A reader asks:

Can you please explain why financial media personnel keep saying the 60/40 is dead but they are not saying target date funds are dead?

Last year was one of the worst years ever for a 60/40 portfolio of U.S. stocks and bonds.

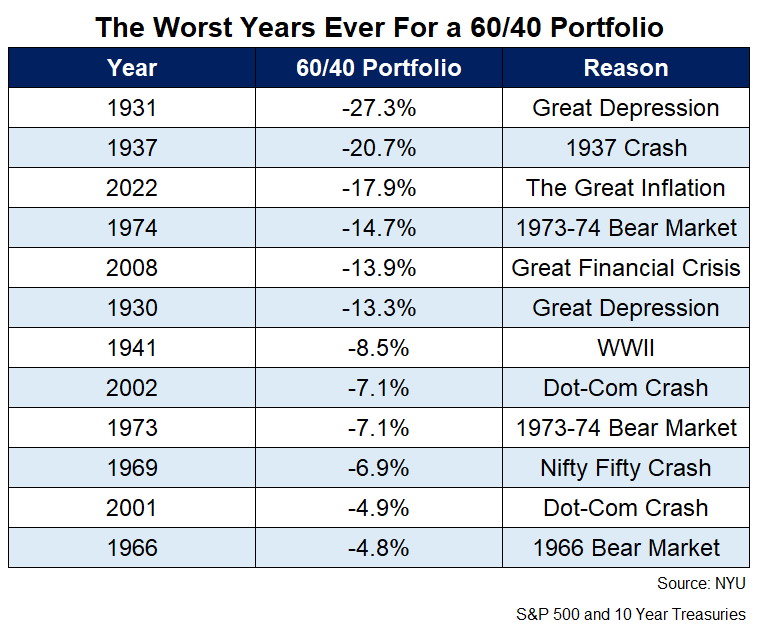

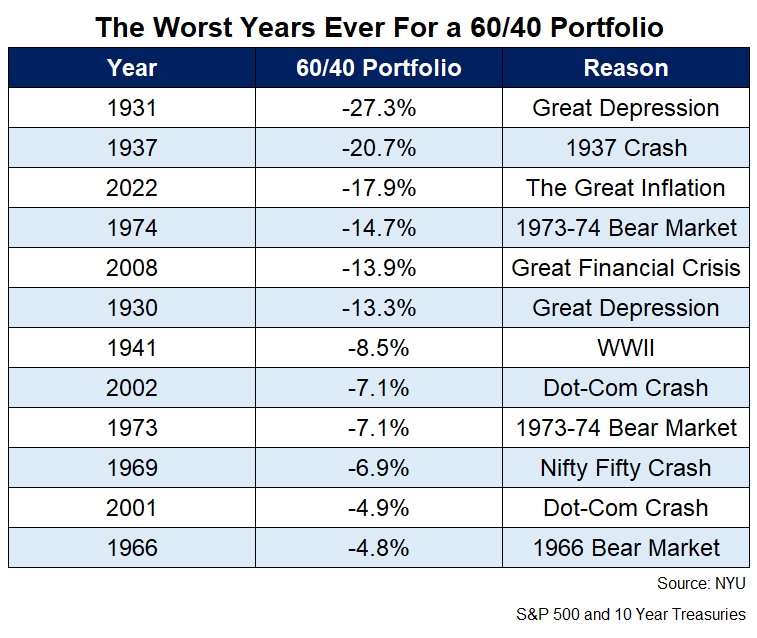

These are the 10 worst calendar year returns for a portfolio comprising the S&P 500 and 10 year Treasuries going back to 1928:

By my calculations, 2022 was the third worst year for a diversified mix of stocks and bonds over the past 95 years.

That’s pretty bad.

But it’s one year.

Bad years happen for every asset class and strategy. They’re called risk assets for a reason. One year does not a successful strategy make.

Some in the financial media have been pouring dirt all over the 60/40 portfolio because of a bad year in 2022.

It’s broken. It’s not going to work going forward. Correlations for stocks and bonds are higher when inflation is higher. Ditch the simple and go with the complex.

I think the simple part irks many people in the financial media and investment industry. Complicated gets more clicks and eyeballs. Complex is easier to sell than simple.

