A reader asks:

On this week’s episode, you guys mention that nobody uses the 4% rule. I have been tracking my annual expenses for the last few years and multiplying it by 25 as a ballpark figure of what I need to retire. Is this not a good way to estimate? If not, what do you suggest? Sorry if this is a dumb question, but yes, I have read this in a lot of blogs.

I’m sure there are some people who follow the 4% rule religiously. But certainly not as many as most financial researchers assume.

Plans change. Returns vary. Inflation is unpredictable. Spending patterns evolve as you age. There are one-off items you can’t plan for.

Either way, you still have to plan for retirement, set expectations and make decisions about an unknowable future.

The 25x rule makes sense to pair with the 4% rule since it’s simply the inversion of that number. If your annual spending is $40k and you multiply that by 25, you would get $1 million as a retirement goal. Just to check our math here, 4% of $1 million is $40k. Pretty straightforward.

It is important to recognize that 25x number is fairly conservative and gives you a healthy margin of safety.

Many people don’t spend as much in retirement as they probably should, given the size of their nest egg. You also have to factor in other sources of income such as Social Security.

It’s also worth pointing out that the 4% rule itself is relatively conservative. The whole point of this spending rule is to avoid the absolute worst-case scenario where you run out of money.

Historically speaking, most of the time you would have ended up with more money using the 4% rule.

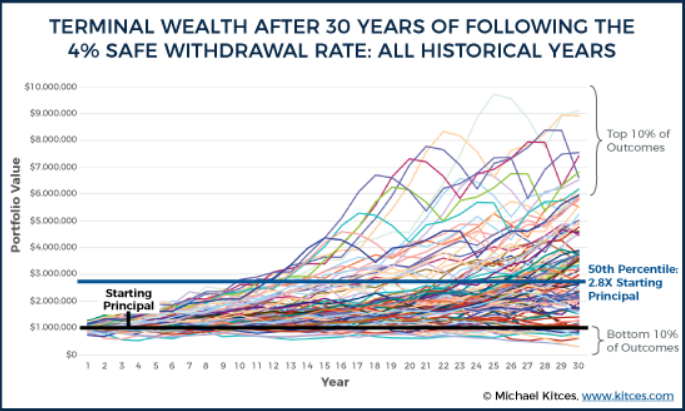

Michael Kitces performed one of my favorite studies on the subject that shows a range of results using different starting points for a 60/40 portfolio:

Here’s the kicker:

As the chart shows, on average a 4% initial withdrawal rate results in the retiree finishing with nearly triple the original principal, on top of sustaining an initial withdrawal rate of 4% adjusted annually for inflation! In fact, in only 10% of the scenarios does the retiree even finish with less than 100% of their starting principal (and in only one of those scenarios does the final value run all the way down to having nothing at the end, which of course is what defines the 4% initial withdrawal as “safe” in the first place).

The average result is a tripling of the original principal over 30 years, and that includes your inflation-adjusted spending along the way. There was only a 10% chance of ending up with less principal after 30 years, the same amount of time you would have finished with 6x more.

As they say, the past is not prologue. You don’t get to experience the average based on a wide range of outcomes. You only get to do this once. There is no guarantee financial markets will deliver as they have in the past.

If you’re a big worrier, saving 25x your annual expenses should allow you to rest easier at night.

The good news is you might not need to save that much money.

And if you over-save, you can always overspend in retirement.

Speaking of over-savings, another reader asks:

My wife and I are 35 and we have $1.1M in retirement accounts invested 95% in S&P 500 index funds and 5% FLIN ETF. I’m wondering if we have enough funds invested to stop contributions and still be able to retire comfortably at 60 years old? We live in our long term house, and have two kids under 4. We make $220k in combined income and would like $10,000/month during retirement (not future inflation adjusted).

We’re talking about someone with the following:

- 25 years until their target retirement date

- 2 young children

- a high income

- a seven-figure nest egg in their mid-30s (nicely done)

- an aggressive asset allocation

- a spending goal in retirement

They’re already winning.

This is a perfectly reasonable question to ask. They obviously saved a lot of money in their 20s and 30s to get to this point.

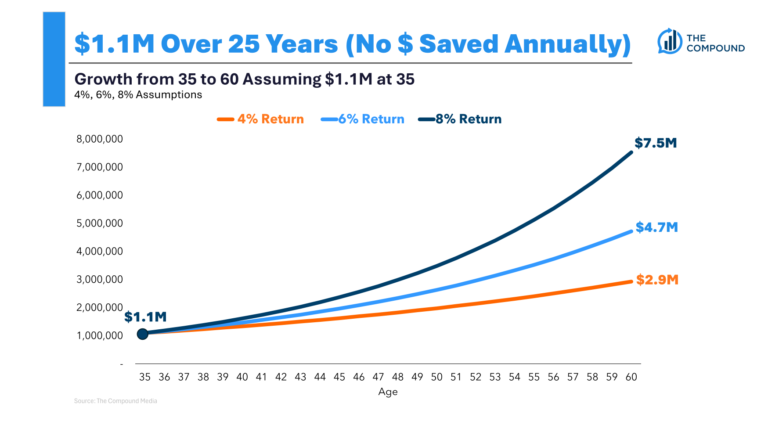

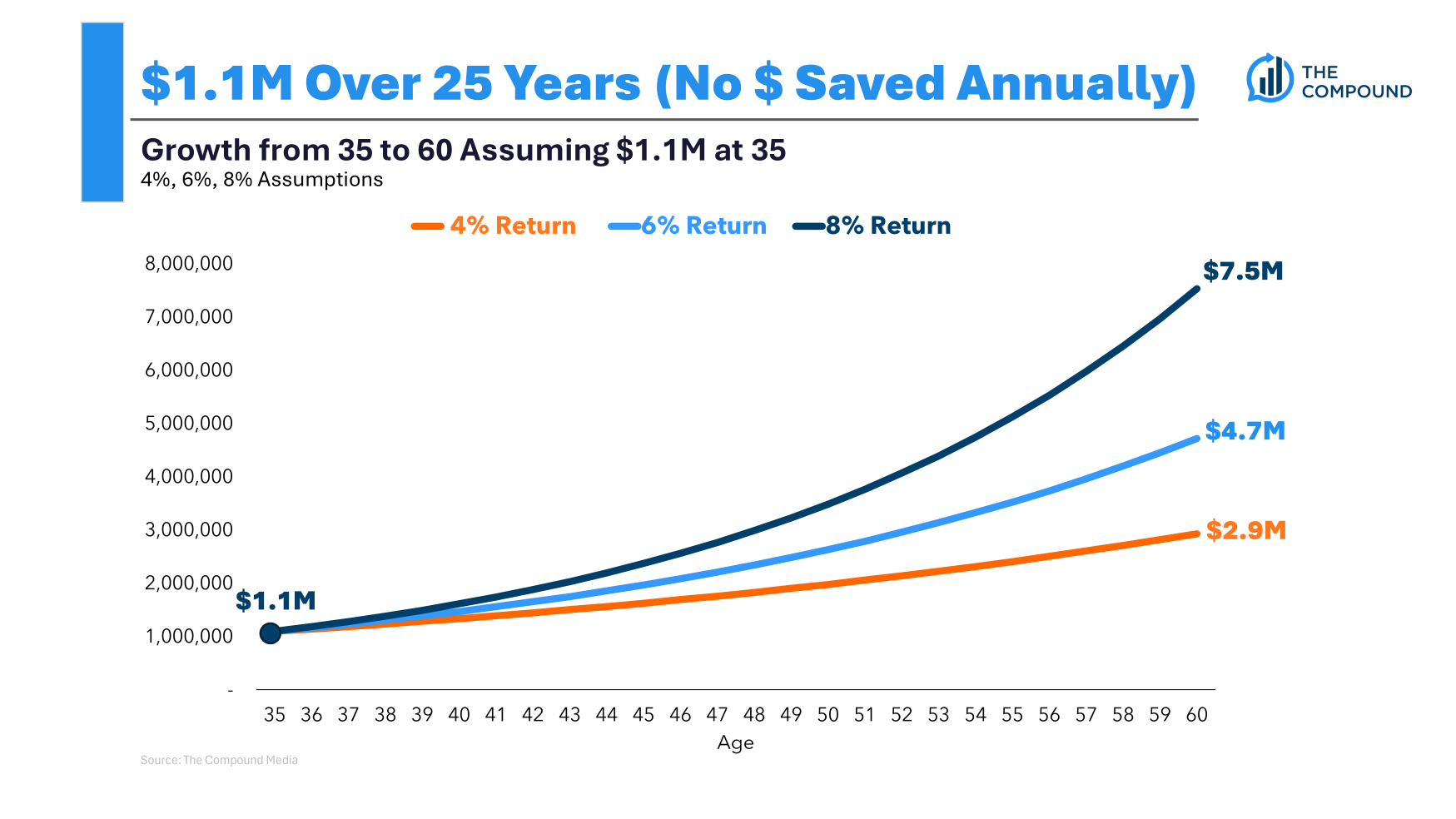

I did some back-of-the-envelope math here. Reaching their goal would take a return of around 4% per year. Over 25 years, $1.1 million would turn into a little more than $2.9 million. Using the 4% rule would produce around $117k in annual income in the first year, or just shy of $10k per month.

At a 6% return now we’re looking at $4.7 million ($15.7k/month). And if you could earn 8% per year that $1.1 million would grow to $7.5 million by the time you’re 60, good enough for $25k/month in spending.

So you’re right on track, assuming the world doesn’t fall apart in the next two-and-a-half decades.

But why not give yourself some wiggle room, just in case?

