Back in 2020 I wrote a quick rundown of the U.S. real estate market in charts to show how the pandemic was impacting the housing market.

It’s been a few years so it’s time to update those charts.

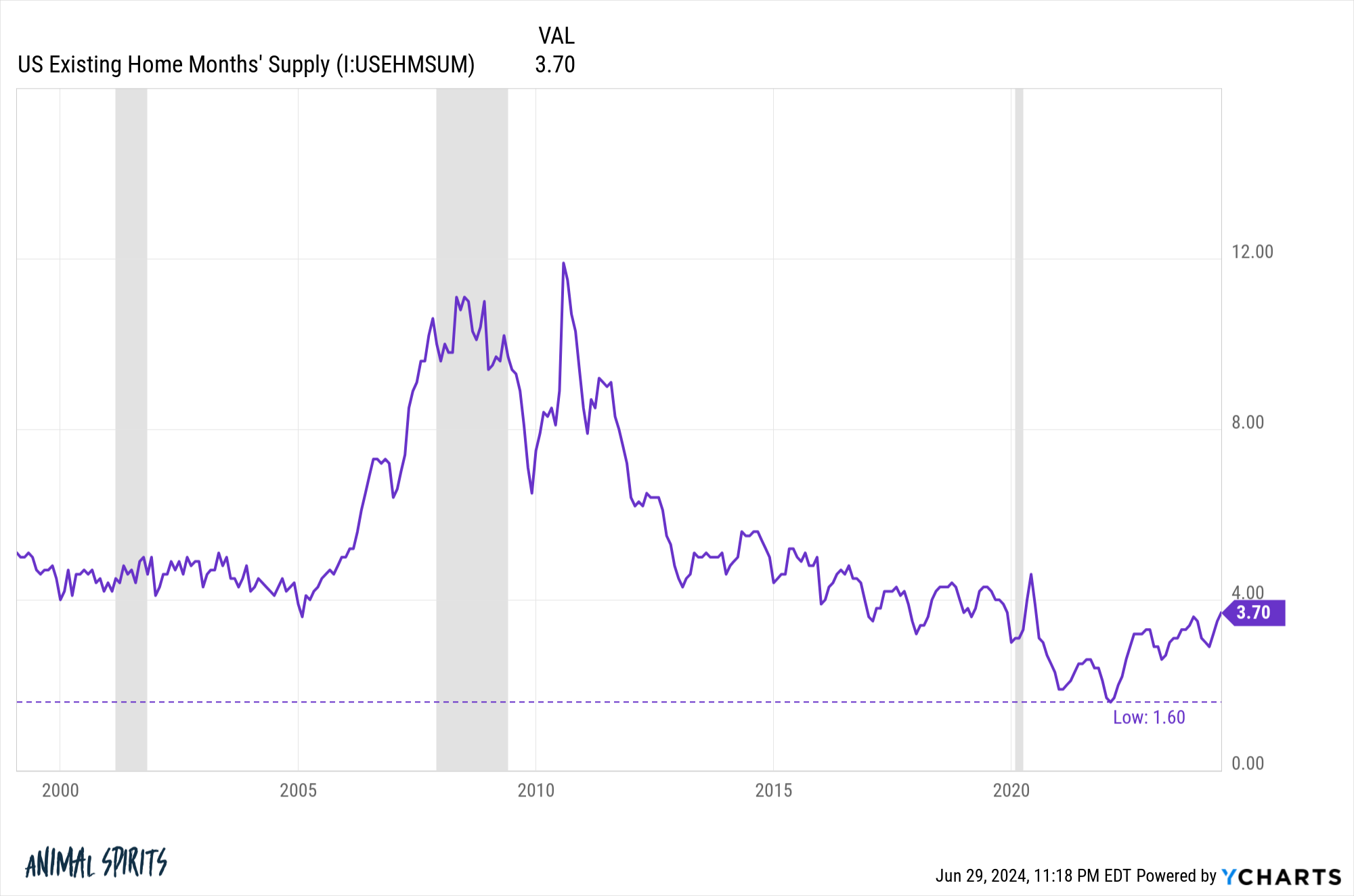

The existing home months’ supply measures the number of months it would take to sell all of the houses on the market at the current pace of sales:

It’s well off the lows of late-2021/early-2022 and trending higher. This is good news for a healthier housing market.

