A reader asks:

I was thinking of retiring with 100% invested in stocks (like an S&P500 index fund) with plans to live entirely on dividend income plus Social Security. The stock portfolio would fluctuate wildly but how much would the dividend amount fluctuate? Does this sound like a reasonable strategy?

The current dividend yield for the S&P 500 is a paltry 1.5%.

That’s low relative to history.

Since 1950, the S&P 500 has sported an average dividend yield of 3.1%. However, that average has been going down for quite some time now. This century, the average yield is just 1.8%.

There are reasons for this. Valuations are higher than they were in the past. Corporations are also more thoughtful about their capital allocation decisions. Stock buybacks play a larger role than they did in the past.

Regardless of the reasons for shrinking dividend yields, the cash flows are all that matter if you’re considering making this part of your retirement spending plan.

The good news about dividends is they tend to grow over time.

I looked at monthly dividends on the S&P 500 using historical data from Robert Shiller. Since 1950, the annual growth rate on dividends was 5.7% per year. That’s more than 2% higher than the 3.5% inflation rate over that same time frame.

Having your cash flows grow at a faster pace than inflation is a huge win in retirement planning. Social Security also has a built-in inflation kicker so we’re off to a good start.

Of course, Social Security is far less volatile than dividends in the stock market. That high annual dividend growth involved risk.

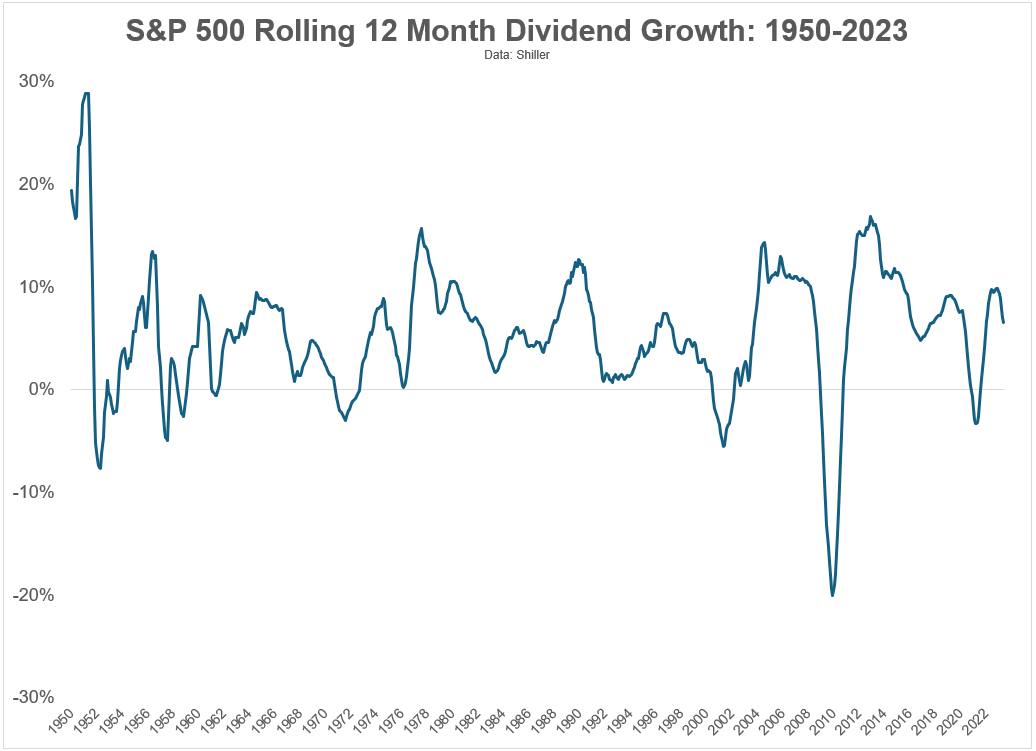

Here is a look at the rolling 12 month dividend growth rate for the S&P 500 from 1950-2023:

Most of the time dividends are going up. In fact, dividends were positive on a year-over-year basis 88% of the time since 1950. That’s an even better hit rate than stock market returns, which have been up roughly 75% of the time on an annual basis historically.

But those negative years could throw a wrench into your retirement plan.

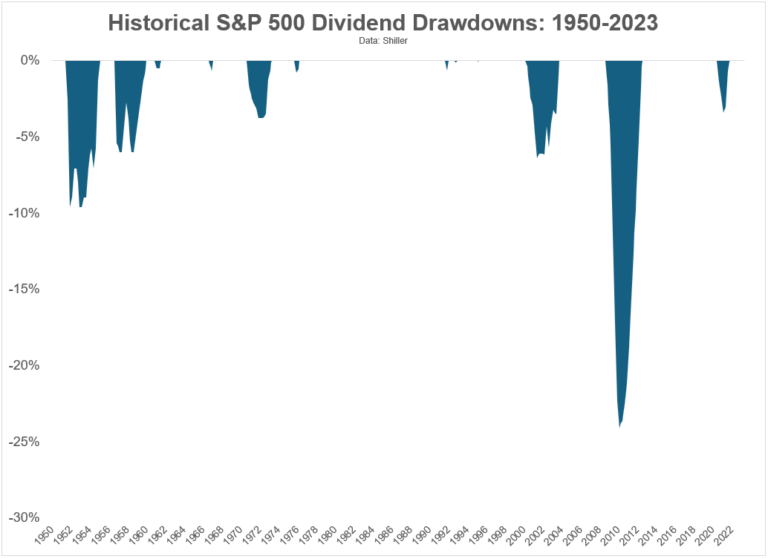

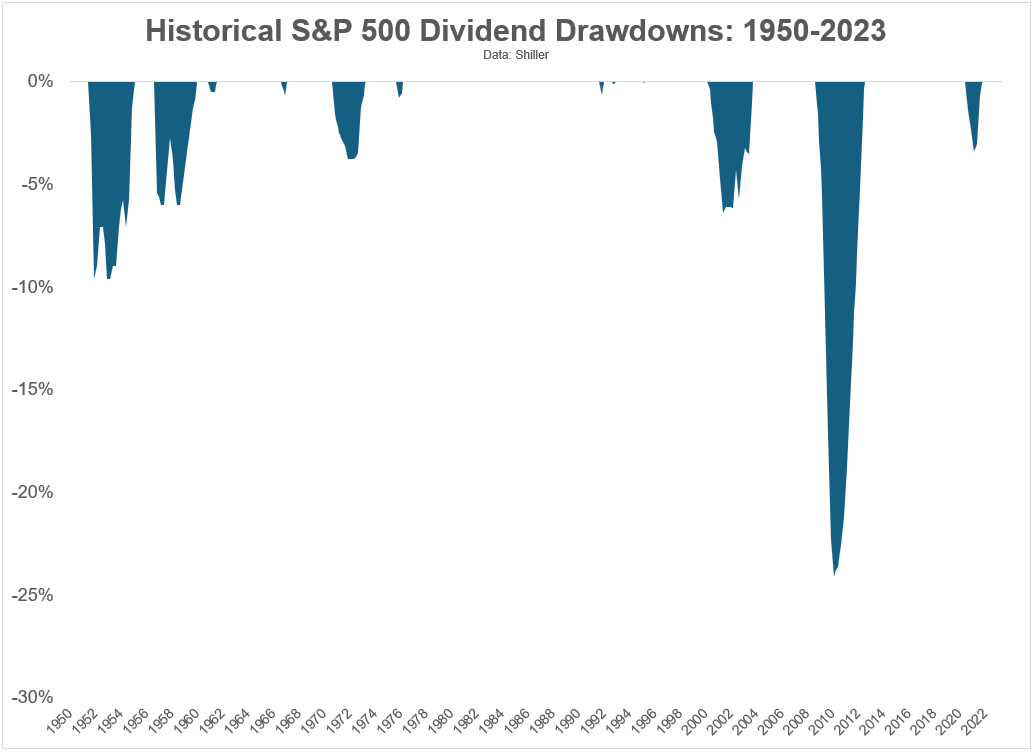

Here’s a look at the historical drawdowns for dividends since 1950:

The good news is dividends fall far less frequently than stock market prices.

By my count, there have been 38 double-digit corrections in stock prices since 1950, including 11 drawdowns in excess of 20%. There has only been a single double-digit correction in dividends since 1950 (although it was close in the early-1950s, down 9% and change).

Cash flows are stickier than prices. That’s a good thing for income investors.

But it is worth noting dividends fell nearly 25% during the Great Financial Crisis.

That’s a massive hole in your retirement spending plan.

Now, the good news is you can create your own dividends. I know a lot of retired investors cannot fathom ever touching their principal balance, preferring to live exclusively on the interest. I don’t get this mentality.

Honestly, it’s OK to spend down some of your principal.

Isn’t that the point of saving in the first place?

So you could create your own income stream by selling some stocks when dividends fall. The problem with this strategy is dividends tend to fall when the stock market falls so you would be selling shares when they’re down.

That’s not optimal.

I know there are dividend investors out there who buy blue chip companies with high or growing dividends to live off that income. That’s a strategy that can work but it’s not foolproof.

Companies get into trouble on occasion. They’re forced to cut dividends. Capital allocation decisions can change. The stock market is volatile.

There is nothing wrong with using dividends as an income strategy for spending purposes. The historical growth rate of dividends is one of the most underappreciated forces in the stock market.

But I still think it makes sense to have some sort of liquidity buffer in cash, bonds, T-bills, CDs, money markets, etc. to break in case of emergency.

You don’t want to be forced to curtail your retirement plan because of an ill-timed financial crisis.

We discussed this question on the latest edition of Ask the Compound:

I was excited to have Jill Schlesinger on this show this week to help me tackle questions about taking care of your parents financially, the best time to invest in the stock market, Roth IRAs for high-income earners, rebalancing your portfolio, owning the world stock market index and how much you should spend on your house.

Further Reading:

How to Create Your Own Dividends