It feels like we’re in a weird place from the perspective of the economy and financial assets.

Housing prices seem too high. Consumer prices seem too high. Stock prices seem too high. Government debt seems too high.

I understand why people are worried. These things are cyclical and the lines can’t go up and to the right forever. Bear markets, financial crises, recessions, etc. are features we cannot do away with.

It can be difficult to see past short-term worries when we know bad things can and will happen. Stocks will fall. The economy will contract. There are no gains without some pain.

However, I prefer to focus on the long term when investing in risk assets. Long-term returns are the only ones that matter.

Here are some questions I like to consider when trying to look past short-term worries:

Ten years from now do you think stock prices will be higher or lower? In all rolling 10 year periods over the past 100 years or so, the S&P 500 has been positive 95% of the time on a total return basis.

There can be lost decades, of course. It’s not completely out of the realm of possibilities.

But it’s rare for the stock market to be in the red over decade-long periods.

The only times the U.S. stock market has been down on a 10 year basis were following the Great Depression and Great Financial Crisis.1

Ten years from now do you think housing prices will be higher or lower? In all rolling 10 year periods over the past 100 years or so, U.S. national home prices2 have been positive 97% of the time.

Housing prices can fall but it’s a rare occurrence for nationwide prices to go nowhere for a decade.

The only times national home prices declined over a 10 year period were following the Great Depression and a brief time following the housing bust after the Great Financial Crisis.

Ten years from now do you think overall consumer prices will be higher or lower? Over the last 100 years or so, the U.S. Consumer Price Index has been higher 10 years later 93% of the time.

The only period that experienced deflation over a 10 year period occurred during the 1930s following the Great Depression (I’m detecting a theme here).

Since World War II, there hasn’t been a single 10 year window when overall price levels fell.

Here’s another way of looking at this: Do you think wages will be higher or lower in 10 years (since wages essentially are inflation in some ways)?

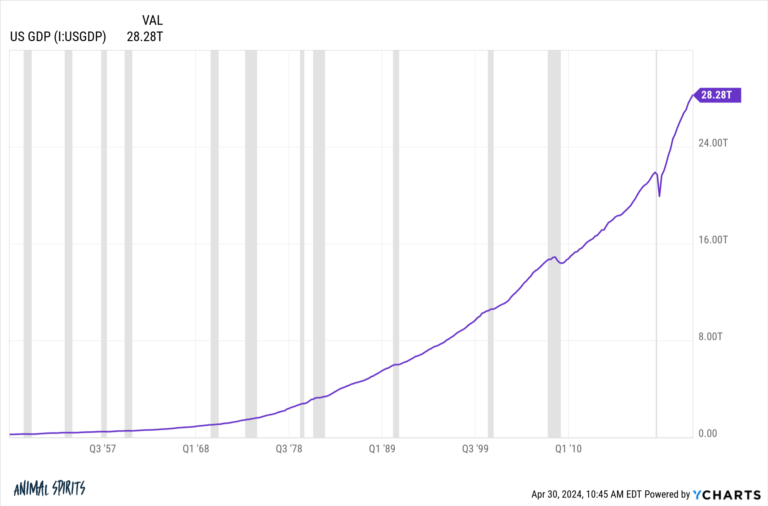

Ten years from now do you think U.S. economic activity will be higher or lower? Over the past 80 years or so, there hasn’t been a single 10 year window when gross domestic product in America was negative.

In fact, the lowest GDP growth over any 10 year window going back to WWII, was a gain of more than 30%.3 That period coincided with the pandemic in the spring of 2020 which saw the largest quarterly drop in GRP in modern economic history.

I’m not trying to be blind to the risks here. I’ve studied financial market history. We’re always one gigantic financial crisis away from a painful decade or so.

I’m simply thinking in terms of baselines here.

Would you rather place your bets on the stuff that happens 3-5% of the time or the stuff that happens 95-97% of the time?

The stock market will probably be higher in 10 years. Housing prices will probably be higher in 10 years. Consumer prices will probably be higher in 10 years. The economy will probably be bigger in 10 years.

I can’t guarantee any of this (hence my probably hedge). There is no such thing as always or never in the financial markets.

The point here is you need to earn more money. Then you need to save and invest that money if you want to keep up.

The only way to guarantee you’ll fall behind is by not investing in anything.

Further Reading:

A Necessary Evil in the Stock Market

1On a nomimal basis. There have been some inflation-adjusted lost decades like the 1970s as well.

2I’m using data from Robert Shiller here.

3Again I’m using nominal values here.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.