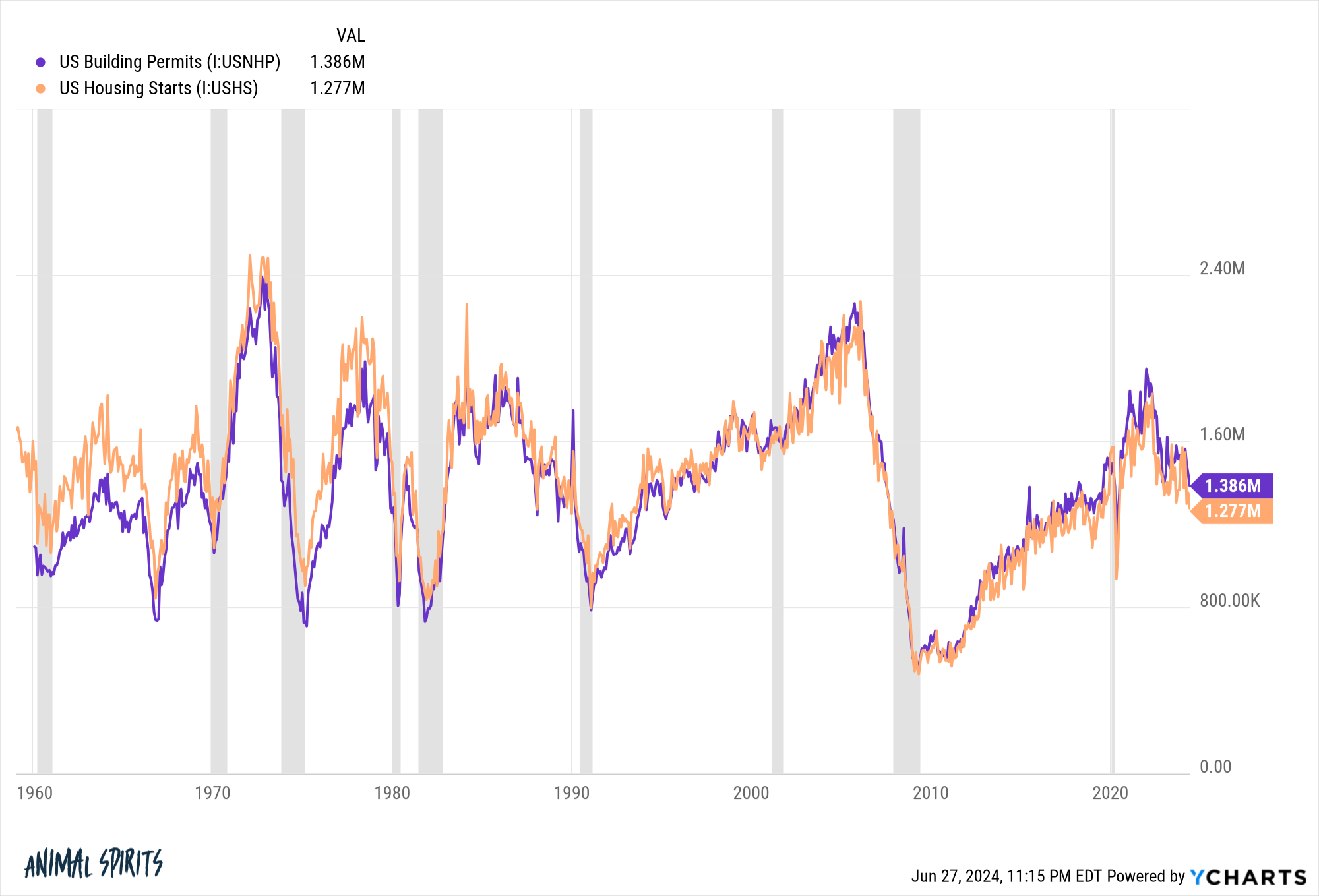

We saw a nice little boom in the construction of new homes when the pandemic created crazy demand for housing.

It was fun while it lasted but higher mortgage rates quickly put an end to that trend. As you can see the number of building permits and housing starts has declined as quickly as it rose:

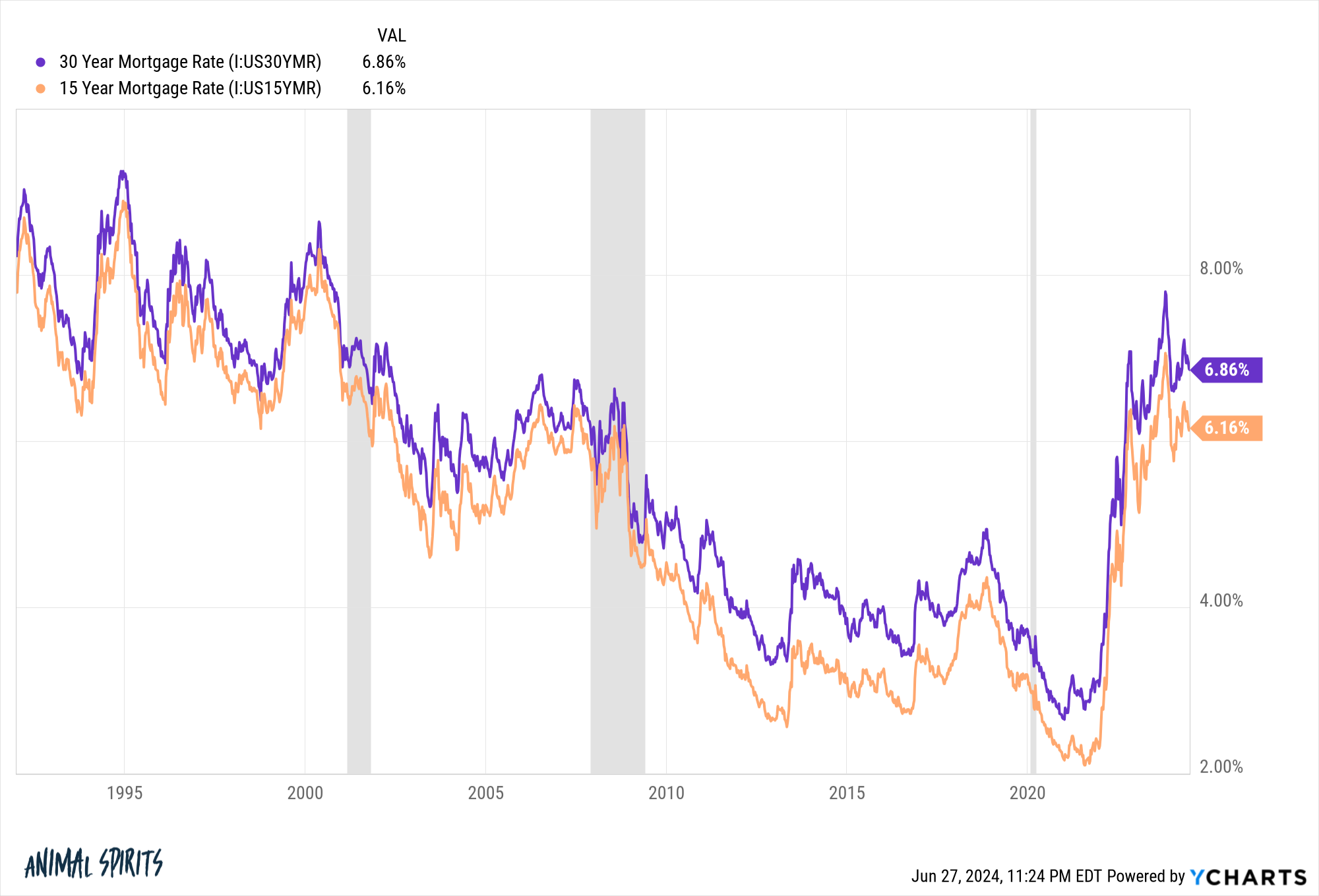

The increase in mortgage rates is a sight to behold on a chart:

It’s hard to believe there was a housing bubble in the first decade of this century with mortgage rates above 6%. The big difference is rates were falling from higher levels back then while today generationally low mortgage rates are fresh in everyone’s memory.

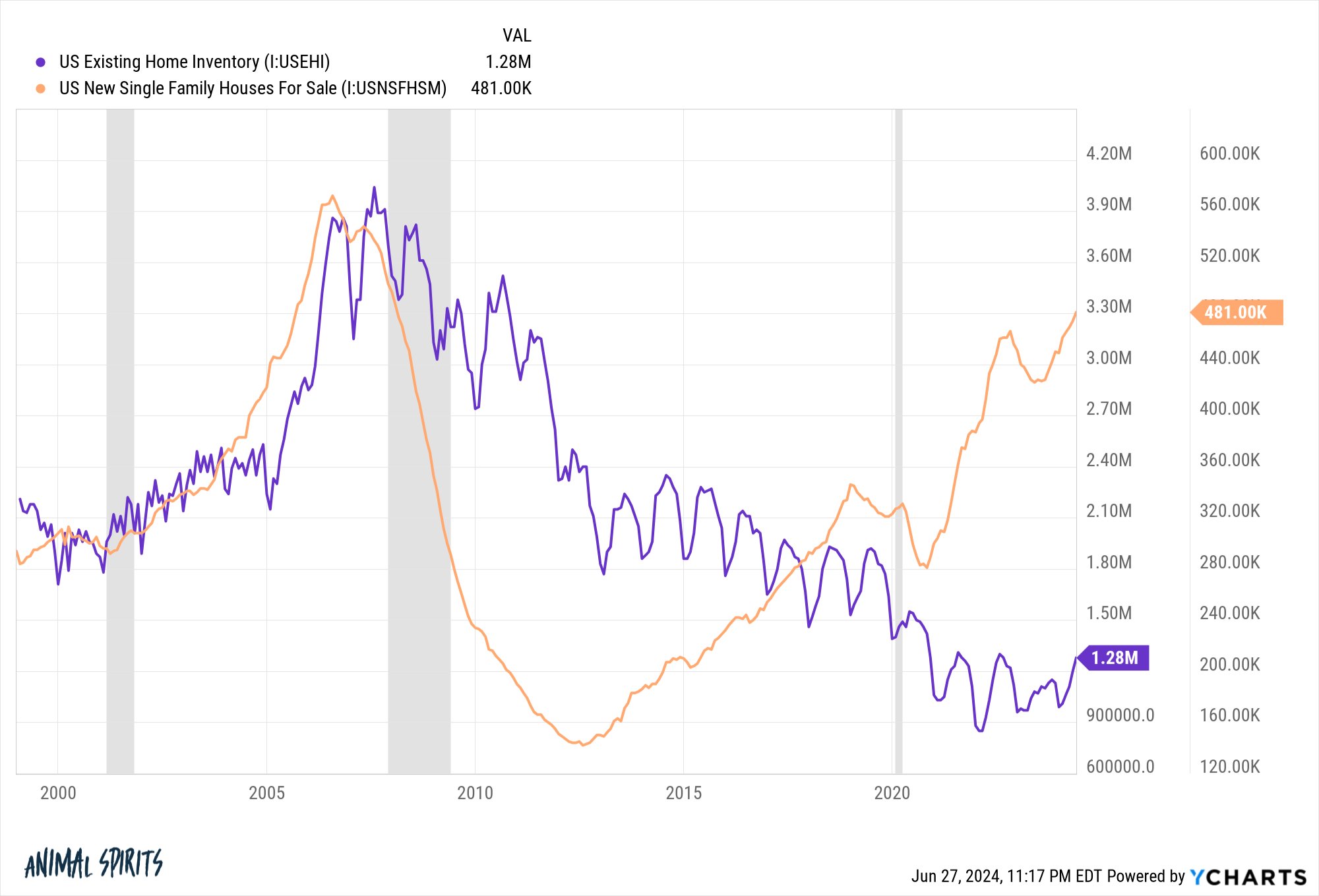

That mini-boom in new construction, coupled with rate buydowns from homebuilders, has helped make up for falling existing home inventory:

Unfortunately, the housing starts data rolling over means this isn’t likely to last so we need the existing housing market to pick up the slack.

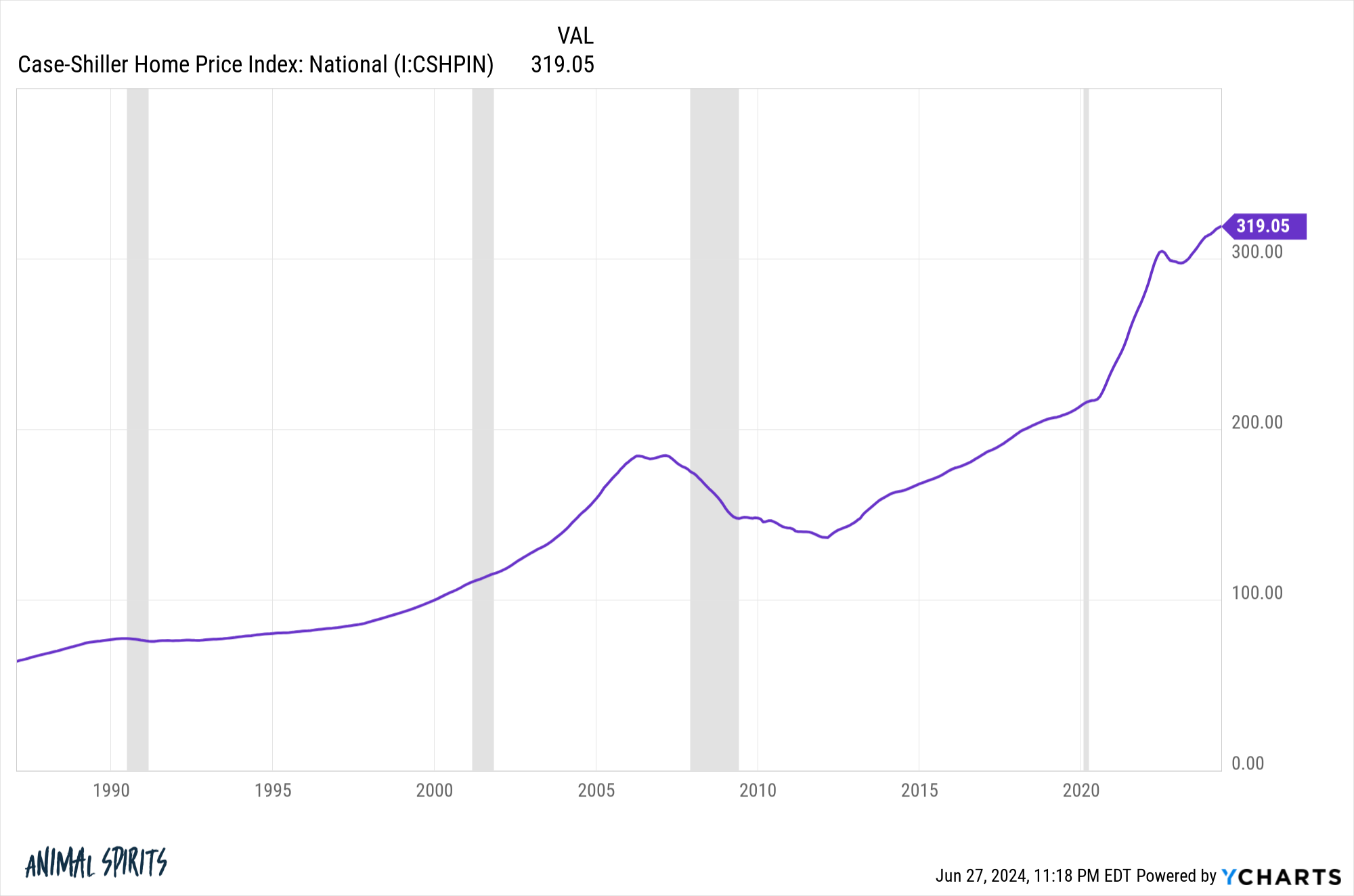

Housing prices continue to take out new highs:

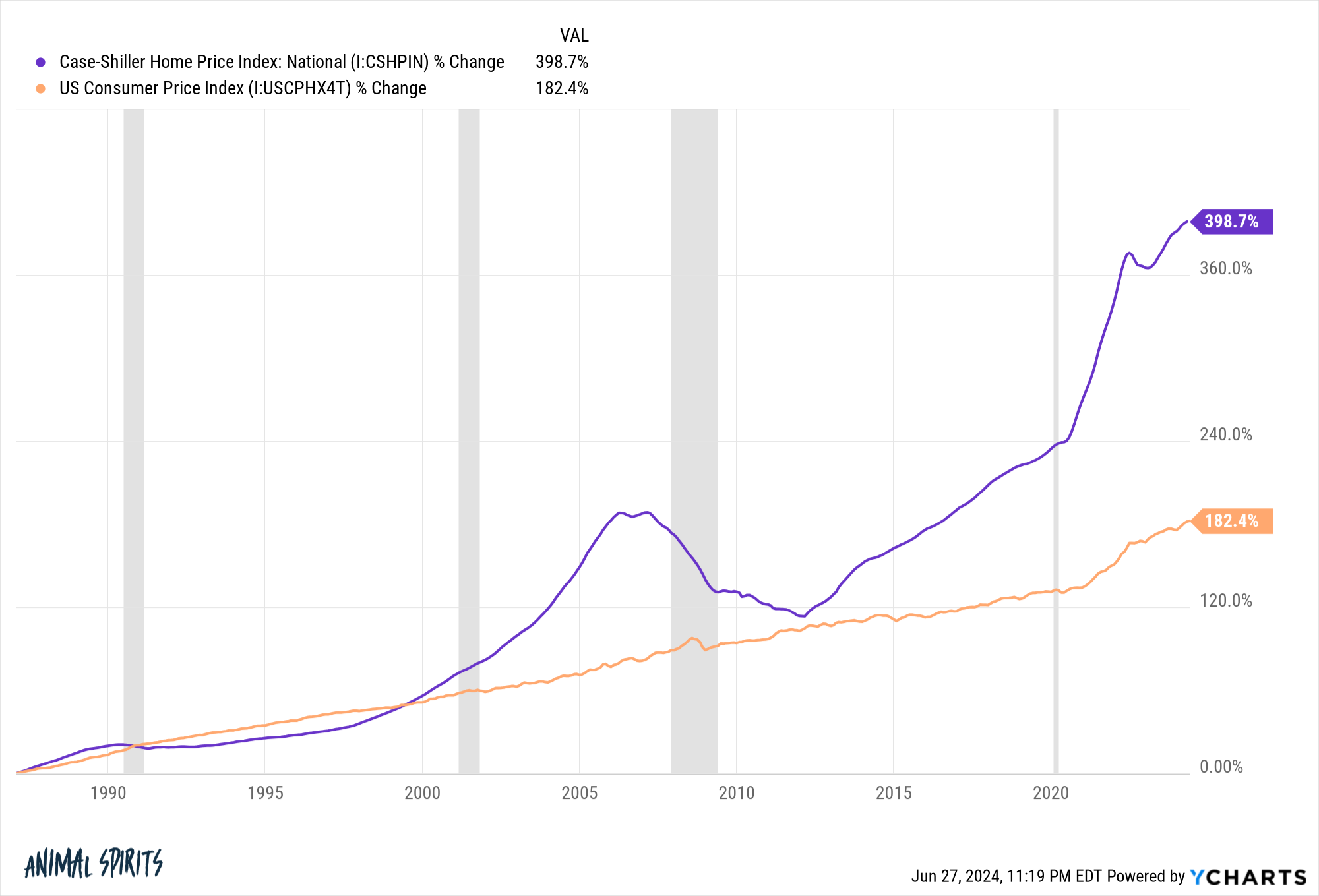

It turns out owning a home was likely your best bet for hedging against inflation during this cycle:

Where housing goes from here is hard to say.

If mortgage rates stay elevated, it would make sense for inventory to continue building and price growth to slow.

If mortgage rates fall enough, we could see a flood of demand from buyers and sellers who have been sidelined but it might depend on why rates fall.

