People have a hard time accepting competing ideas at the same time.

Humans are averse to discomfort so when that happens our brains work really hard to reduce that feeling. Cognitive dissonance makes it difficult to see both sides of an argument.

Everything is either good or bad with no middle ground.

And so it is with the economy.

Some people think the current economic environment stinks. Other think people are overlooking the positives underlying the data.

As usual, the truth probably lies somewhere in the middle.

To avoid my own cognitive dissonance, let’s look at both the good and the bad in the U.S. economy right now:

Economic growth is high. The U.S. economy is not getting enough credit for swallowing one of the most aggressive Fed hiking cycles in history and then printing real GDP growth of almost 5%. Rates went from 0% to 5% in a hurry and the economy is still booming.

You could make the argument a lot of this is a normalization process from the pandemic but in the face of rising rates it was certainly unexpected considering most experts assumed we would already be in a recession by now.

This past quarter was probably the peak of growth this cycle and it’s possible a recession is on the horizon but it would be hard to argue we’re in one right now.

Economic growth is good.

The inflation is still relatively high. Consumers really hate inflation.

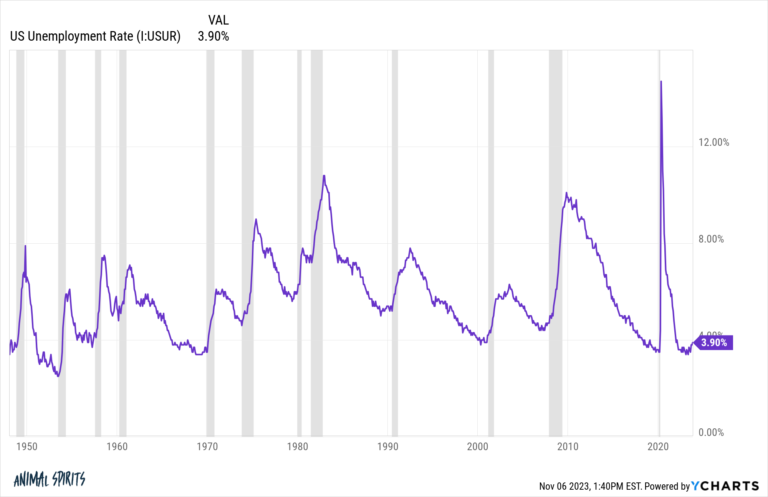

The inflation rate was only this high once in the entire decade of the 2010s which was briefly in the fall of 2011:

A lot of people didn’t like the economic environment in the 2010s. Growth was slow. Wages were stagnating. Interest rates were too low.

But people hate high inflation way more than they disliked that environment.

Wages have more or less kept pace with prices since the pandemic but people get used to higher wages relatively quickly. Higher prices beat you over the head every single day.

We’re on the right path but the fact that inflation has experienced an uptick in recent months isn’t helping with consumer sentiment.

Volatile prices are not good.

