Today’s Talk Your Book is sponsored by F/m Investments:

On today’s show, we spoke with Alex Morris, President and Chief Investment Officer of F/m Investments to discuss the basics of Fixed Income investing.

On today’s show, we discuss:

- What duration, maturity, and convexity mean to a bond

- How duration changes over time with the movement of rates

- Duration of an individual bond vs a bond fund

- Understanding reinvestment risk

- The psychology of bond bear markets

- Why Treasury Inflation-Protected Securities did not perform as expected in 2022

- The differences between yield to maturity and the 30-day SEC yield

Investment Grade (IG): An investment grade is a rating that signifies a municipal or corporate bond presents a relatively low risk of default. Bond rating firms like Standard & Poor’s (S&P), Moody’s, and Fitch use different designations, consisting of the upper- and lower-case letters “A” and “B,” to identify a bond’s credit quality rating.

Yield to Maturity: Yield to maturity (YTM) is considered a long-term bond yield but is expressed as an annual rate. It is the internal rate of return (IRR) of an investment in a bond if the investor holds the bond until maturity, with all payments made as scheduled and reinvested at the same rate.

30-day SEC Yield: The SEC yield is a standard yield calculation developed by the U.S. Securities and Exchange Commission (SEC) that allows for fairer comparisons of bond funds. It is based on the most recent 30-day period covered by the fund’s filings with the SEC. The yield figure reflects the dividends and interest earned during the period after the deduction of the fund’s expenses. It is also referred to as the “standardized yield.”

Distribution yield: is the measurement of cash flow paid by an exchange-traded fund (ETF), real estate investment trust, or another type of income-paying vehicle. Rather than calculating the yield based on an aggregate of distributions, the most recent distribution is annualized and divided by the net asset value (NAV) of the security at the time of the payment.

Convexity: is apparent in the relationship between bond prices and bond yields. Convexity is the curvature in the relationship between bond prices and interest rates. It reflects the rate at which the duration of a bond changes as interest rates change. Duration measures a bond’s sensitivity to changes in interest rates. It represents the expected percentage change in the price of a bond for a 1% change in interest rates.

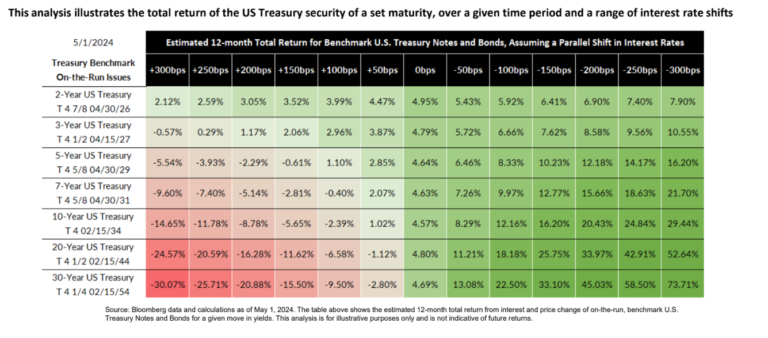

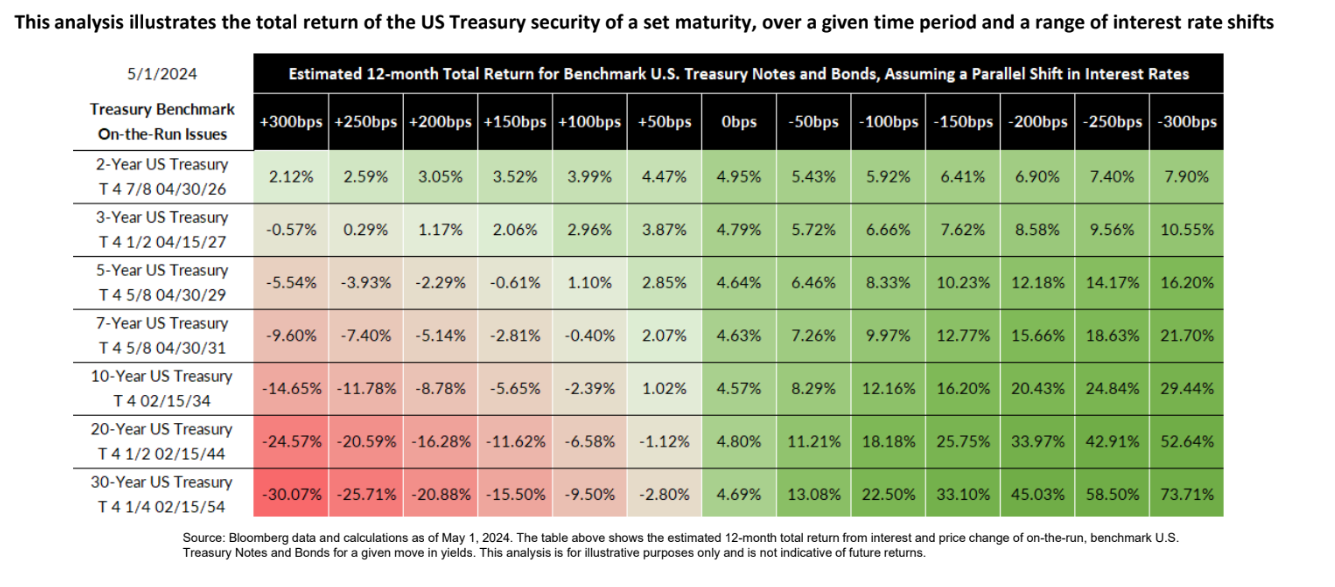

Basis Point: Basis points (BPS) are used to indicate changes in interest rates of a financial instrument.

Treasury Inflation-Protected Securities (TIPS): are a type of Treasury security issued by the U.S. government. TIPS are indexed to inflation to protect investors from a decline in the purchasing power of their money.

Listen here:

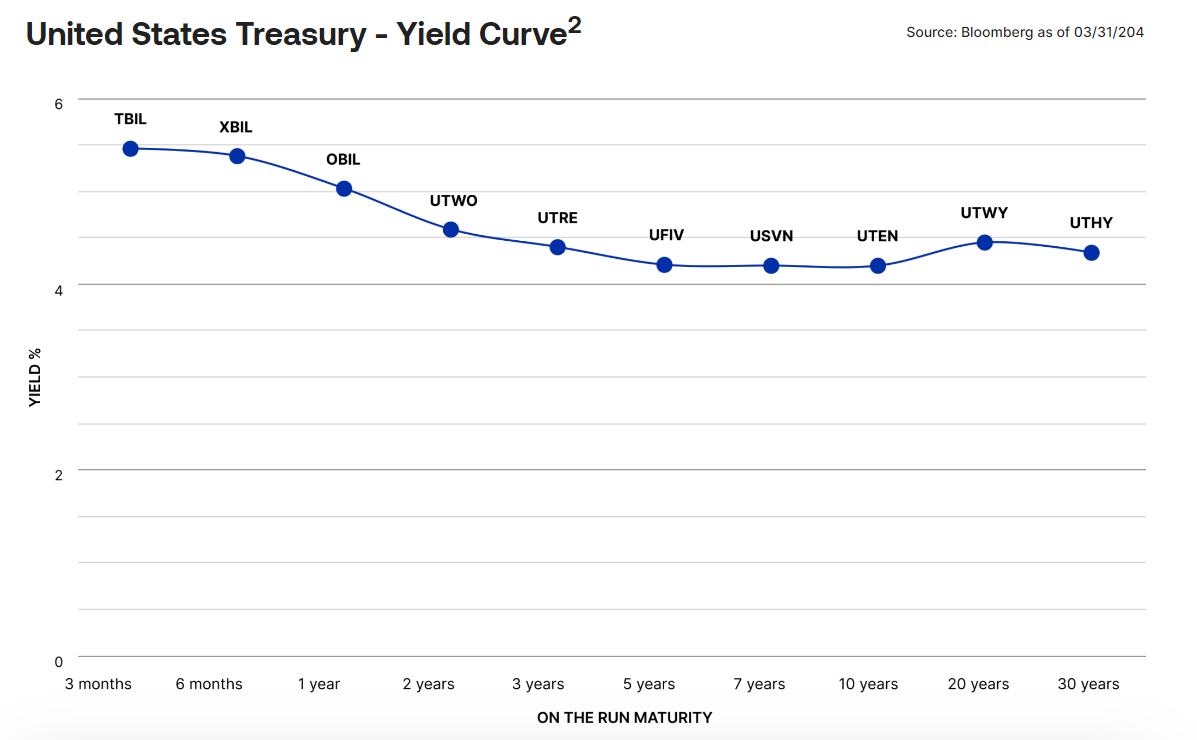

Charts:

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound Media, Inc, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.