A study from Cambridge University trained monkeys to expect either 2 or 20 liquid treats for completing certain tasks.

Think of these rewards as income earned for doing their job. Once those baseline expectations were set, the researchers would unexpectedly give them 4 (instead of 2) or 40 (instead of 20) reward units.

The crazy thing is the magnitude of the increase in reward didn’t matter — the dopamine release was the same for 4 or 40 units of liquid. The size of the reward didn’t matter nearly as much as the unexpected nature of the payout. Going from 2 to 4 gave their monkey brain the same response as going from 20 to 40.

It’s not necessarily good or bad absolute outcomes that matter when it comes to producing stimulus in your brain — it’s the unexpected good news that can cause you the most pleasure. Getting exactly what you expected is basically a non-event when it comes to the receptors that bring you pleasure.

Unfortunately, even those upside surprises eventually wear off as well and become the new baseline.

This is why achieving your financial goals is often such a letdown. If you expected it to happen, it doesn’t bring all that much joy when you check it off your list.

The Wall Street Journal had a piece this week about HENRYs (high earner not yet rich) who earn six-figures but don’t feel all that wealthy.

Here’s one of them:

Fifteen years ago if you’d told April Little that she’d make $300,000 a year, she would have pictured a life free of financial stress.

“The white picket fence–I have the whole visual in my head,” says Little, 38 years old, a human-resources executive turned career coach in Rochester, N.Y. “I don’t want to sound ungrateful, but when I got to that proverbial mountaintop I realized there’s a lot of expenses. And I still don’t own a home.”

This makes sense. As you age you gain more responsibilities. When you’re young, a six-figure salary sounds like more money than you could ever hope to spend.

As your tastes change, expenses add up and luxuries become necessities, the money doesn’t go as far.

