A podcast listener asks:

Michael and Ben are so optimistic it makes me nervous. This past month+ has been so good it can’t be real. The market goes up and gas goes down every day, the VIX is at 12, etc. Life and investing is not this easy! Help us explore the potential downsides. Do you see consumer credit risk after holiday bills come due?

My wife and I are 43 and entering our peak earning years. Is it selfish to want the market to chill the F out so we can buy in? We are at a point where we can really accumulate shares but everything is going up faster than our paychecks arrive. How do you talk to clients that feel they are putting significant money in play in a market that seems very expensive?

I take umbrage with the idea that Animal Spirits is a contrarian indicator. We are a coincident indicator!

I am an optimistic person by nature but there is a huge difference between being blindly perma-bullish and celebrating the fact that we just made it through an extremely difficult economic and market environment.

I’m relieved we didn’t have a recession this year like everyone expected.

The downside risks are what they always are — an economic slowdown, a stock market crash, geopolitics, something completely out of left field. The reason itself doesn’t matter nearly as much as setting the right expectations for the occasional downturn and financial crisis.

The why and the when aren’t as important as most people think because timing the economy and the stock market is more or less impossible.

The second question is far more important because risk means different things depending on where you are in your investing lifecycle.

It’s fairly straightforward for the young and old.

Young people should hope for markets to go down so they can deploy their human capital at lower prices.

Old people should want markets to go up so their portfolio’s market value stays high.

In middle age, you have a foot in both camps. Maybe this is the reason for a mid-life crisis.

You should own some financial assets at this stage of life so it’s nice to see prices rise.

But you should also be entering your prime earning years so bear markets should be welcomed.

New all-time highs in the stock market are nice and all but the all-time high you should really care about at this stage of life is how much you’re saving and investing in your retirement and brokerage accounts.

If the stock market is down from all-time highs but your savings rate is hitting new highs that’s a good combination.

You have no control over what happens to financial markets. The timing of bull and bear markets rarely lines up perfectly with life events.

That means you have to take advantage of the opportunities to buy lower when they present themself.

Markets feel like they’ve been easy these past couple of months but investors have been through a lot these past couple of years.

The U.S. stock market last saw all-time highs during the first week of 2022:

You had two years to buy at lower prices!

Two-thirds of the time over the past two years the S&P 500 has been in the midst of a double-digit drawdown.

This has been a wonderful market for dollar cost averaging.

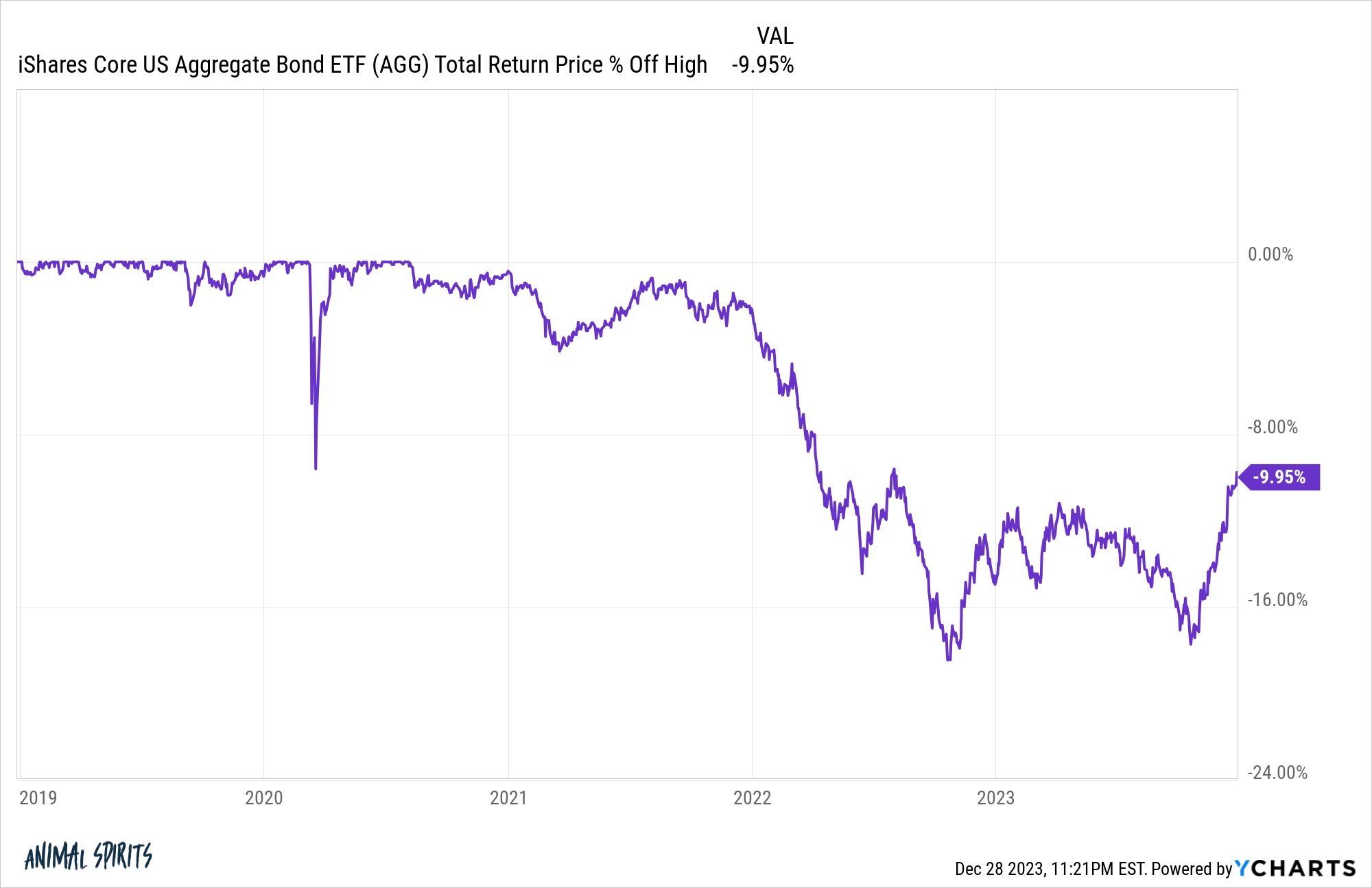

Stocks are basically back at all-time highs but bonds are still in the midst of a correction:

Rates have come in at a decent clip, but bonds have been underwater since 2021.

These weren’t generational buying opportunities by any means but those situations don’t come around very often.

It was a pretty nasty bear market though. If we include the late-2018 downturn, that was the third bear market of the past 5 years or so.

If you went to cash or tried to time the market you likely did much worse over this period than those who simply kept buying on a regularly scheduled basis.

Dollar cost averaging isn’t a perfect strategy but it does allow you to diversify across time and market cycles.

There are no guarantees in markets or life but increasing your savings rate while making periodic contributions is about as foolproof as you can get.

If your savings rate is at all-time highs, that will have a much bigger impact on your financial outcomes than trying to time the markets.

Michael and I discussed this question and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Staying the Course is Harder Than it Sounds

I haven’t been reading all that much around the holidays but these were the best books I read in 2023 in case you missed it:

The Best Books I Read in 2023

Post Script: The guy who emailed us this question sent a follow-up email after we discussed it on the podcast. He admitted some of the optimism stuff was projection based on the fact that they were pretty cash-heavy coming into the year. Credit to him for the explanation. Great questions too.