Some questions I’m pondering about the economy at the moment:

1. Why do people keep spending money if the economy is so terrible? We’re breaking records for holiday travel:

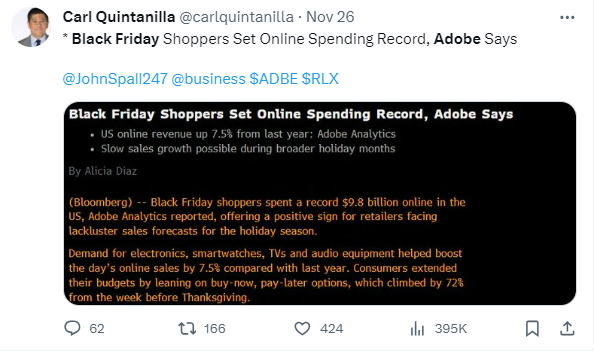

And spending money on Black Friday like crazy:

Granted, this is holiday travel and spending. It’s not the normal course of action.

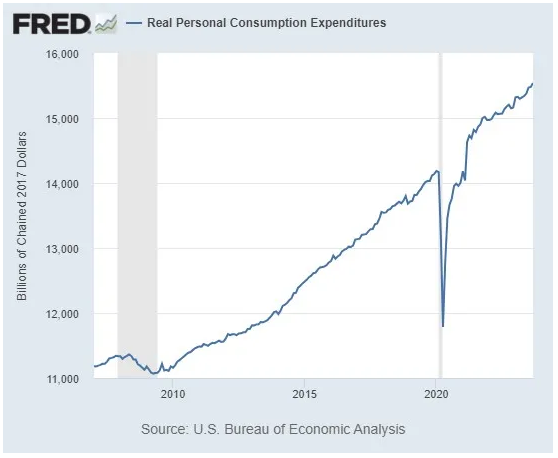

But just look at the inflation-adjusted spending for consumers on goods and services:

Lots of people say they hate this economy (especially the higher prices) but people keep right on paying those higher prices and spending money.

We love to consume in this country and it’s going to be difficult to change our spending habits even with higher prices.

It’s probably going to take a recession to stop this.

