Greg Ip at The Wall Street Journal penned a piece recently that warned potential homebuyers about the prospect of low returns from current levels:

I don’t need to offer any more details from the story because you already know them. Housing prices are up a lot. Mortgage rates are also up a lot.

This is a fair warning.

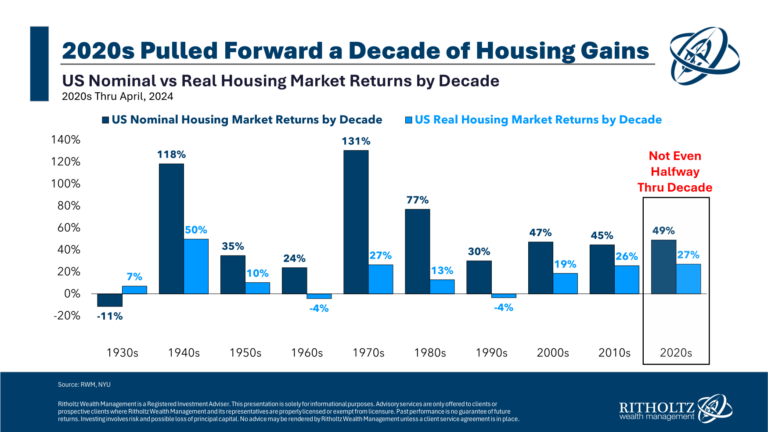

We essentially pulled forward a decade’s worth of housing returns into the first few years of the 2020s:

Housing prices in the 2020s have already outpaced most decades. On an inflation-adjusted basis, only the 1940s saw higher returns and we still have five-plus years remaining.

If I were a Wall Street pundit, I would say the easy money has been made, but I’m not going to fall for that trap.2

I don’t know if this is some sort of top in the housing market. Given the gains, I wouldn’t be surprised if housing prices remained stagnant for a while. Even a pullback in prices wouldn’t be shocking.

My baseline assumption is that prices will rise by something close to the inflation rate in the coming years, but predictions about the future are hard. I don’t know where housing prices will go from here.

The idea of a top in housing prices got me thinking about what it would mean for those considering buying, selling or staying put in their current home. Here are two scenarios to consider:

Scenario 1. Housing prices fall by 20%.

Scenario 2. Housing prices go nowhere for the remainder of the decade.

How you feel about either of these scenarios likely depends on your current situation or future plans.

From the perspective of someone who plans on being in their home for the foreseeable future (me), neither of these scenarios makes much of a difference.

Put aside the fact that a 20% decline in home prices would likely be accompanied by some sort of financial crisis, the value of my home is more or less irrelevant in my day-to-day life.

As long as I can continue to pay the mortgage, insurance, and property taxes, my life wouldn’t change in a meaningful way if the price of our house fell by 20% tomorrow. It might take away my ability to tap equity through a HELOC but I’m not overly reliant on that as a source of capital.

It would be a little annoying to watch someone else come into our neighborhood and buy a house on sale for 20% off. And sure, it would be painful if we were forced to sell for some reason but in that case all of the other houses would also be 20% cheaper. We would be trading one asset at a lower price for another at a lower price.2

My net worth would drop but it’s not like the equity in my home is liquid anyway.

If prices go nowhere for the rest of the decade, we’ve already experienced the pulled-forward gains this decade.

Anyone who has owned a home for more than a few years is sitting pretty.

The homeowners who would feel the most pain in either of these scenarios would be people buying right now.

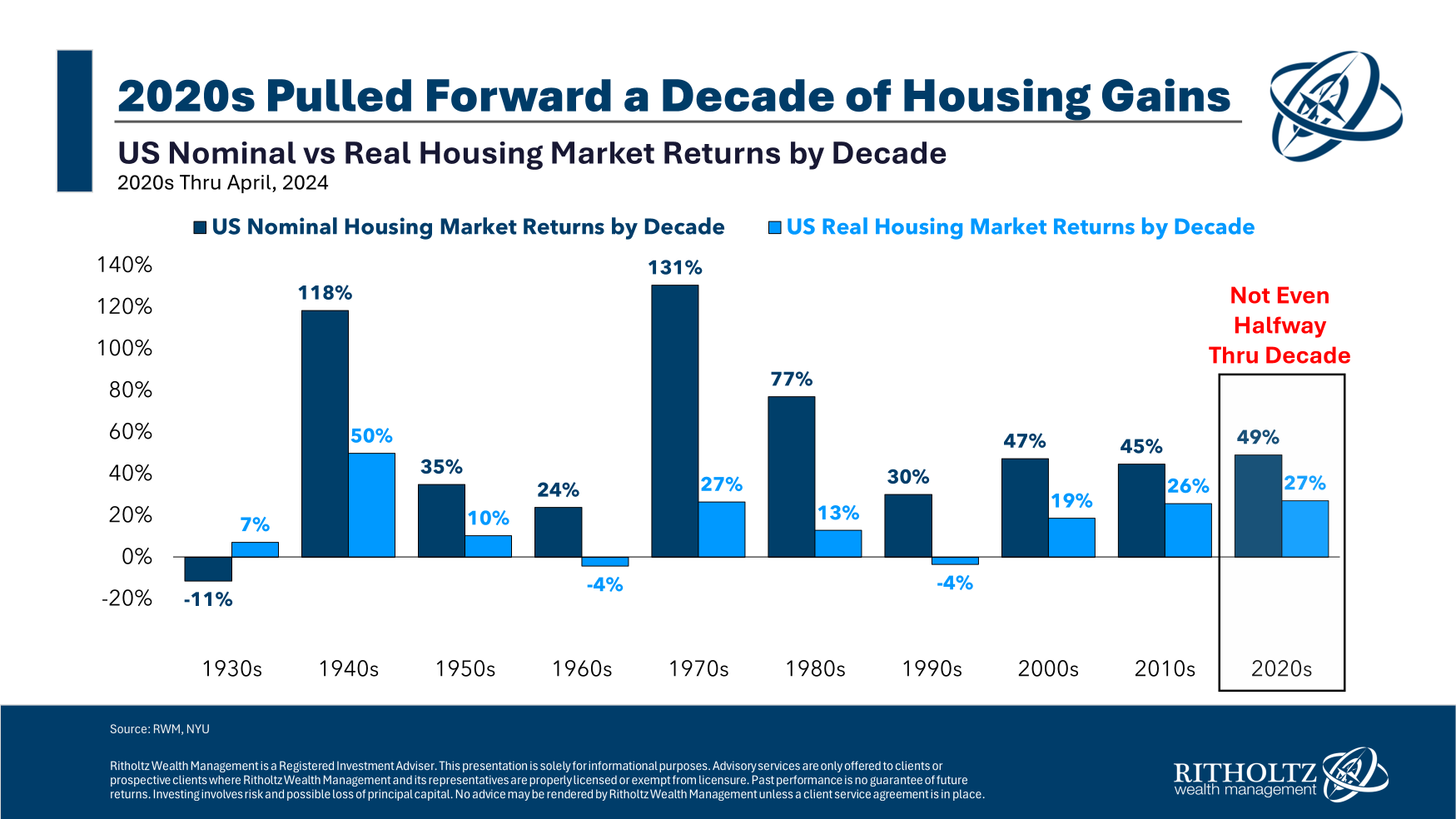

You don’t have to look back that far in our country’s history to see this play out. From early-2007 through late-2016, U.S. housing prices were underwater from their historical peak up until that point:

Prices fell by more than one-quarter along the way.

More than 6 million new and existing homes were sold in 2007, so plenty of people actually top-ticked the housing market back then.

