A reader asks:

I was listening to WAYT and Josh mentioned and Michael seemed to agree that the small cap premium no longer exists (since the 1980s). I was hoping that this question can be discussed and dissected: What is this premium? Why doesn’t it exist anymore? How do you know? Is it still worth being owning small caps? My uneducated opinion was that small caps historically performed on par, if not better, than the rest of the market. Also, with the S&P 500 significantly outperforming small caps, it seems like being overweight on new contributions going into small caps doesn’t seem like a farfetched or irrational idea.

The Jeremys (Siegel and Schwartz) covered the small cap premium in the latest edition of Stocks for the Long Run.

They look at returns from 1926-2021. Small cap stocks outperformed large cap stocks 11.99% to 10.35%. But basically all of that premium came in one nine year window between 1975 and 1983 when small cap stocks were up more than 1,400% in total. Small caps outperformed large caps 35.3% to 15.7% per year in that time. Take away that outlier and the long-run returns are much closer.1

They explain why this happened:

One explanation for the strong outperformance during that period was the enactment of the Employee Retirement Income Security Act (ERISA) by Congress in 1974, making it far easier to pension funds to diversify into small stocks. Another was the turn of investors to buy small stocks following the collapse of the big-cap Nifty Fifty stocks earlier in the decade.

Fair enough. Although I’m sure if we exclude the 2016-2024 period of large cap outperformance, small stocks would look much better historically.

Let’s look at data over other time horizons to see how small caps have held up historically.

The Russell 2000 Index goes back to 1979. Here are the annual returns through May of this year:

- Russell 2000 +10.9%

- S&P 500 +12.0%

The S&P 600 Index, which excludes the many unprofitable stocks included in the Russell 2000 goes back to 1995. Here are the annual returns through May of this year:

- S&P 600 +10.7%

- S&P 500 +10.7%

Vanguard has a small cap index fund that goes all the way back to 1962.2 Here are the annual returns through May of this year:

- NAESX +10.7%

- S&P 500 +10.2%

DFA has a small cap value fund that goes back to 1993. Here are the annual returns through May of this year:

- DFSVX +11.3%

- S&P 500 +10.3%

I’m sure you could pick some other start dates that prove your point for or against small cap stocks but this is a relatively wide range of results over various time horizons. Over the long haul small caps have more or less kept up with large caps (or vice versa).

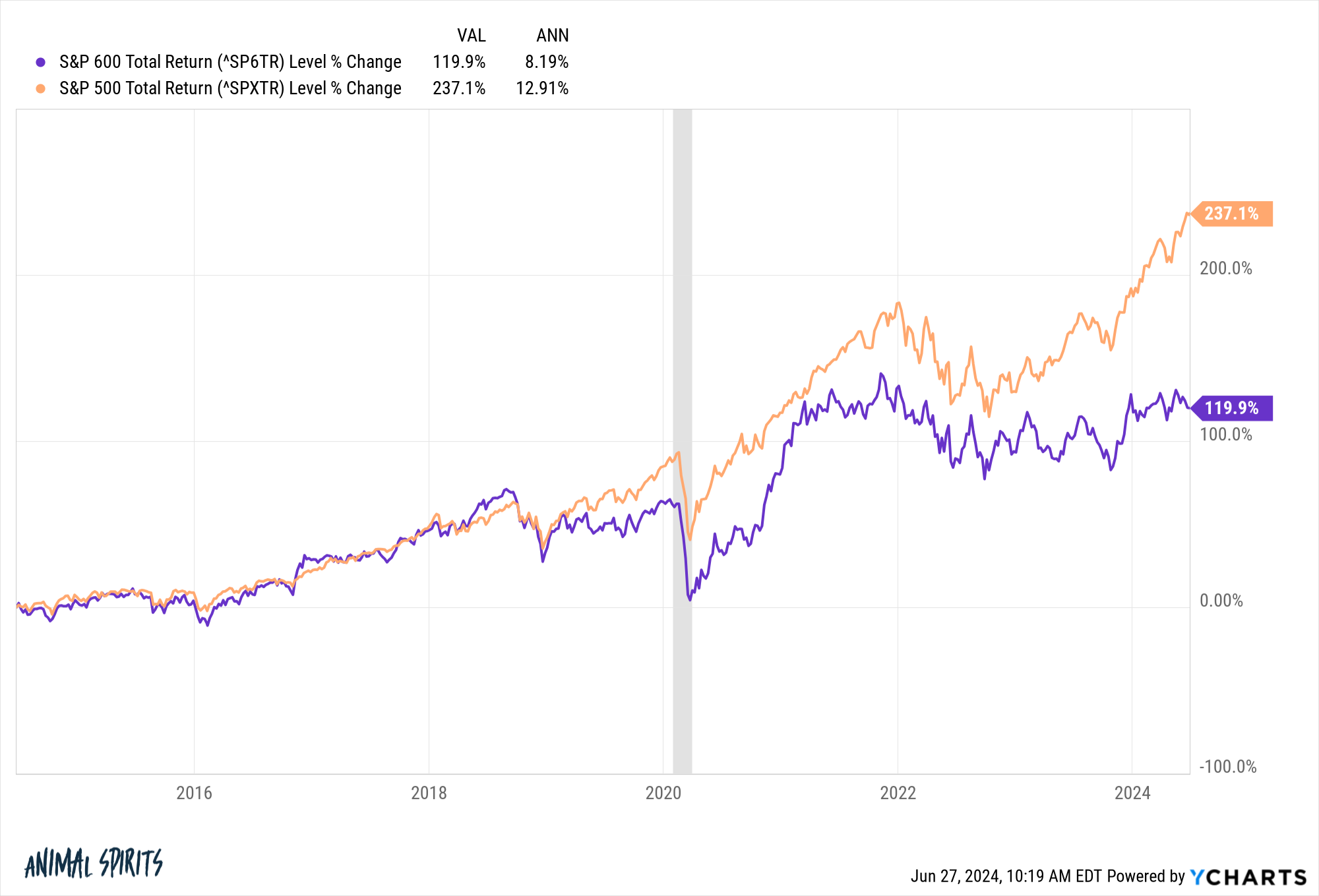

Small caps have not kept up this cycle. Here are the returns over the past 10 years:

I’m not in the camp that you should own small caps for some sort of alpha or factor premium. The stock market is too smart to allow that kind of thing to persist.

I look at small caps as providing a diversification premium.

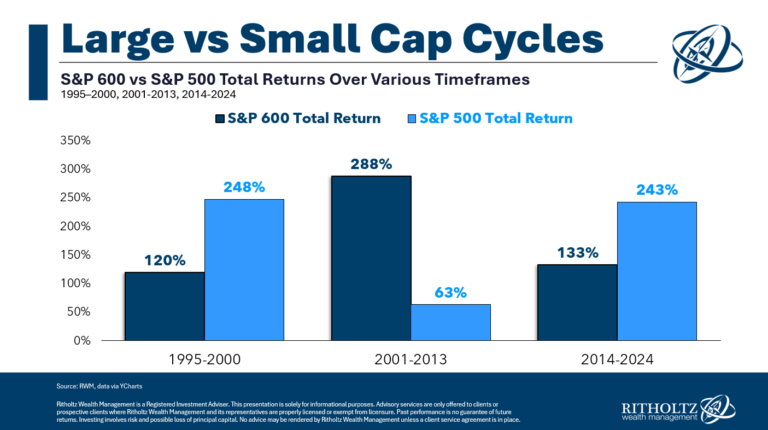

Just look at the cycles of relative performance for the S&P 600 and S&P 500 since the mid-1990s:

You could find similar cycles going even further back.

The Vanguard Small Cap Index Fund outperformed the S&P 500 by more than 200% in total from 1975-1983. Over the ensuing 9 year period, the S&P 500 outperformed by more than 200%.

Interestingly enough, the last time small caps lagged in a big way was the late-1990s when the dot-com bubble went into hyperdrive. Large cap stocks crushed small cap stocks. Then large cap stocks became overvalued and when the cycle turned the undervalued small company stocks outperformed in a big way during the next cycle.

I can’t be positive this same scenario will play out again when this cycle finally turns. Maybe markets have changed forever when it comes to large caps vs. small caps.

Companies are staying private longer. More private money is available today for venture, M&A, and leveraged buyouts. Plus, many large corporations simply buy out the competition before they can go public, so there are far fewer IPOs today than in the past.

Plus, higher rates have disproportionately hurt smaller companies when it comes to borrowing. Larger corporations were able to lock in lower rates and are now earning money on their cash holdings because of the higher yields, a luxury more small corporations don’t have.

Maybe these factors make small caps less attractive than they were in the past. You can’t rule it out but we also can’t be sure small caps are dead money now either.

Stock market returns have been concentrated in large-cap growth stocks for some time, but this trend will not last forever.

I’m still a believer in diversification even when it makes you feel like an idiot.

Markets are cyclical because human emotions are cyclical.

And I don’t think human nature has changed.

We covered this question on the latest edition of Ask the Compound:

Everyone’s favorite tax expert, Bill Sweet, joined me again on the show this week to discuss questions about what happens to a Roth IRA when you pass away, how a backdoor Roth works in practice, investing your cash on the sidelines and how to reduce investment taxes as a teacher in a low tax bracket.

Further Reading:

This is a Wonderful Environment for Dollar Cost Averaging

1Still a slight edge to small caps: 10.03% to 9.80%.

2I’m not exactly sure how many different index iterations this fund has gone through in its history but I was more interested in the extended track record.