2. Is debt propping up the economy? Fine, people are spending but surely it’s all on credit, right?

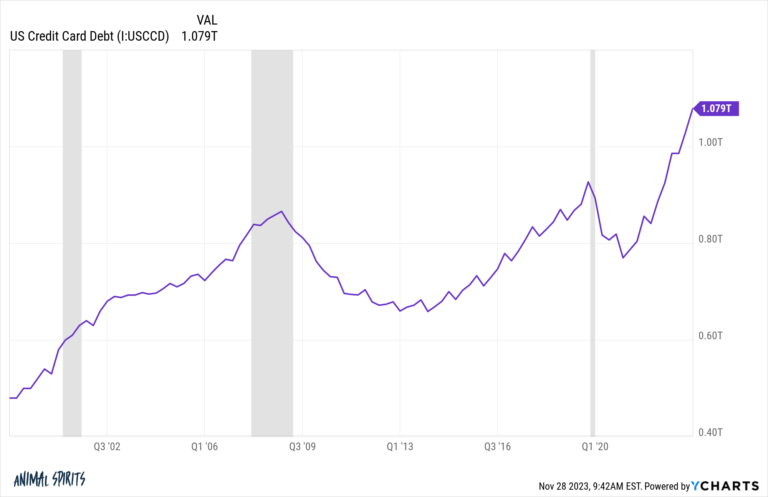

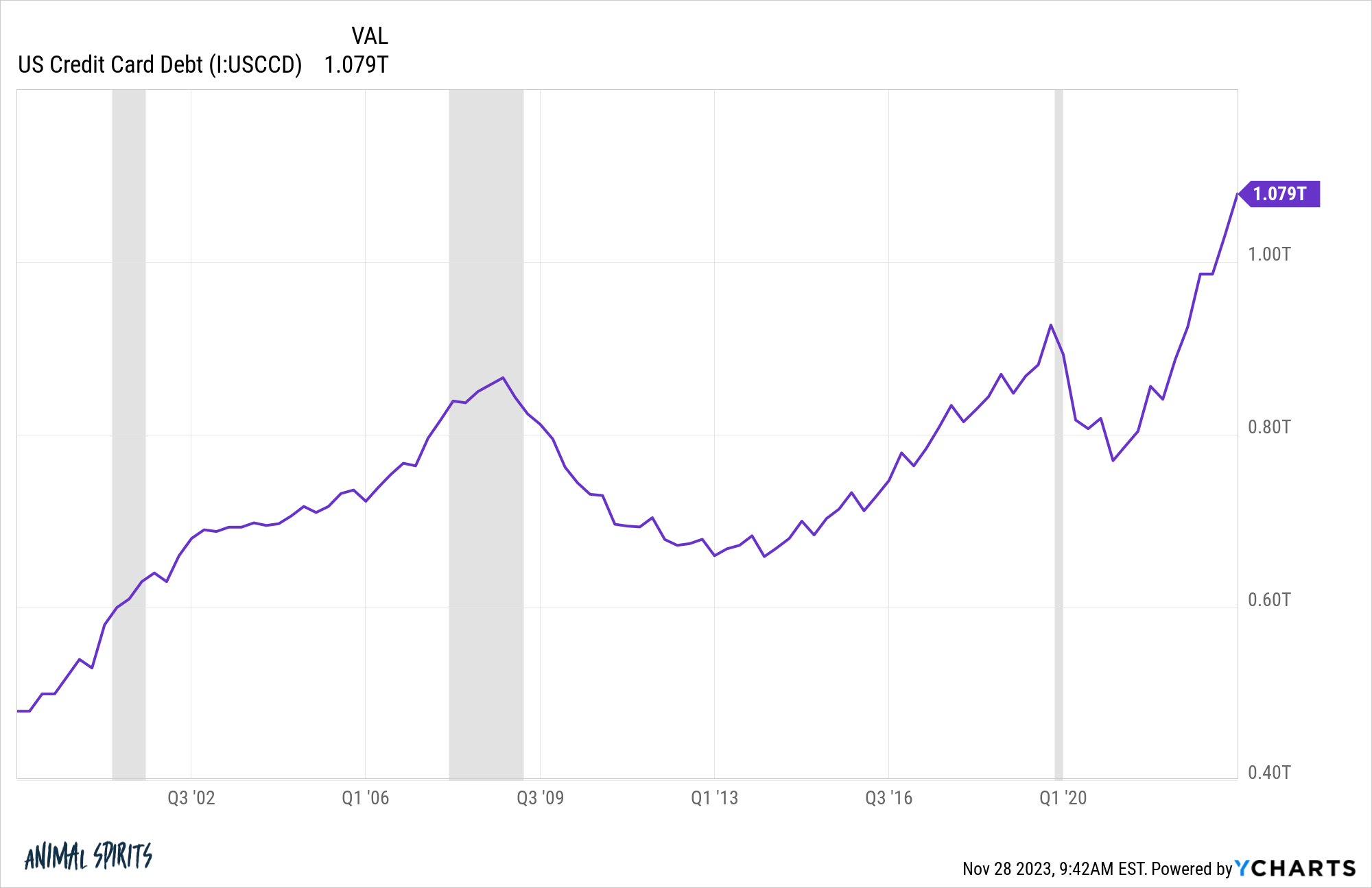

The total amount of credit card debt is going higher:

Total credit card debt going over a round number like $1 trillion is scary but we also have to put these numbers into perspective.

Remember inflation is up 20% or so cumulatively since 2020. If you adjust credit card debt for inflation we’re basically back to 2018 or 2019 levels.

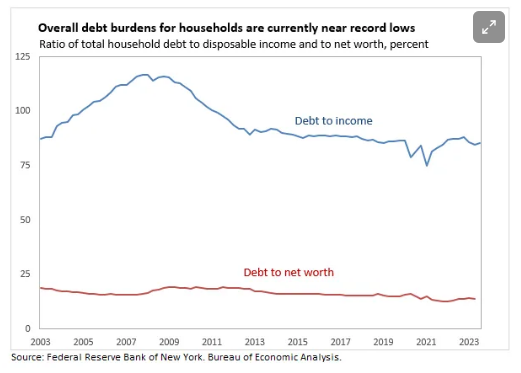

Now look at debt relative to income and net worth (via Claudia Sahm):

Not so bad.

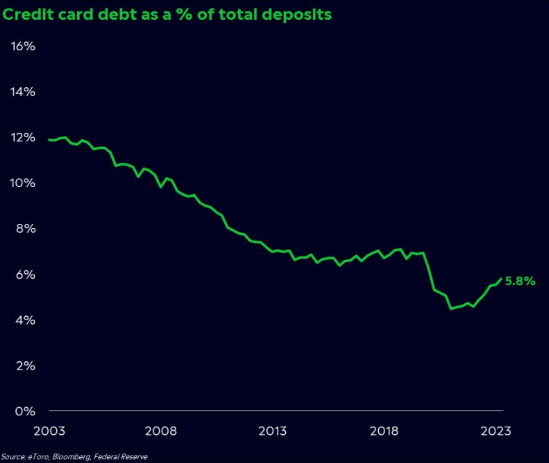

Callie Cox has this great chart that shows credit card debt as a percentage of bank deposits:

It’s on the rise but way lower than most of this century.

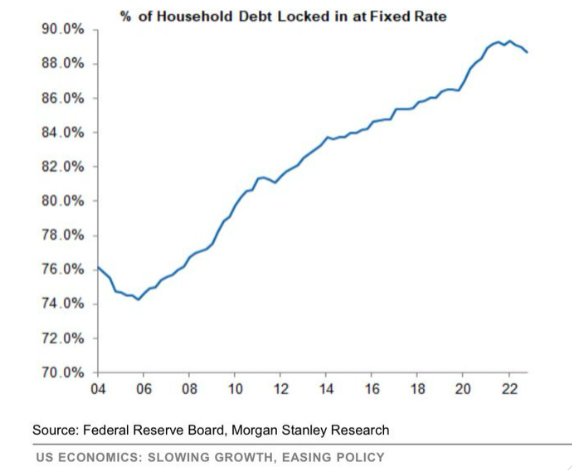

Or how about the amount of household debt that it locked in at a fixed rate:

Higher borrowing costs are obviously having an impact on some consumers right now. It’s a painful experience if you’re borrowing for a house or car right now.

And I’m sure there are plenty of households who are taking on credit card debt they can’t handle.

But things aren’t out of control…yet.

3. Who has the biggest gripe about the economy right now? There are always winners and losers in the economy but it feels like the haves and have not are even more magnified than ever in the information age.

Higher prices have strained many household balance sheets for those who haven’t seen their incomes keep up with inflation. And those working in interest rate sensitive industries (like real estate) are certainly feeling the pain right now.

