I’m a neat freak, so occasionally, I clean out my office and re-organize.

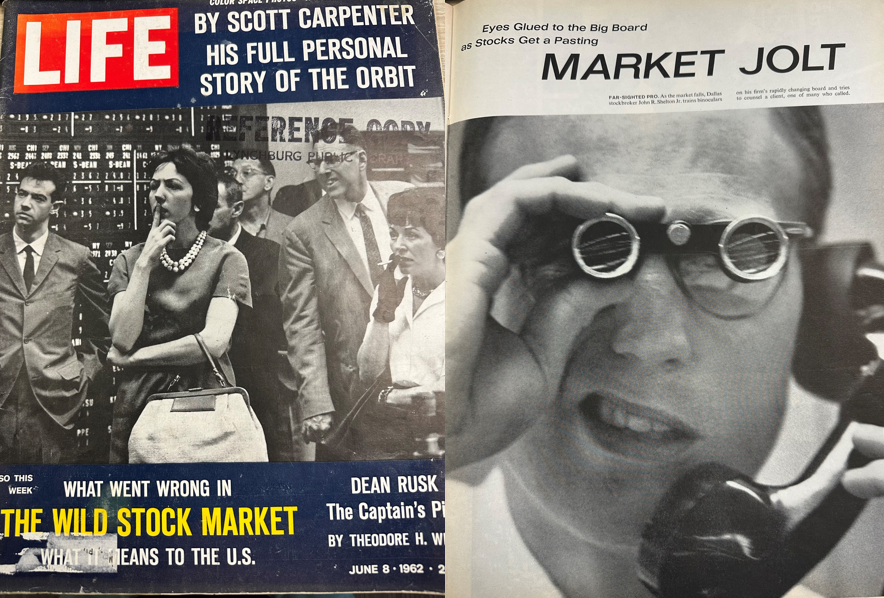

While doing so earlier this week I came across an old Life magazine a reader sent me a number of years ago.

It’s from June 1962 and the stock market was the cover story:

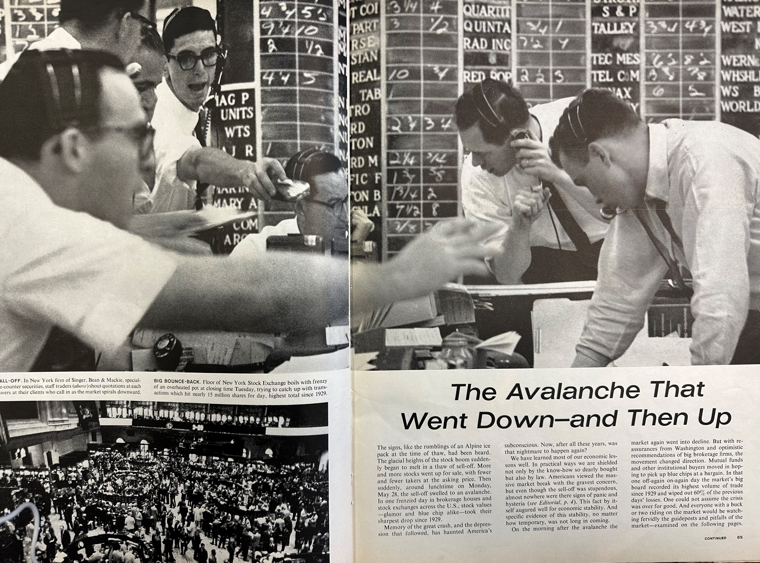

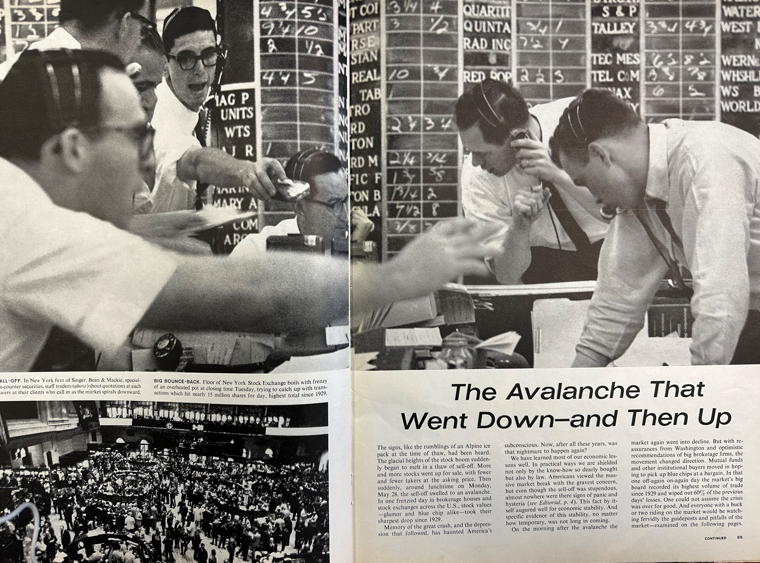

The pictures are fantastic.

So was the lede of the story:

The signs, like rumblings of an Alpine ice pack at the time of thaw, had been heard. The glacial heights of the stock boom suddenly began to melt in a thaw of sell-off. More and more stocks went up for sale, with fewer and fewer takers at the asking price. Then suddenly, around lunchtime on Monday, May 28, the sell-off swelled to an avalanche. In one frenzied day in brokerage houses and stock exchanges across the U.S., stock values — glamour and blue chip alike — took their sharpest drop since 1929.

In the spring of 1962, the stock market was already in the midst of a double-digit correction. Then on May 28, there was a flash crash, sending stocks down nearly 7% in a single day. It was the biggest one day sell-off since the Great Depression.

Why did it happen?

Here’s the explanation from the article:

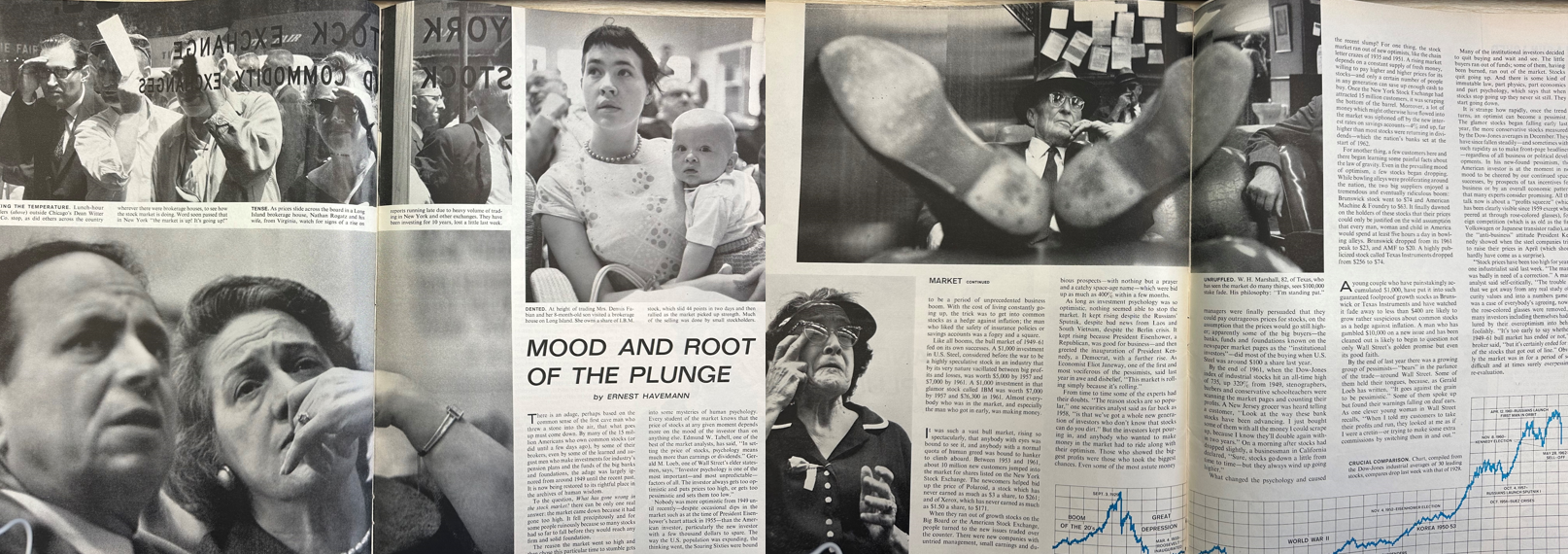

There can only be one real answer: the market came down because it had gone too high.

The reason the market went so high and then chose this particular time to stumble gets into some mysteries of human psychology. Every student of the market knows that the price of stocks at any given moment depends more on the mood of the investor than on anything else.

Sometimes the reason stocks fall is because they rose too much in the first place. There was a massive bull market in the 1950s. Investors were likely complacent and in need of a comeuppance.

The stock market can act like a lunatic in the short run because human emotions are fickle.

It’s becoming clearer by the day that last Monday’s stock market swoon was also a flash crash. As of August 5, the S&P 500 was down more than 6% for the month. It’s now positive in August.

I’m not ruling out further volatility ahead but that mini-flash crash looks like a freakout moment by investors. There are all sorts of macro reasons one can point to for that freakout — a slowing labor market, Japan raising rates, the carry trade unwind, a possible Fed misstep on monetary policy, etc.

But the most logical reason for last Monday’s stock market turmoil is the market came down because things were too calm. The stock market cannot stay calm forever.

Flash crashes happened in the 1920s, they happened in the 1960s and they happen today.

The biggest difference between now and then is the interconnected nature of the global markets. You have computer and algorithmic trading. Information flows at the speed of light. Every piece of economic data is parsed in real-time with a fine-tooth comb.

Overreactions can happen much faster now.

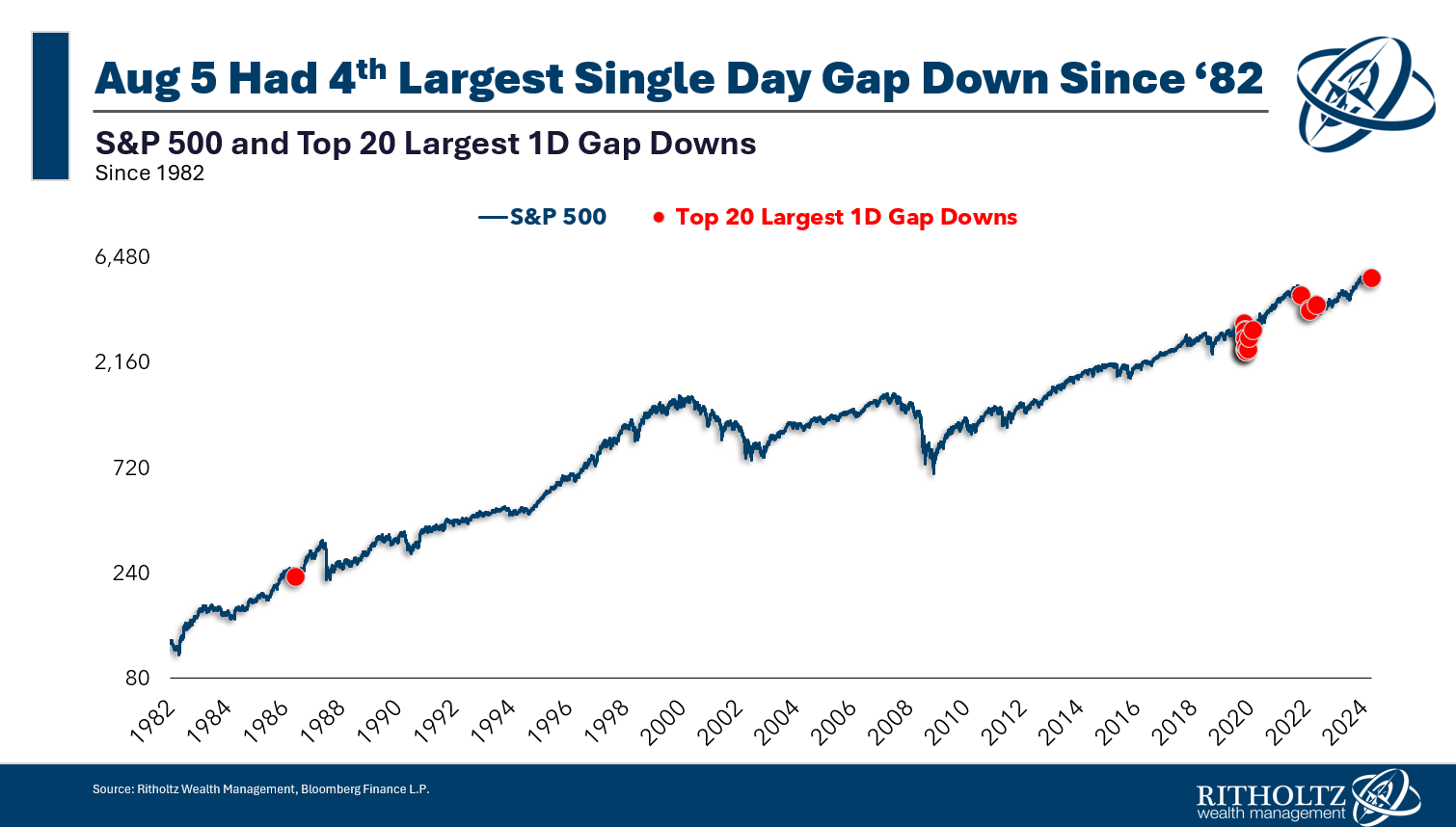

Just look at the biggest gap downs over the past 40+ years:

This chart shows the biggest difference between the opening price of the stock market and the prior day’s close. All of them have occurred this decade outside of the 1987 crash.

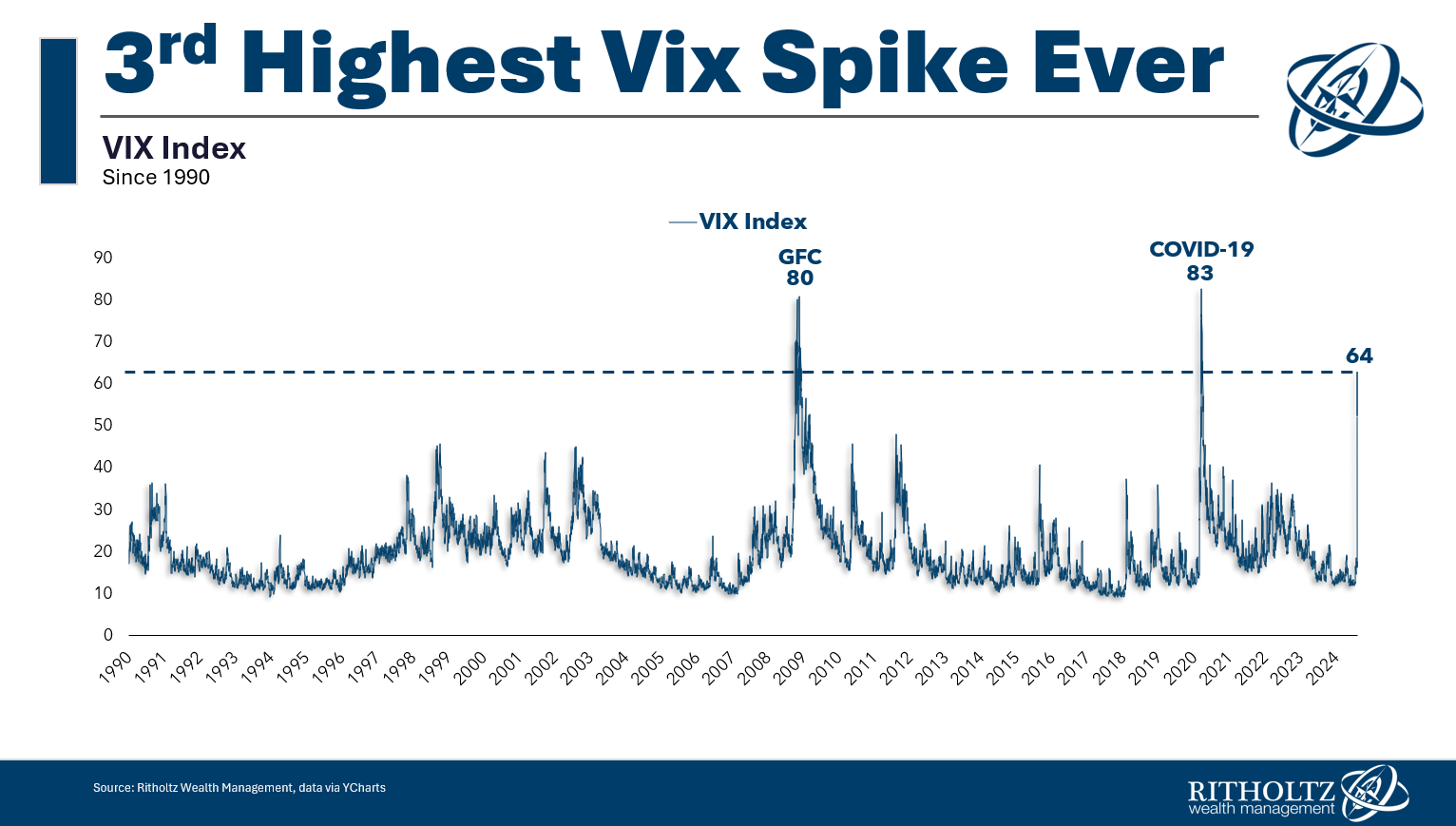

We had the third biggest VIX spike ever during a 9% correction:

This was a financial crisis-level volatility eruption and we never even hit double-digits on the drawdown.

I can’t predict the future, but I wouldn’t be surprised if these types of events occur more frequently going forward.

Human nature is the one constant across all market environments but we’re not trading with hand-written trade tickets and chalkboards anymore.

The information age has added a Barry Bonds level of HGH to human nature in the markets.

We are likely to see more of these flash crashes in the future due to a combination of increased leverage in the system, globalized markets and computer trading.

The hard part for investors is that it’s now easier to lose control during these types of market events. You don’t have to call your broker on the phone to place a trade. You can change your entire portfolio on your phone with the push of a button.

Just because markets are getting faster does not mean your decisions must be made faster.

In a world that is speeding up by the day, it’s more important than ever to take it slow when it comes to your investments.

Michael and I talked about flash crashes and more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

The Minsky Market

Now here’s what I’ve been reading lately:

Books: