Diversified investors experienced one of the worst bear markets ever in 2022.

The stock market downturn wasn’t great but not out of the ordinary as far as bear markets go. It was relatively calm in comparison to history’s worst crashes.

The average bear market since 1928 is a loss of more than 36%, so the 25% peak-to-trough drawdown in 2022 wasn’t the end of the world.

What made the 2022 bear so devastating was the bond side of the portfolio. Usually, when stocks fall, high-quality bonds act as a portfolio stabilizer. This time around, bonds were the reason stocks fell.

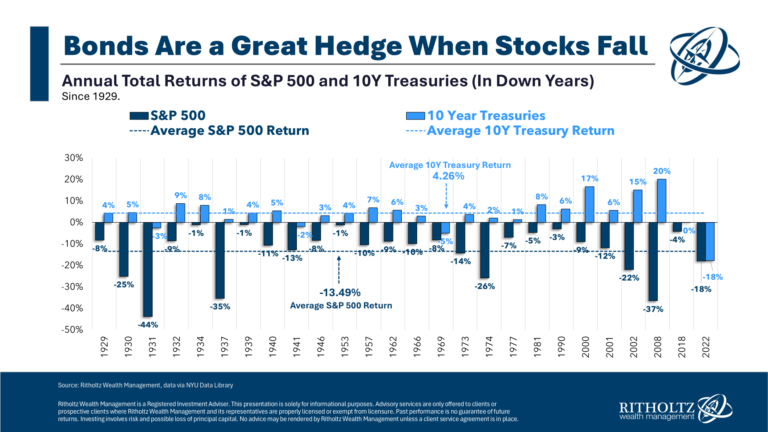

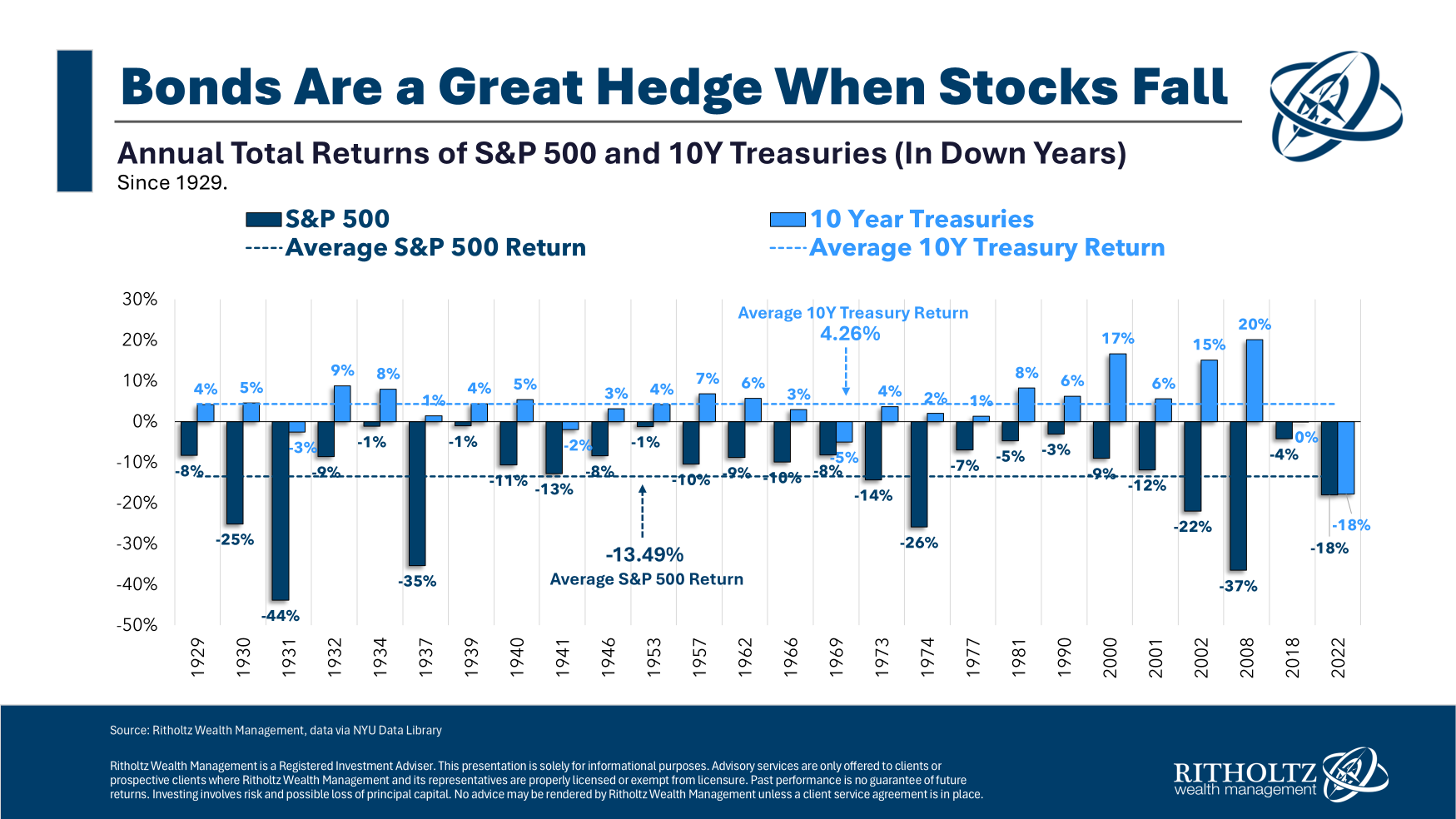

Just take a look at how bonds (10 year Treasuries) performed every time the S&P 500 has had a down year since 1928:

Bonds had fallen in the same year as stocks a handful of times before1 but those fixed income losses were insubstantial. There had never been a year in which stocks and Treasuries fell double-digits simultaneously.

It was brutal.

That type of environment could happen again in a rapidly rising rate environment but you can see from the chart that 2022 was an outlier, not the norm.

The average down year for the U.S. stock market is a loss of almost 14%. In those same down years, Treasuries have averaged a gain of more than 4%. And that number includes the downright awful year that was 2022.

Most of the time bonds act as a good hedge against bad years in the stock market even if they’re not a good hedge against bad years in the stock market all the time.

Unfortunately, there are no perfect hedges. Nothing works all the time the way you would like.

That’s risk for you.

There are exceptions to every rule.

If we are in a situation where the economy is slowing, disinflation (or even deflation) is the current trend and we finally go into a recession at some point, high-quality bonds will likely provide diversification benefits.

Bonds have yield again too.

There are no guarantees. Rising rates and inflation are not a great combination for bonds.

But high-quality fixed income can help protect your portfolio from stock market volatility and recessions if and when they strike again.

Further Reading:

Fixed Income Has Income Again

1In 1931, 1941 and 1969.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.