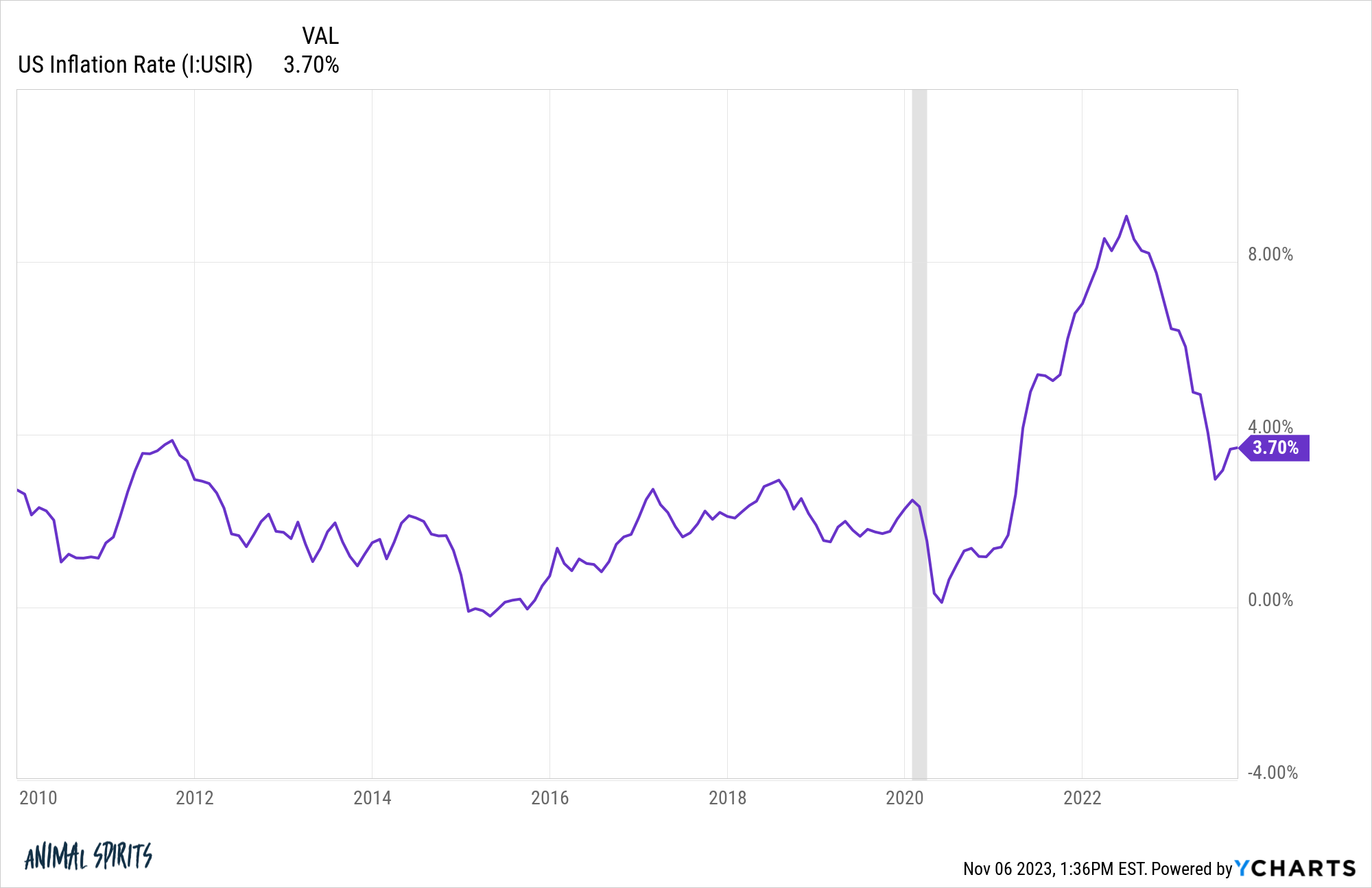

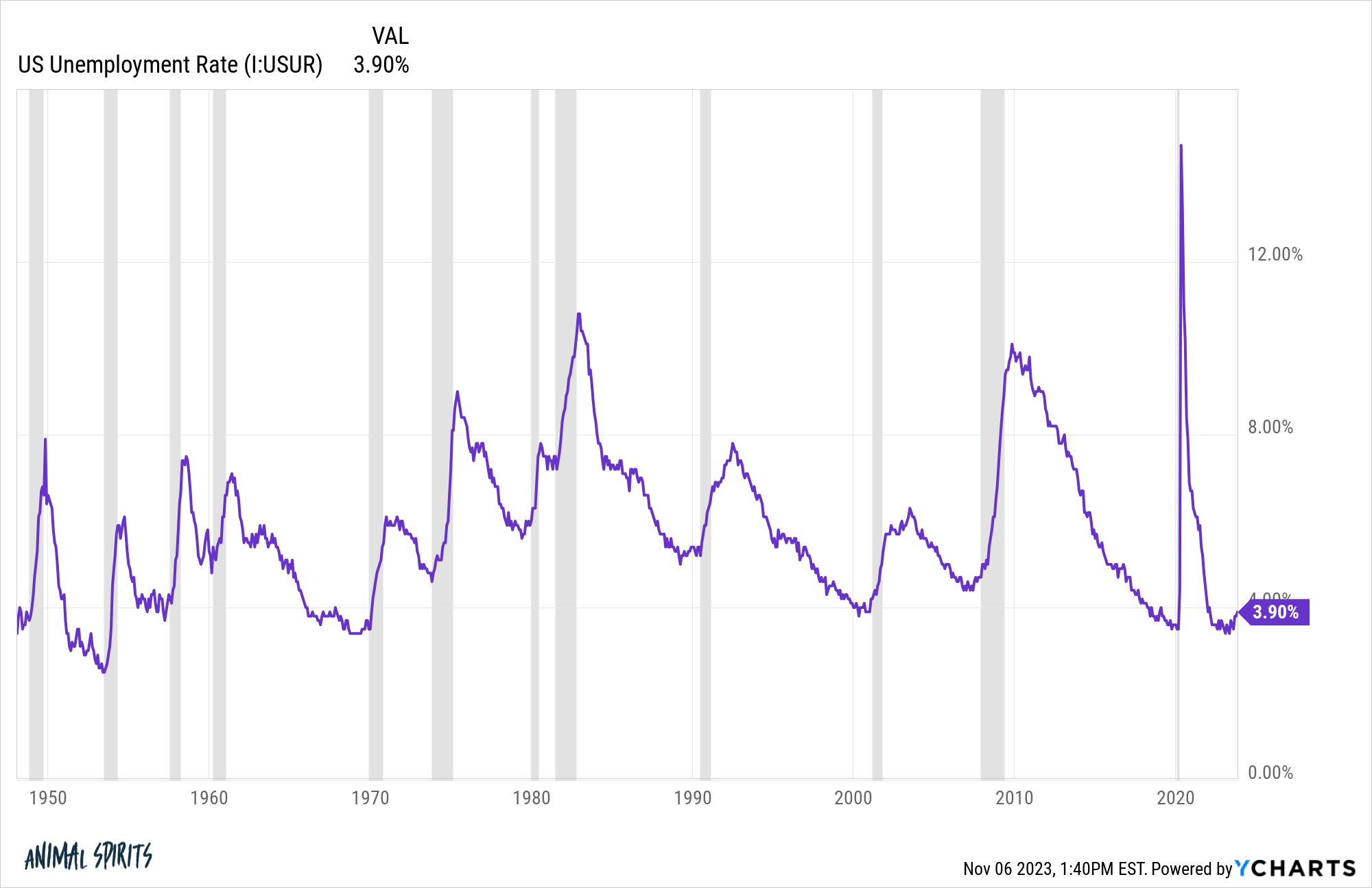

The unemployment rate is low. The unemployment rate never got as low as it is today even once during the 1970s, 1980s or 1990s1:

The employment recovery from the pandemic was an economic miracle as far as I’m concerned. Yes it cost the government trillions of dollars but the alternative would have meant an economy that fell trillions of dollars short and millions of people unemployed.