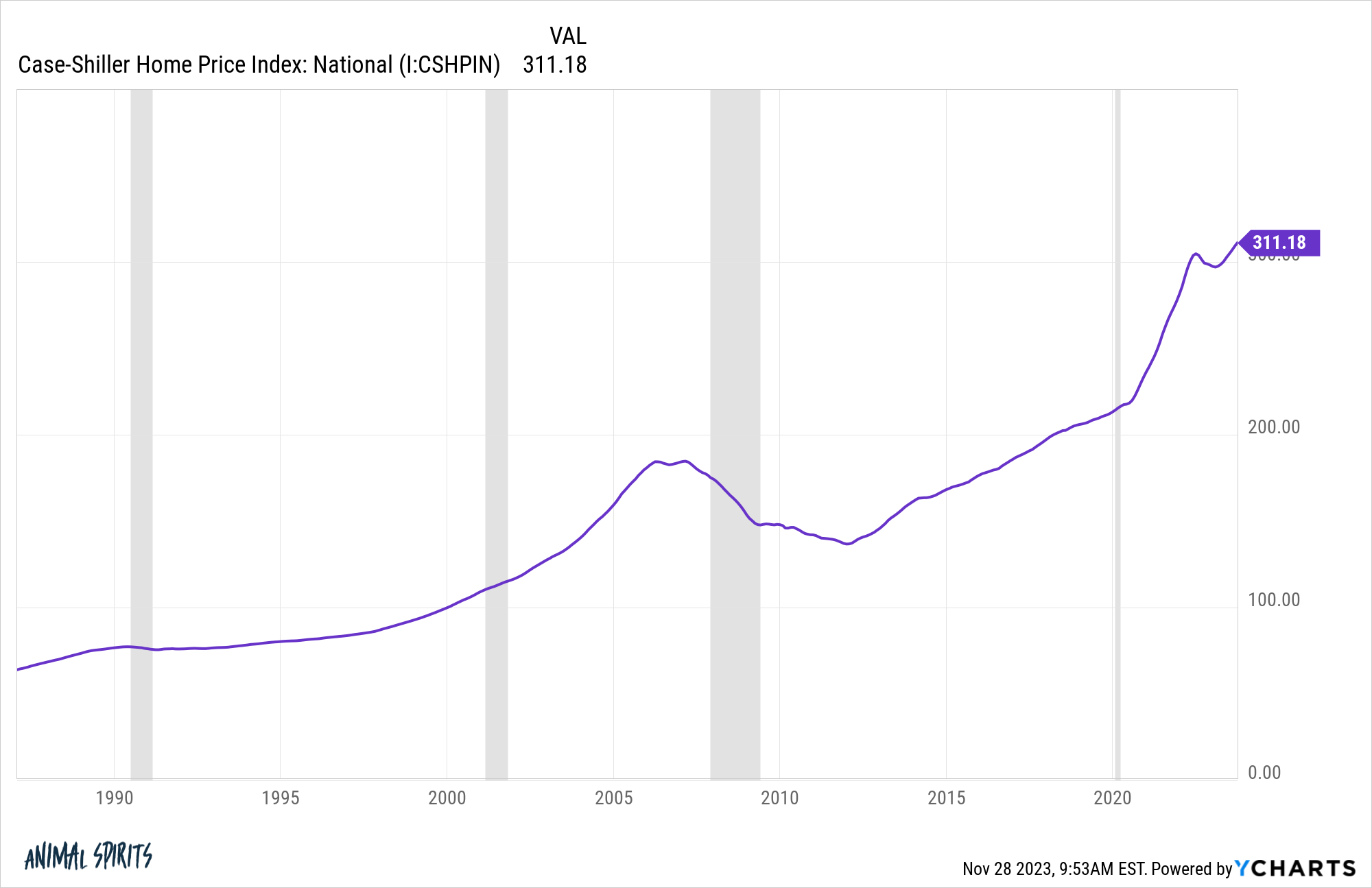

But young people in the first-time homebuyer stage of life might have the right to air the most grievances this Festivus season. Housing prices hit another new all-time high in data released from Case-Shiller this morning:

If you missed the ~50% rise in prices since the start of the pandemic and the 3% mortgage rate cycle and saw your rents increase you have every reason to be disenchanted with this economy.

4. Will we ever see a good time to buy a house again? Annie Lowrey at The Atlantic asks if it will ever be a good time to buy a house again:

It’s a terrible time to buy a house. But that news, bad as it is, seems to convey some promise: Someday, things will change and it will once again be a good moment to buy. You just have to wait. I’m sorry to tell you that the bad news is even worse than it sounds. It’s not going to be a good time to buy a house for a really long time.

Demographics are destiny in the housing market, so I was fairly confident in the 2010s that we would see a 2020s housing boom when millennials reached their household formation years.

But demographics couldn’t have predicted a pandemic would cause a decade’s worth of gains to occur in less than three years.

Baby boomers are likely going to add supply to the housing market sometime in the 2030s as they sell or die off. We just don’t know what unforeseen factors could cause this trend to speed up or slow down in the years ahead.

Everything is cyclical so I’m confident it will be a buyer’s market again at some point. You might just have to be patient.

5. Are economic sentiment gauges broken forever? It’s no mystery that people hate inflation and economic volatility. That’s a big reason why consumer sentiment is in the toilet even in the face of strong economic growth and a low unemployment rate.

But there’s more to the sentiment piece than higher prices.

