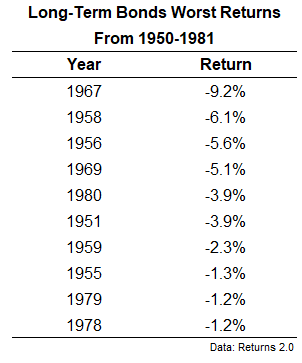

Long-term bond performance wasn’t great, that’s for sure, returning just 2.2% per year from 1950-1981. But there wasn’t a crash like we’re seeing today.

In fact, the worst calendar year return for long bonds in this period was in 1967 when they fell a little more than 9%.

We’ve seen far greater losses in long bonds this century. Last year they were down 26%. In 2013 long-term Treasuries fell 12%. In 2009 they declined by nearly 15%.

The bond bear market of the 1950s through the early-1980s was more of a death-by-a-thousand cuts. And the source of those cuts was inflation. Sure, annual nominal returns were positive at a little more than 2% per year but inflation was in the 4-5% range over that period.

The long bond crash was on a real basis, not nominal. From 1950 through the fall of 1981, long-term Treasuries lost almost 60% of their value on an inflation-adjusted basis.

The change in rates back then was gradual. That’s not been the case this time around.

Yields on 30 year Treasuries have gone from a low of around 1% in March 2020 to nearly 5% a little more than three years later.

That aggressive re-rating in yields has led to a crash this time around.

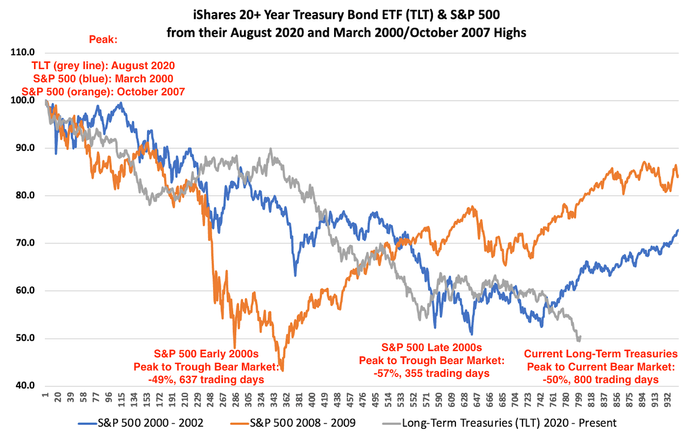

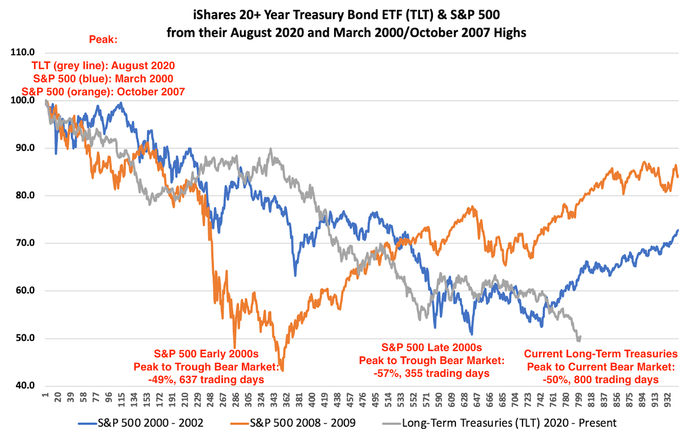

This chart from Datatrek shows the crash in long-term bonds is now roughly the same magnitude as the crashes in the stock market during the dot-com bust and the Great Financial Crisis:

Plus the crash is longer in bonds than it was for those two stock market blow-ups.

Long-term bonds are getting massacred.

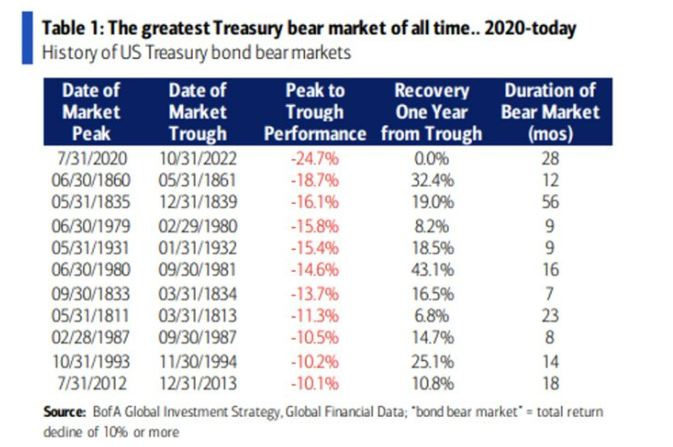

The same is true of 10 year Treasuries. Bank of America says this is the worst bear market in the benchmark bond ever:

I actually had to look up what happened from 1835-1839 to cause a 56 month bear market in bonds. Apparently, President Andrew Jackson made it his goal to pay off the national debt in the United States in its entirety. It led to one of the biggest financial crises in American history. The U.S. economy cratered 33%.

Whoops.

One of the strange parts about living through the worst bond bear market in history is there doesn’t seem to be a sense of panic.

If the stock market was down 50% you better believe investors would be losing their minds.

