It’s estimated just 1% to 3% of American households owned stocks heading into the Great Depression.

Few people made enough money to save and invest back then plus it was difficult to access the market for regular people — no 401ks, IRAs, online brokers, robo-adviors, index funds, ETFs, Robinhood, etc.

By the early-1980s stock ownership was more like 1 in 5 households.

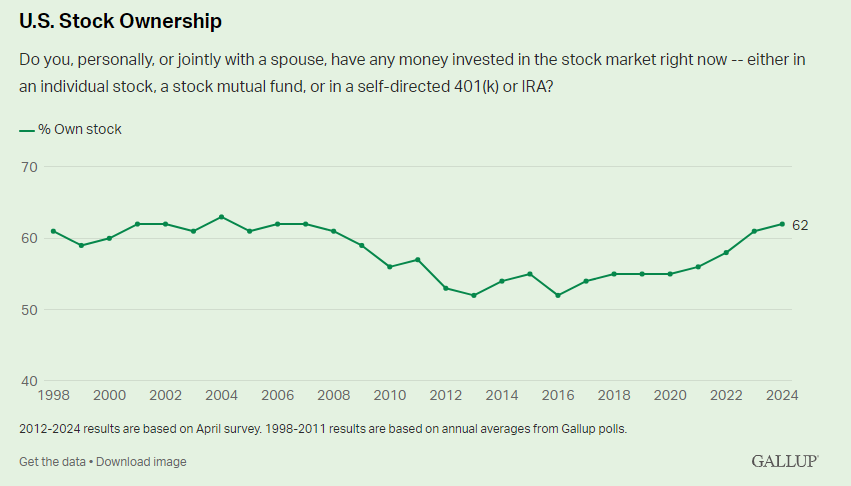

Things really ramped up in the 1990s as the dot-com boom, growth in retirement accounts, baby boomer wealth and online brokers pulled people off the sidelines. By the end of that decade stock market ownership was closer to 60%.

The twin stock market crashes in the early 2000s halted that growth. The aftermath of the Great Financial saw stock market ownership in America decline, from a high of 63% in 2004 to 52% by 2013.

Those people missed out on one of the greatest buying opportunities in history.

Luckily, we’ve slowly but surely dug ourselves out of that hole and are basically back at all-time high levels of ownership (via Gallup):

