A reader asks:

I know Ben talked about rate cuts and the stock market a few weeks ago but what about the economy? Did Powell just guarantee a soft landing by cutting 50 basis points this week?

There are no guarantees in life or the markets, unfortunately.

The rate cut helps the soft landing scenario but you never know with these things.

Let’s invert this question and start with what Fed rate cuts don’t mean.

Rate cuts don’t mean a recession is coming. Sometimes the Fed is forced to cut rates because of a financial crisis or slowing economy but rates cut in and of themselves don’t just happen during a slowdown.

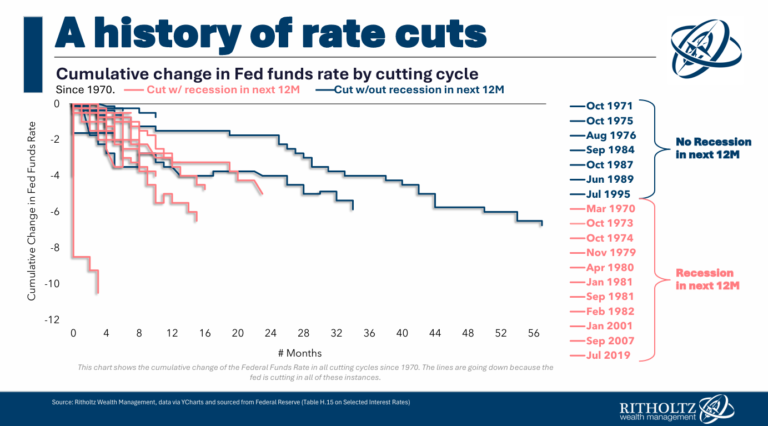

Here’s a look at every Fed rate-cutting cycle going back to 1970:

It’s been a while since the Fed went on a rate-cutting spree outside of a recession, but Alan Greenspan and company pulled off a soft landing in 1995, which was followed by one of the biggest boom times in history.

A recession is possible but not the only potential outcome here.

Rate cuts don’t mean inflation is coming back. Some people are worried that inflation will rear its ugly head again after we just tamed it.