Yes, some people are concerned about higher interest rates but it feels pretty orderly all things considered.

So why aren’t people freaking out about bond losses more?

It could be there are more institutional investors in long bonds than individuals. There are lots of pension funds and insurance companies that own these bonds.

It’s going to take a very long time for investors to get made whole but you can hold these bonds to maturity to get paid back at par.

The risk-reward set-up in long duration bonds in 2020 was awful. There was only downside with little-to-no upside. Investors have had an escape hatch in bonds in T-bills and short-term bonds. It’s not like individual investors hold long bonds for their entire fixed income exposure.

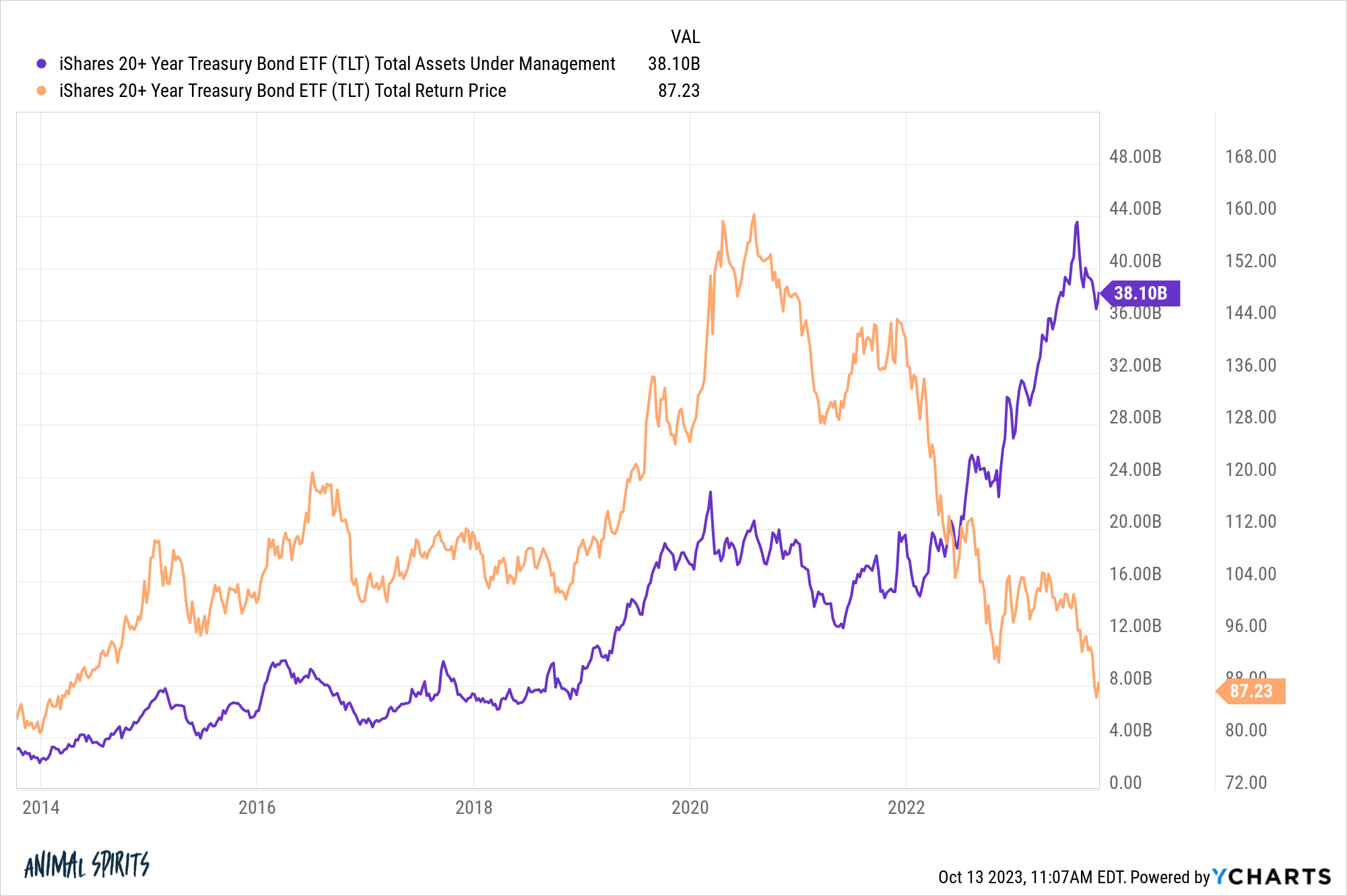

Don’t get me wrong, there are plenty of investors who have lost their shirts in long-term bonds. Just look at the growth in assets versus the performance of TLT:

Money has been flowing into this fund during the crash. Investors have been wrong trying to catch a bottom here (or a top in rates I should say) but this makes sense in the context of interest rates.

Rates on bonds are higher now than they’ve been since 2007 almost across the board.

The crash has been painful to live through but ripping the bandaid off this time around as opposed to the death-by-a-thousand cuts during the last bond bear market should be preferrable to investors.

Sure, rates and inflation could keep going up from here. But interest rates are now much higher to act as a margin of safety.

That didn’t exist at the outset of this bear market.

Michael and I discussed the bond bear market and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

The Bond Bear Market & Asset Allocation

Now here’s what I’ve been reading lately:

Books: