I was perusing the BLS data following the inflation release last week and one number sticks out like Victor Wembanyana standing next to a group of kindergartners.

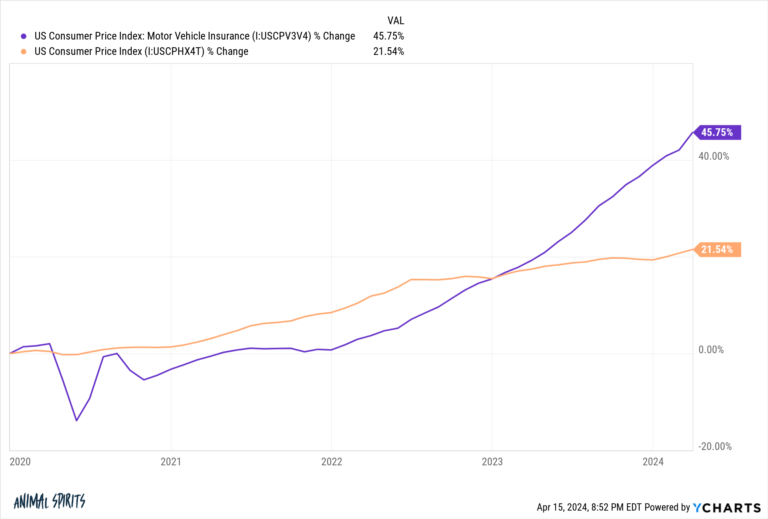

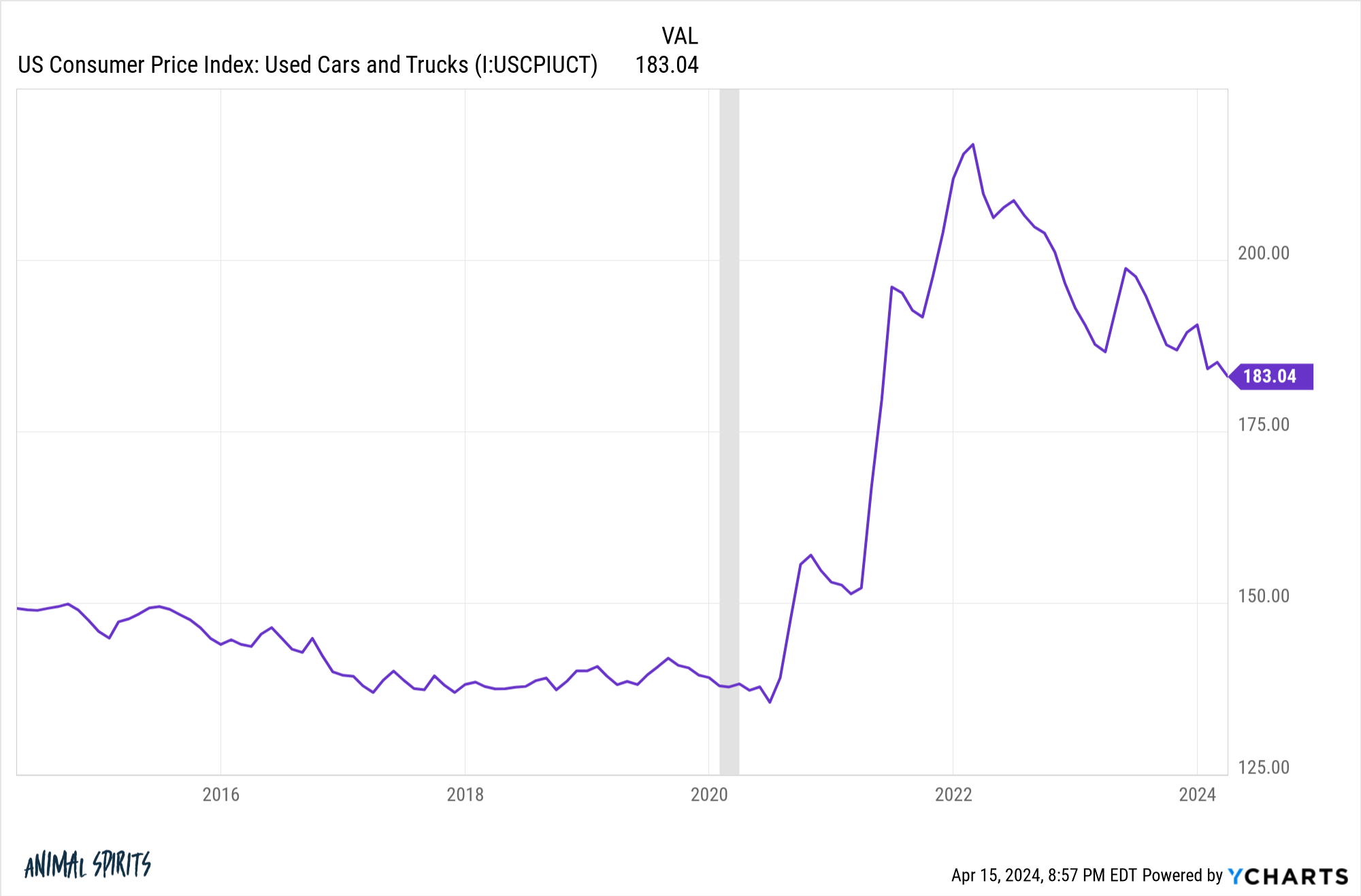

Auto insurance was up 22% over the previous 12 months versus an overall inflation rate of 3.5%. Look at the change in auto insurance rates these past few years:

It’s like a meme stock.

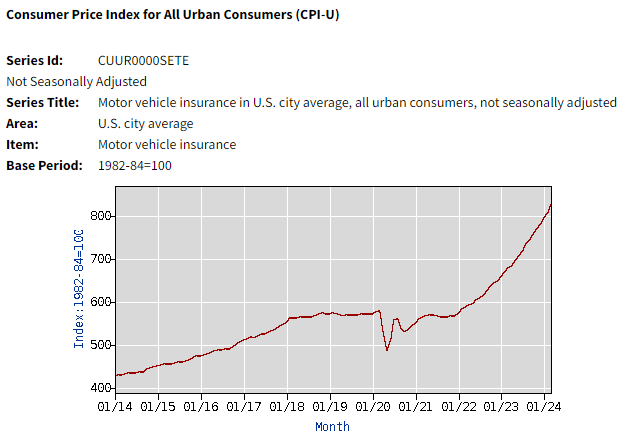

Since the start of 2020, auto insurance has spiked 46% against an overall surge in CPI of nearly 22%:

Most of the increase has come recently.

So what’s going on here? Why is auto insurance going up so much faster than the average basket of prices?

I did some research and talked to a handful of people in the insurance space. It’s not just one thing. Here are the main reasons as far as I can tell:

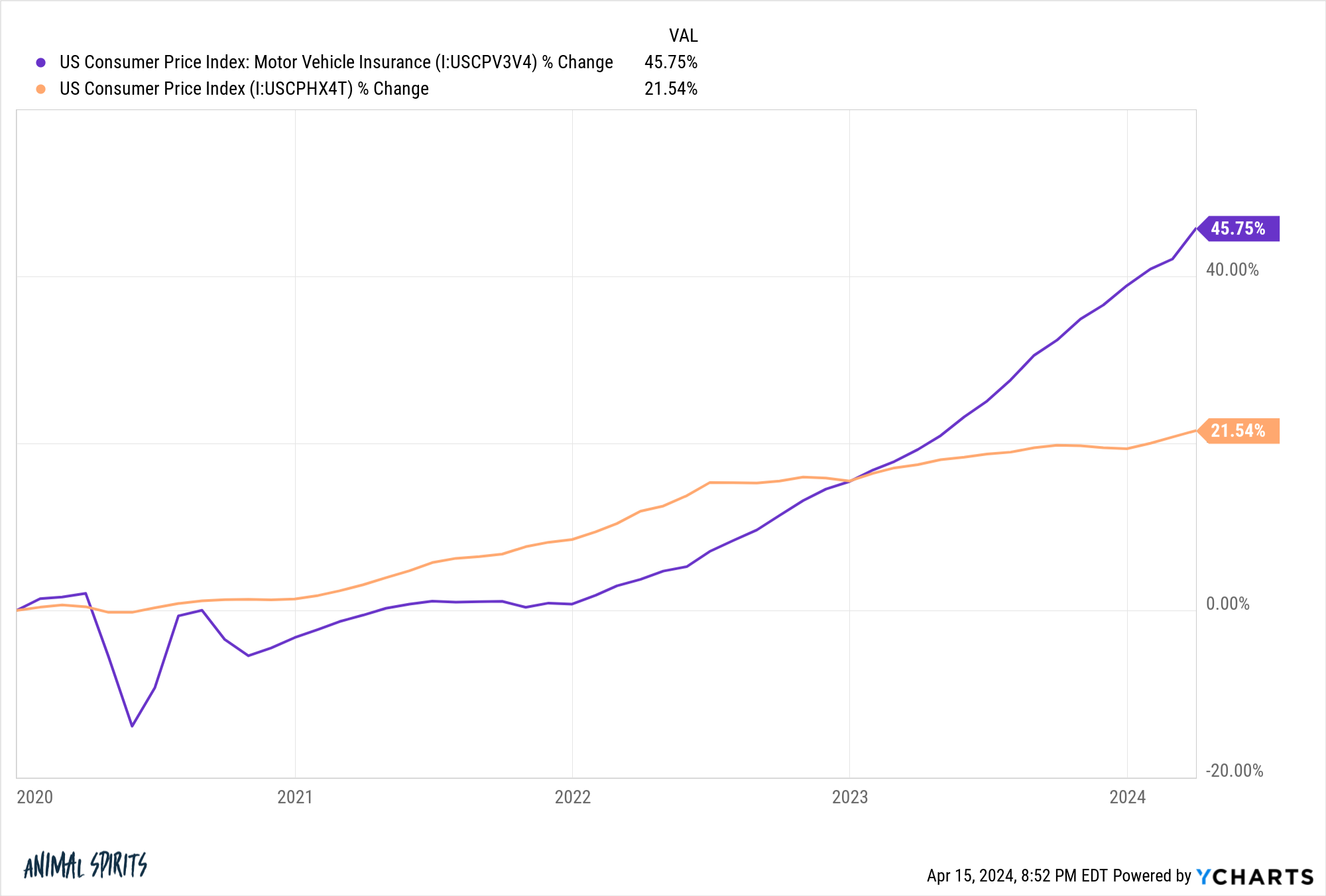

Vehicle prices are higher. The replacement cost of other vehicles went up a lot during the pandemic. Just look at soaring used car prices:

There were pandemic-related and supply chain reasons for this, but more expensive vehicles mean higher replacement costs, which means higher insurance premiums.

People are also driving larger, more expensive vehicles these days, which adds to the costs.

Maintenance & parts. A few years ago, I got in a minor fender-bender with my Explorer. All it needed was a new rear bumper and some new panels. It was still drivable.

The total repair costs were more than $15,000 (all I paid was my deductible).

Supply chains didn’t help. But all of the new sensors, technology and cameras meant the parts were much more expensive and the work more complex.

More complexity in the work and inflation in parts prices also translate into increased labor costs for repairs.

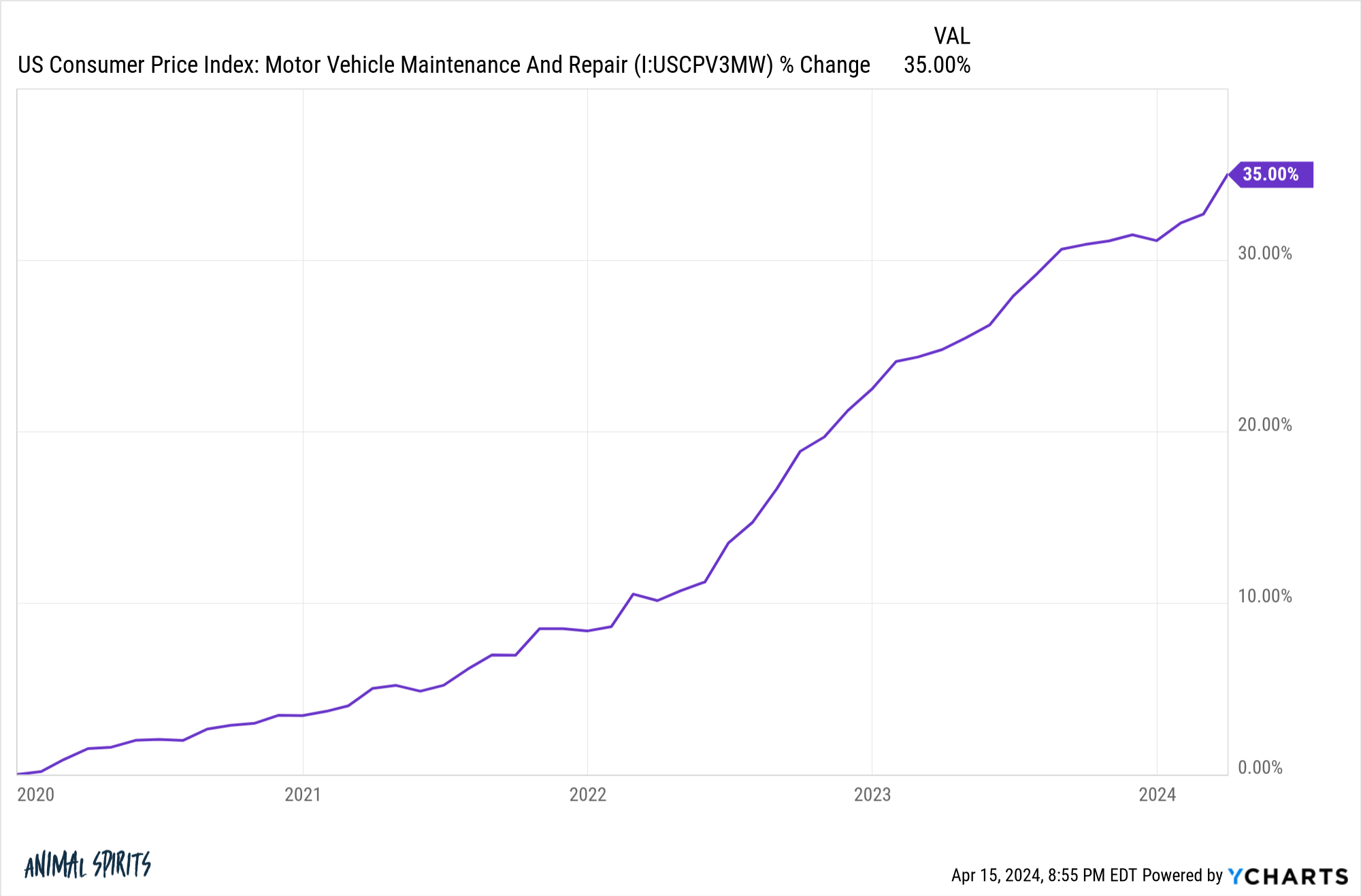

This helps explain why inflation is so much higher in these areas:

With EVs and self-driving vehicles coming this is going to get even more expensive.

Drivers are getting worse. People began driving faster and more recklessly during the pandemic with fewer cars on the road. That behavior didn’t stop once traffic came back.

