There’s a bull market in bull market indicators flashing red right now.

Barron’s had a bullish cover:

The Economist too:

The Nasdaq 100 is up more than 60% since the start of 2023. Nvidia is up 500% in that time.

There are tens of billions of dollars flowing into the new bitcoin ETFs. Speculation in tech stocks, crypto, NFTs, options, day trading, etc. makes it feel like we picked up right where we left off in the mini-2020/2021 meme stock bubble.

If you want to find areas of concern and complacency, you don’t have to look very hard right now.

The strange thing is there are some offsets to this bullish behavior.

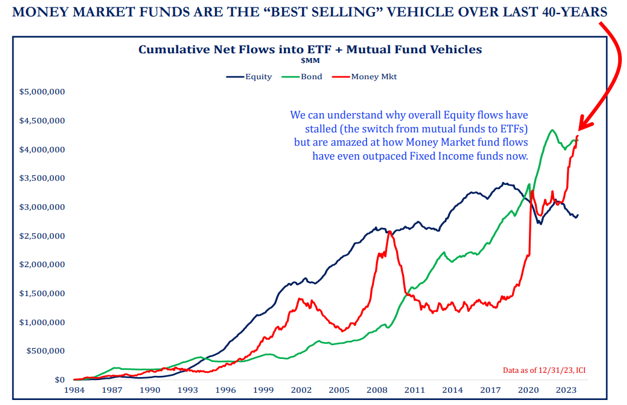

Strategas has this chart showing the long-term net flows for stocks, bonds and money market funds:

Look at the trillions of dollars that have poured into money market funds these past few years. Money has actually come out of stock market mutual funds and ETFs on a net basis while money market funds have raked in trillions of dollars.

Does that sound like speculative behavior to you?

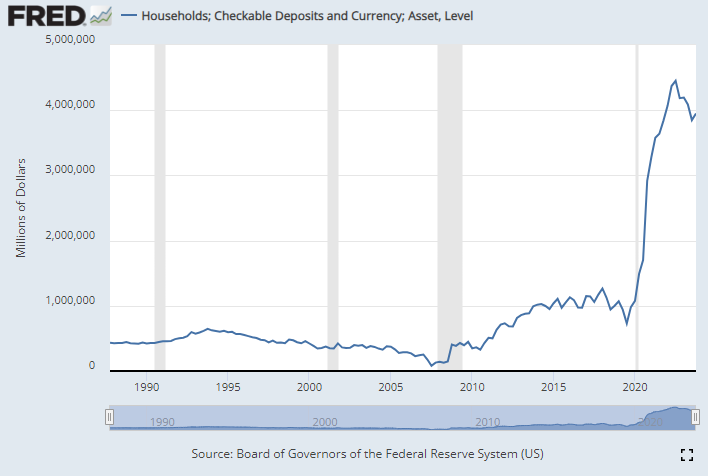

Now look at the amount of money in checking accounts:

The post-Covid move in cash held at banks is unlike anything we’ve ever seen. And while it’s rolled over a bit, there is still way more money just sitting in checking accounts doing nothing.

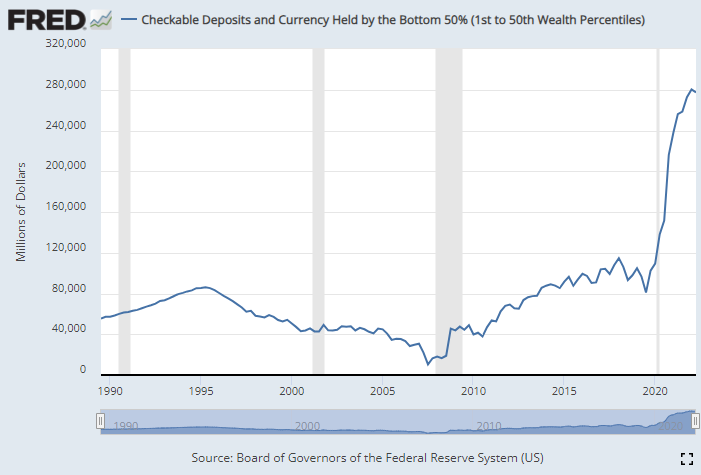

And this is not just the wealthy either. Look at checkable deposits for the bottom 50% by wealth:

This group is sitting on way more cash too.

The stock market has proven far more resilient than most people would have expected considering the inflationary environment we lived through. Everyone thought it was certain we would be in a recession by now.

There are many reasons the stock market is up and the economy remains strong (I’ve chronicled them here, here, here, and here).