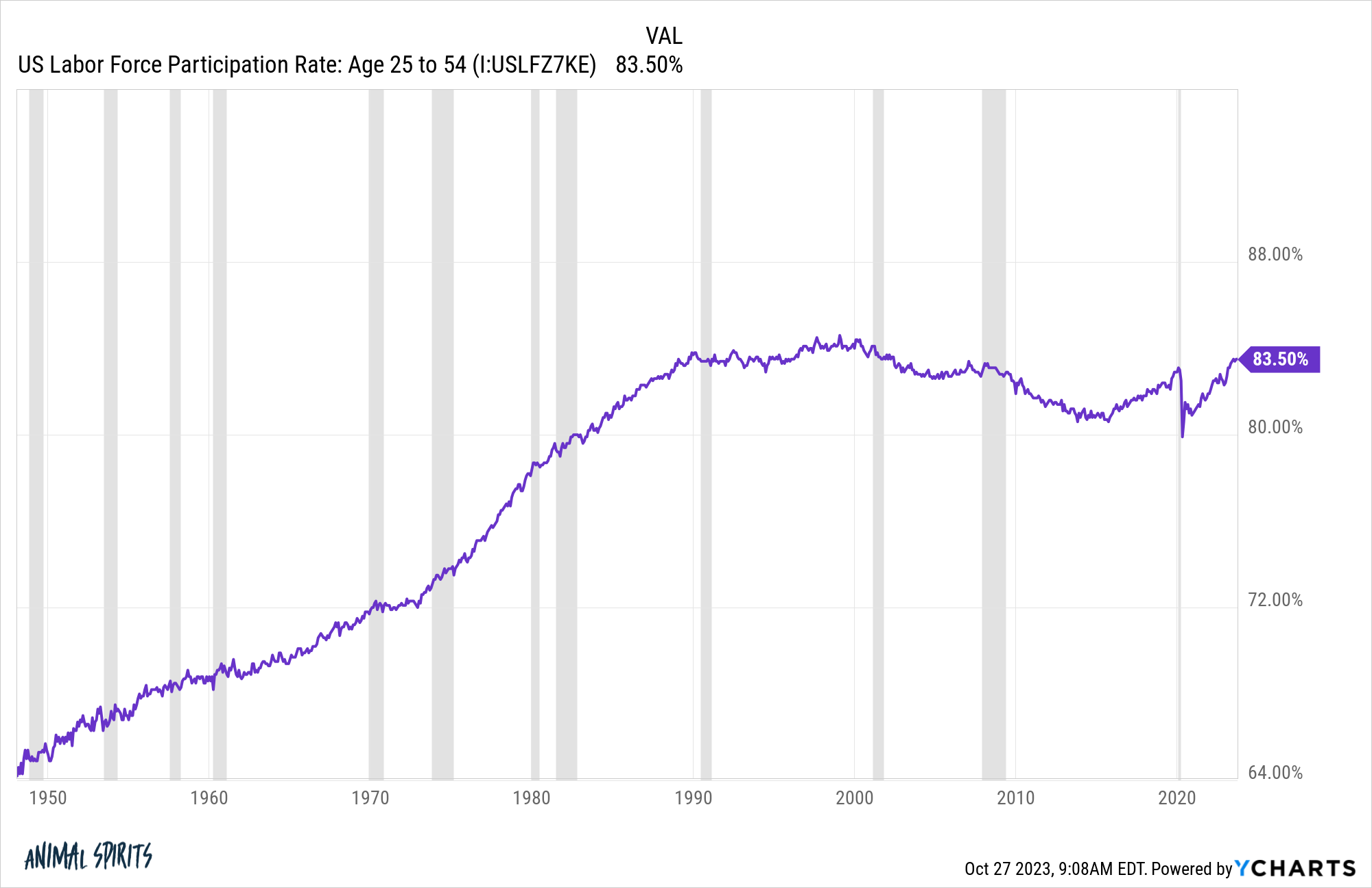

The overall labor force participation ratio can be a bit misleading because so many baby boomers are retiring early but look the prime age (25-54) range:

We’re within spitting distance of the all-time highs in the 1990s and well above pre-pandemic levels. More young and middle-aged people have actually gotten jobs these past three years.

Low unemployment is a good thing.

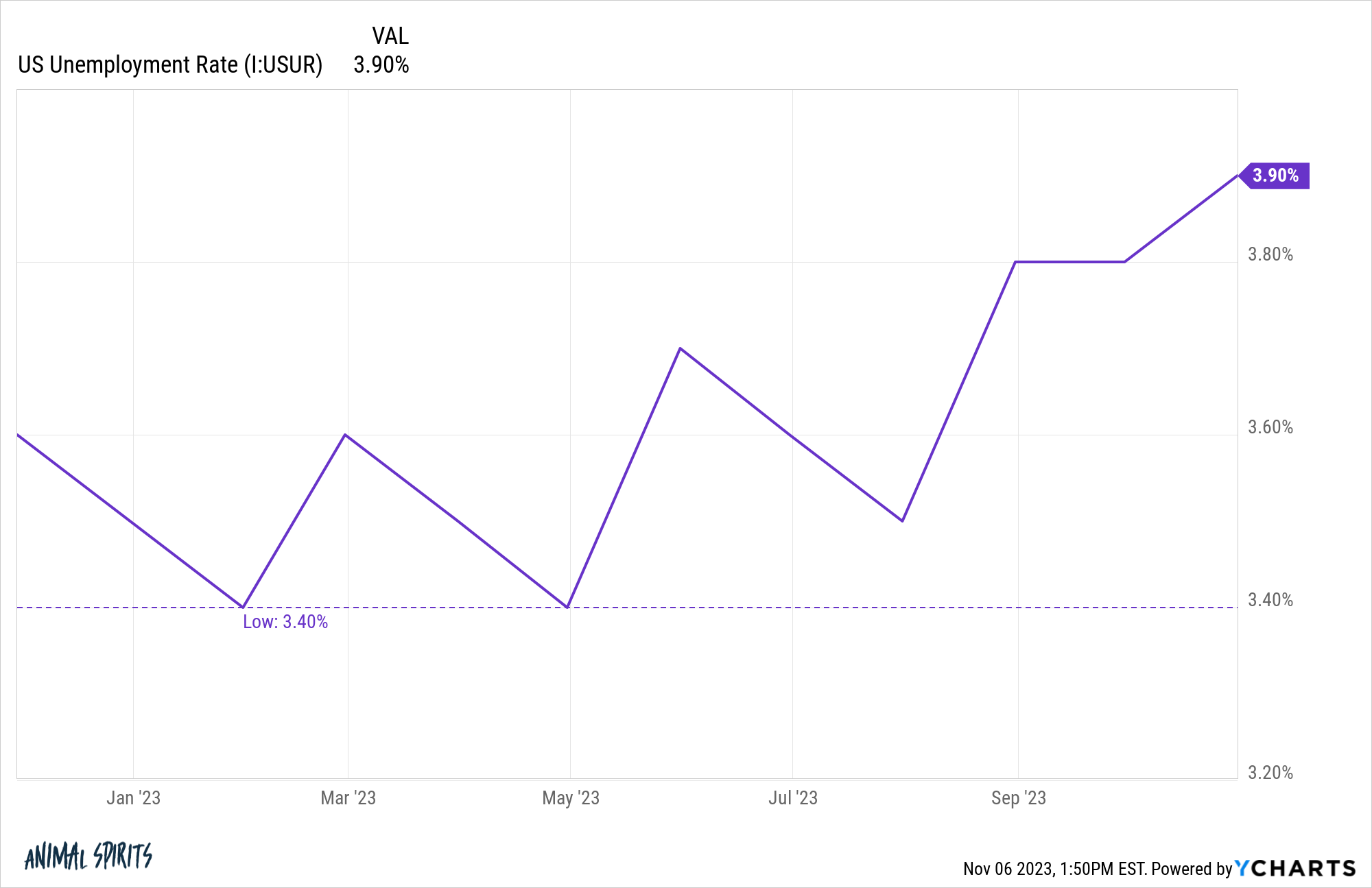

The unemployment rate is rising. The unemployment rate is historically low but it’s rising.

We’ve gone from a low of 3.4% to 3.9%:

Historical economic relationships have gotten thrown out the window this cycle but it would be rare to see a minor increase in the unemployment rate without a bigger slowdown coming down the line.

Rising unemployment is not good.

Interest rates aren’t having an adverse impact on consumers yet. Most consumers and corporations locked in ultra-low interest rates during the pandemic.

Corporations like Apple and Microsoft took out debt at generationally low levels and are now earning high yields on their enormous cash balances. If you’re wondering why the stock market has fared so well in the face of rising rates this it the simplest explanation.

