Here’s a conversation between me and a hypothetical stock market investors who worries a lot:

Investor: The S&P 500 is the only game in town to invest in but I’m worried because the valuations are so high and all of the gains are coming from a handful of stocks.

Me: If you think the large cap U.S. stocks are overvalued you could always invest in small caps, value stocks or foreign shares.

Investor: Yeah but the returns for those stocks have been terrible! They’ve all underperformed the S&P for years now!

Me: True but the valuations are much more reasonable.

Investor: But the valuations are low for a reason!

Me: Stocks don’t get cheap for no reason!

It’s basically this meme:

I understand the consternation.

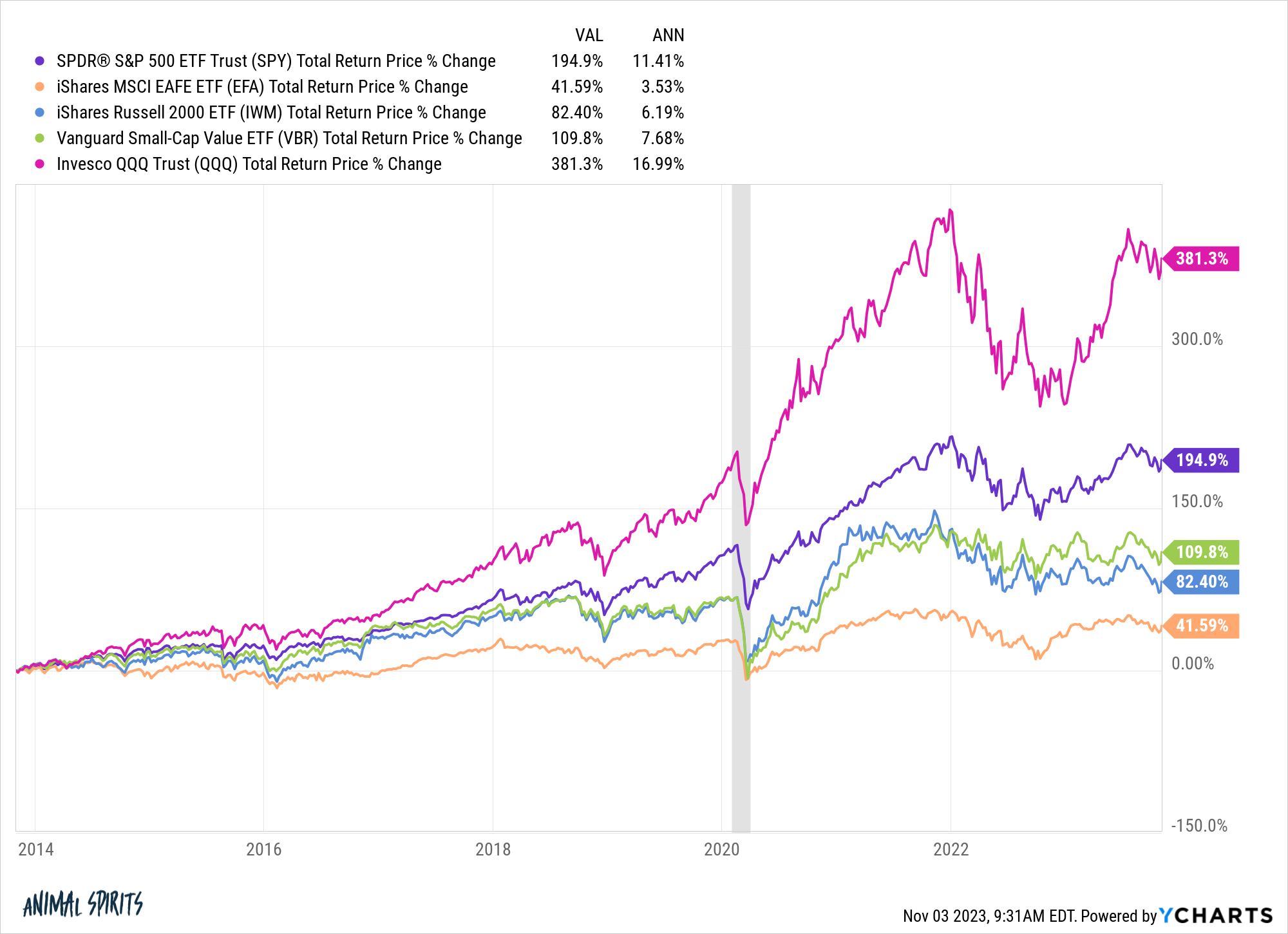

Big tech stocks have been carrying the day for some time now. Just look at the difference in performance between the tech-heavy Nasdaq 100 and S&P 500 versus the Russell 2000, small cap value stocks and international equities over the past 10 years:

Tech stocks have been dominating and rightly so. These are some of the most successful corporations the world has ever seen and the stock prices bear this out.