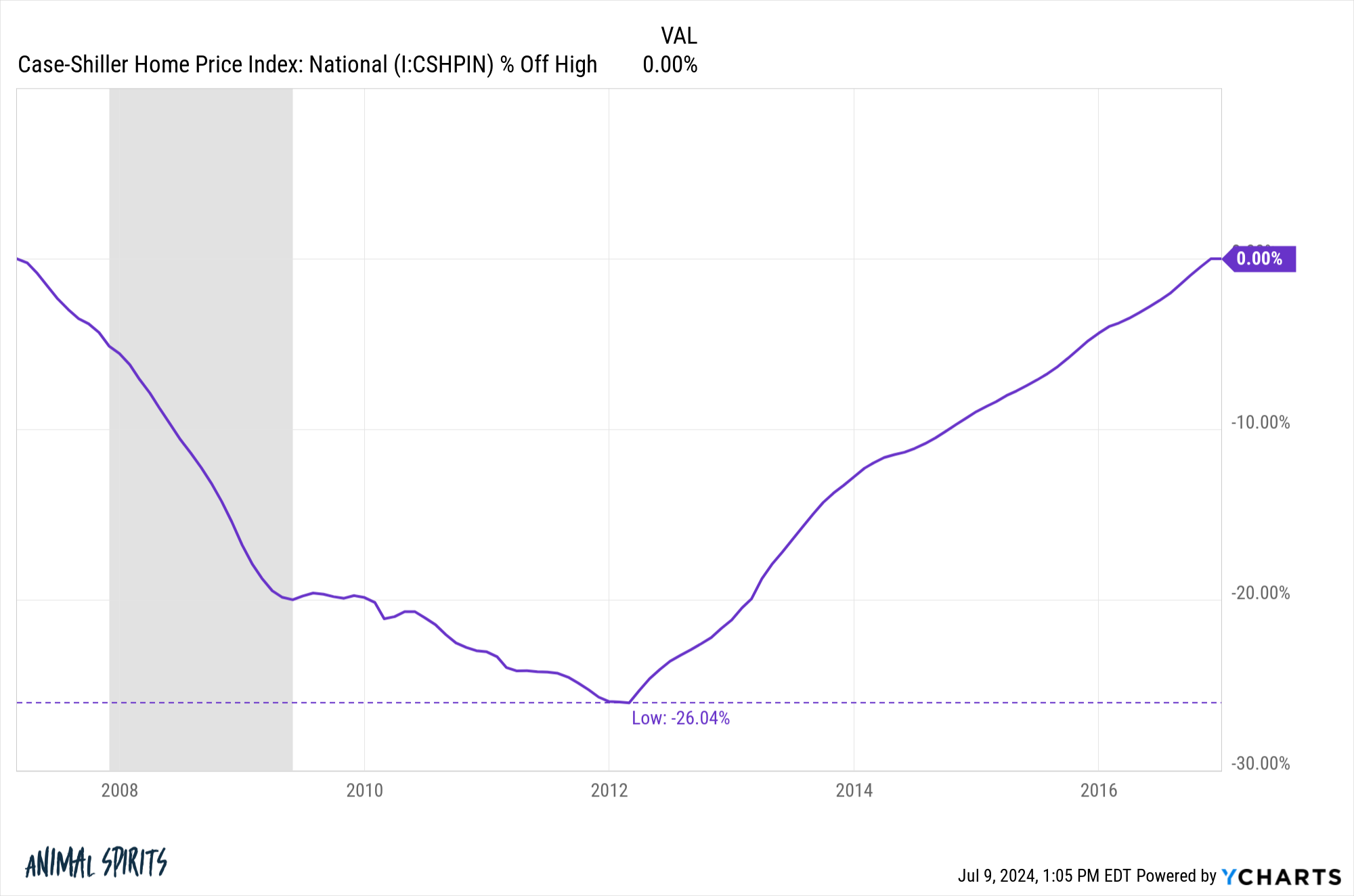

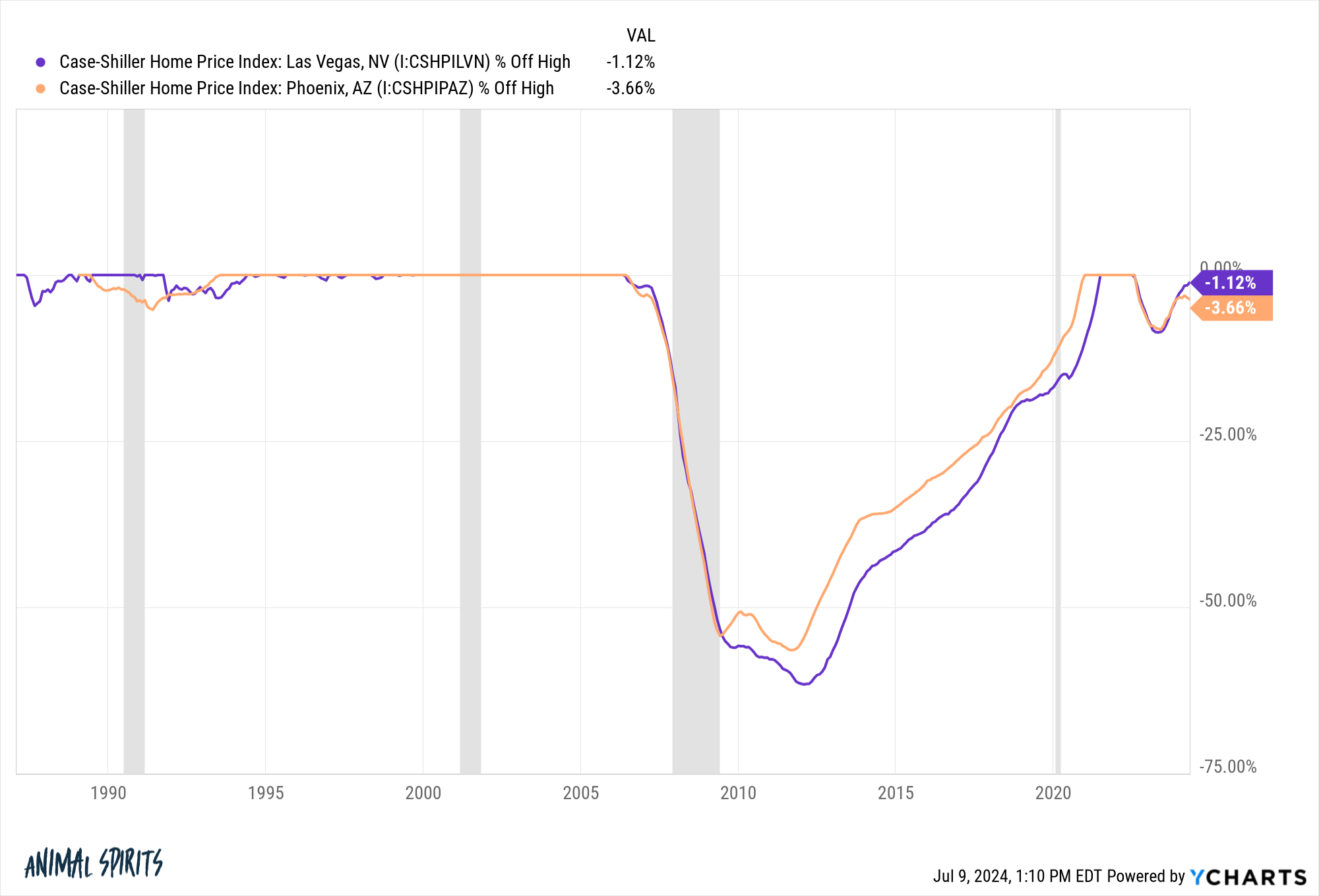

It was even worse in the hottest real estate markets in the country. Housing prices were underwater in Phoenix and Las Vegas from 2006 through 2020 and 2021, respectively:

There are no sure things when it comes to housing prices. The national housing market might do well for the rest of the decade while certain local markets struggle. Or certain local markets could remain hot while nationwide prices struggle.

You really have to ask yourself why you’re buying a house in the first place.

Is it purely a financial asset where you’re just trying to earn a high rate of return?

Or is a house something that provides psychic income as a place to raise your family, live in a specific community and make your own?

Most people probably prefer financial and psychic returns, but it’s not a foregone conclusion that your house will be a wonderful investment, especially from current levels.

I consider our house a place to live, call our own, and raise our kids. It acts as an inflation hedge because we have a fixed-rate mortgage and there isn’t much land to build on in our area. Plus, paying it off over time builds equity.

The price of the house doesn’t matter to me as much as our ability to live there for as long as we would like.

A portfolio is where investment returns matter.

A house is where investment returns are a bonus.

Further Reading:

The Problem with Timing the Housing Market

1Credit to me.

2Just like if we sold now we would be locking in gains but then paying a higher price for a new home.