Boy that escalated quickly.

Markets sold off in a hurry this week.

The S&P 500 is down almost 6% from the recent highs. The Nasdaq 100 is in an 11% drawdown.

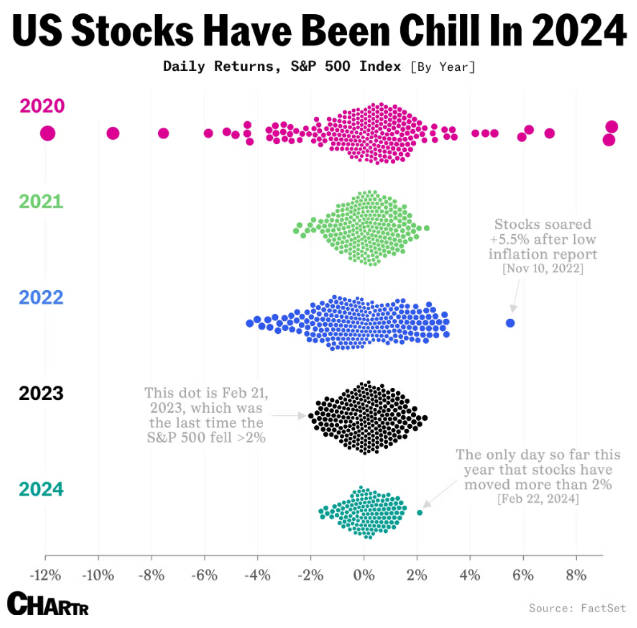

After an extremely calm year, the past week or so has finally seen some volatility in the stock market.

Here’s the thing — it’s what happened before this that was not normal:

This really cool chart came out a couple of weeks ago (via Sherwood). It shows how abnormally calm the stock market was in 2024 before the current correction.

That situation couldn’t last forever so it didn’t.

I hate love to be the guy who provides these reminders during every single correction but this is perfectly normal.

The stock market is supposed to fall every once in a while. It can’t just keep going up forever.

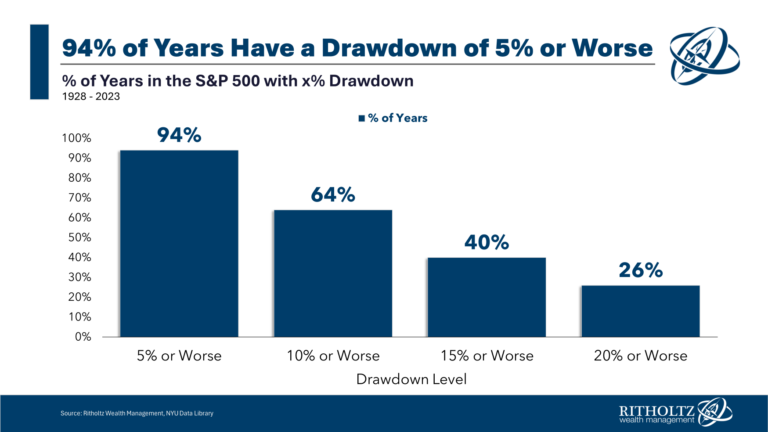

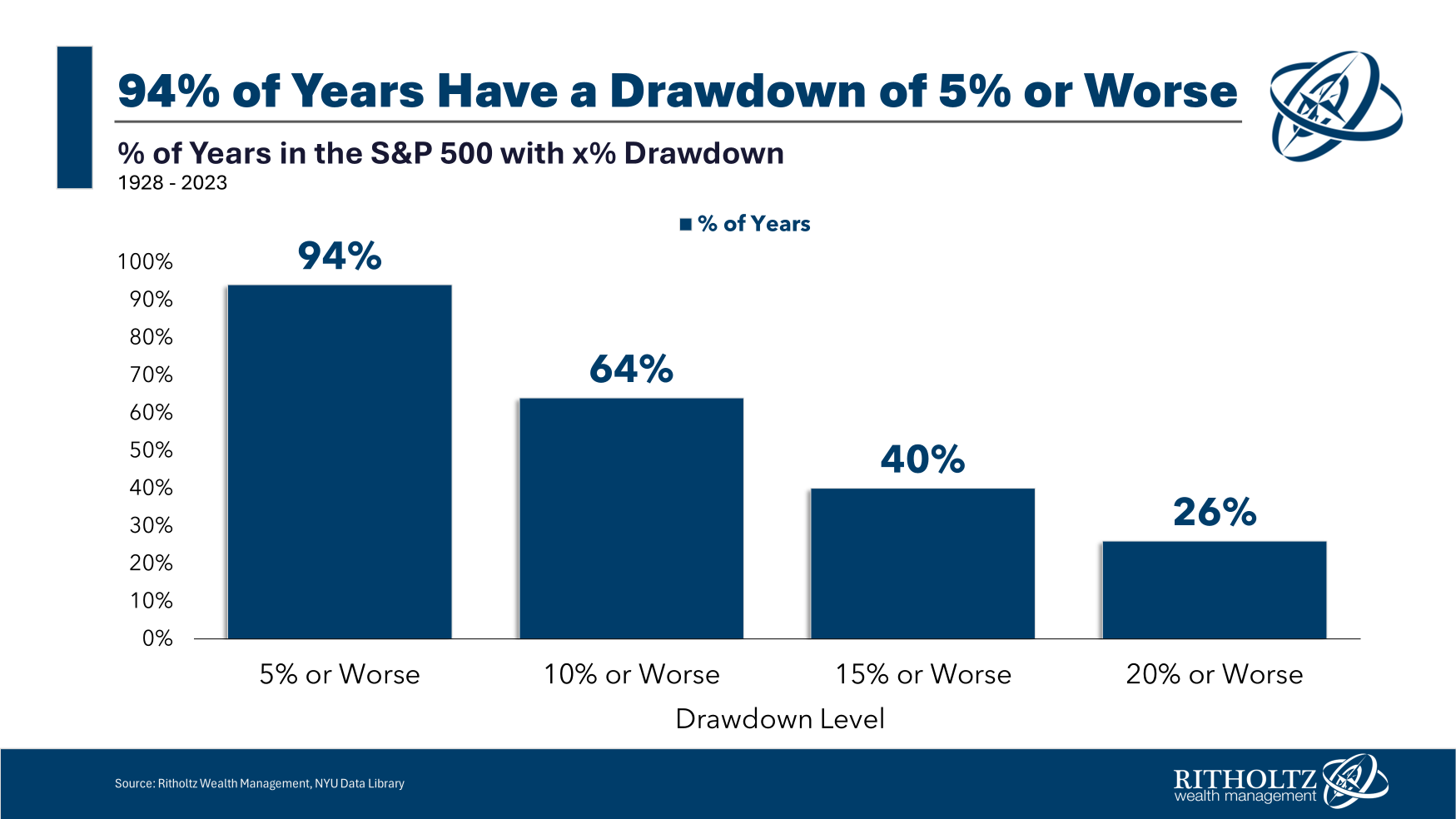

The U.S. stock market experiences a correction almost every year:

A 5% downturn is all but guaranteed in most years.1

A double-digit drawdown happens more than two-thirds of all years since 1928.

The average intrayear drawdown from 1928 to 2023 was -16.4%. Since 1950, the average correction in a given year was -13.7%. This century it’s been -16.2%.

If anything, the current correction is weak based on historical data.

It could get worse. I don’t know what’s going to happen the rest of the year. One week does not a market make.

The S&P 500 is still up nearly 13% on the year. It was up as much as 20% at one point but we’re still looking at a double-digit total return in 2024 (so far).

I don’t know if that will hold for the remainder of the year but it’s perfectly normal to experience a decent-sized correction even when the market finishes the year with solid gains.

From 1928 through 2023, the S&P 500 was up 70 out of the 96 years (73% of the time). In 35 of those 70 years with positive returns, there was a double-digit correction along the way. So half of all years with a gain experienced double-digit losses to get there.

The stock market goes down even when it goes up.

This is true even when stocks go up a lot.

The S&P 500 has finished the year up double-digits in 56 out of 96 years since 1928 (almost 60% of the time). In 24 of those 56 years with double-digit gains, there was a double-digit loss at some point in the same year. That means nearly 45% of the time when the stock market has been up 10% or more, there has been a correction of 10% or worse on the path to those gains.

Maybe this year finishes with yet another double-digit gain, maybe not.

Maybe we see another double-digit drawdown, maybe not.

When investing in the stock market you have to be prepared for both possibilities. Big gains and big losses are par for the course when it comes to investing in stocks.

Volatility is the price of admission when it comes to investing in equities.

That’s true when markets go up or down.

Further Reading:

What Does a Healthy Correction Look Like?

1The last year the S&P 500 didn’t experience a drawdown of at least 5% was 2017. That was an exceptionally boring year for the market.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.