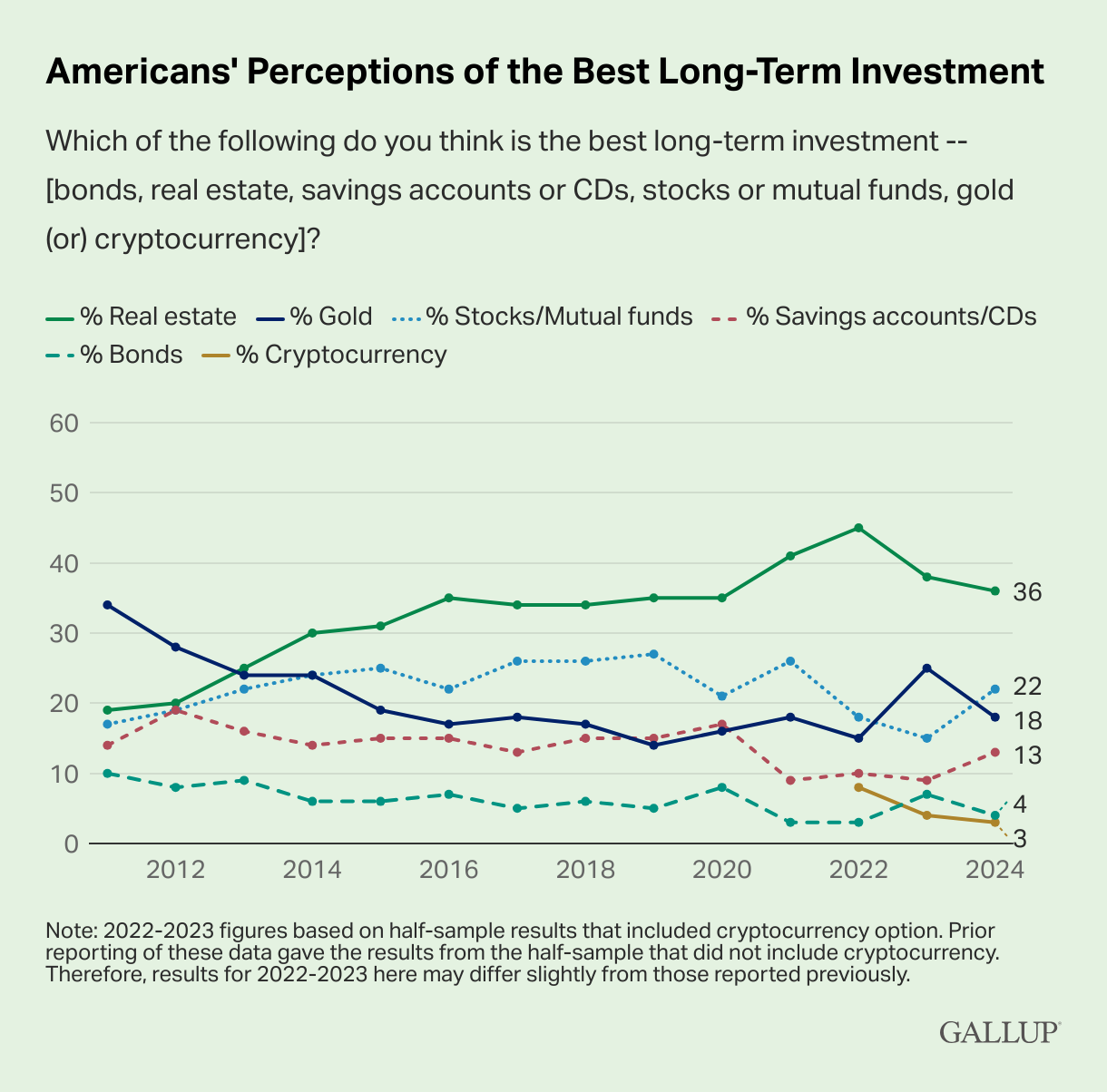

Each year since 2011, Gallup has asked people what they think is the best long-term investment:

After a brief love affair with gold, real estate has been in the top spot every year since 2013. Stocks are a distant second.

So why do we Americans love the housing market so much from an investment perspective?

There is something about the American Dream of homeownership combined with the size of the price tag involved for sure. A house is both the biggest purchase and largest financial asset for most households.

You could say it’s the bull market we’ve experienced since the pandemic but housing was at the top of the list for many years before the pre-Covid era.

The strange thing is real estate recovered fairly quickly on this list following the biggest housing crash we’ve ever seen.1 I would have thought more people would have been scarred for a lot longer following the crash. The stock market bottomed in 2009, but housing prices kept falling well into 2012.

A big part of it has to do with the nature of pricing in the housing market.

