Early on in my savings journey I prioritized tax-deferred retirement accounts over all else.

I like the ease and simplicity of 401k contributions coming out of my paycheck before it ever even touches my checking account. It’s easy to automate. The set-it-and-forget-it nature of a workplace retirement plan is one of my favorite features.

Plus, I like the fact that it’s difficult to get the money out of these accounts. I’m not going to touch the money until retirement age so taking away the temptation to do so is a wonderful behavioral protection.

Once all of that was on autopilot and I felt comfortable with the amount we were saving in tax-deferred retirement accounts, phase two was building up a taxable account to offer some more flexibility before retirement age.

I used a tax refund to set up my initial low-cost brokerage account a number of years ago. The amount was so small I decided to pick some stocks in what was deemed my fun account.

I’m a tried and true believer in long-term investing and the benefits of index funds, but I don’t mind investors who pick stocks on the side if it allows them to scratch an itch.

I’ve had fun with this account over the years but as it’s grown and I’ve allocated more dollars the stakes have risen. When that taxable account started to become real dollars, it wasn’t very much fun anymore.

The simple reason for this is stock picking is not the same thing as portfolio management. Picking stocks is always hard but it’s even harder when you’re trying to marry it with financial planning.

Investing in index funds and quantitative strategies is easy. Dollar-cost averaging into them is straightforward. I buy and hold and buy and hold and never sell outside of rebalancing. But rebalancing is easy too, because I’m not worried about any of these funds blowing up and never recovering.

Dollar-cost averaging with a portfolio of individual stocks is challenging.

You have some stocks that are up huge and some stocks that have gotten crushed. Where do you allocate new savings? Into the big winners or big losers?

There’s not an easy answer.

Understanding when to sell stocks might be the hardest part of owning individual names.

There are plenty of strategies for buying stocks. I’ve never heard a good explanation from anyone on sell discipline.

Sell your winners to buy more of your losers? That’s like cutting your flowers to water your weeds. But no one ever went broke taking a profit. But also let your winners run.

OK, so sell your losers and double down on your winners? Why would you be fearful when others are fearful? Why would you run out of the store when there’s a sale?

And if you do sell a winner or loser do you sit on the cash for a while to wait for a fat pitch? What if the market gets away from you? Do you put that money into a new name or another holding in the portfolio? What if the valuations aren’t so compelling?

Obviously, there are people who do this for a living who have a process and think deeply about these issues.

However, owning individual stocks invites infinitely more behavioral hurdles than a simpler strategy.

It’s easier to ignore index funds and ETFs. You can’t ignore individual stocks.

For example, the stock market can act like a deranged lunatic at times. Just think about how insane something like the 1987 crash was when the entire market fell more than 20% in a single day.

But now consider the fact that individual stocks have their own 1987-like crashes on a regular basis.

Snap just fell more than 30% after reporting earnings last week. You can also get a reverse-1987 upcrash.1 Lyft was up more than 30% after reporting earnings this week.

And this happens all the time with individual stocks.

Think about the fear, greed and FOMO caused by the stock market as a whole. Now multiply that by a factor of 10 or so and that’s the kind of emotional swings owning individual stocks can bring investors.

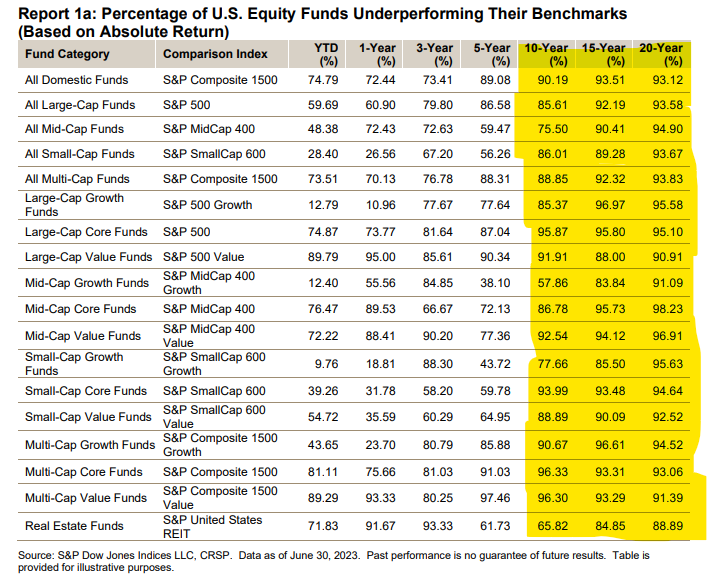

How else can we explain the fact that so many investors think they can outperform the market when the evidence is conclusive — over the long-run around 90% of professional investment managers underperform simple index funds.

These people do this for a living. They have teams of people researching stocks day and night, talking to management teams, researching competitors, performing forensic accounting on company financial statements, going on road shows to uncover new ideas and pouring over quarterly earnings reports.2

And the vast majority of them still fail.

Beating the market is really hard.

It’s even harder in the context of portfolio management.

I still own a handful of individual stocks in my brokerage account. But all of my new savings are going into index funds in that account.

That mental alpha helps me sleep at night.

Michael and I talked about stock picking and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Picking Losers is Easier Than Picking Winners in the Stock Market

Now here’s what I’ve been reading lately:

Books:

1Is that the right word for this? Still workshopping that one.

2I actually enjoy following corporate earnings but not because it makes me a better stock-picker. It helps me better understand the underlying trends in the economy.