If you already owned a house or refinanced in the pre-2022 era, you’re not fretting about higher mortgage rates right now unless you want to move.

This is one of the main reasons consumers and corporations alike have been so resilient throughout this rapid rise in interest rates.

Interest rate-sensitive industries are feeling the pain. There are certain parts of the economy where higher rates are devastating their business.

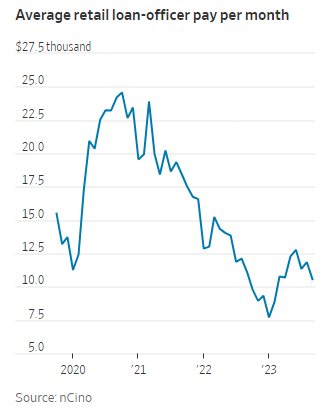

The Wall Street Journal recently ran a story about the state of the mortgage lending business and it’s ugly out there:

Mortgage industry employment has already declined 20% to about 337,000 people, from 420,000 in 2021, according to Bureau of Labor Statistics data compiled by the MBA, which anticipates a further 10% decline. The employment tally includes mortgage bankers, brokers and loan processors but not real-estate agents.

Those still employed are earning less. Loan officers’ average monthly pay in September was down by more than half from three years earlier, according to financial technology company nCino. The average loan officer closed 3.45 loans last month versus 8.15 in the same month in 2020.

The mortgage market used to be Steve Walsh’s cash cow, but now it’s squeezing him on both sides. Business at his Scottsdale, Ariz., mortgage brokerage, Scout Mortgage, is down about 90%, he said, and head count has fallen to seven from a high of about 25 at the end of 2020.

Look at the average monthly earnings rollercoaster:

Loan officers went from the roaring 20s to a depression in the span of three years.

I don’t see what makes this better any time soon since mortgage rates would have to fall precipitously to get activity back to those levels.

This industry is in a world of pain.

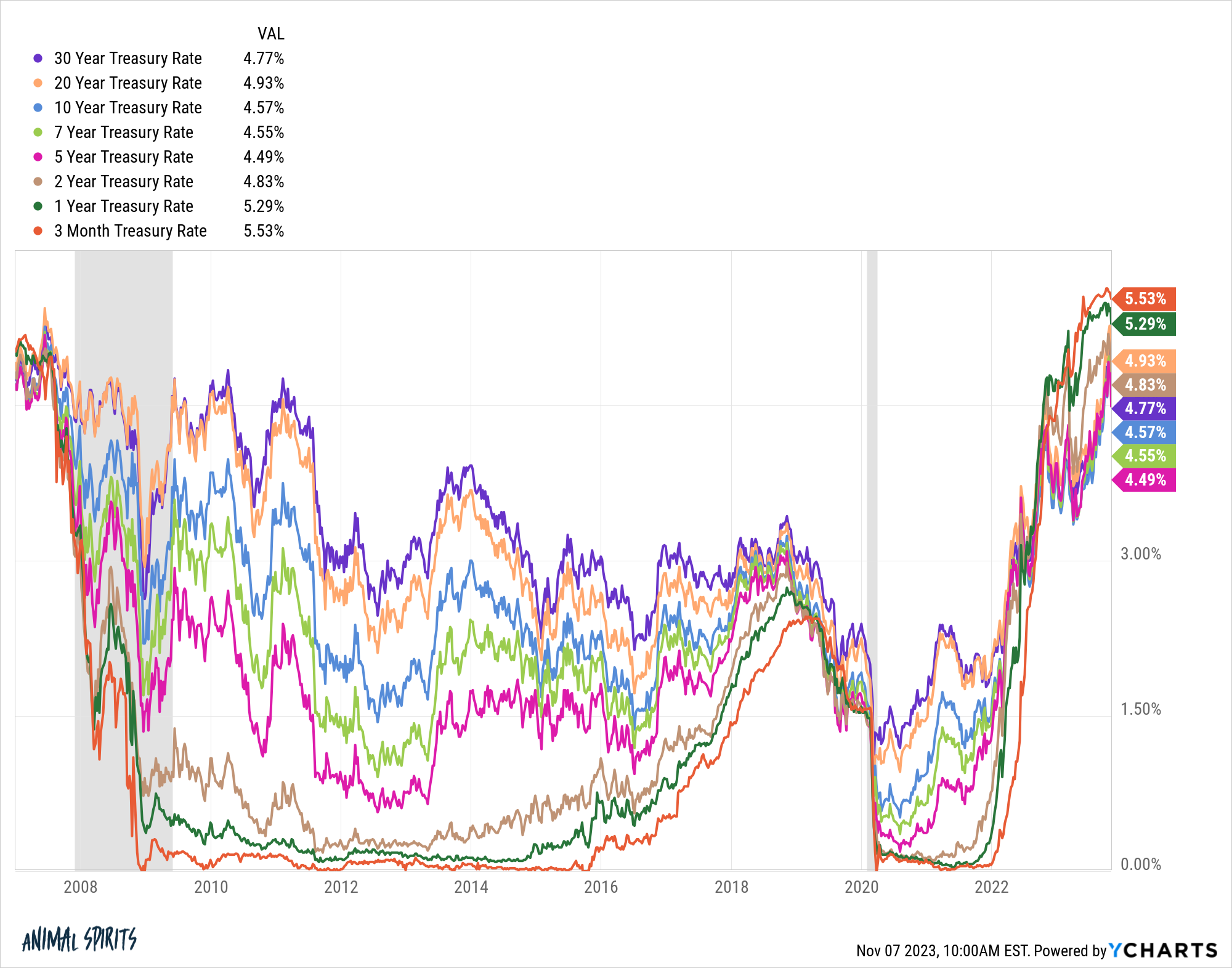

Savers are no longer being punished. For the first time in a decade-and-a-half, you can find decent yields on CDs, money market funds, online savings accounts and bonds.

Short-term rates are the highest they’ve been since 2007. Long-term and intermediate-term yields have spike in recent months as well.

There are options galore for your cash or fixed income needs at the moment.

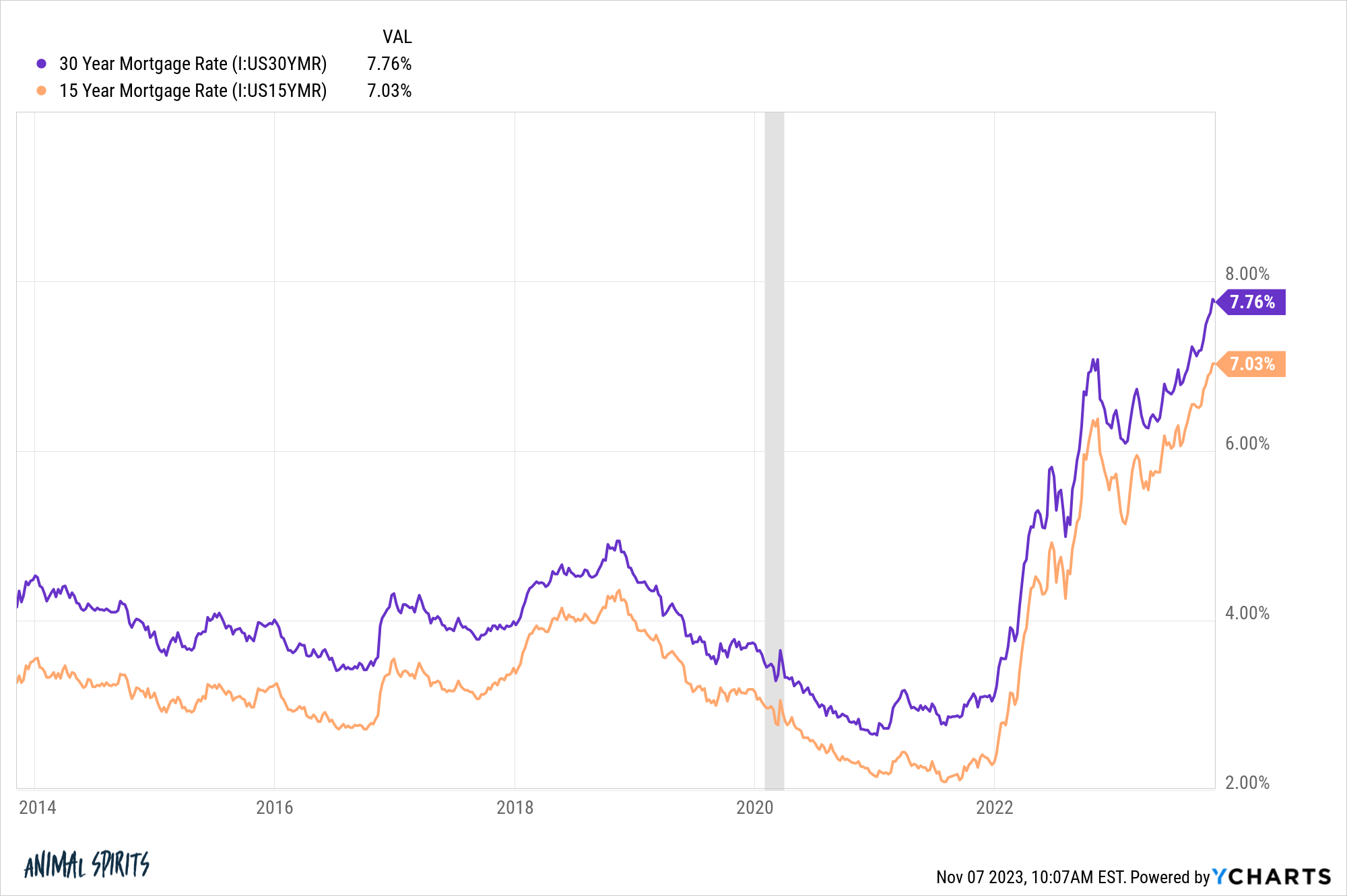

Borrowers are being punished. If you locked in lower rates, the current environment doesn’t seem so bad. But if you’re a borrower the terms today seem onerous when compared to the recent past.

