A lot of people are turning bearish on housing prices.

Cullen Roche and Nick Maggiulli, two financial voices I respect, both predicted in recent weeks that housing will be the worst-performing asset class over the next decade.

Their case makes sense.

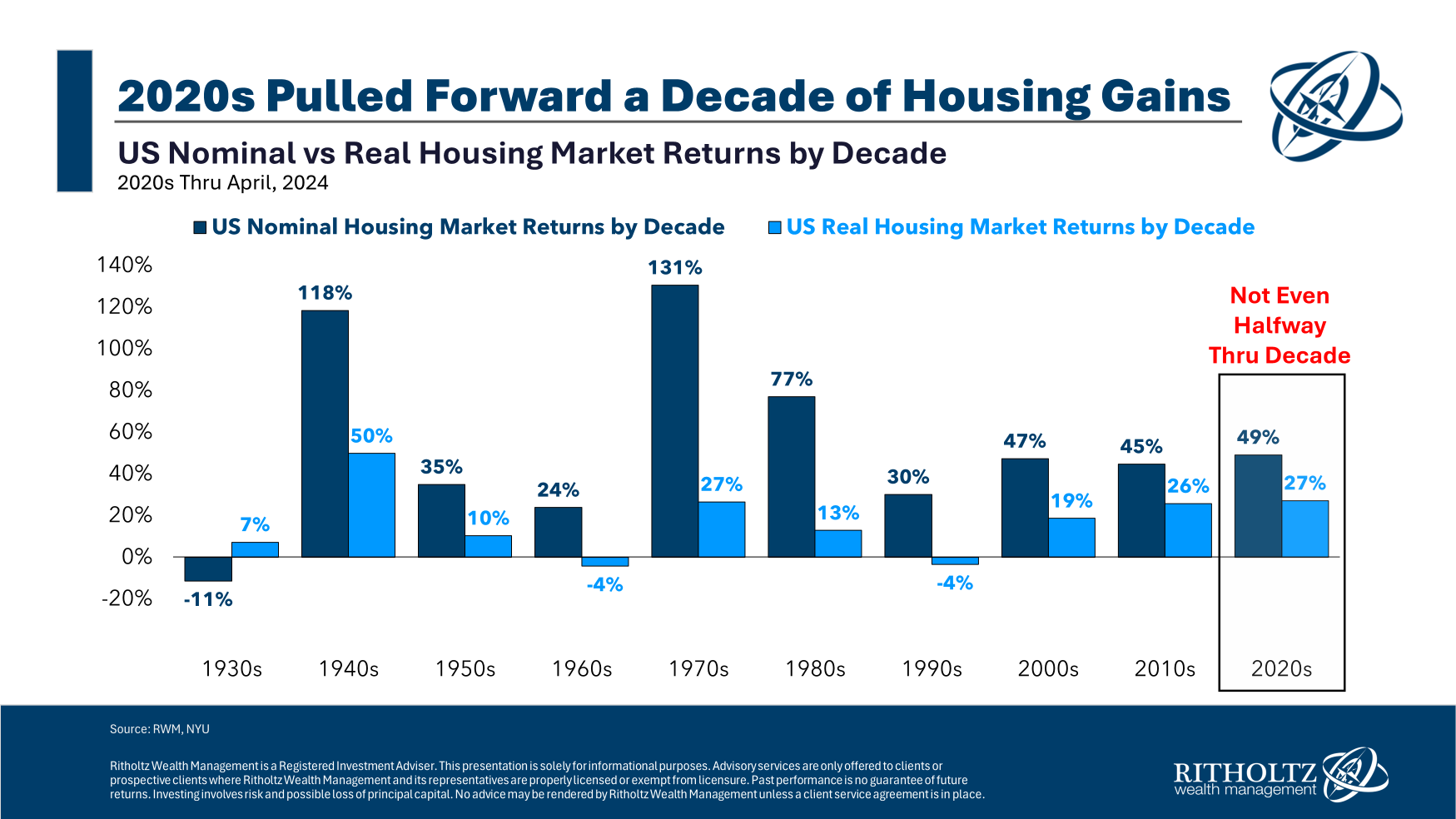

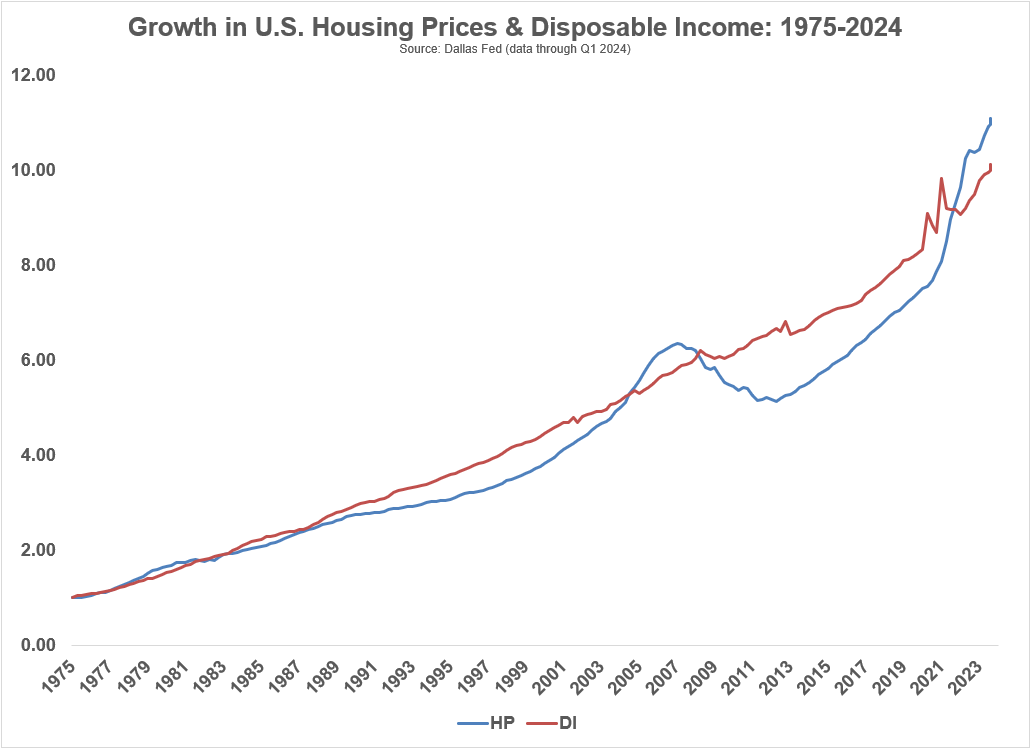

We pulled forward a decade’s worth of returns in the first part of the 2020s:

Prices are high. Mortgage rates are still high (relative to the price moves). This makes housing unaffordable to a large portion of the population.

It certainly wouldn’t surprise me to see housing prices languish for a number of years as incomes play catch up to prices to make things more affordable.

The bearish case is compelling.

What about the bull case? What could cause housing prices to defy both gravity and realistic expectations?

Let me give it a try:

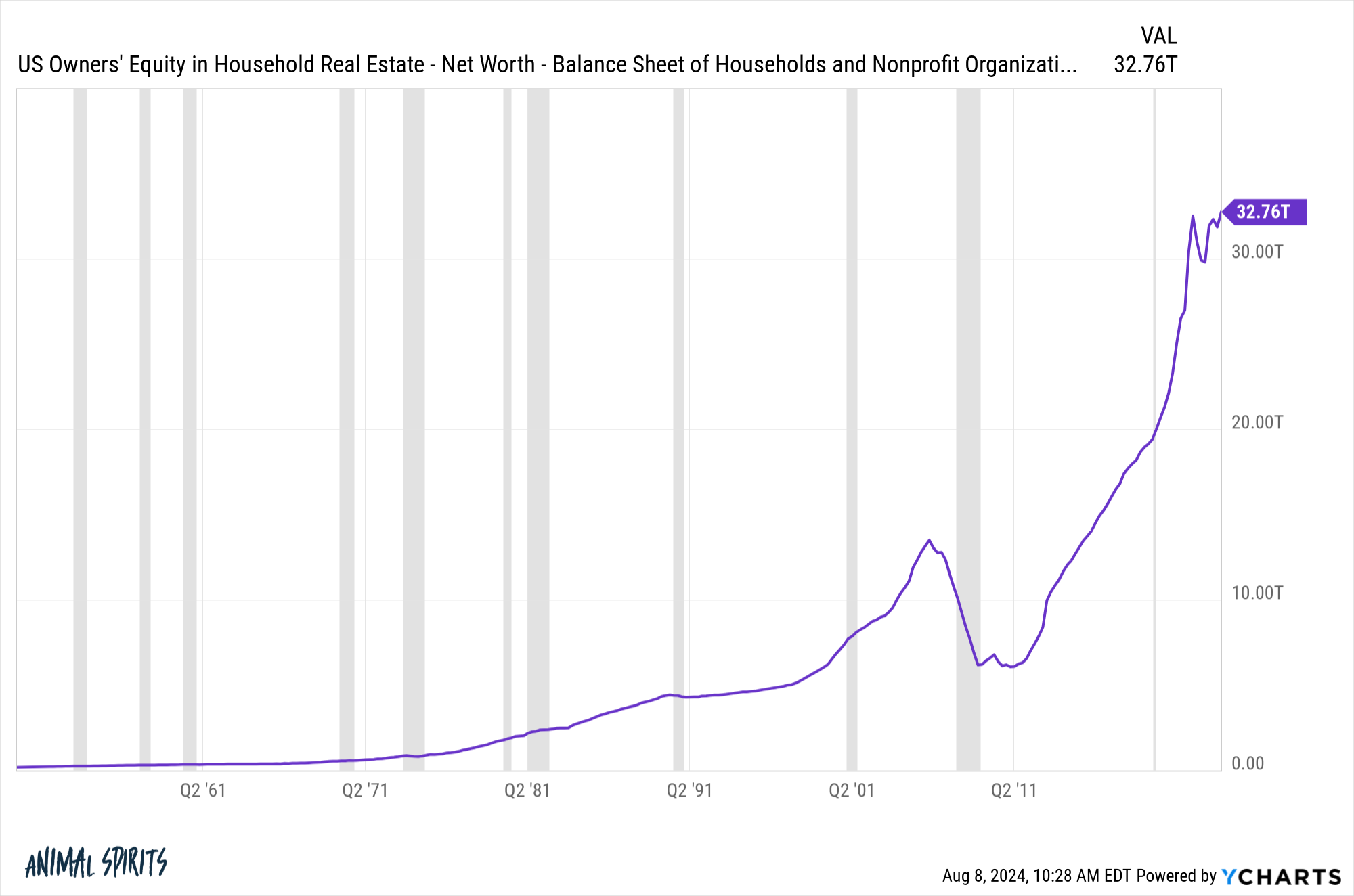

There is a buttload of home equity. It’s becoming exceedingly difficult for first-time homebuyers in today’s housing market but there are trillions in dry powder if current homeowners need it:

Since the start of the pandemic, U.S. homeowners have added more than $13 trillion in home equity. As recently as 2015, that was the total amount of home equity.

If mortgage rates continue to decline, there is plenty of cash on the sidelines