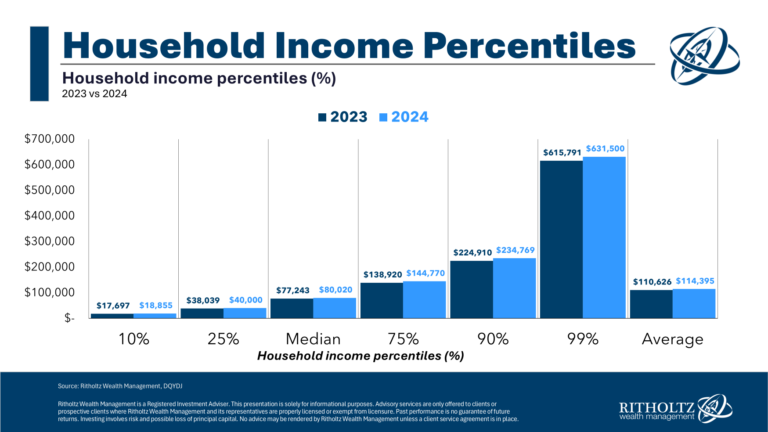

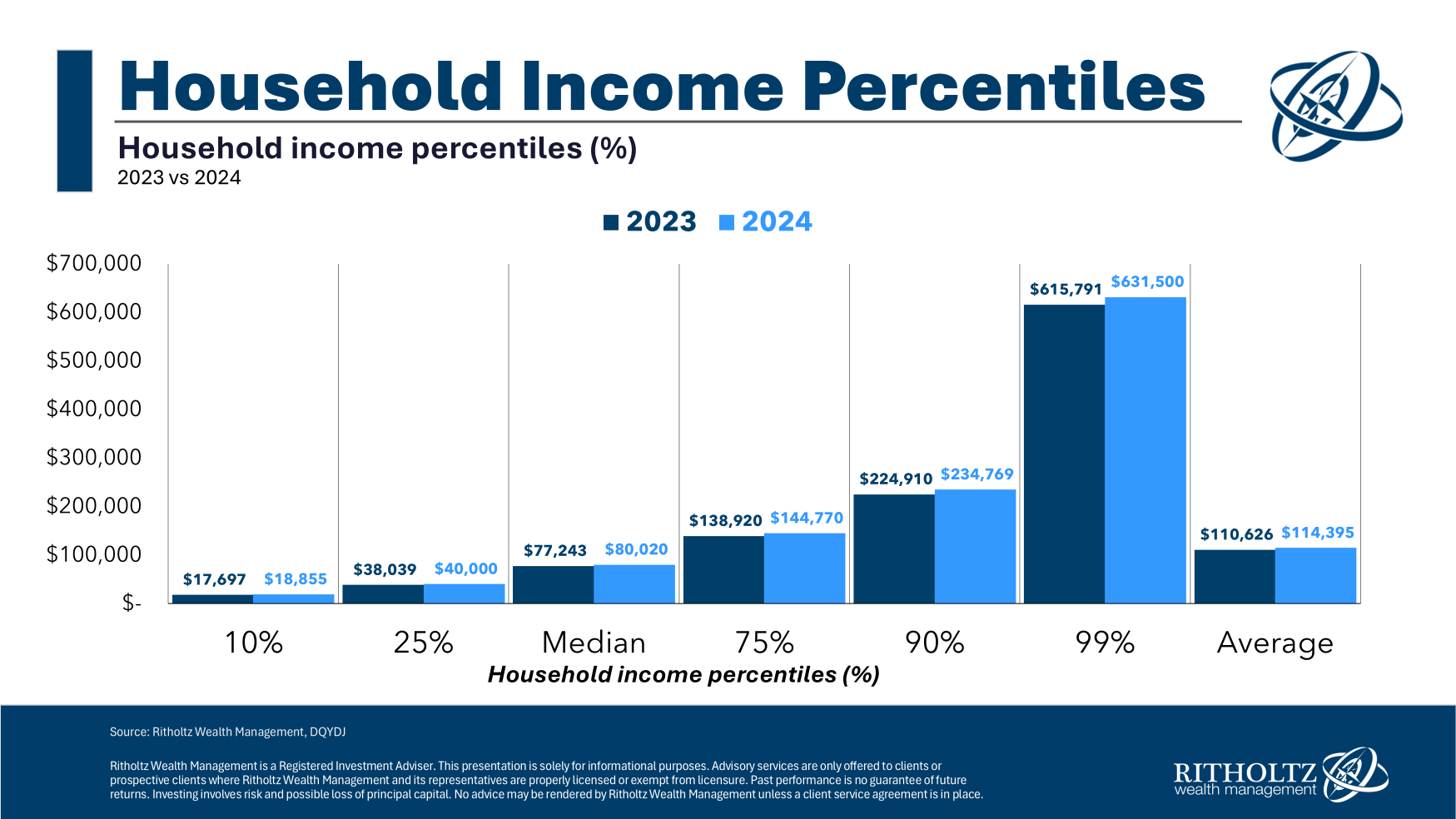

On the other hand, $300k a year in puts you in the top 5-6% by income:

Sure, where you live can make a difference but there aren’t that many people making that much money.

Here’s another person with an enviable financial position from the article that doesn’t feel all that wealthy:

Monique So, a 40-year-old financial consultant, says she and her husband, a software engineer, have a net worth in the mid-seven figures. But she likely won’t breathe easy until, or if, they accumulate an eight-figure net worth. Daycare for their 2-year-old takes a $30,000 bite out of their family budget.

“I have this scarcity mindset that is very common,” she says.