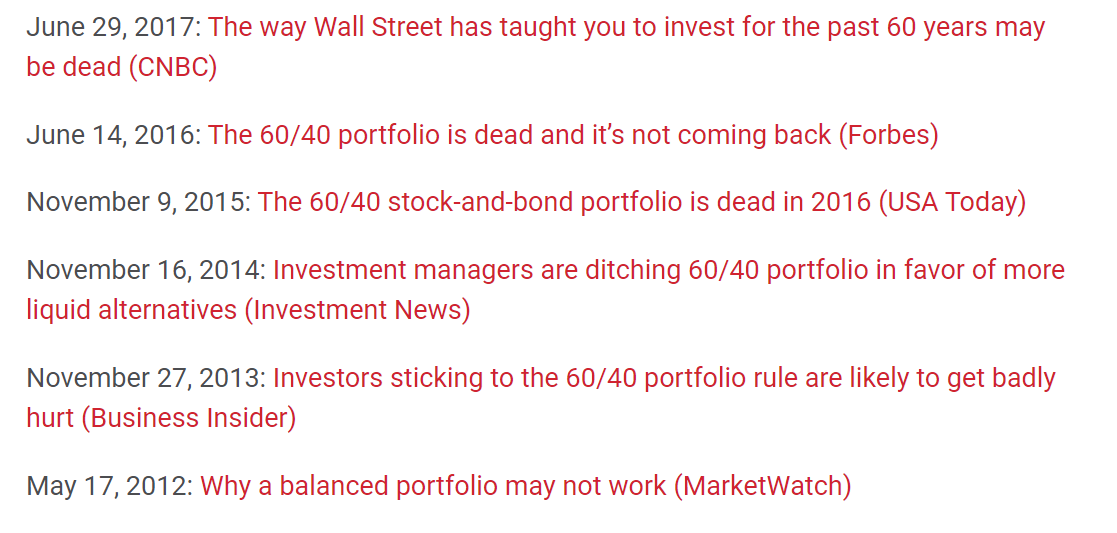

The media has been planning a funeral for the 60/40 portfolio for years:

I even wrote a eulogy for the 60/40 portfolio back in 2019.

It’s also important to note I’m not sure I’ve ever met anyone who actually has all of their money split evenly between 60% stocks and 40% bonds.

Most investors own some real estate. They hold some cash. They might be invested in some individual stocks. Or some other strategy — REITs, foreign stocks, small caps, mid caps, value, quality, momentum, dividends, alternatives, munies, high yield, corporate bonds, etc.

In this sense, most portfolios are probably more similar to targetdate funds, some of which have an allocation that’s 60% in stocks and 40% in bonds but in a more broadly diversified manner. Targetdate funds also change allocations over time whereas the 60/40 portfolio is static beyond rebalancing.

We also live in a world where pundits become famous for predicting the beginning or end of something. Everything has to be the top or bottom. A bull market or a bear market.

You’re never going to see the following headline:

A boring diversified portfolio does well most of the time but sometimes it doesn’t

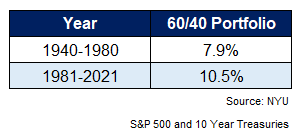

There is also a contingent of financial pundits who assume the 60/40 portfolio is a construct of the disinflationary era from 1980-2021. The only reason returns were so high was because rates and inflation were falling.

Those tailwinds certainly helped but it’s not like financial market returns were that terrible in the pre-1980 era.

Here are the returns over the 41 years from 1981-2021 which saw rates and inflation mostly falling and the 41 year period from 1940-1980 which saw rates and inflation mostly rising:

The 41 year period from 1981-2021 was certainly aided by falling rates and high starting yields for bonds. Ten year Treasuries returns 7.5% annually in this period. Bonds were only up 2.6% per year in the 1940-1980 time frame.

If we look at the previous 95 years from 1928-2022 for a longer-term view, the annual return was 8.1% per year. So it’s not like the environment with higher rates and inflation from 1940-1980 was that far away the long-run average.

The crazy thing about 2022 being one of the worst years ever for the 60/40 portfolio is the ten years ending last year were still pretty good. Annual returns were 7.7% from 2013-2022.

I can’t promise what the returns will be going forward because I can’t predict what the stock market or interest rates will do in the future.

But the 60/40 portfolio’s expected returns are in a pretty good place right now because investors can finally earn something on the 40.

If you’re earning something in the 4-6% range on your bonds the stock portion of a diversified portfolio doesn’t have to do as much of the heavy lifting.

Saying 60/40 is dead is like saying diversification is dead. It’s a short-sighted view that has no basis in reality.

Diversified portfolios are alive and well thank you very much.

We touched on this question on the latest edition of Ask the Compound:

Bill Sweet joined me again this week to discuss questions about portfolio rebalancing, asset allocation, the tax implications of holding bonds in taxable accounts, municipal bonds, real estate in high-cost-of-living areas and more.

Further Reading:

A Eulogy for the 60/40 Portfolio