for those homeowners who have felt trapped by the high cost of borrowing these past couple of years.

They can use that equity as a healthy down payment on a new house.

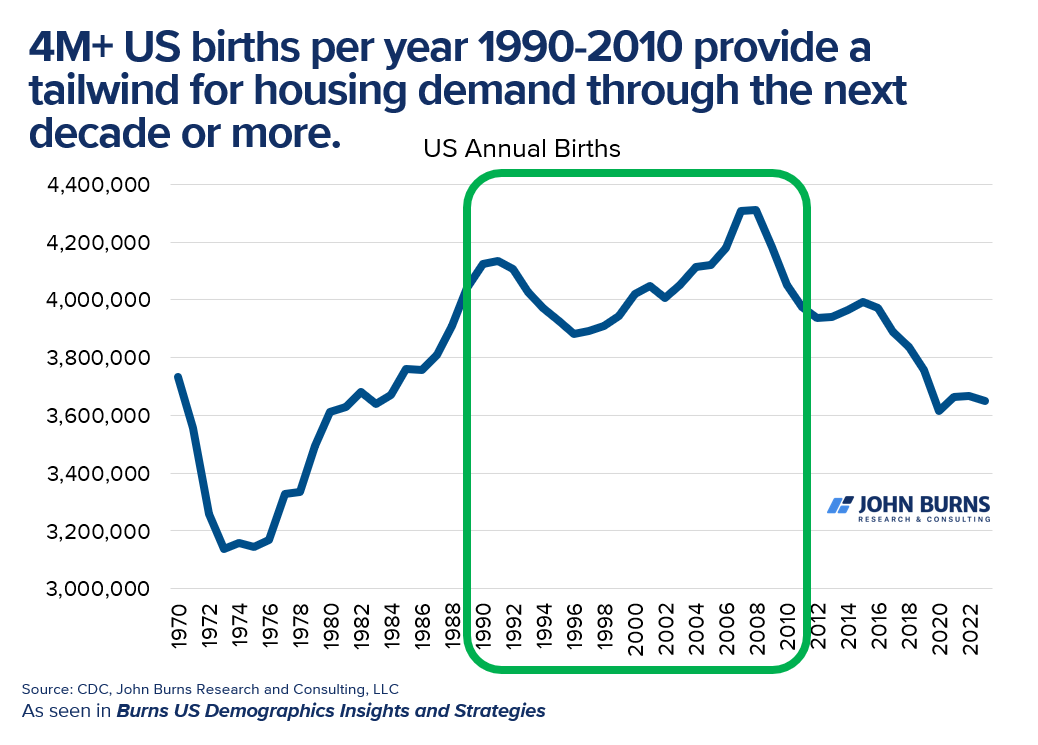

Demographics are destiny. On the one hand, there are 10,000 baby boomers retiring every single day. Some of them might feel compelled to sell their house to fund retirement or downsize, but many of the boomers own their homes outright and will be in no hurry to sell.

Young people, on the other hand, are coming for the housing market in big numbers.

The most common age in the United States is people who are 31 and 32. Births spiked in the 1990s and first decade of this century, peaking around 2007/2008:

So we’re talking people in the 17-37 age range. That’s 20 years’ worth of home demand right there.

Right or wrong, most young people still feel that buying a house is a necessary step in adulthood.

Some of these young people won’t be able to afford houses at current prices but plenty of them will stretch to make it happen.

Maybe Gen Z will go against the grain with the American dream but I wouldn’t bet on it.

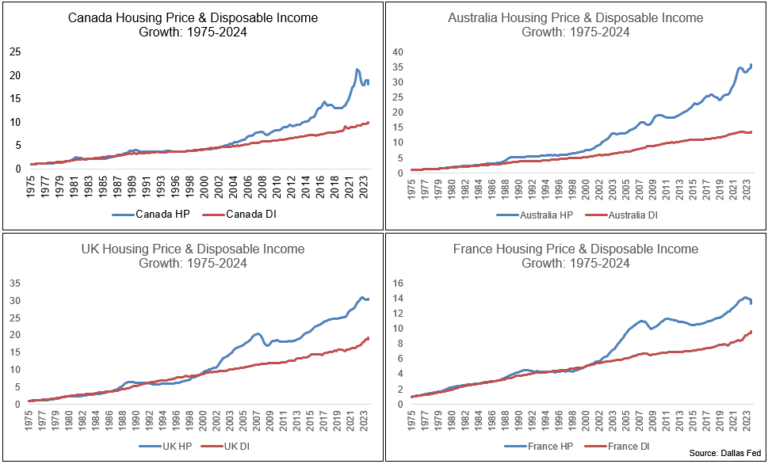

We could turn into Canada. Housing prices in Canada went crazy a number of years ago. Instead of mean-reverting, they turned it up to ludicrous speed and got even crazier.

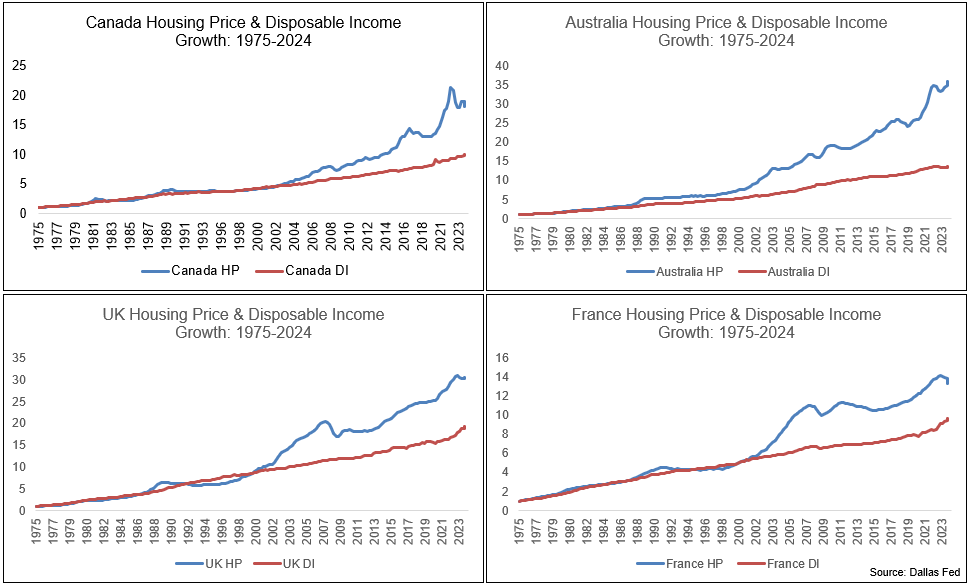

If you compare disposable income to housing prices among a handful of developed countries, things look tame in the United States:

Prices are far more out of whack in Canada, Australia, the UK, and France than they are in America.

What if the lack of housing supply continues to push housing prices higher as it did in these other countries?

I’m not guaranteeing this outcome but it’s not out of the realm of possibilities.

A rational person would expect housing prices to chill out for a while. That would be my baseline assumption as well.

However, human beings are not always rational.

You can’t rule out the possibility that a lack of supply, combined with favorable demographics and a huge piggie of home equity could potentially take prices even higher.

Michael and I talked about the bull and bear cases for the housing market and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Buying a House at the Top of the Market

Now here’s what I’ve been reading lately:

Books:

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.