Do you know how long we’ve been in a recession for since the end of the Great Financial Crisis?

Two months.

In 15 years, the U.S. economy has been in a recession for just two months!

That’s roughly 1% of the time, meaning that since July 2009, the United States has avoided a recession 99% of the time.

This helps explain why so many people have been predicting a recession for so long — it feels like we’re due.

There have been 11 recessions since 1950. That’s one every 7 years or so, on average.

But recessions don’t die of old age. To extend this analogy, economic expansions die because they get hit by a bus (some exogenous event), murdered (a policy error) or kill themselves (excesses from speculation).

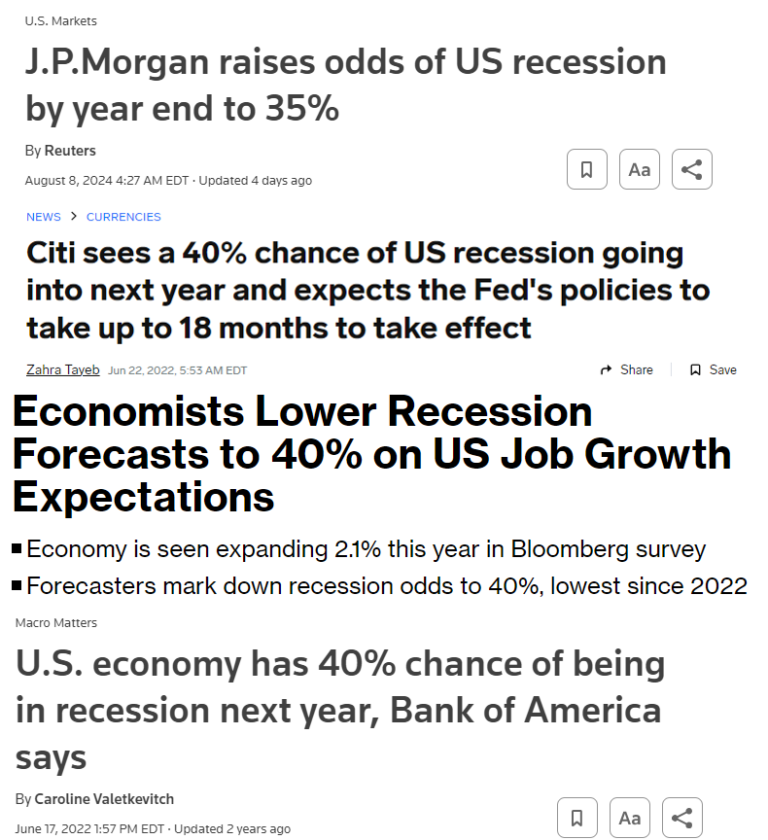

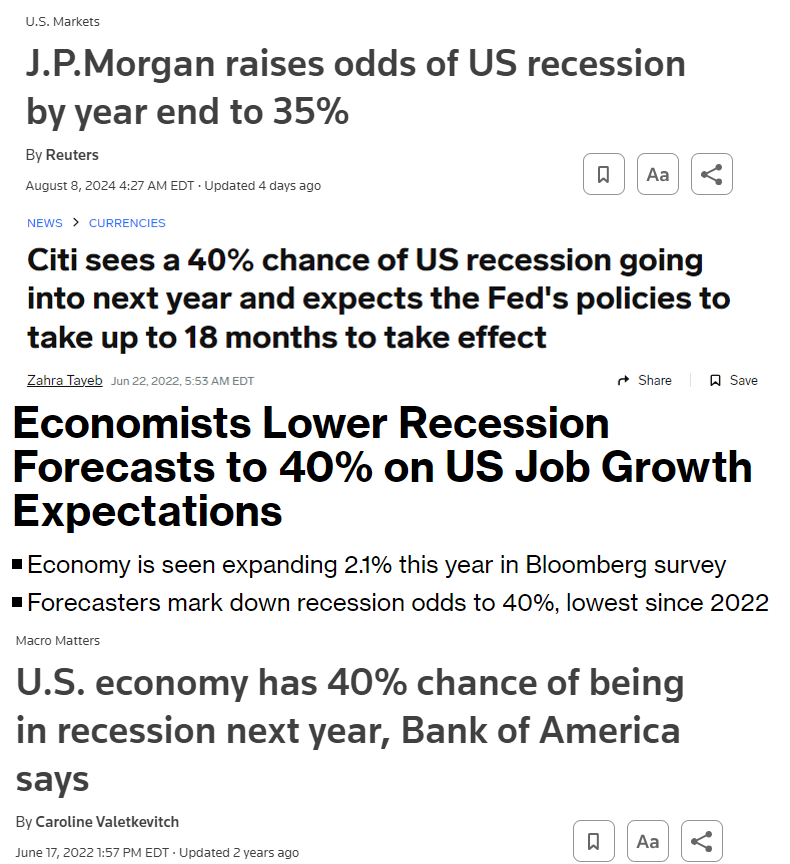

One thing is certain about recessions — everyone is terrible at predicting them. This cycle is a case in point.

Most economists thought a recession was all but certain in 2022 or 2023:

Many business leaders were in the same camp.

Jamie Dimon thought an economic hurricane was coming in 2022:

Jeff Bezos told CNN in late-2022, “The probabilities say if we’re not in a recession right now, we’re likely to be in one very soon.”

Elon Musk predicted a global recession that would last well into 2024:

Elon Musk predicted a global recession that would last well into 2024:

We’re now past the point where Musk guessed the recession would end.

Whoops.

Predicting the economy is hard.

The stock market gets it wrong too.

The old saying goes that the stock market has predicted 9 of the last 5 recessions. The S&P 500 has experienced drawdowns of -25%, -34%, -20% -19% and -16% since 2009. Only one of those drawdowns occurred because of a recession.

So the stock market has predicted 5 of the last one recession.1

Regular people aren’t very good at the economy either:

I don’t really believe 60% of Americans think we’re in a recession because of some survey but consumers are just as bad at predicting the economy as the talking heads.2

So how should you predict a recession?

You could get wonky and use the inverted yield curve, the Sahm Rule, leading economic indicators or some other textbook rule that will likely be proven wrong in due time.

Or you could do what most economists do to save face and predict the odds of a recession are around 40%:

If you say 20% that’s too low. No one will take you seriously. If you say 80% that’s too high. Everyone will hold you accountable for making an extreme call.

Forty percent is the sweet spot so you’re never wrong. If a recession happens you can say your model was close to 50%. And if it doesn’t happen, you can say there was a 60% chance of a positive outcome.

Win-win.

I’m only half kidding here.

Probabilities can be helpful when dealing with the reality of an uncertain future. No one knows what’s going to happen, so assigning probabilities for different outcomes can help you place bets in a more reasonable manner.

It really depends on whether you’re making predictions to become famous or investing your capital based on your forecasts. Most people who forecast recessions for a living are in the takes game with no real money at stake when it comes to their predictions.

It’s understandable why so many people are eager to predict a recession in advance. They’re painful. People lose their jobs. Businesses go under. Money is lost. Corporations are forced to change course.

I just don’t think something as large and dynamic as the U.S. economy can be forecasted with scientific precision.

Even if you could predict the timing of recessions it would be difficult to profit. Timing the stock market is different than timing the economy:

It’s more helpful to prepare for the eventuality of recessions than to try to predict their timing and magnitude.

Further Reading:

Macro is Hard

1To be fair, the 2022 bear market made sense even though we didn’t go into a recession. There was a severe re-pricing because of the rise in rates and high inflation (among other things).

2There are more examples of these surveys. See here.