Following the Great Financial Crisis, there was a worry the coming tsunami of retiring baby boomers was going to lead to a retirement crisis of epic proportions.1

Their portfolios were down bad. Housing prices had crashed. They didn’t save enough money. People were worried about Social Security. Everyone was predicting lower returns for financial assets going forward. There are far fewer pensions these days.

Things looked bleak.

While we haven’t quite solved the retirement equation for everyone, the picture looks much brighter today than it did back then.

Financial market returns have been better than anyone could have expected in the early-2010s. The pandemic caused housing prices to skyrocket. People were able to refinance at generationally low mortgage rates. People paid off their homes.

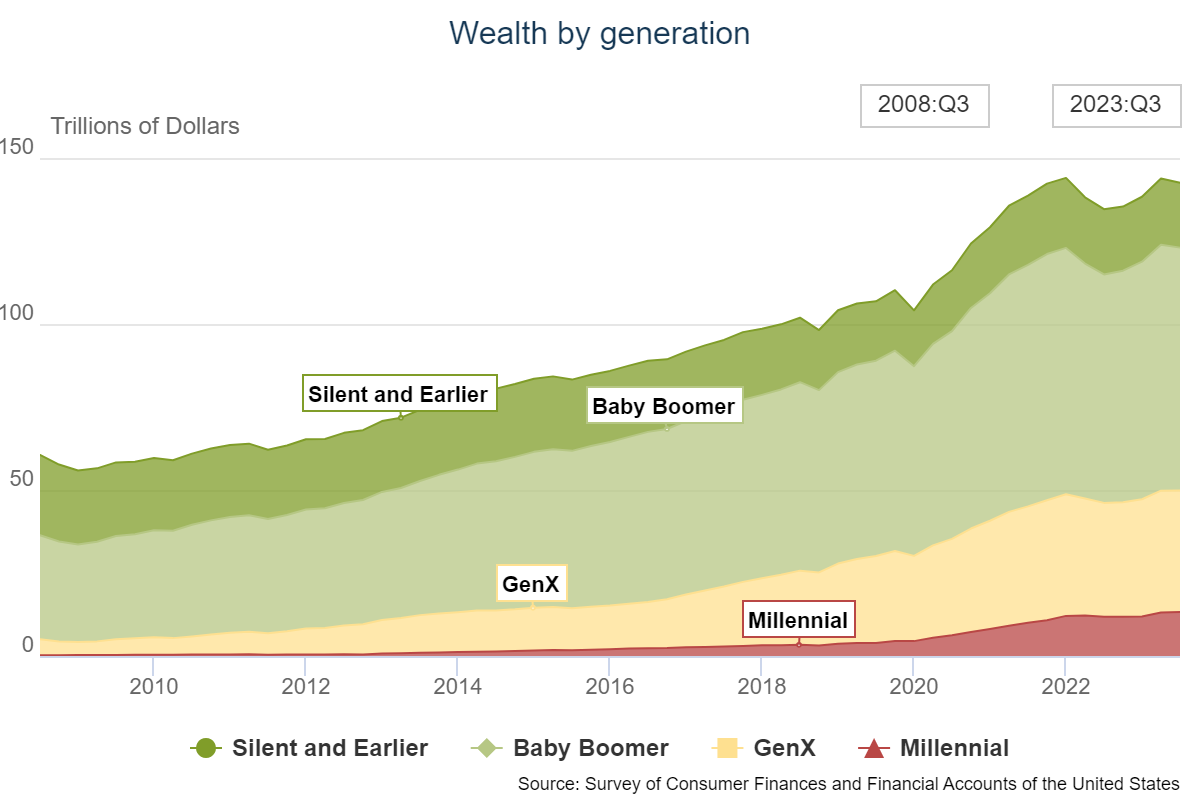

Baby boomers and the silent generation (a lot of that money will get passed down to the boomers) now control nearly $93 trillion of wealth. That’s 65% of the wealth in this country:

They are doing just fine and feeling fine as well.

