The plural of anecdote is not data.

You can’t extrapolate your individual experience or the experiences of your family, friends and peers to the broader economy, markets, political climate, etc.

Just because the dumbest person you know is going all-in on Nvidia does not mean the stock market is going to collapse tomorrow.

That’s not how any of this works.

I am, however, a big fan of using investor anecdotes as a way to avoid making costly behavioral mistakes with your money.

One of my favorite parts of the financial media is when they interview regular people to talk about their investment successes and blunders. I’m shocked these people are willing to share their experiences in most cases.

For example, Bloomberg recently ran a long profile on syndicated real estate deals. These deals allow investors to pool their money to access larger institutional-like real estate investments.

The combination of rising rates, too much leverage, and a slowdown in multi-family housing caused a number of these deals to blow up. Here’s one such example from the article:

Lynn Nathe was growing tired of the meager gains from her family’s retirement account. In late 2021, she invested $200,000 with a company that was making 30% returns by buying the hottest ticket in global real estate: US apartments.

Upstart landlords like Western Wealth Capital, in which Nathe invested her money, specialized in speculative fix-and-flip deals, levering up with loans that were often then packaged as securities and sold to institutional buyers.

Now, she says, most of that money is gone.

Nathe shifted her retirement strategy during the Covid-19 pandemic, when it seemed like everyone in the world was getting rich. Her family had lived well on her husband’s earnings as a dentist, but after putting four kids through medical school, their 401(k) wasn’t cutting it.

For Nathe, a business school graduate who invested earnings from her husband’s dentistry practice in Yakima, Washington, the loss is a personal calamity.

Mistakes were made.

To her credit, she owned up to it:

“I feel guilty,” Nathe said. “It was my own stupidity.”

But here’s the kicker:

She’s now watching her portfolio for more trouble. She said she’s invested more of her husband’s 401(k) — an additional $1 million — with other real estate syndicators.

Where to begin?

I cannot imagine putting four kids through college and then medical school. With three kids of my own, I do understand the desire to do everything you can for your children.

But taking more risk to make up for lost ground is a slippery slope. The late-Peter Bernstein once wrote, “The market’s not a very accommodating machine; it won’t provide high returns just because you need them.”

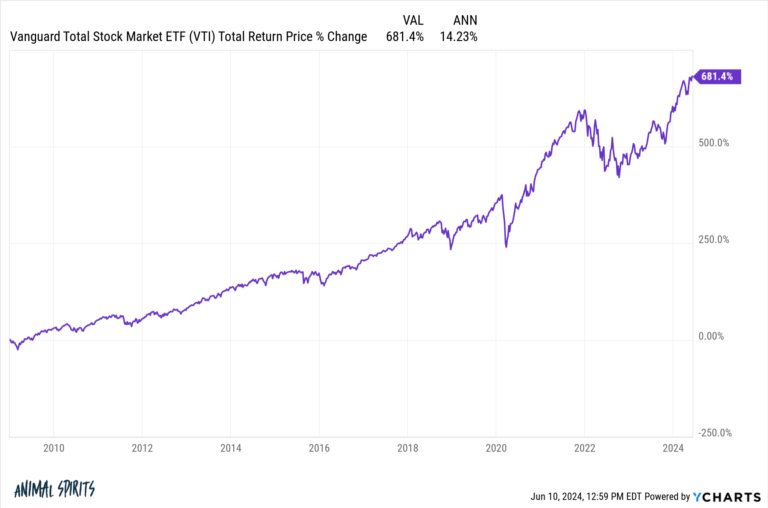

I’m not sure how they were investing in their 401k plan, but imagine living through one of the biggest stock bull markets in history and not being satisfied with the gains. The U.S. stock market is up nearly 700% in total since the start of 2009. That’s 14.2% annual returns.1

Over the past 5 years, U.S. stocks have doubled, which is also good enough for 14%+ returns per year.

I know 30% returns sound far more appealing but that’s just greed taking the steering wheel. It’s like you’re trying to skip the line. In the immortal words of Gem Coughlin from The Town: “You know what your problem is? You think you’re better than people”

I don’t care how much money you have — there are no shortcuts when it comes to making money in the markets.

There are necessary and unnecessary risks. Volatility and losses are necessary risks. Investing in overleverage real estate deals that shoot for 30% annual returns is an unnecessary risk.

Sure, it could work out for a select few, but chances are you’ll fail.

I have some simple rules when it comes to staying out of trouble when investing:

- Know what you own and why you own it.

- If you don’t understand something, don’t invest in it.

- If it sounds too good to be true, it probably is.

This is not exciting or sexy advice but successful investing is generally boring.

Half the battle is just staying in the game over the long haul by avoiding crippling mistakes.

Further Reading:

It’s OK to Build Wealth Slowly

1The global stock market is up nearly 12% per year in this time frame.