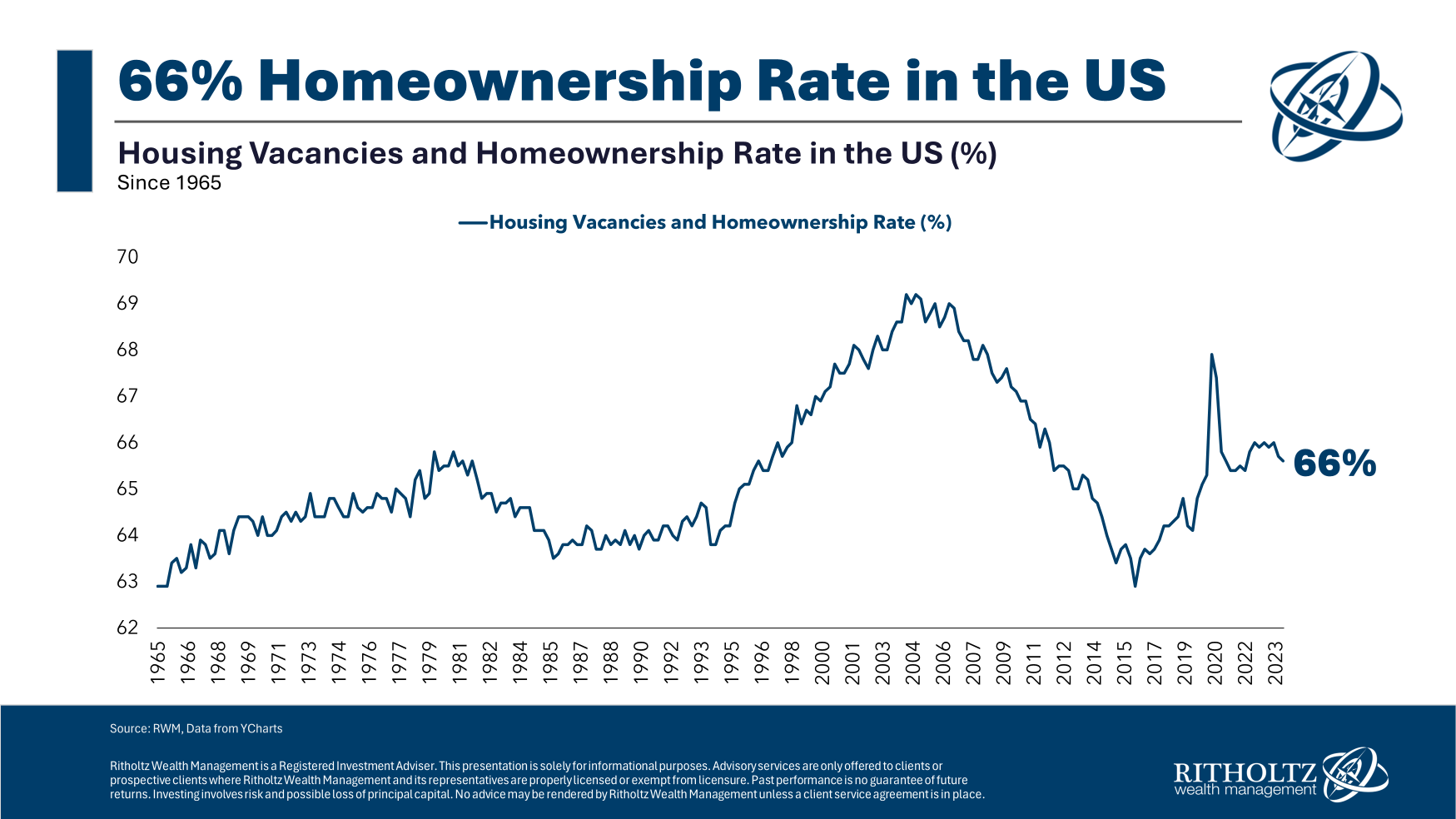

Interestingly enough, the stock market ownership rate is essentially on par with the homeownership rate in America:

The homeownership rate doesn’t technically mean two-thirds of Americans own their homes. It’s the percentage of homes that are owner-occupied, the difference being that rentals can consist of more than one household.1

Regardless of the technical details, lots of people own homes and lots of people own stocks. That’s the good news and one of the main reasons net worth figures are at all-time highs.

Owning financial assets was the best hedge against inflation again.