It would be unprecedented if tech stocks continue to dominate the stock market in the coming decade like they have over the previous decade but unprecedented things happen in the markets all the time.

An AI bubble is certainly not out of the question.

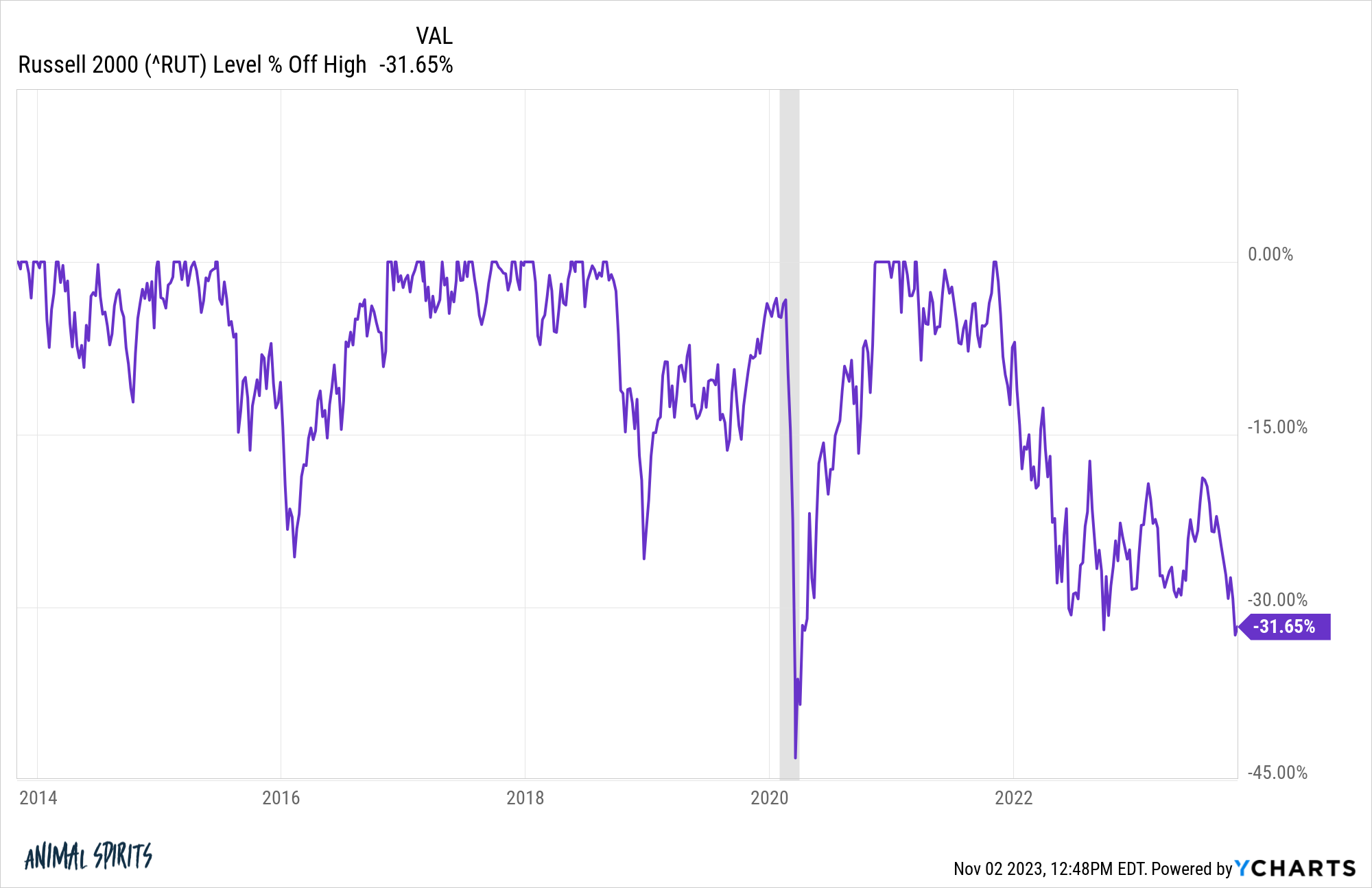

Small cap stocks have not only underperformed the S&P 500 but they’ve done so with far greater volatility.

