A lot of investors have abandoned international diversification (or at least strongly considered it) in recent years.

I understand why this is happening.

The U.S. stock market has destroyed all comers ever since the Great Financial Crisis ended.

Since 2009, a total U.S. stock market index fund is up more than 660% while a total international index fund is up more like 180%. That’s annual returns of more than 14% per year in the U.S. versus less than 7% per year in the rest of the world.

There are good reasons for this performance gap — a bigger tech sector, a strong dollar, the U.S. economy has performed better, etc.

A lot of investors assume they don’t need to hold international stocks anymore because large U.S. corporations get a decent chunk of sales and earnings overseas, the U.S. is in a dominant position in the global stock market (making up roughly 60% of the overall market cap), a more favorable regulatory environment for innovation and the tech sector.

I get all of that. Considering how powerful our corporations and financial markets are, it seems foolish to invest outside of the United States.

Yet I still believe in international diversification.

Why?

There is no guarantee the U.S. stock market is going to replicate the success it has had over the past 15 years over the next 15 years.

While the U.S. stock market has been the clear winner for the past decade and a half, the winners tend to change from decade to decade.

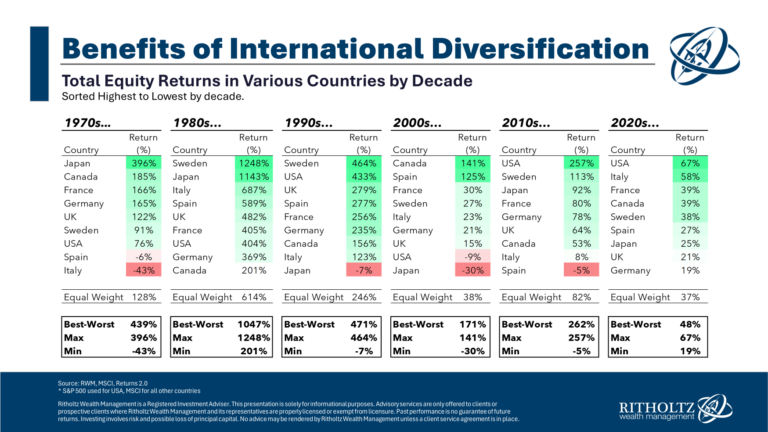

Take a look at the total returns by decade1 for various developed economies going back to the 1970s:

Every decade has big winners and big losers. Just look at the spread between the best and worst performers in each period. There are some massive gaps.

U.S. domination could be a sign of a paradigm shift in global markets or it could be recency bias.

You don’t have to look too far back for a lost decade in U.S. stocks (it happened from 2000-2009). In the 1970s and 1980s, U.S. stocks were closer to the bottom of the pack than the top.

I like diversification as a form of risk management because it helps you avoid the extremes. Yes, that means you’ll never be fully invested in the best performer, but it also means you’ll never be fully exposed to the worst performer.

Diversification also opens you up to surprising winners too.

Legendary investor Peter Bernstein once said, “I view diversification not only as a survival strategy but as an aggressive strategy, because the next windfall might come from a surprising place.”

International diversification might not protect you against bad years or even bad cycles.

What it’s meant to do is protect you against terrible decades. Every country has them.

Even the United States.

Further Reading:

The Case For International Diversification

1I used MSCI country stocks market indexes for the foreign markets, which means these returns would be from the perspective of a U.S.-based investor, not in local currency terms. I used the S&P 500 for U.S. stocks.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.