A reader asks:

What REAL rate of return is best to use for retirement forecasting? I always read that equities return ~10% on average, but am curious what real return is best to use to factor inflation into retirement planning.

One of the most important aspects of any successful investment plan is setting reasonable expectations up-front. The hard part about this equation is most of those expectations are guesses and they are likely to be wrong.

The obvious reason is that the future is both unknowable and unpredictable.

When it comes to the stock market the best you can do is analyze the past, think about the present and make educated guesses about the future.

I like how this reader is asking for real returns because those are the only ones that matter over the long haul. Luckily, the stock market has historically been a wonderful hedge against inflation.

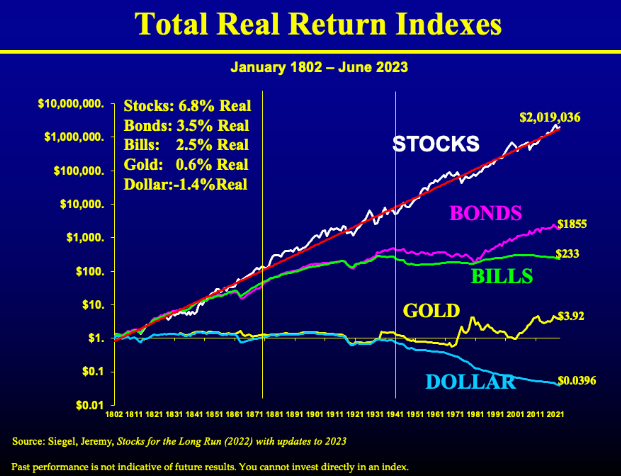

Here are some updated long-term inflation-adjusted returns for stocks, bonds, cash, gold and the dollar going back more than 200 years from Stocks For the Long Run by Jeremy Siegel and Jeremy Schwartz:

Stocks are the big winner over the long run (hence the name of the book).1

The dollar’s purchasing power has been decimated but that’s because of inflation. You shouldn’t earn a return on your money for simply burying it in your backyard. You have to take risk to earn a reward.

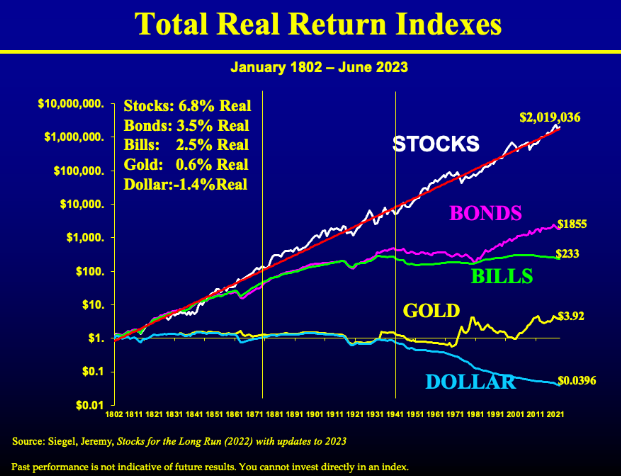

Aswath Damodaran has annual data for stocks, bonds and cash going back to 1928. Here are the real returns for those three asset classes over that time frame:

That’s pretty close for stocks but slightly lower for bonds and cash.

The interesting thing about real stock market returns over the long run is how relatively stable they have been regardless of the economic environment.

The big question is this: Can we use the historical return for stocks to set expectations for the future?

The honest answer is we don’t know for sure. No one can tell you what the future holds.

I am fairly confident the stock market will continue to beat bonds and cash over the long run but no one can be sure what that premium will be. That’s simply a function of risk.

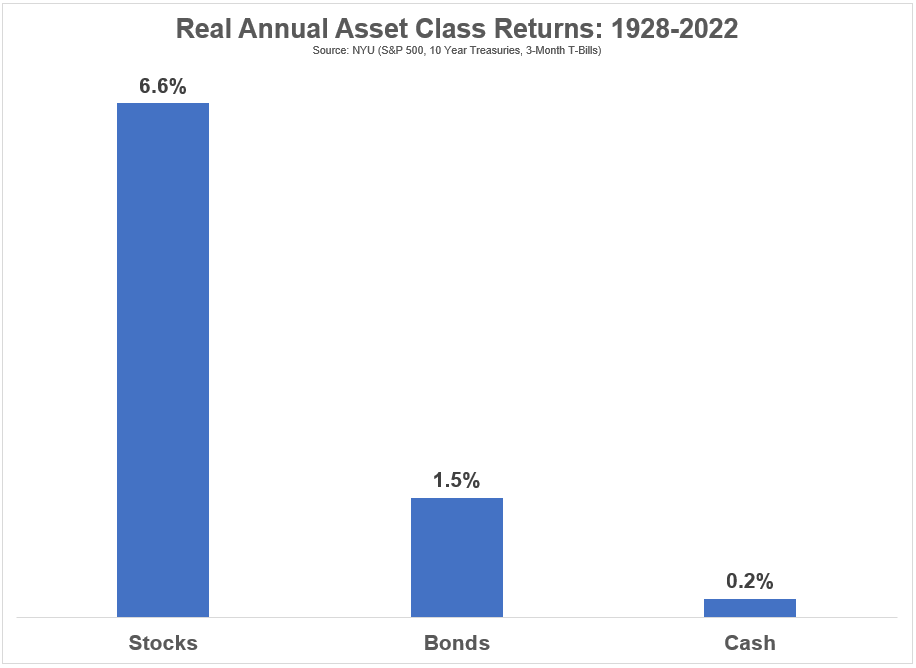

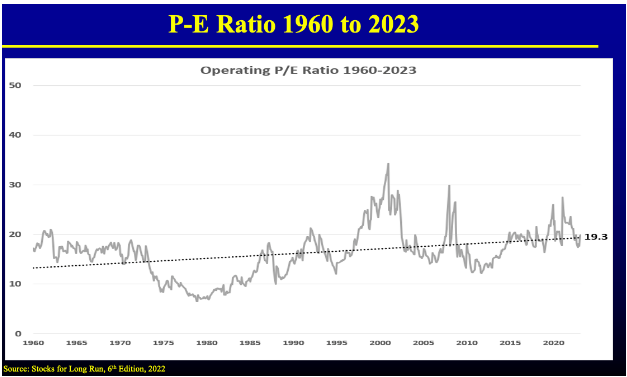

A lot of people assume the fact that valuations have been rising over time should mean lower returns going forward. Just look at the upward swing in the CAPE ratio over time:

My thinking here is there is a case to be made that stock market returns can and should be lower going forward but it’s not really based on valuations per se. Instead, it’s based on the idea that accessing the stock market was much harder in the past.

There were much higher barriers to entry.

Costs were higher and the financial system was more unstable. Thus, investors rightly demanded higher returns on a gross basis. But net returns in the past were likely much lower since trading costs, fees and expense ratios were so much higher.

Even if gross returns are lower going forward, it’s much easier to earn market returns on a net basis through index funds, ETFs and zero-commission trading. Plus, there were no tax-deferred retirement accounts before 1980 or so.

The best case for lower returns going forward is probably the United States. Our stock market has been the clear winner over the past 120+ years relative to the rest of the world:

I wouldn’t bet against the United States of America but we can’t expect a repeat performance either.

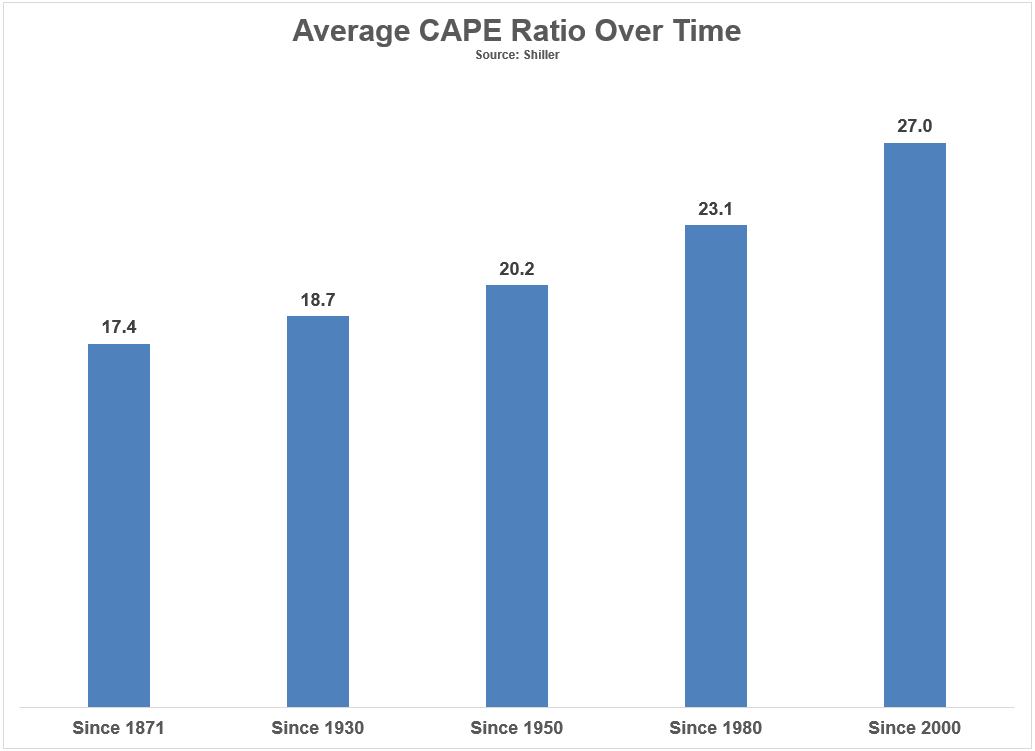

I guess what I’m trying to say here is you’re best bet is probably to use a range of real returns to set expectations for the future of your portfolio. I would say somewhere in the range of 5-6% real is reasonable based on current valuation levels:

The earnings yield is the inverse of the P/E ratio, which currently stands at around 5.2%.2

If things are better than expected you can adjust your plan accordingly.

If things are worse than expected you can adjust your plan accordingly.

Life would be a lot easier if risk assets offered us future returns that are set in stone. But then they wouldn’t be risk assets and certainly wouldn’t offer a premium over other asset classes or the inflation rate.

One of the biggest reasons stocks offer this premium is we simply don’t know exactly what their future returns will be.

Jeremy Schwartz joined me on this week’s Ask the Compound to answer this question and talk stocks for the long run, expected returns, international stocks, currency hedging and why the inflation rate is actually lower than it looks:

Further Reading:

Do Valuations Even Matter For the Stock Market?

1I would argue real estate would be a close second on this list from an inflation hedge perspective but the long run returns are much harder to calculate when you include things like ancillary costs, mortgage rates, refinancing, leverage, etc.

2And this is real since stocks are a real asset.