Maybe the simplest reason is that most people are wealthier than they’ve ever been.

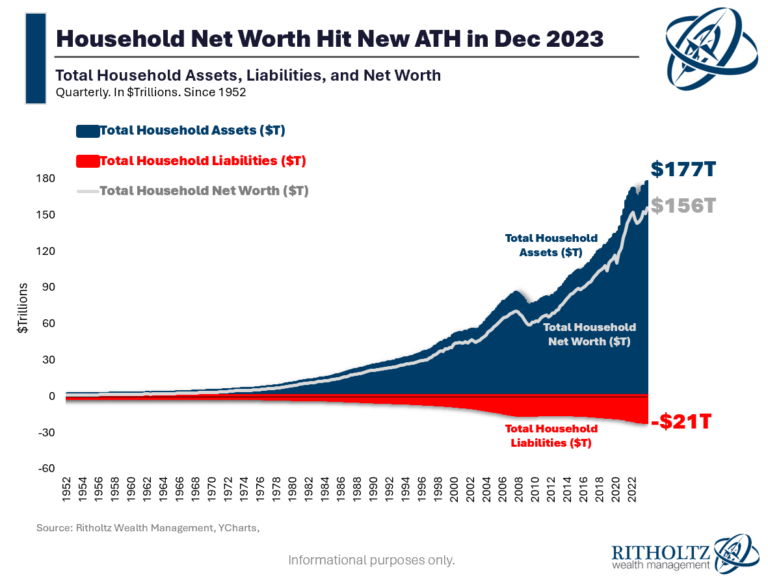

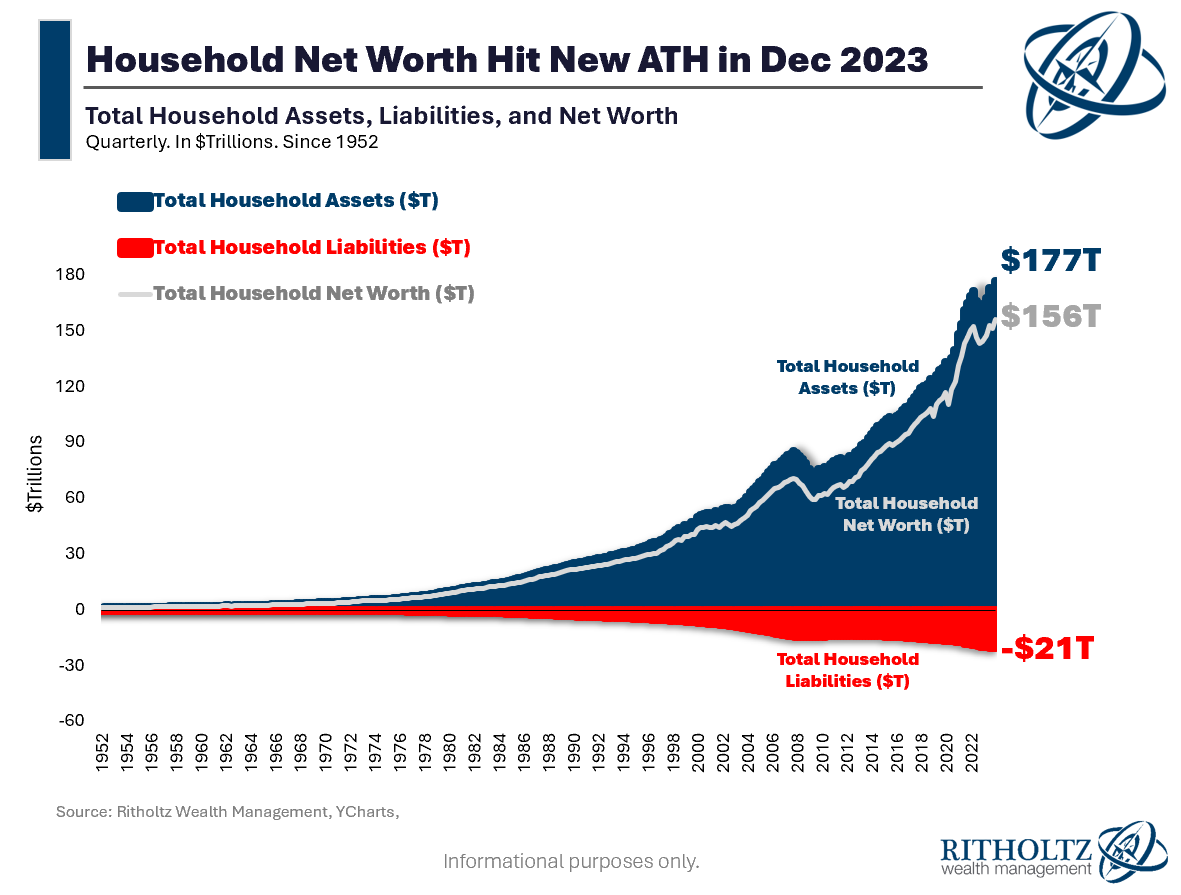

Just look at the updated Fed data on household wealth through the end of 2023:

The net worth of Americans hit another new all-time high by the end of 2023. And sure, debt levels have hit new all-time highs as well but assets are growing at a much faster pace:

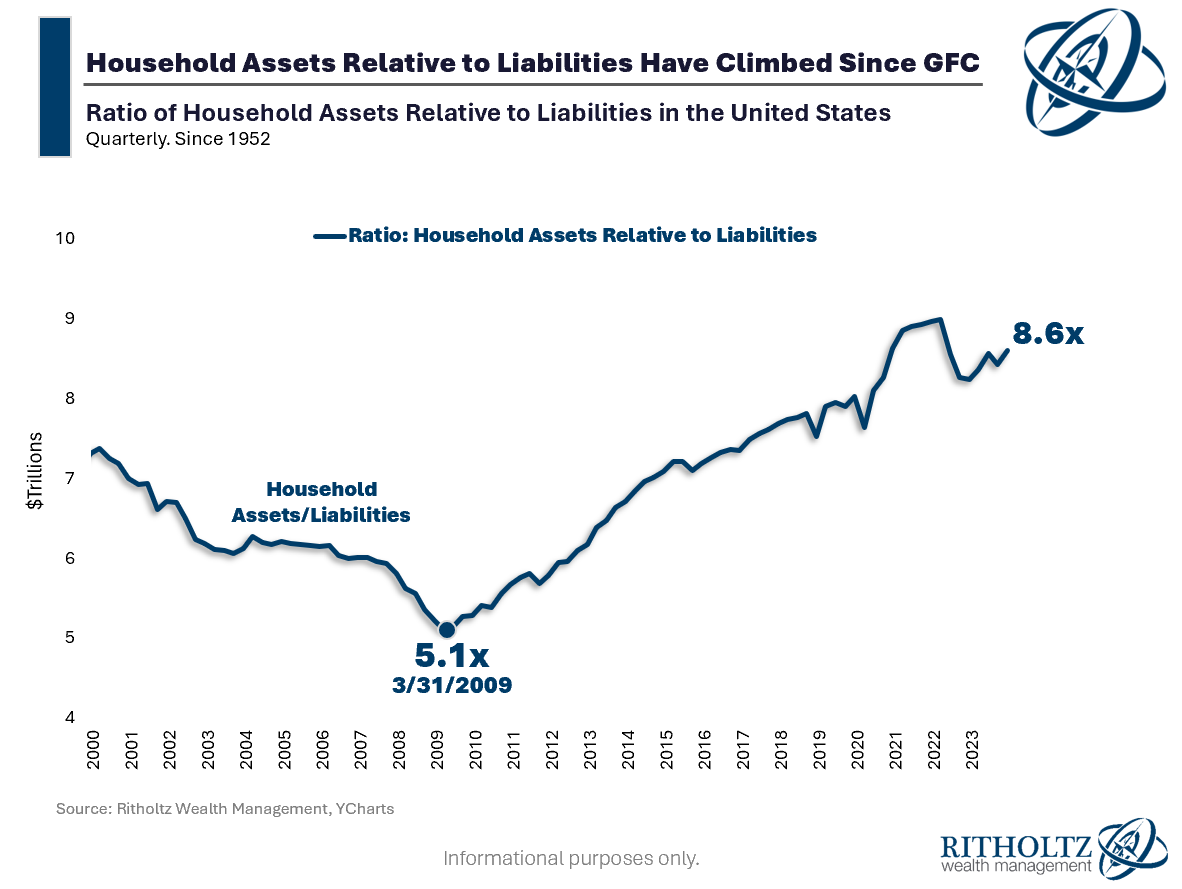

You can see that the ratio of assets to liabilities was falling all the way from the end of the dot-com bubble in 2000 right through the bottom of the Great Financial Crisis in 2009.

That was not good. Ever since then households have reversed that trend.