It’s an illiquid asset. You can’t see the tick-by-tick changes in price like you do in the stock market. There isn’t nearly as much volatility in housing prices.

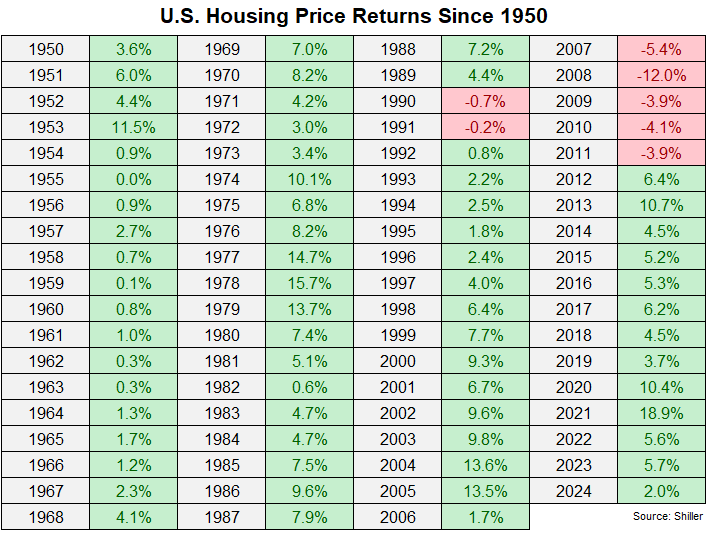

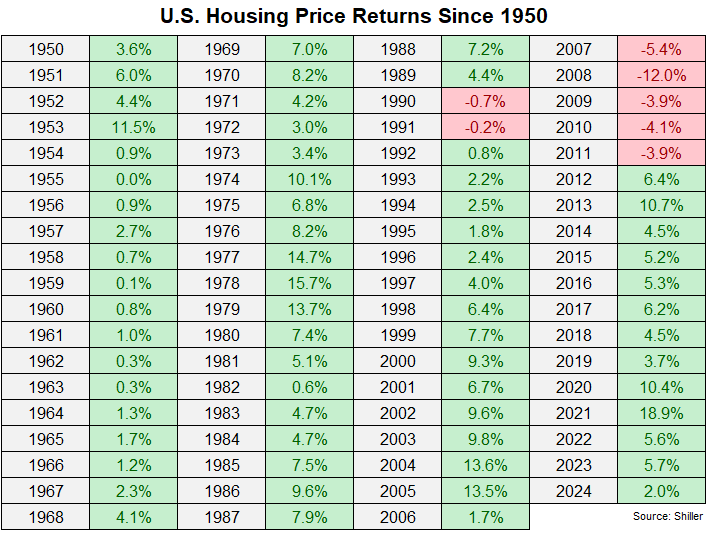

I used Robert Shiller’s historical housing price database to calculate the annual returns on a national basis going back to 1950:

Look at all the green on there. Housing prices rarely go down.

By my count, there have been just seven down years for the U.S. housing market over the past 75 years. That’s losses just 9% of the time. And five of those seven years occurred after the housing bubble popped.

The stock market has been negative on a yearly basis 22% of the time since 1950. But there have also been 32 double-digit drawdowns in that time. Ten of those 32 drawdowns have been bear markets (down 20% or worse) while there have been six outright crashes (down 30% or worse).

The housing market has gone down a handful of times and crashed just once over the past 75 years.

Even if housing prices were more volatile, you wouldn’t notice because it’s an illiquid asset. It’s out of sight, out of mind.

I’m not making the case that housing is a better investment than stocks, gold, bonds, crypto or anything else.2

For certain investors, real estate can be quite lucrative. For others, it can be an albatross.

A lot of it depends on location, timing and luck.

Plus you have all of the ancillary costs — property taxes, insurance, maintenance, renovations, realtor fees, closing costs, moving costs, etc.

No one actually keeps track of those costs. Plus you have to live somewhere and there is typically leverage involved so it’s nearly impossible to calculate the actual return you get from homeownership.

Most people simply take the price they paid and subtract it from the price they sell it for or the current Zillow market value and call it good.

The housing market has been good to homeowners over the past decade or so. I’ve personally been very lucky in the housing market.

But just because housing has been good over the past decade doesn’t necessarily mean I think it will be the best-performing asset class going forward.

The good news is you don’t have to pick a single asset class to invest in from current levels.

Life doesn’t work like a survey or hypothetical.

You can spread your bets among housing, stocks, bonds, cash, gold, crypto or anything else that catches your fancy.

Diversification takes extremes out of the equation.

Further Reading:

What’s the Historical Rate of Return on Housing?

1I wouldn’t argue with you if you said the Great Depression was worse but housing wasn’t seen as a financial asset back then as it is today.

2I wrote about the bull and bear case for housing here and here.