Mortgage rates are above 7%:

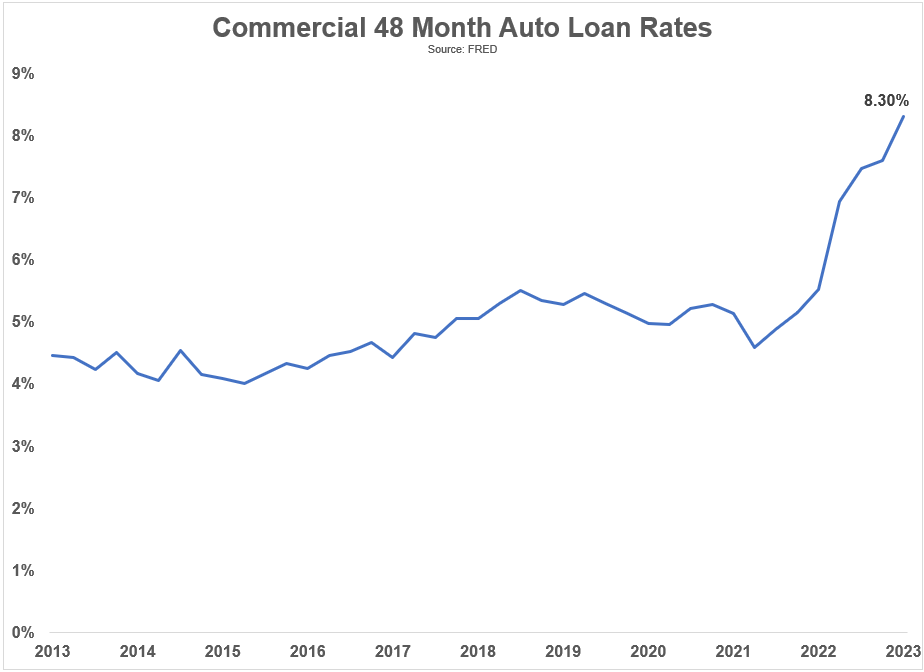

Car loan rates are now well above 8%:

The combination of higher prices and higher borrowing rates makes this a terrible environment for those who need to take on debt.

If you’re in the market for a house or car, things are not great.