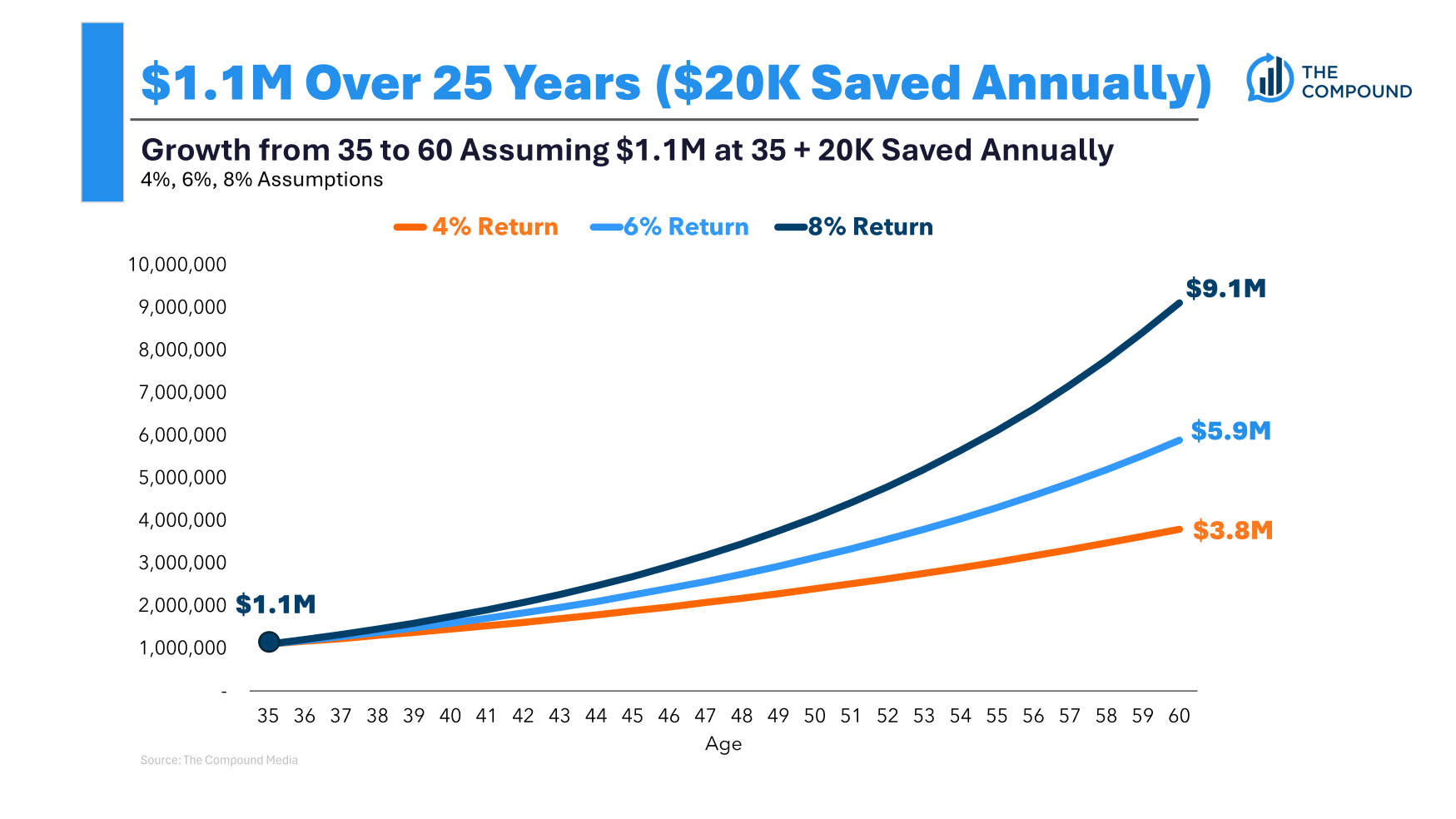

What if you saved around 10% of your income or $20k a year?

That 4% return gives you $3.8 million ($12.6k/month). A 6% return is $5.8 million ($19k/month). At 8%, you go from $7.5 million to $9.1 million ($30k/month).

Now you have a bigger margin of safety should things change.

These are spreadsheet answers. Life never works out like the assumptions on a retirement planning spreadsheet. Things are far more volatile in the real world than in financial planning software. The emotions of money cannot be solved through linear calculations.

But that’s the point here — it makes sense to give yourself a little breathing room just in case reality doesn’t align with expectations, your plans change or life gets in the way.

A lot can happen between 35 and 60.

The good news is you’ve already done much of the heavy lifting by saving so much money. Compounding, even at below-average rates of return, should be able to handle most of the hard work from here as long as you stay out of the way.

But I still think it makes sense to save some more money just in case.

Jill Schlesinger from Jill on Money joined me on Ask the Compound this week to cover these questions:

We also discussed questions about tips for buying and selling stocks, handling a complex housing situation and finding a side hustle.

Further Reading:

You Probably Need Less Money For Retirement Than You Think