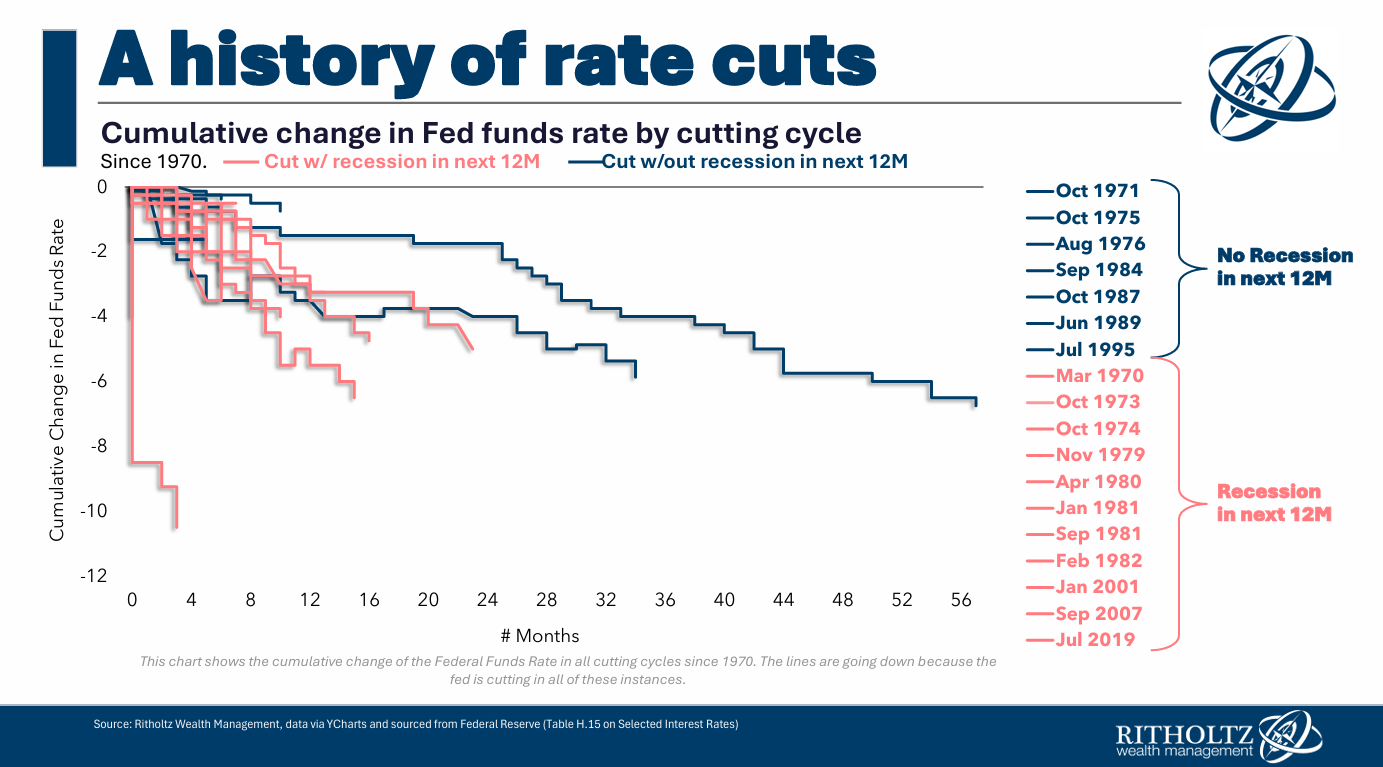

Again, anything is possible, but I would be dubious of people predicting higher inflation from interest rate cuts alone. We learned in the 2010s that low rates from the Fed don’t cause inflation:

We had 0% rates for years following the Great Financial Crisis. Rates averaged less than 1% in the 2010s yet the inflation rate for the decade was under 2% per year.

Government spending has a much greater impact on inflation than monetary policy.

Rate cuts don’t put a floor under equities. A lot of the Zero Hedge crowd assumes there has been a Fed put in place that drives equities higher.

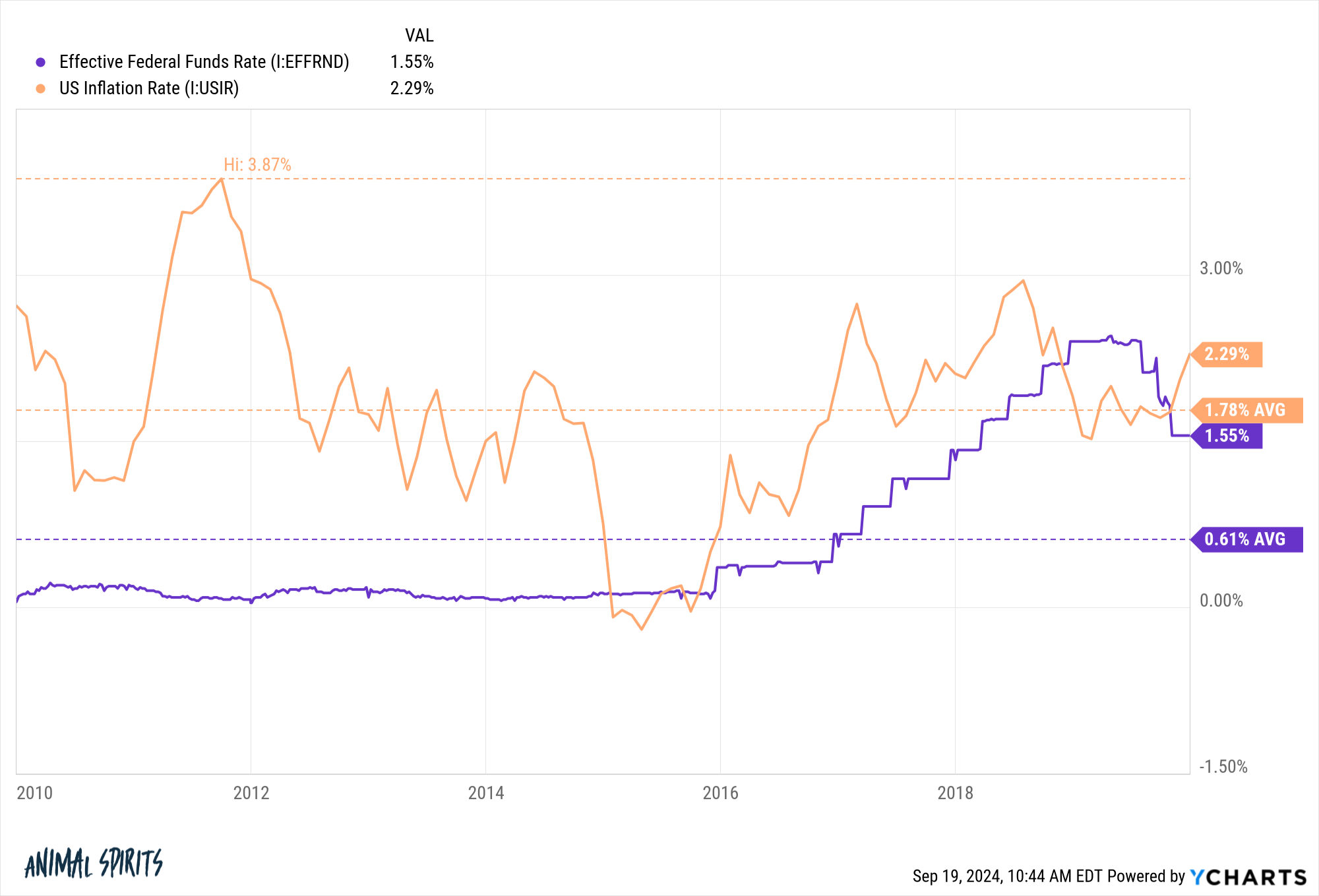

Well, we just went through one of the most aggressive rate hiking cycles in history and the stock market has held up just fine:

The Fed first began raising rates on March 17, 2022. There was some volatility along the way but since then the S&P 500 is up nearly 35%.

That’s pretty good.

But this should also be instructive on the other side of the equation. The stock market can do just fine during a rate-cutting cycle. But the Fed cutting rates doesn’t necessarily mean the stock market is now better-protected against risk.

Low rates don’t guarantee the stock market has to keep going up.

Rate cuts don’t guarantee bond gains. Here’s a meme I made:

Bonds could do well in a rate-cutting cycle but it could be more complicated than that.

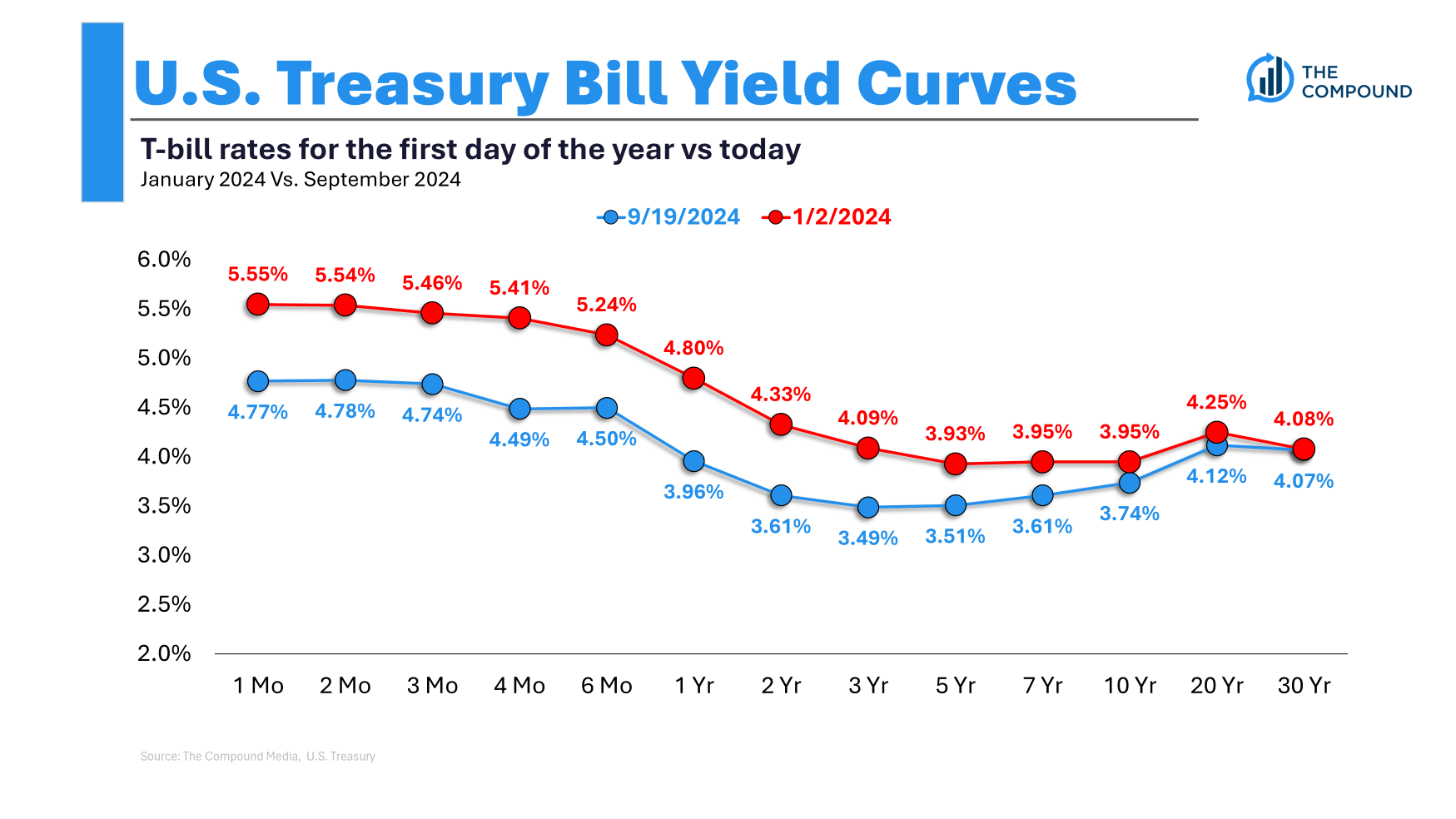

Short-term rates have been higher than long-term rates for some time now. Bond yields have already come down in anticipation of Fed rate cuts:

The market is forward-looking. It doesn’t wait around for the Fed to move. It moves before they do.

What if intermediate and long-term rates don’t budge all that much as short-term rates fall and the yield curve dis-inverts (un-inverts? de-inverts?)? Those rates never rose as much as short-term yields in a rate-hiking cycle.

If we go into a recession or inflation falls well below the Fed’s 2% target you would expect bond yields to fall.

But bond yields aren’t guaranteed to go down in a soft landing-like scenario.

The good news is that bond yields are decent right now, so rates don’t have to fall for bonds to offer reasonable returns. Timing the stock market is hard but timing the bond market is not a walk in the park either.

I guess what I’m trying to say is that not much is guaranteed by the Fed cutting rates.

You should expect rates on your savings account, CDs, money markets and T-bills to fall immediately. You should expect borrowing costs to fall.

Other than that, the future is uncertain, just like any other time.

I covered this question on the latest edition of Ask the Compound:

We also tackled questions about how bond yields are impacted by rate cuts, when you should refinance, AI financial advisors and how to break into the world of wealth management.

Further Reading:

The Impact of Fed Rate Cuts on Stocks, Bonds & Cash

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.