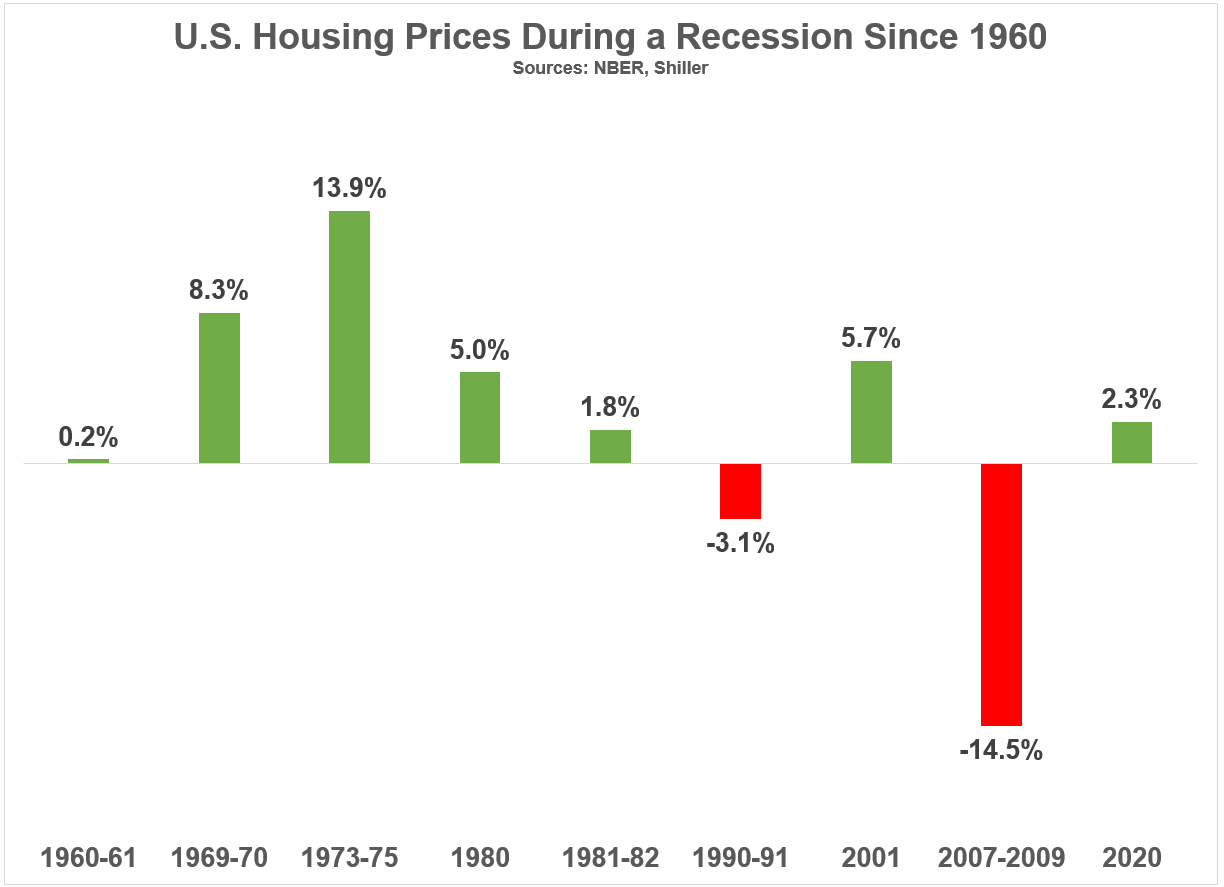

Recessions don’t always crush the housing market as you’d expect:

It’s not a foregone conclusion prices would get killed during the next economic contraction.

Higher mortgage rates have slowed the craziness of the pandemic housing market. But this is also setting us up for more problems down the road since it’s slowing new construction from homebuilders.

Lower mortgage rates would provide relief to borrowers and incentivize more building but it could also lead to increased demand in an already supply-constrained market.

We won’t be in this situation forever because something unexpected always happens eventually, but for now, we’re in a damned-if-you-do, damned-if-you-don’t housing market.

Further Reading:

Who is Buying a House in this Market?

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.