Look at the drawdown profile of the Russell 2000 over the past ten years:

By my count there have been give double-digit corrections in the past ten years:

- 2014: -12.2%

- 2015-16: -26.4%

- 2018: -27.2%

- 2020: -41.9%

- 2022-23: -33.0%

That’s also four bear markets and two outright crashes of 30% or worse. This has not been a fun time to hold small cap stocks.

There is a silver lining here though.

This has been an outstanding market for dollar cost averaging into small cap stocks. Maybe I’m a glutton for punishment, but I’ve been buying small caps during every correction along the way.

Falling prices are a good thing for periodic investors.

If you’re a net saver, you don’t want to see all-time highs all the time. You should hope for volatility, corrections and crashes. They allow you to buy in at lower prices and valuations.

And valuations in small cap stocks are very low right now, relative to both the S&P 500 and their own history.

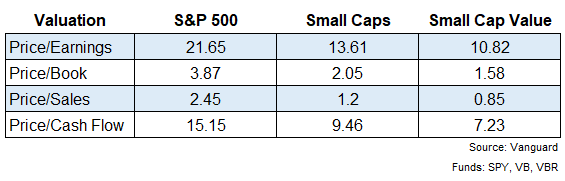

I grabbed a handful of valuation metrics on the S&P 500 along with a simple Vanguard small cap index fund and small cap value fund:

Across every metric small caps and value stocks look way cheaper than large caps.

To be fair, small cap stocks are cheap for good reason. Smaller corporations are far more interest rate sensitive than large corporations. The biggest companies were able to lock in ultra low interest rates during the pandemic. Many small companies weren’t so lucky and are paying the price now in a higher rate environment.

Stocks usually underperform for good reason.

There are sector differences as well that might help explain the valuation gaps. Tech stocks make up something like 38% of the S&P 500 but just 18% of the Vanguard small cap index fund.1

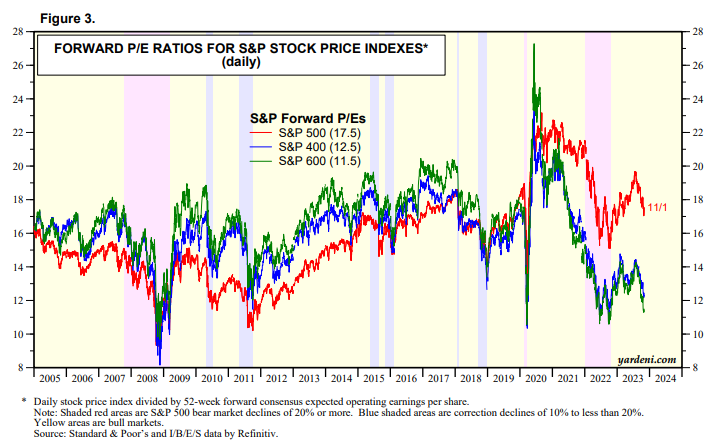

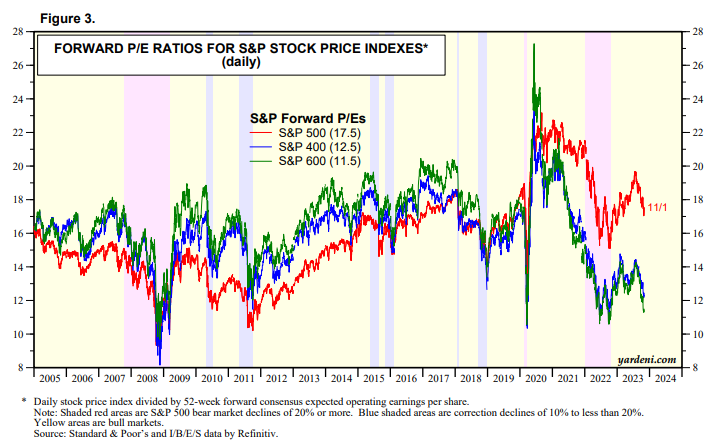

But even looking at small cap stocks relative to their own history shows valuations are rather attractive. Here’s a look at valuations for large caps, mid caps and small caps from Yardeni Research:

Small cap and mid cap stocks are nearly as cheap as they were on a forward P/E basis as they were during the Covid crash. They’re cheaper now than they were at any point during the 2010s.

Of course, valuations don’t guarantee investors anything, especially in the short run. The S&P 500 has been expensive relative to small caps, international stocks and value stocks for a number of years now and it hasn’t mattered.

Maybe fundamentals don’t matter anymore but that’s not a bet I’m willing to make with my savings.

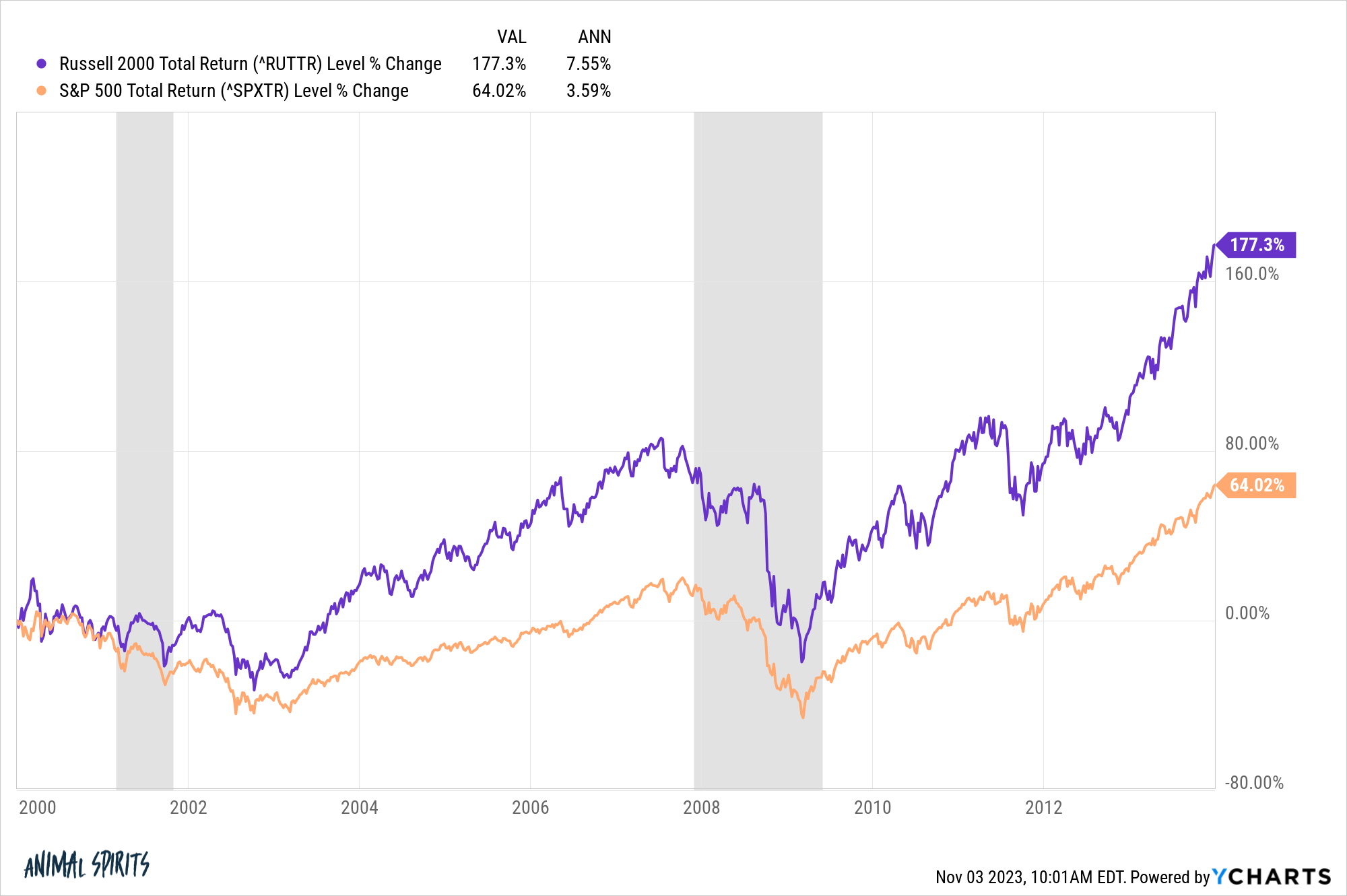

Plus, you don’t have to go back all that far to find a cycle where the roles were reversed and small caps dominated large caps.

These are the returns from the start of 2000 through the end of 2013:

Small cap stocks destroyed the S&P 500 for well over a decade, more than doubling up the returns of large cap stocks.

I’ve never been an all-or-nothing investor.

I don’t see the need to take unnecessary risks by concentrating in any single sector or strategy. There are no free lunches when it comes to investing but diversification is about as cheap as a hot dog and fountain drink at Costco.

Micheal and I talked about the stock market going nowhere for two years and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Now here’s what I’ve been reading lately:

Books:

1I’m including both tech and communication services in these calculations.