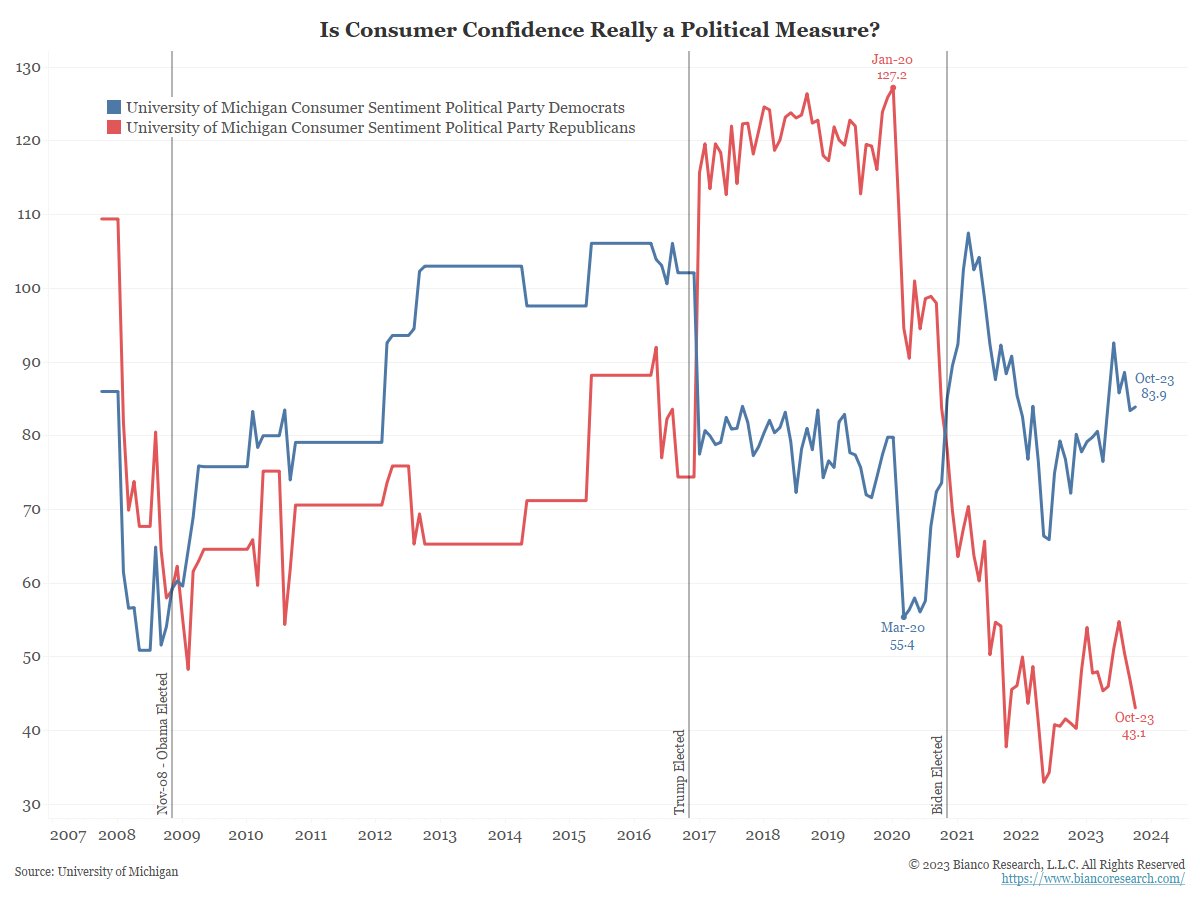

Jim Bianco has a chart that shows sentiment broken out by Democrats and Republicans over time:

When Obama was president Democrats thought the economy was better. When Trump was president Republicans thought the economy was better. When Biden became president it flipped again.

These aren’t realistic reflections of the economy. It’s how people feel about their team.

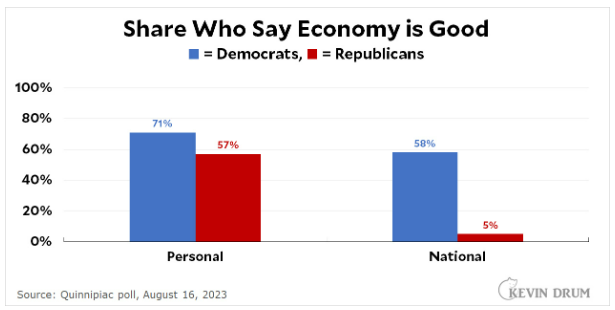

People also have a hard time reconciling their own situation with how they feel about the economy (via Kevin Drum):

I’m doing fine but everyone else is doing terrible.

Social media and 24 hour news networks make it a lot harder to trust sentiment readings today.

It’s probably only going to get worse regardless of how the economy is doing.

Watch what they do not what they say.

Further Reading:

Seeing Both Sides of the U.S. Economy