A reader asks:

Ben used the Seinfeld tipping over the Coke machine analogy a few weeks ago to describe the consumer and economy. Does the same thing apply to the stock market. Hear me out: The yen/carry trade debacle a few weeks ago was the initial push. Then yesterday NVDA fell almost 10% while the market was down 2%. Are we getting closer to the Coke machine (stock market) falling over?

One of the reasons Seinfeld has staying power all these years later is so much of the show remains relevant to life experiences. Here’s the Coke machine analogy I mentioned on Animal Spirits a few weeks ago:

Jerry was talking about break-ups. I was talking about consumer spending. This question is about the stock market.

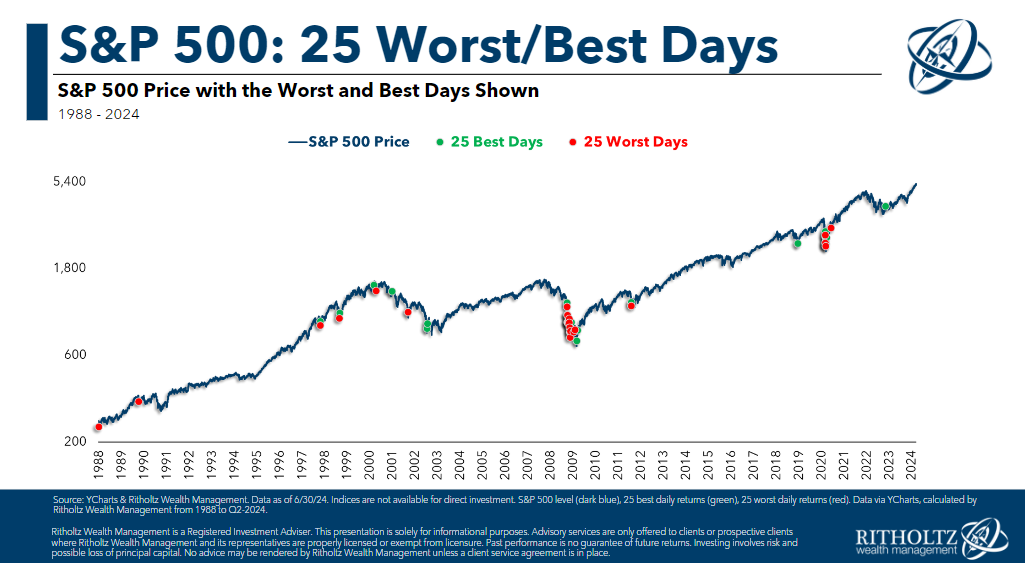

There is something to the idea that volatility clusters during downturns. Take a look at the 25 best and worst days on the S&P 500 going back to 1988:

The green and red dots are all fairly close to one another. It’s not like you see all green during the bull markets and red during bear markets.

Typically, bull markets are boring. Uptrends tend to occur in slow, methodical moves higher. The big down days and big up days usually happen in downtrends because that’s when investor emotions are high.

People panic sell and panic buy during corrections, bear markets and crashes.

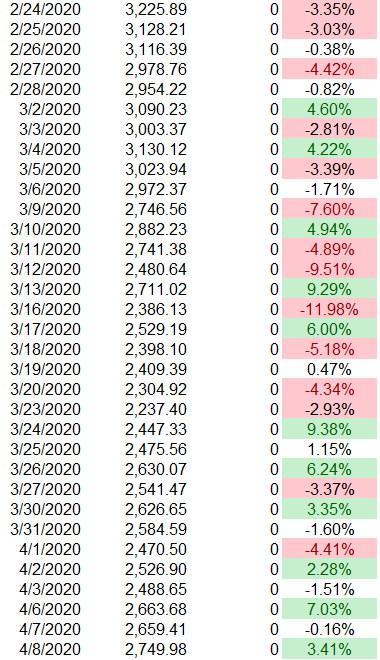

I have this spreadsheet where I keep track of the daily price moves, new all-time highs and drawdowns for the S&P 500 going all the way back to the 1920s. Here’s a look at the daily price action during the initial days of the pandemic in early-2020:

I have a color-coding system for the big gains and losses, of which there were many.1 This is an extreme example but it shows during a sell-off the stock market often has huge gains mixed in with the nasty losses.

In the past month we’ve now had a down 3% day, and up 2% day and a down 2% day. This minor uptick in volatility may be a harbinger of worse things to come in the stock market. A downtrend has to start from somewhere.

Markets have been running strong for some time now some another correction wouldn’t surprise me.

The financial media seems to think the stock market has its ear to the ground of a coming economic slowdown. Here are some headlines from Tuesday’s down day:

The stock market has predicted five of the last one recession but this is another possibility. The economy was running hot. The Fed raised rates. They might be too slow to lower them which could worsen the economy.

The stock market is forward-looking.

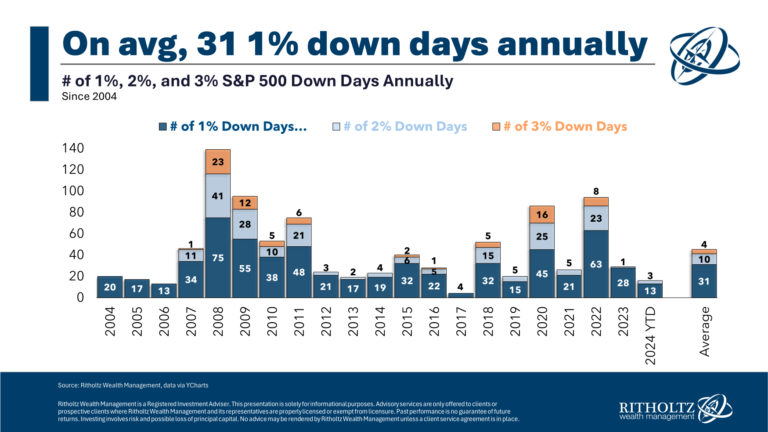

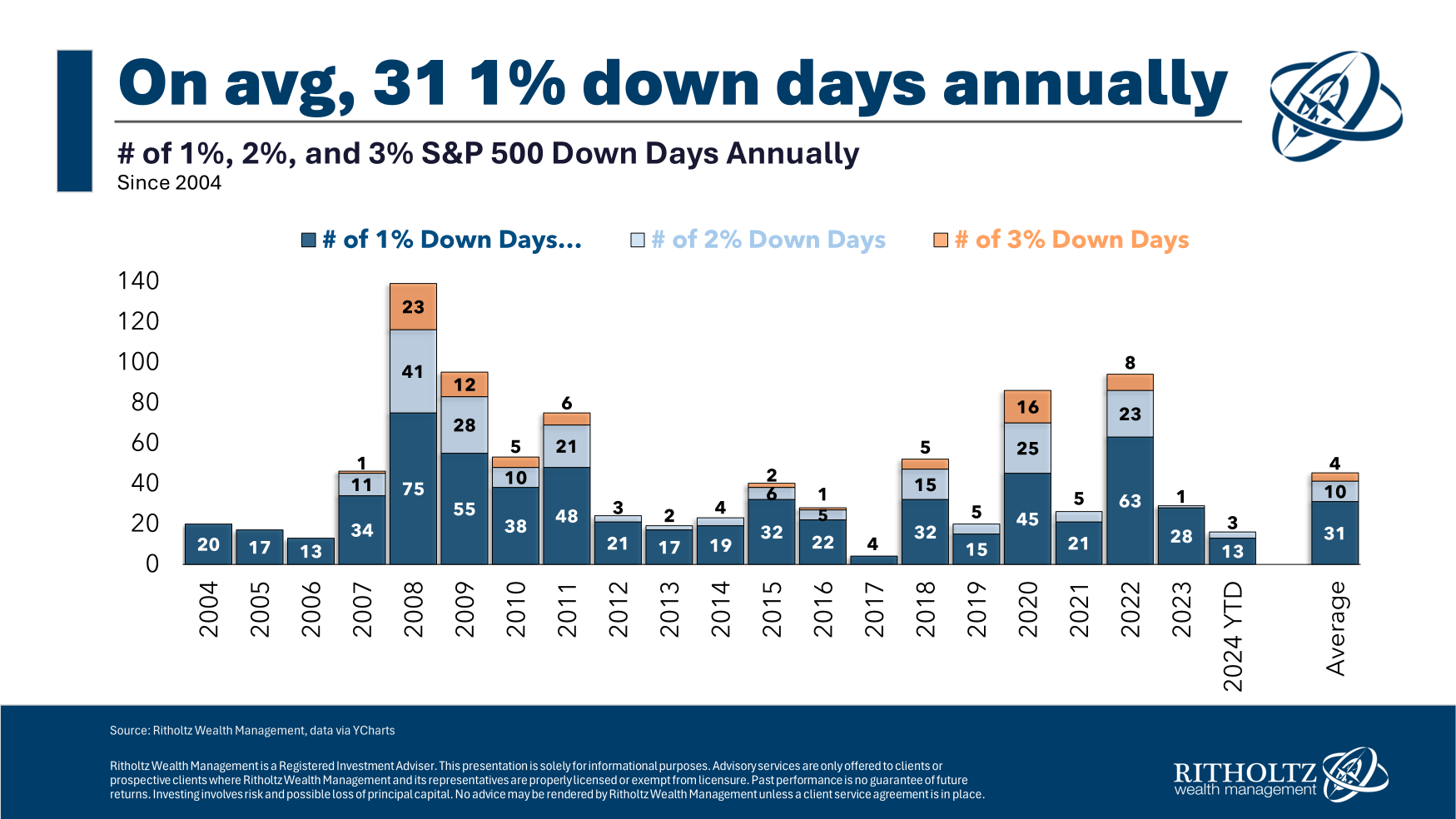

Another explanation is sometimes stocks just go down and there isn’t a good reason for it. Here’s a look at the number of big down days on the S&P 500 over the past 20 years:

There are bigger down days during the years with large drawdowns (2008, 2020, 2022, etc.) but there are also big down days when you don’t have a market crash.

The U.S. stock market has been up 8 out of the past 10 years (including 2024). In those 7 of those positive years (I’m excluding 2020 here), the stock market has fallen by 1% or worse on a daily basis 23 times, on average.

Out of 252 trading days in the year, that’s roughly 10% of the time. So even in the relatively calm up years in the stock market, one out of every 10 trading days was a big down day. In those same years, the average number of 2% or worse days was four. This year there have been three 2% or worse down days.2

To recap, our three potential scenarios right now are:

- The stock market needs a breather.

- The stock market is predicting a slowdown in the economy.

- The stock market needs to fall sometimes and it doesn’t mean anything.

I don’t know which scenario will play out because I don’t know what the future holds.

The stock market is a manic depressive in the short-run so it’s often difficult to discern its intentions.

If you can’t handle a 2% loss every once in a while, you probably own too many stocks to begin with.

Big down days come with the territory.

We talked about this question on this week’s Ask the Compound:

The OG financial blogger Barry Ritholtz joined me on the show this week to discuss questions about what the next recession will look like, creating an investment plan for a banker with cash on the sidelines, paying down a low interest rate mortgage and how to sell your automobile.

Further Reading:

The Minsky Market

1It’s pretty obvious but red for losses of 2% or worse and green for gains of 2% or more.

2All 3 have come since the end of July.