A reader asks a follow-up to a previous blog post:

Do you have an inverse chart that shows what bonds do when the market goes up (which happens much more than it falls)?

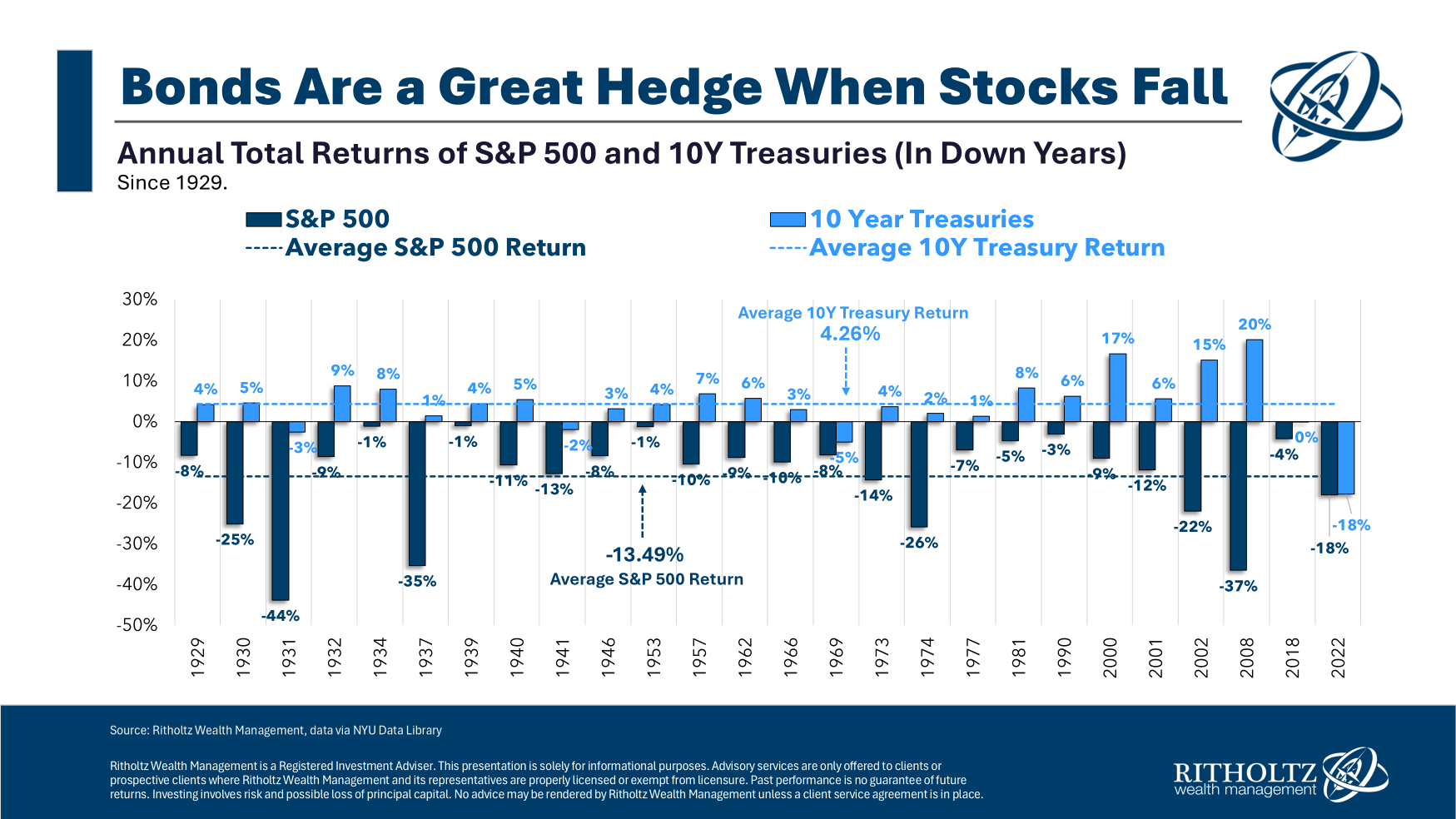

Recently, I looked at the historical performance of bonds when stocks go down:

In summary, most of the time when stocks go down, bonds go up…but not all the time.

High-quality bonds are a pretty good hedge against bad years in the stock market.

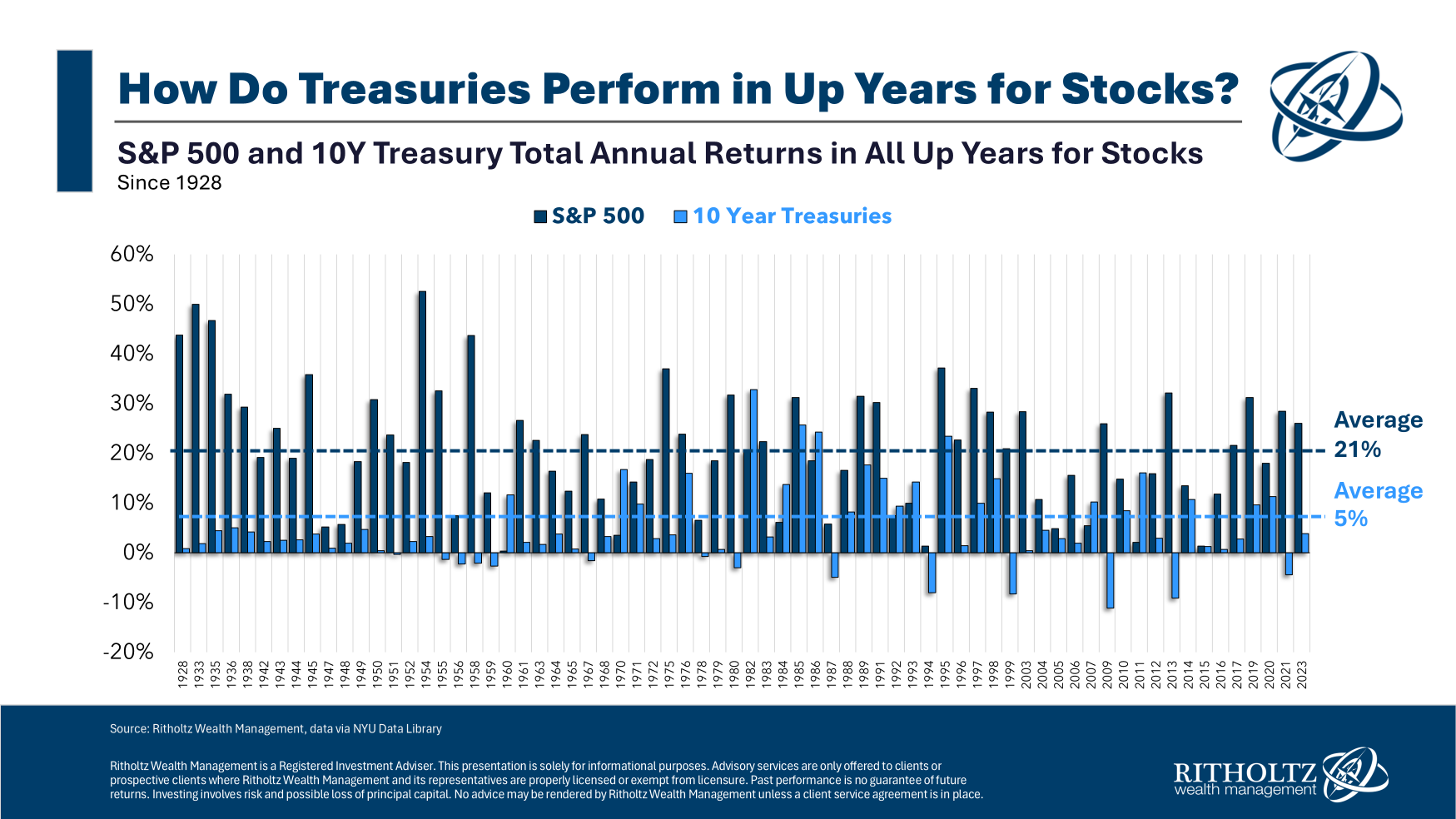

I’ve never actually looked at the other side of this before — how do bonds perform when the stock market goes up?

Here’s a look at every positive year for the S&P 500 along with the corresponding return for 10 year Treasuries going back to 1928:

Some investors mistakenly assume stocks and bonds are negatively correlated, meaning that when stocks rise, bonds fall and when stocks fall, bonds rise.

But bonds have done just fine during up years for the stock market.

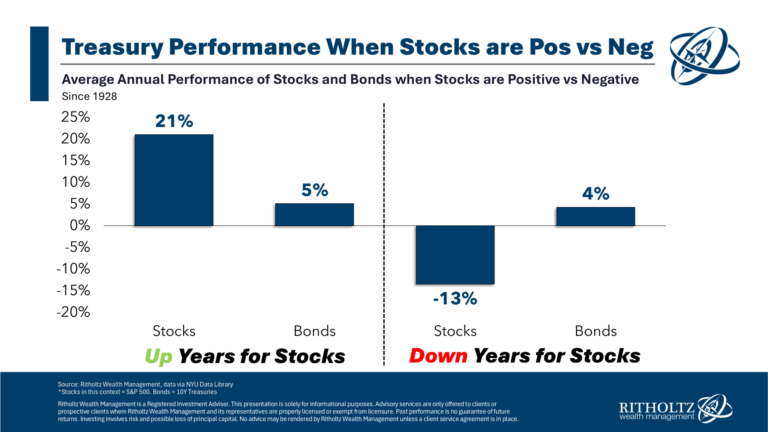

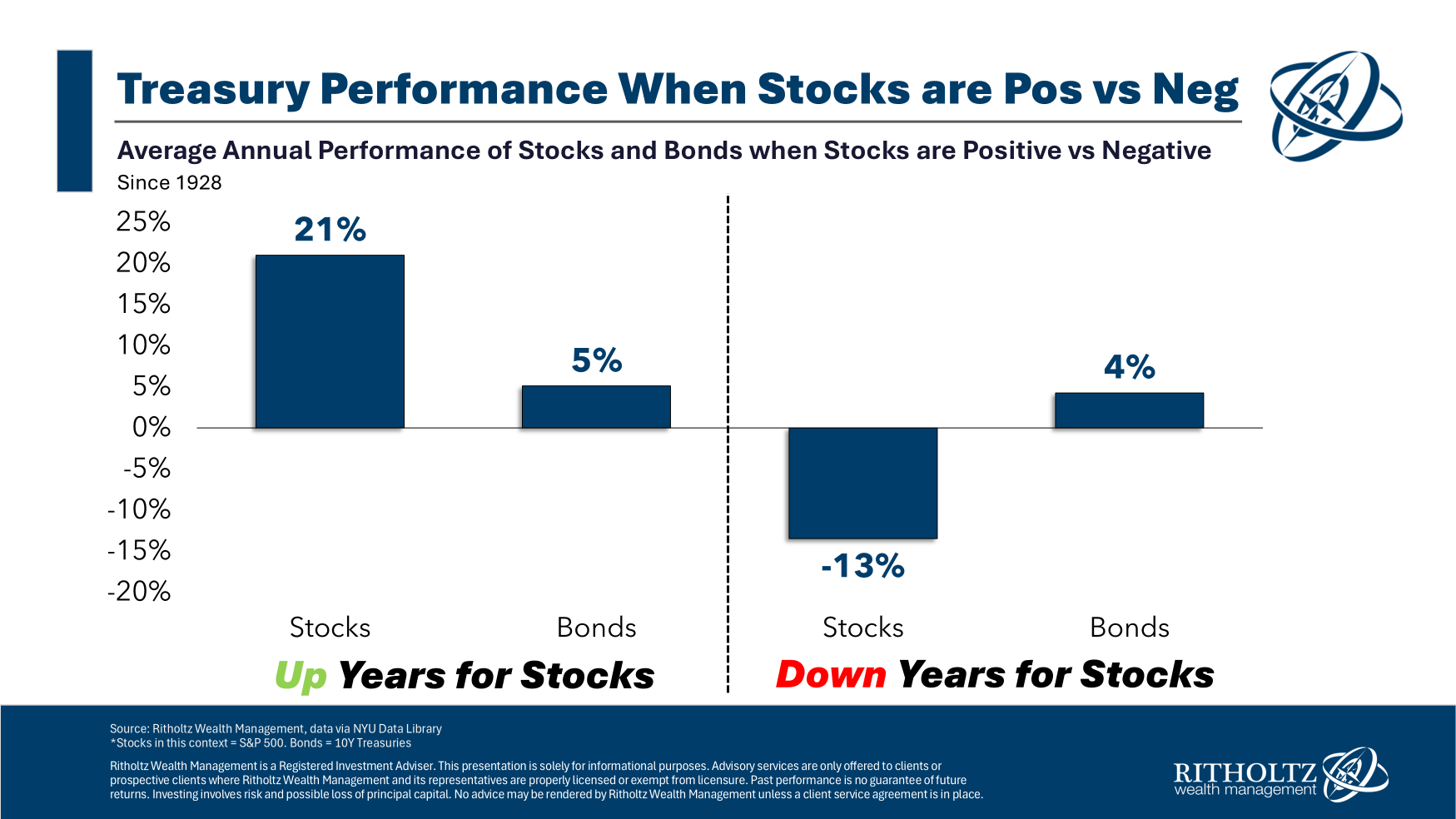

In fact, the average returns for 10 year Treasuries have been higher during up years than down years:

Bonds are obviously far more stable than the stock market. The distributions of bond gains and losses were similar during stock market upswing and downturns.

When the S&P 500 was positive bonds had a negative return 20% of the time (meaning 80% positive results).

When the S&P 500 was negative bonds had a negative return 19% of the time (meaning 81% positive results).

The average returns were similar and the win/loss rates were similar.

What does this tell us?

Bonds are a pretty good diversifier.

Of course, there are market environments where bond and stock correlations can be harmful to a portfolio. The most recent example was 2022 when both stocks and bonds fell in a rising rate/inflation environment.

Diversification works most of the time but not all of the time.

It’s also interesting to note the average gains and losses for the stocks and bonds market.

The average up year for the stock market was a gain of more than 20% while the average down year was a loss of more than 13%. For bonds, the average up year was +7.1% while the average down year was a loss of -4.9%.

Bonds were also positive on the whole in more years than stocks.

From 1928-2023, 10 year Treasuries finished the year with a gain 80% of the time while the stock market was up in 73% of all years during that period.

These numbers offer a good explanation of the risk premium inherent in the stock market. The stock market earned more than double the annual return over bonds in the 96 year period from 1928 through 2023 partly because there is more risk involved when owning stocks.1

The gains are bigger in the stock market but so are the losses.

You can’t earn a risk premium without taking some risk.

The good news for diversified investors is there can be a time and a place for both asset classes.

Stocks and bonds both finished the year with gains simultaneously nearly 60% of the time. Bonds finished the year higher than stocks 36% of all years.

The stock market wins over the long run but that’s not always the case in the short run.

Bonds are up most of the time, whether stocks are up or down.

Not perfect, but fixed income remains one of the simplest stock market hedges there is.

We covered this question on the latest edition of Ask the Compound:

My colleague Alex Palumbo joined us on the show this week to discuss questions about how to deploy a big chunk of cash savings, how to diversify out of company stock, benchmarking financial performance and how to think about alpha when it comes to choosing a financial advisor.

Further Reading:

The Holy Grail of Portfolio Management

1The S&P 500 was up 9.8% per year while the 10 year Treasury gained 4.6% annually from 1928-2023.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.