The bad news about the historic bond bear market is that fixed income investors were forced to deal with large losses in certain areas of the bond market.

The good news is the rising rates that caused the bear market in bonds mean yields are in a much better place than they’ve been for the past 10-15 years.

Fixed income has income again.

In fact, investors in search of yield have all sorts of options — T-bills, money market funds, corporate bonds, asset-backed securities, Treasuries, TIPS — paying anywhere from 4% to 8% or higher.

Investors who lived through the ZIRP era are happy to see absolute yield levels like these. But you can also think about yields on a relative basis.

When interest rates change, they don’t typically do so equally across the various segments of the bond market. Differences in credit quality, maturity, loan types, yield, etc., cause rates to shift by different amounts.

That’s true in this rising rate cycle as well.

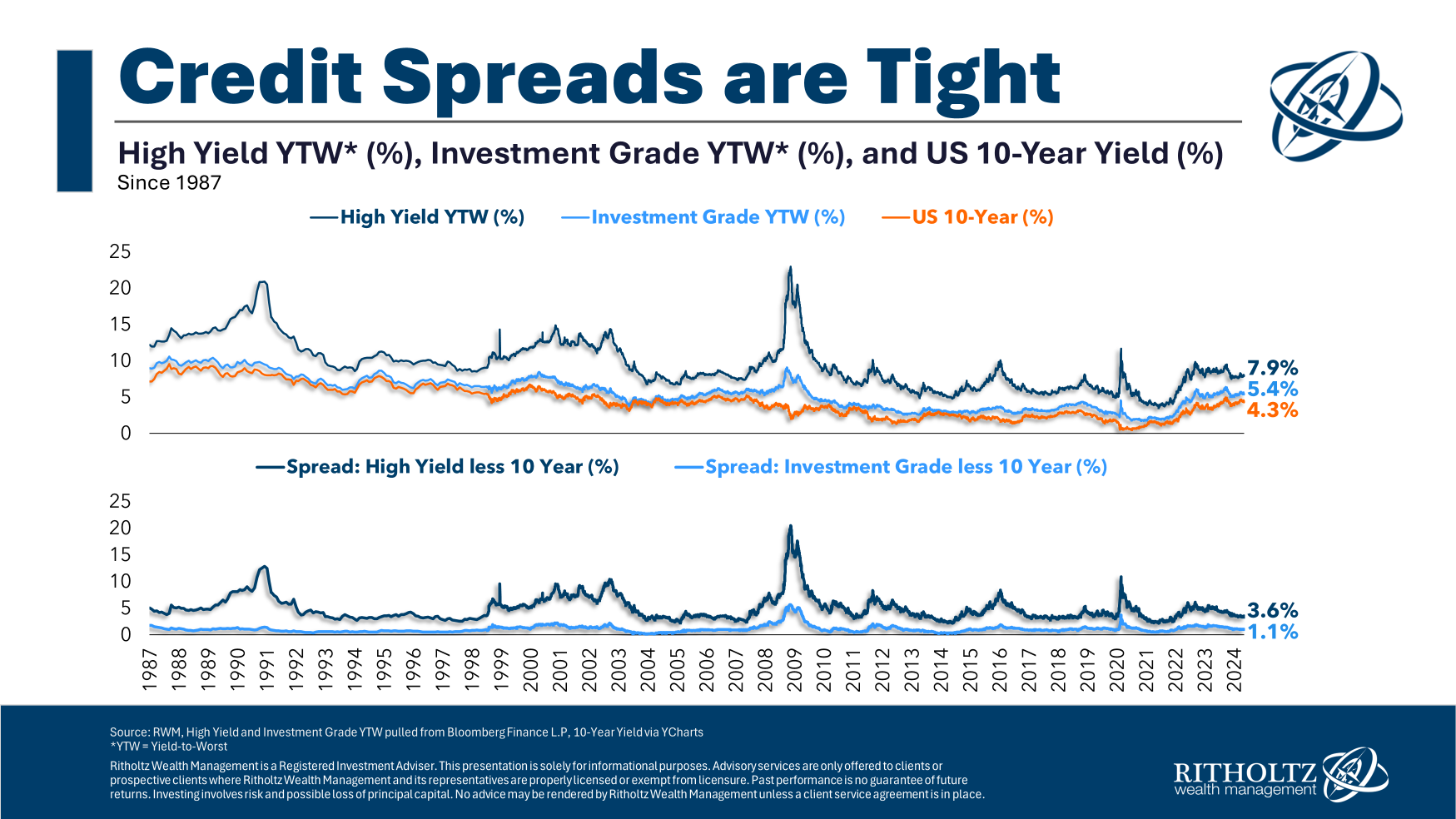

Here’s a look at current and historical yields on the 10-year Treasury, investment-grade corporate bonds and high yield debt:

The average high yield spread over 10 year Treasuries since 1987 is 5%. So spreads on junk bonds are still relatively tight.

Corporate bond spreads are just a tad tighter than the long-term average of 1.2%.

Yields are more attractive on corporate and junk bonds, but the spreads over Treasuries remain relatively tight compared to historical norms.

I guess my point here is that although yields are higher than they were in the recent past, you also have to assess the risks involved across the fixed income spectrum.

Invest in high yield and deal with default risk and equity-like volatility at times when spreads blow out.

Invest in T-bills and deal with reinvestment risk if rates fall.

Invest in corporate bonds and deal with higher drawdowns during economic crises.

Invest in longer-dated Treasuries and deal with interest rate risk.

Invest in TIPS and deal with the potential for lower or falling inflation.

Invest in newer areas like private credit and deal with illiquidity and the unknown risks of a new-ish asset in this space.

There are all sorts of other risks, but the point here is that there are always trade-offs. You have to choose your regret as an investor.

There are no right or wrong answers when it comes to your fixed income exposure.

It depends on what you’re looking for. Absolute yield levels? Tactical positioning? An anchor in your portfolio with little to no volatility?

There’s also no rule that says you have to concentrate on any specific segment of the bond market.

You can diversify your bond allocation so you’re not tied to any one risk too. I’m a big fan of diversification.

I don’t know what’s going to happen with the Fed, inflation, interest rates, economic growth, recessions or any of the other factors that influence bond returns.

I also don’t know how long the current yield environment will last.

Enjoy those yields while they’re here, but also consider the risks involved as well.

Further Reading:

The Worst Bond Market Market Ever Marches On

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.