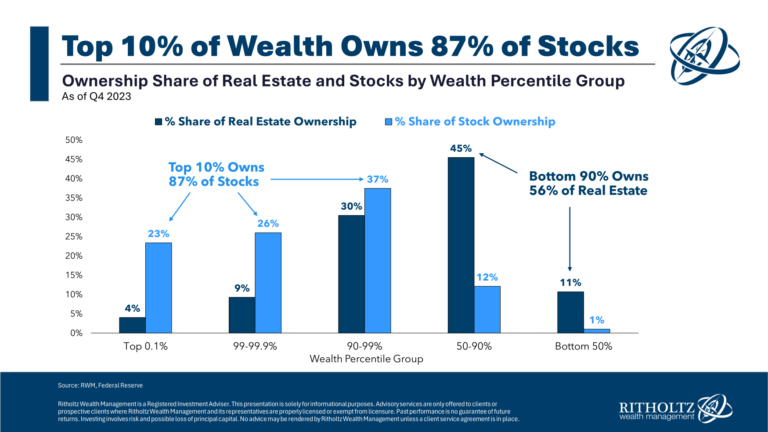

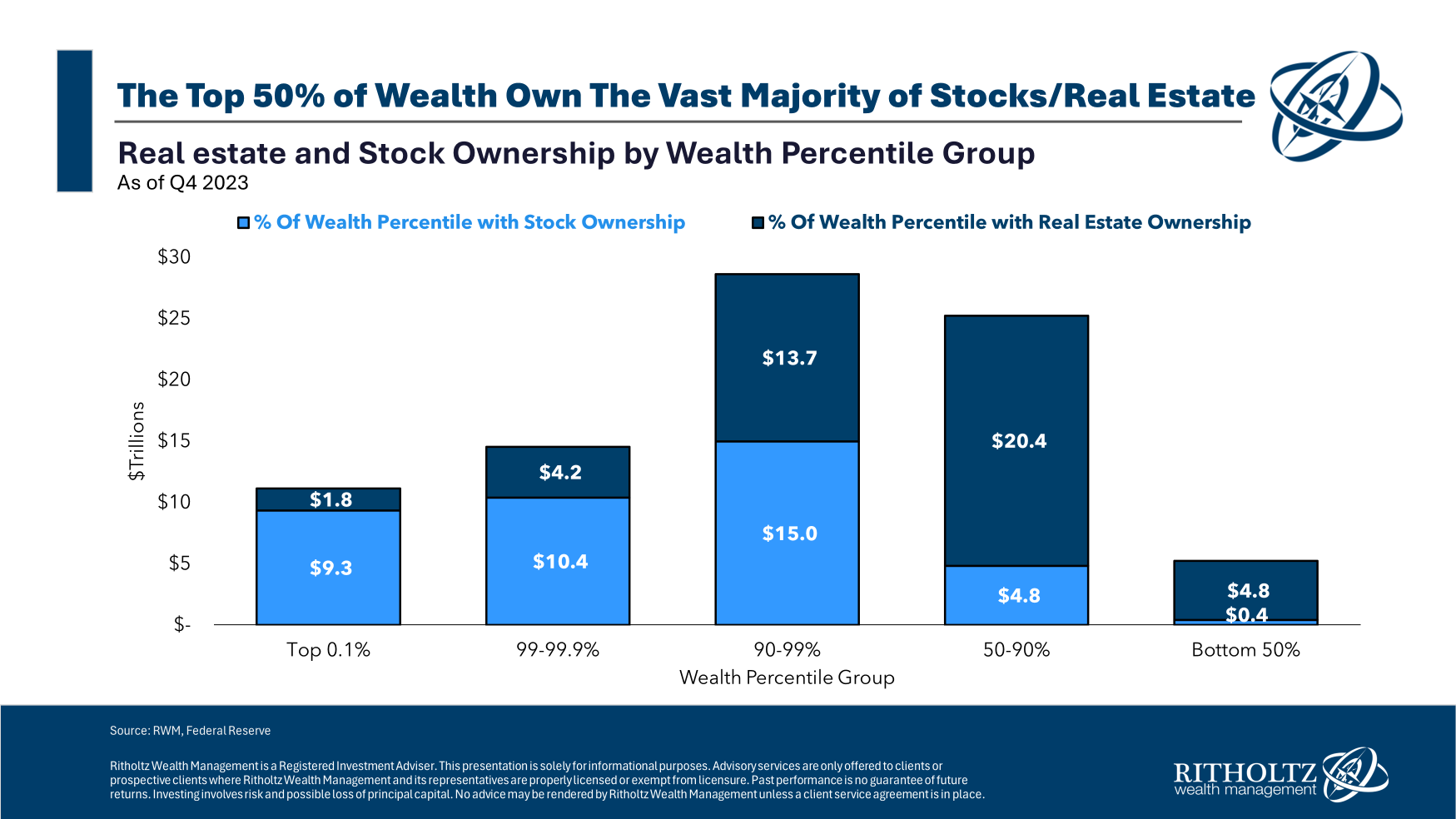

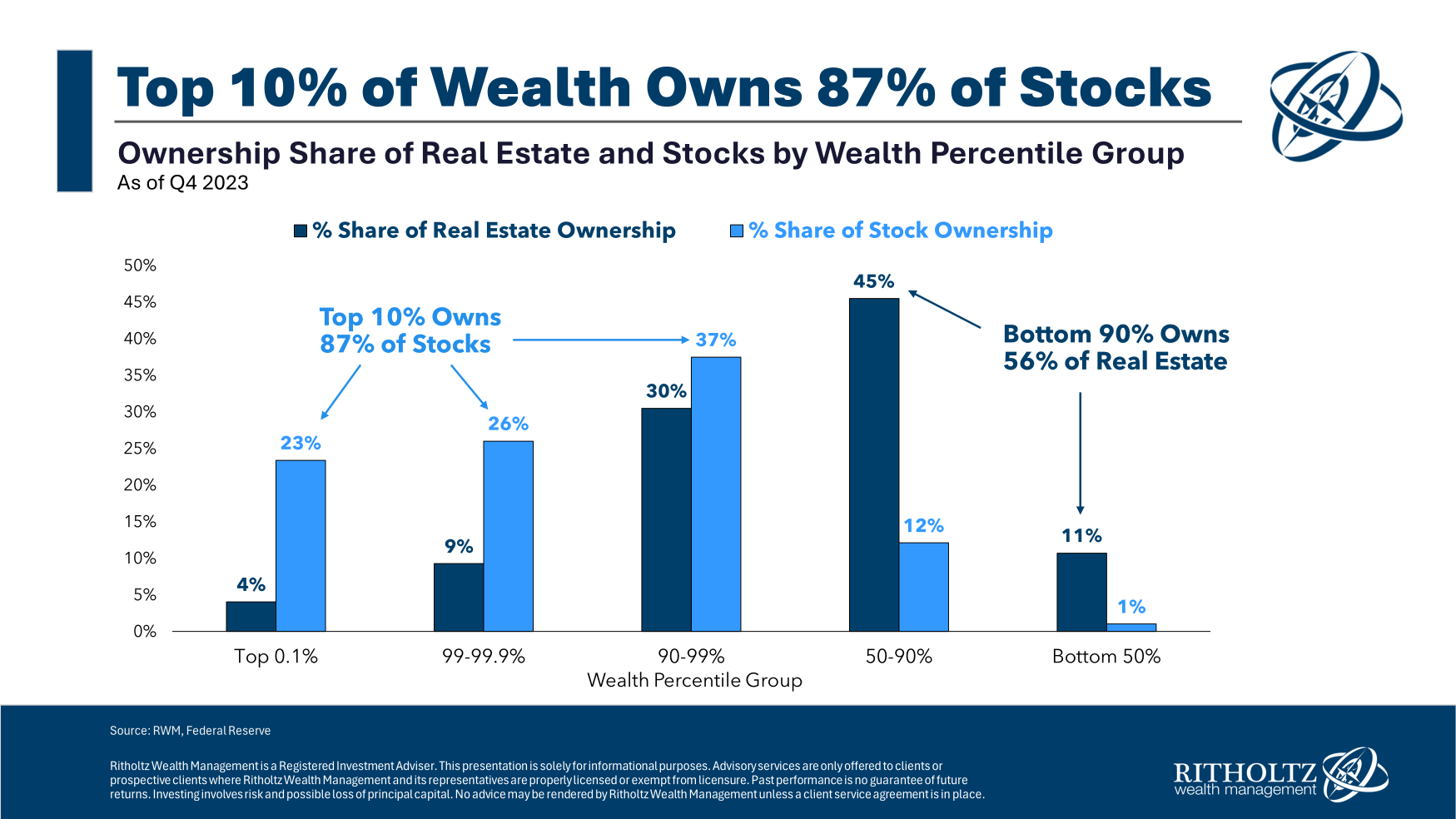

The problem is that wealth is not evenly distributed:

The top 10% own the majority of financial assets in this country. And the top 0.1% owns a ridiculous amount of that wealth.

Housing market wealth is much more spread out than the stock market:

The top 10% own nearly 90% of the stocks while the bottom 90% owns almost 60% of the housing market.

If I had to guess the homeownership rate will likely stagnate or decline in the years ahead while I’m hopeful stock market ownership will continue on its upward trajectory.

The barriers to entry in the stock market have never been lower.

Most workplace retirement plans now have an auto opt-in feature. There are targetdate funds, zero commission brokers on your smartphone, fractional shares and automated investing platforms.

It’s never been easier to take part in the best long-term wealth-building apparatus on the planet.

Unfortunately, the barriers to entry in the housing market are about as high as they’ve ever been. Prices have skyrocketed. Supply is too low. There is a near-endless supply of young people looking to buy. Mortgage rates have more than doubled in a short period of time.

It won’t always be like this. Things could change.

But the homeownership rate is facing some serious headwinds.

If you can’t build equity in the housing market, you better make sure you own equities in your retirement or brokerage account.

We need more people to own financial assets in this country.

Michael and I talked about how many people own stocks and homes on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Ownership Inequality in the Stock Market

Now here’s what I’ve been reading lately:

Books:

1To be fair, this is a difficult statistic to calculate since most households consist of more than one person and often have children in them. It’s a tricky statistic to pin down.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.