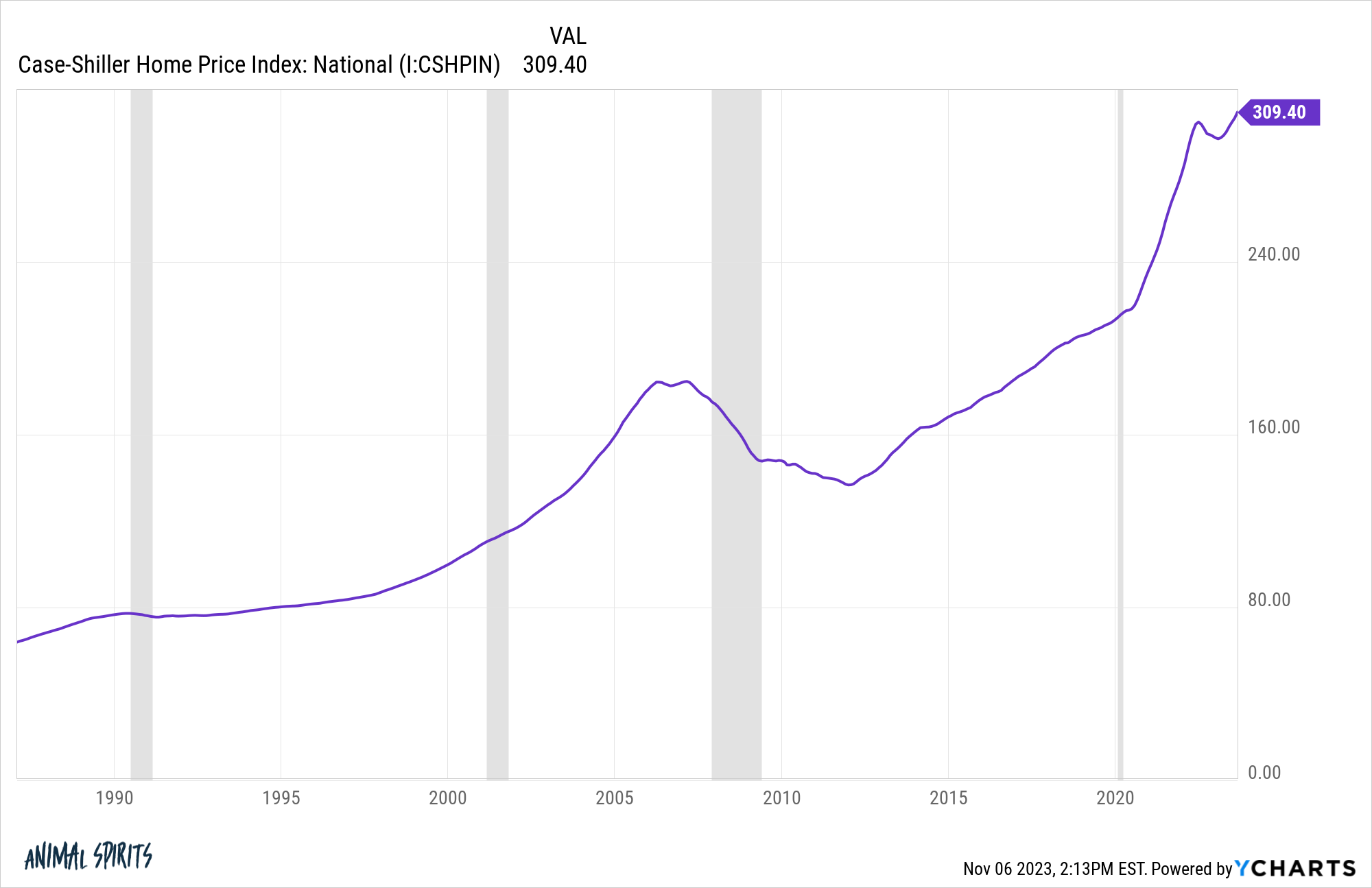

Housing prices are back at all-time highs. The Case-Shiller National Home Price Index is back at new all-time highs after a minor dip in prices:

You didn’t have to go looking for some exotic hedge against inflation. Owning a home was your best defense against an inflationary spike.

Lots of Americans own their homes so rising prices have been a boon to consumer balance sheets.

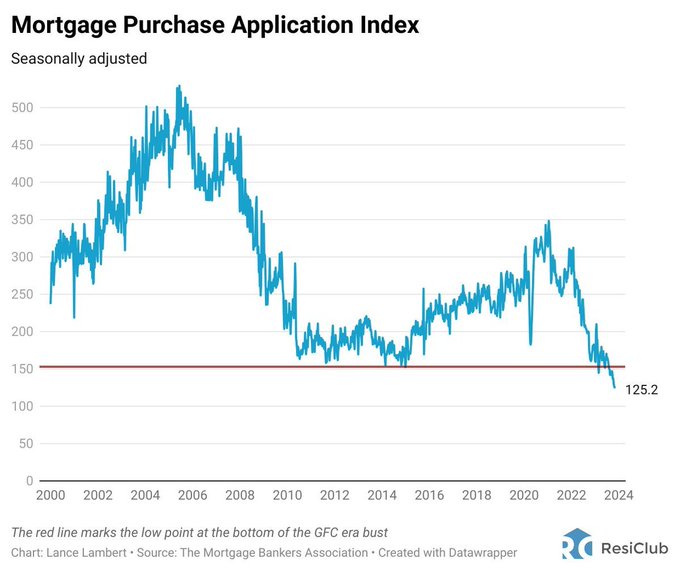

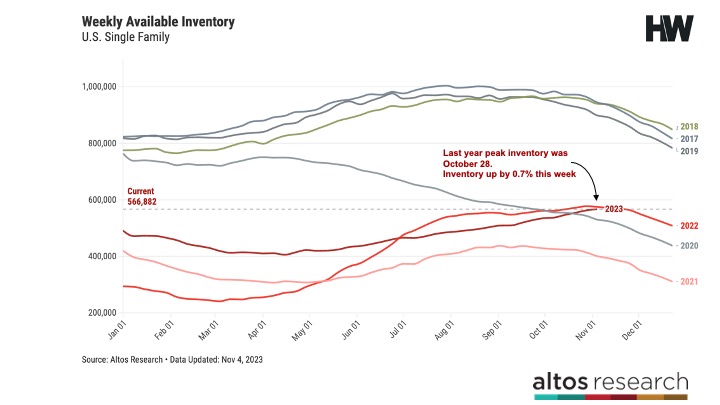

The housing market is broken for anyone wanting to buy. High prices are helpful to homeowners but good luck if you’re on the outside looking in.

Supply is dreadful right now. Just look at mortgage purchase applications:

We’re still well below pre-pandemic levels of housing supply:

Prices are up, it’s expensive to borrow and there aren’t many houses on the market.

This is just a dreadful time for anyone in the market looking to buy.

I could keep going but you get the idea.

There are pros and cons right now for the U.S. economy.

There’s an old saying: Where you stand is a function of where you sit. How you feel about the U.S. economy depends on how your personal economy is going.

I care about aggregates, medians and averages when trying to determine the trend of the economy but individuals and households don’t care about economic data. All people really care about is their personal situation — their job, their personal life, their finances, etc.

There are good and bad things going on in the economy right now but all people really care about is the good and bad things happening in their own lives.

Further Reading:

The 3 Kinds of Inflation

1To be fair, the 1990s did end with an unemployment rate of 4%. But we never saw a sub-4% number in any of those three decades.