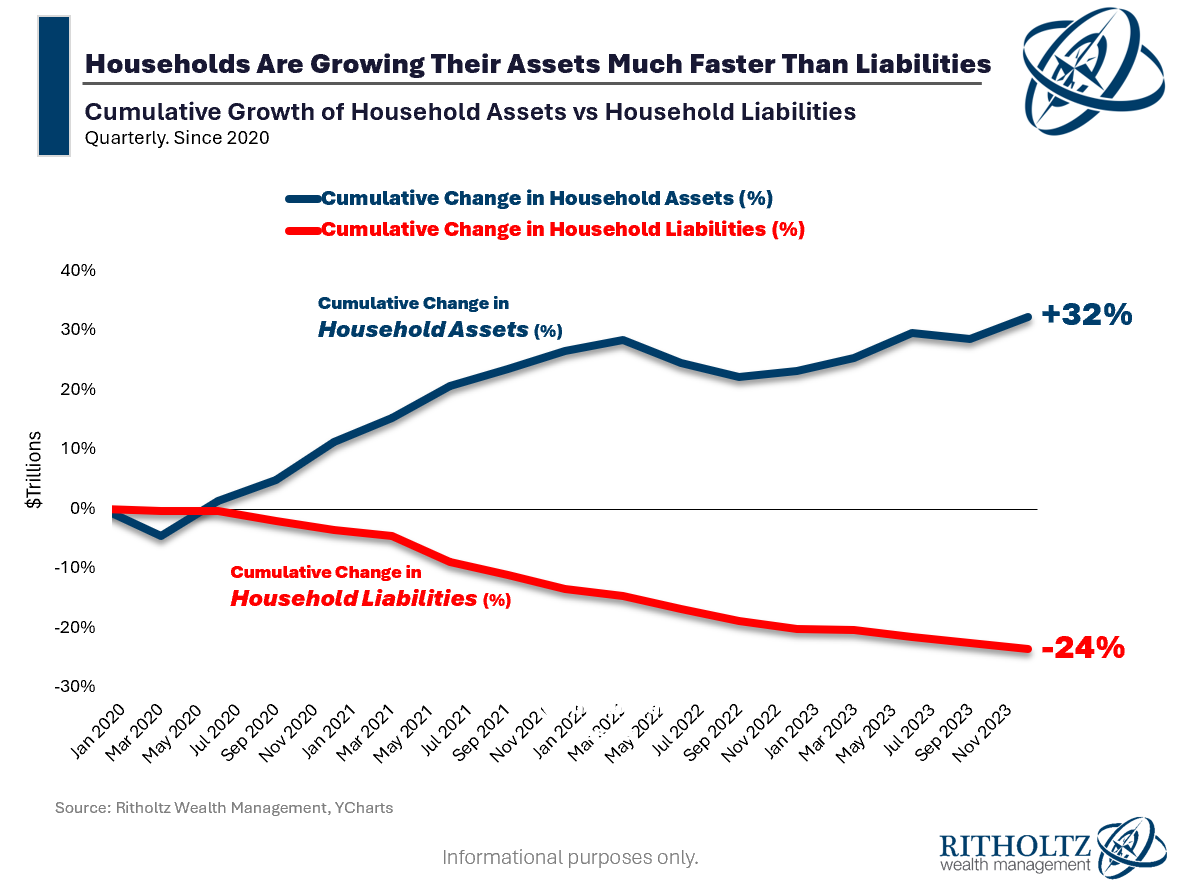

The pandemic has put the collective balance sheet of Americans in an even better place:

Since the start of 2020, assets have grown at a healthy clip while debt totals have actually fallen.

Consumers were in terrible shape heading into the 2008 financial crisis. They were overleveraged and didn’t have enough money saved to provide a margin of safety.

That’s simply not the case this time around.

Cash balances are high. Stock prices are high. Home equity has never been higher. Yields are at the highest levels they’ve been in well over a decade. Investors, savers and consumers alike are in good shape.

Obviously, this is not everyone. Wealth inequality is still a problem. Not everyone owns financial assets or a home.

But the people who do own financial assets are as flush as they’ve ever been. And this is the group that spends the most money and buys stocks, money market funds and houses.

Prices on everything are up because people have a lot of money right now.

Of course, this situation won’t last forever.

There will be a recession at some point. Asset prices will fall. The economy will overheat or an unexpected event will cause a slowdown.

Recessions have not been outlawed.

But American household balance sheets are in a great position when we have to weather the inevitable storm.

Further Reading:

Americans Have Never Been Wealthier & No One Is Happy