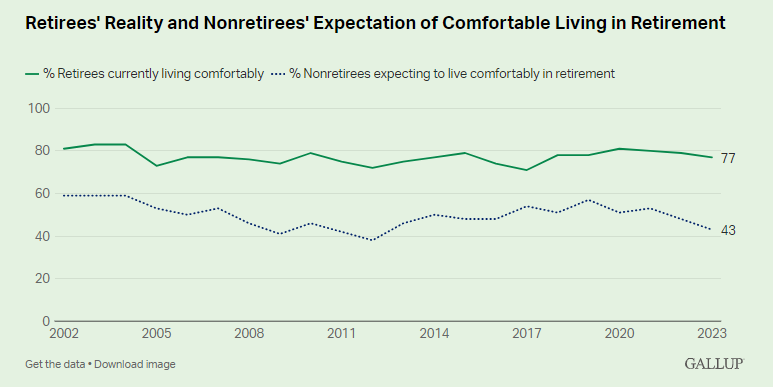

According to a Gallup poll, just 43% of non-retirees expect a financially comfortable retirement while 77% of retirees say they have plenty of money to live comfortably:

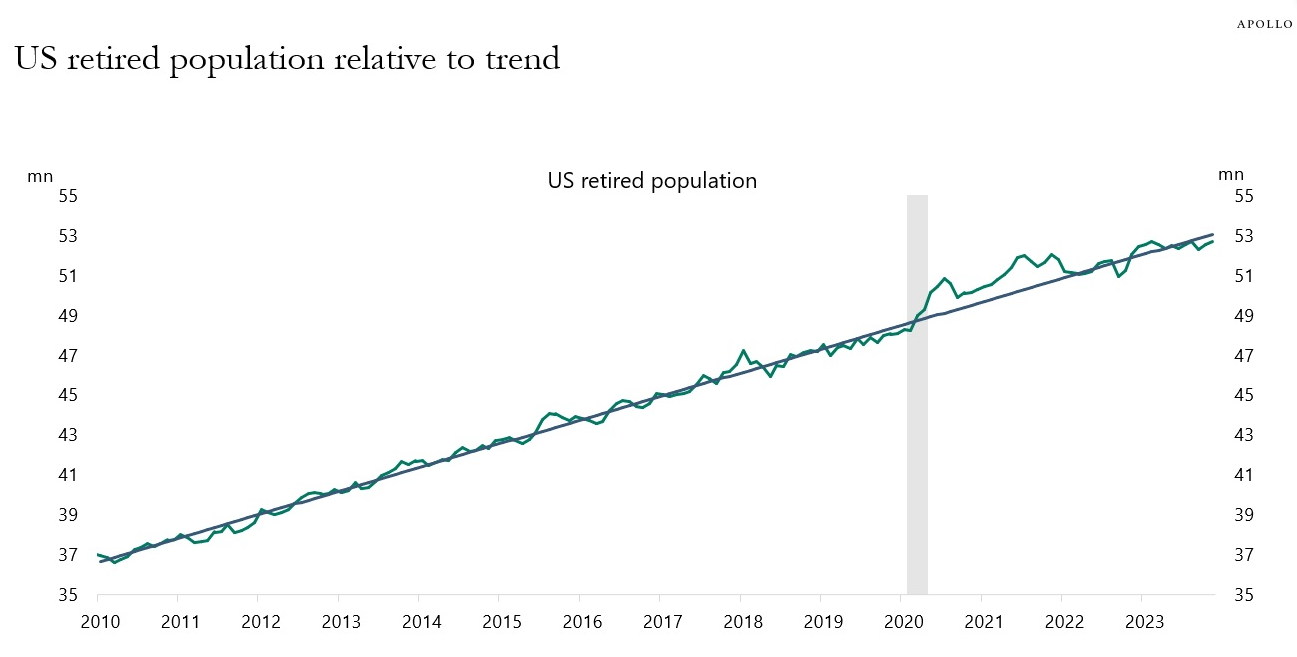

And this is despite the fact that the retired population in the United States has grown substantially over the past decade and change:

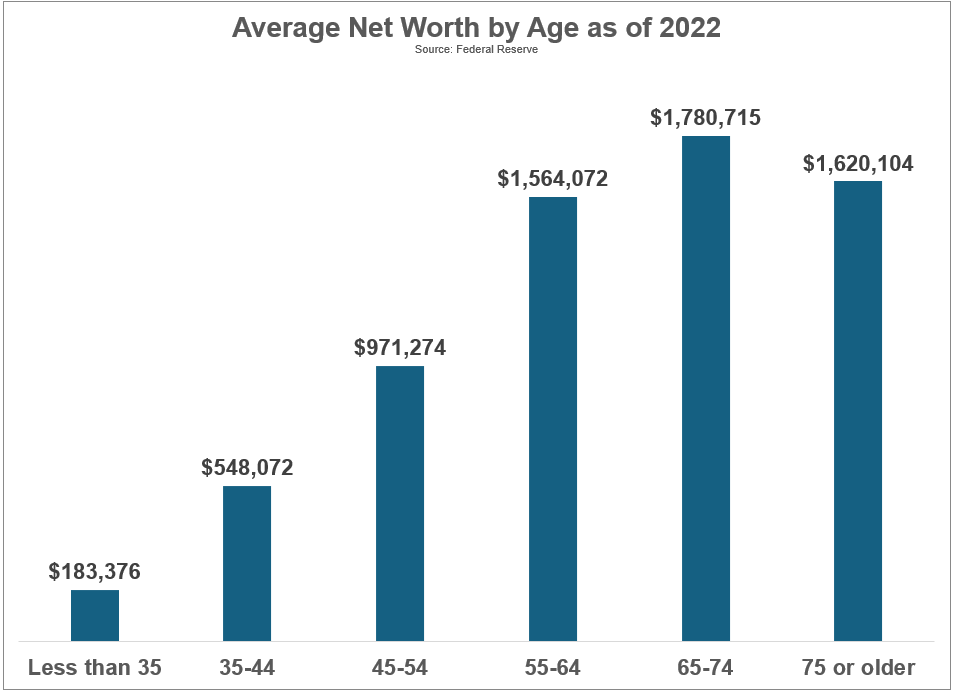

This is the average net worth by age bracket courtesy of the Federal Reserve as of year-end 2022:

Not bad for older Americans, right?

Obviously, these averages are skewed by the wealthiest households.

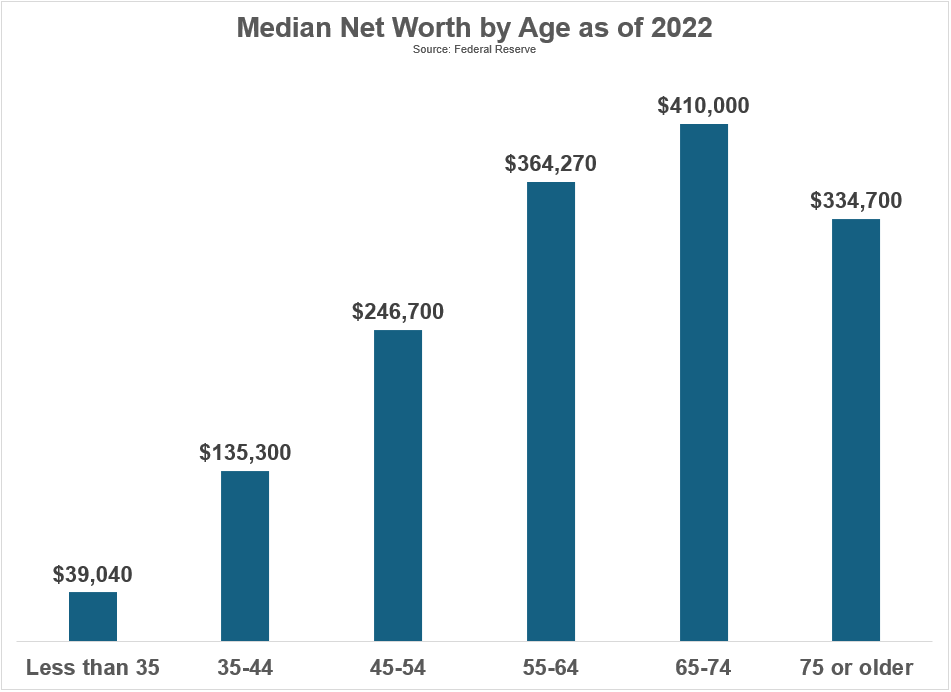

The median numbers provide a better picture of the financial health of most Americans:

I know this might not look like much to some people but these numbers are way higher than they were in the early 2010s when people were still licking their wounds from the 2008 financial crisis.

This money goes further than you think.

Many retired people now have their homes paid off.

Social Security provides an average benefit of more than $1,800 a month. That’s nearly $45,000 a year for a married couple. And remember, that income is indexed to inflation.

You also have to remember taxes are lower in retirement for most people. You don’t have to save money for retirement anymore.

Take away all of these expenses and now that annual retirement income takes you a lot further.

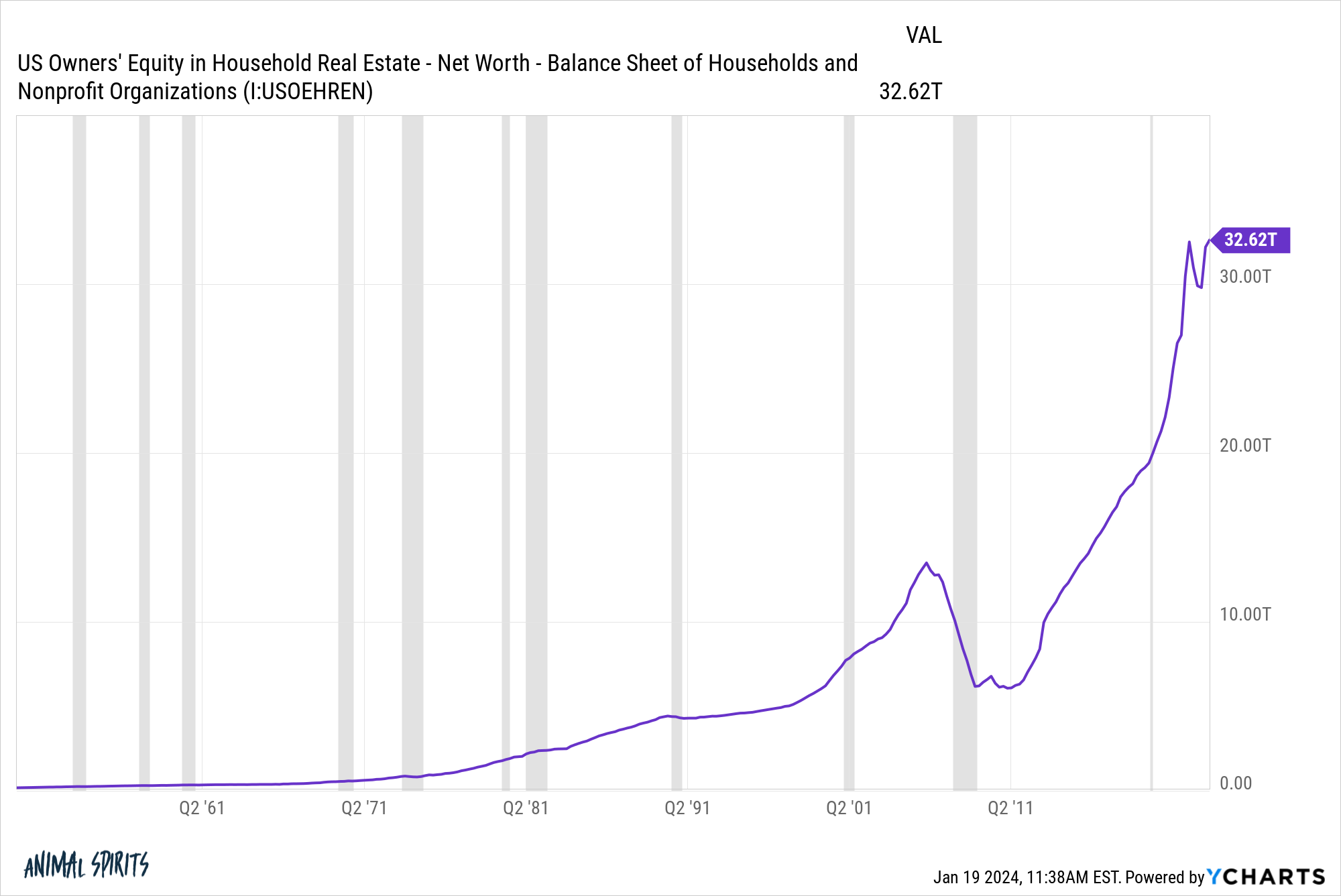

Plus, baby boomers have an insane amount of home equity to tap in retirement. A house is the biggest financial asset for the majority of the middle class. The pandemic housing boom added a ridiculous amount of equity for homeowners.

Some combination of Social Security, home equity, and retirement savings means most people are going to be just fine in retirement. This doesn’t mean everyone gets to live an opulent lifestyle but we’re not talking breadlines here either.

The U.S. population ages 65 and above has gone from 9% in the 1960s to nearly 18% today. That number will continue to grow.

People are living longer so retirement planning has never been more important than it is today.

Some might need to work longer, delay taking Social Security or use their home equity as a piggy bank. But that’s a far better situation than the disaster we were staring at coming out of the Great Financial Crisis.

There are always going to be people who struggle but the retirement crisis everyone was predicting in the 2010s didn’t come to fruition.

Michael and I talked about the retirement crisis and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Now here’s what I’ve been reading:

Books:

1I’ve been writing about it too.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

Wealthcast Media, an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.