Inflation and wages are kind of a chicken or egg issue.

Do higher prices cause higher wages or do higher wages cause higher prices?

I suppose it’s probably a little of both.

There is an obvious relationship when you look at the data.

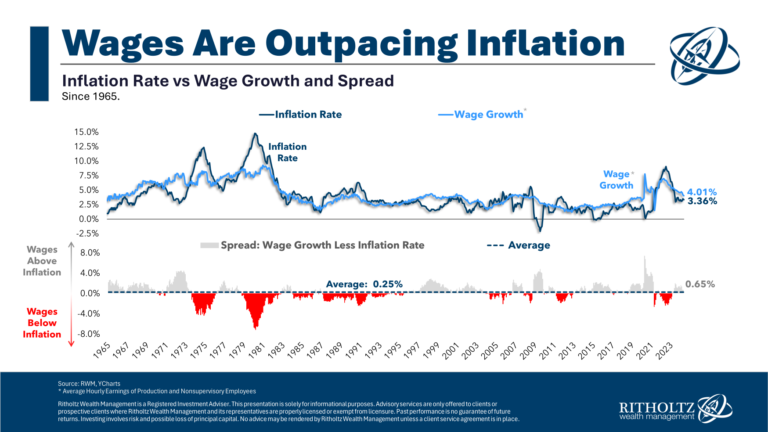

Here’s a look at year-over-year wage growth versus trailing twelve-month inflation going back to 1965:

Wages grow faster than prices most of the time, but not always. Since 1965, wages have been growing above the rate of inflation a little less than 60% of the time.

The worst period by far for wages falling behind prices was the 1970s.

From 1973 to 1976, wage growth was slower than inflation for 36 months straight. Then, from late 1978 through the end of 1982, real wage growth was negative for 50 consecutive months.

And it wasn’t just the length of time but the magnitude of the difference. At the worst point in 1980, inflation was outpacing wage growth by more than 7%.

Surprisingly, there was a long stretch from the mid-1980s through the mid-1990s when wages were growing slower than inflation. From 1984 through the summer of 1995, prices were rising at a faster clip than incomes 88% of the time.

You don’t hear much about that time frame producing economic misery but maybe that’s because at least it was better than the 1970s.

This time around, wage growth was lower than the inflation rate for 21 out of 23 months from 2021 through early 2023.1

We’re currently on a streak of 14 straight months where wages have outpaced inflation.

The good news is wages are growing faster than inflation. The bad news for many households is no one’s life ever matches up exactly with economic averages.

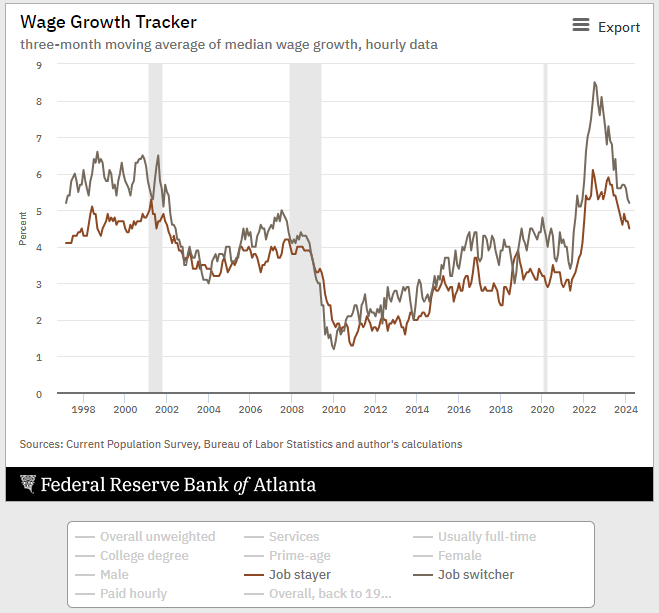

The people who changed jobs during the pandemic saw far higher wage growth than those who stayed with their current employer:

As always, some people are doing better while others are falling behind.

The problem with this relationship is people see higher wages as something they earned while higher prices are a form of theft.

This is one of the big reason economic sentiment has been off these past couple of years. People really despise high inflation.

But you can’t talk about the impact of inflation without talking about the other side of the ledger.

Wages have been rising too and they’re a big reason the economy has remained so resilient.

Further Reading:

The Psychology of Inflation

1It’s also worth noting that huge spike we had in wage growth at the outset of the pandemic is something of a myth. The only reason you see that massive rise (and subsequent fall) in the data is because so many people with lower incomes were laid off (think service professions).

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.