Plus, the combination of bigger trucks and SUVs, along with increased smartphone usage while driving, has led to the highest level of pedestrian fatalities in 40 years.

People staring at their phones while driving is like adding drunk drivers all over the roads at all hours of the day.

With more accidents comes bigger insurance claims.

Climate change. Nearly 360,000 vehicles were ruined or damaged during Hurricane Ian.

Hurricanes, wildfires, and other natural disasters are making vehicle insurance more costly. Some people in climate-impacted areas are seeing more limited insurance options. Some insurers are pulling out of these areas altogether.

It’s not just auto insurance either. The Wall Street Journal recently ran a story about increases in property insurance:

The average annual home insurance cost rose about 20% between 2021 and 2023 to $2,377, according to insurance-shopping site Insurify, which projects another 6% increase in 2024.

Worst of all, home insurance premiums are soaring. Rates rose by more than 10% on average in 19 states in 2023 after a series of big payouts related to floods, storms, wildfires and other natural disasters across the U.S., according to an Insurance Information Institute analysis of data from S&P Global Market Intelligence. More Americans also moved to disaster-prone areas in recent years, increasing the exposure to these events.

So even if you have already locked in the price of your house and automobile, these ancillary expenses can still raise the cost of ownership.

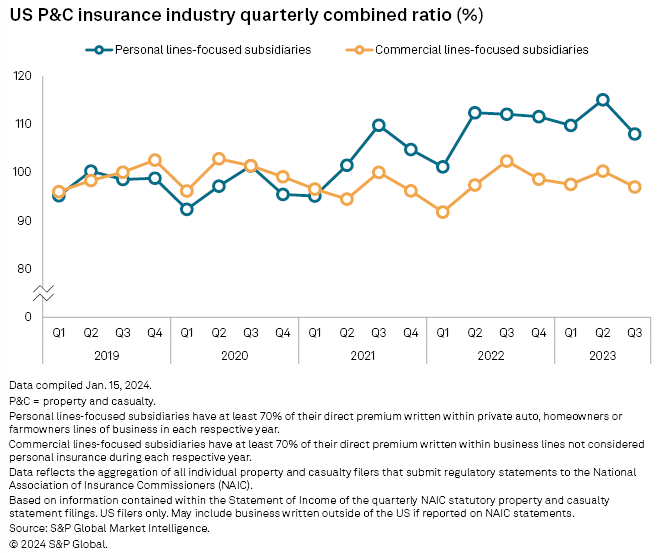

Some would point to corporate greed as a reason for the increased costs but the numbers don’t bear out that thesis.

The combined ratio is a way to measure profitability in the insurance space. It’s essentially the losses plus expenses incurred by an insurance company divided by the premiums earned. The higher the ratio the worse off the profitability for insurers.

If the number is greater than 100 that means the insurers are losing money by paying out more than they’re taking in. If it’s below 100 that means they’re profitable.

Data from Standard & Poors shows personal providers of home and auto insurance have been losing money for a few years now:

The payouts exceed the premiums earned from customers.

So what happens from here?

Used car prices are coming down after the dramatic re-pricing during the pandemic. Hopefully, that will filter through to lower prices and lower premiums now that supply chains have healed.

It’s harder to see the other problem areas improve in the years ahead.

We Americans love driving massive trucks and SUVs. With new technologies, our vehicles are becoming increasingly complex. Unless we ban smartphones while driving, I don’t see a path to a road full of better drivers until we have fully self-driving cars.

And natural disasters only seem to be increasing in their frequency and severity.1

It’s difficult to envision a scenario in which insurance rates drastically decline to levels consumers were accustomed to.

My only financial advice is to shop around when your insurance comes due and you see higher premiums.

And get used to paying higher insurance prices, especially in certain states.

Further Reading:

How Much is That $70,000 Truck Costing You

1A less severe hurricane and wildfire season would obviously help, too.