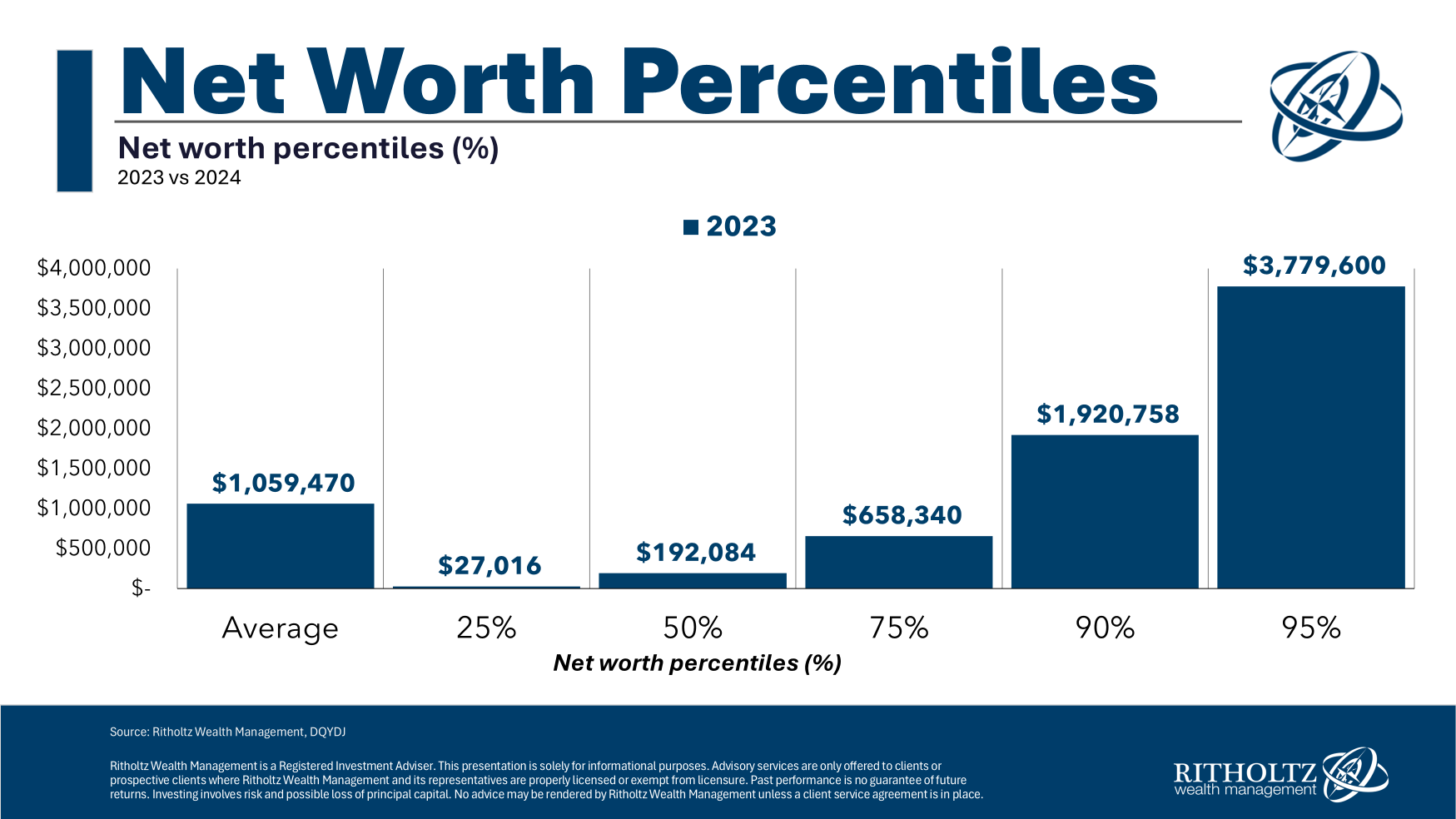

Mid-seven figures would put you somewhere in the top 4% or so by net worth. An eight-figure net worth means you’re in the top 1%:

If you have multiple millions of dollars you’re doing better than the vast majority of households. You can afford high daycare costs.

Obviously, no one should feel sorry for these people making high six figures or those with a seven figure net worth. By any metric, they are doing better than most other Americans.

But these financial feelings of inadequacy make sense when combined with lofty expectations.

The goalposts are always moving when it comes to your finances and they should be. If you work hard, earn more money and save enough, you should allow yourself some lifestyle creep.

One of the best ways to feel better about your money situation is to go into it with low expectations.

Getting an upside surprise is more satisfying and gives you a dopamine margin of safety.

Michael and I talked about rich people who don’t feel wealthy and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Rich vs. Wealthy

Now here’s what I’ve been reading lately:

Books: