The U.S. stock market has been on fire of late.

But it doesn’t feel like we’ve entered the euphoric phase of investor psychology just yet. In fact, many prognosticators have been lowering expectations.

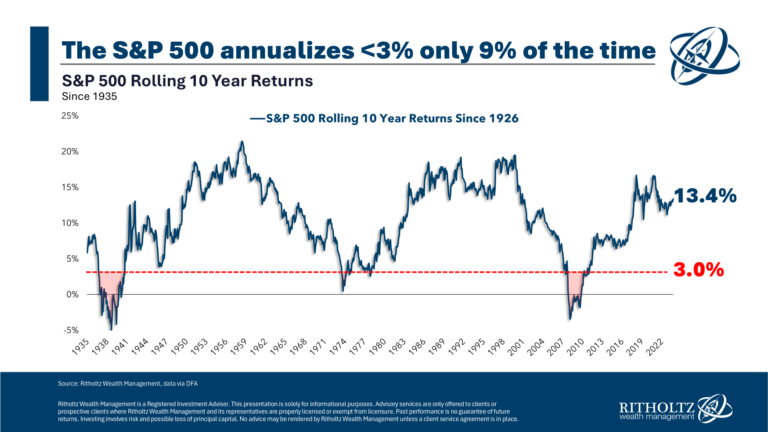

Goldman Sachs put out a research piece that posits the S&P 500 could return just 3% annualized over the next 10 years (just 1% after inflation):

These are their baseline assumptions and they offer a range of potential outcomes but that would be a rough decade for stock market investors. Goldman also estimates a more than 70% chance that U.S. Treasuries will beat stocks in that time frame.

The usual caveats apply here. Predicting future returns is hard. Goldman Sachs doesn’t know the future any better than you or I do. People have been predicted below-average returns since the start of this epic bull market run.

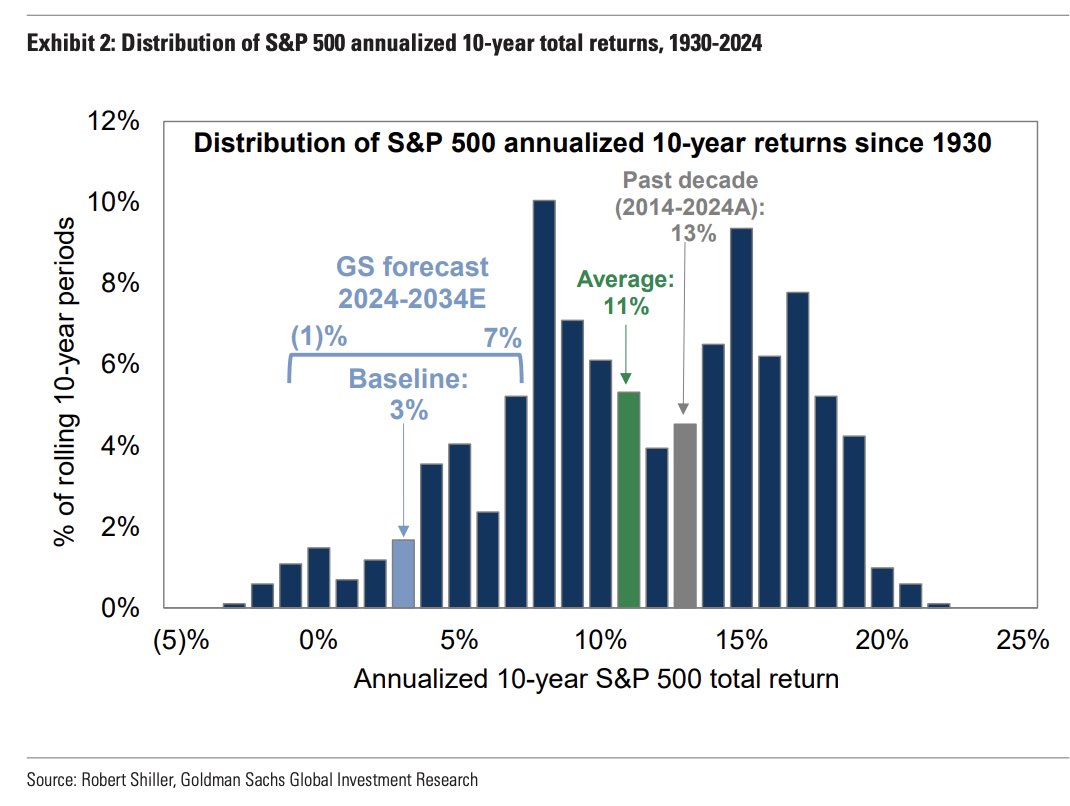

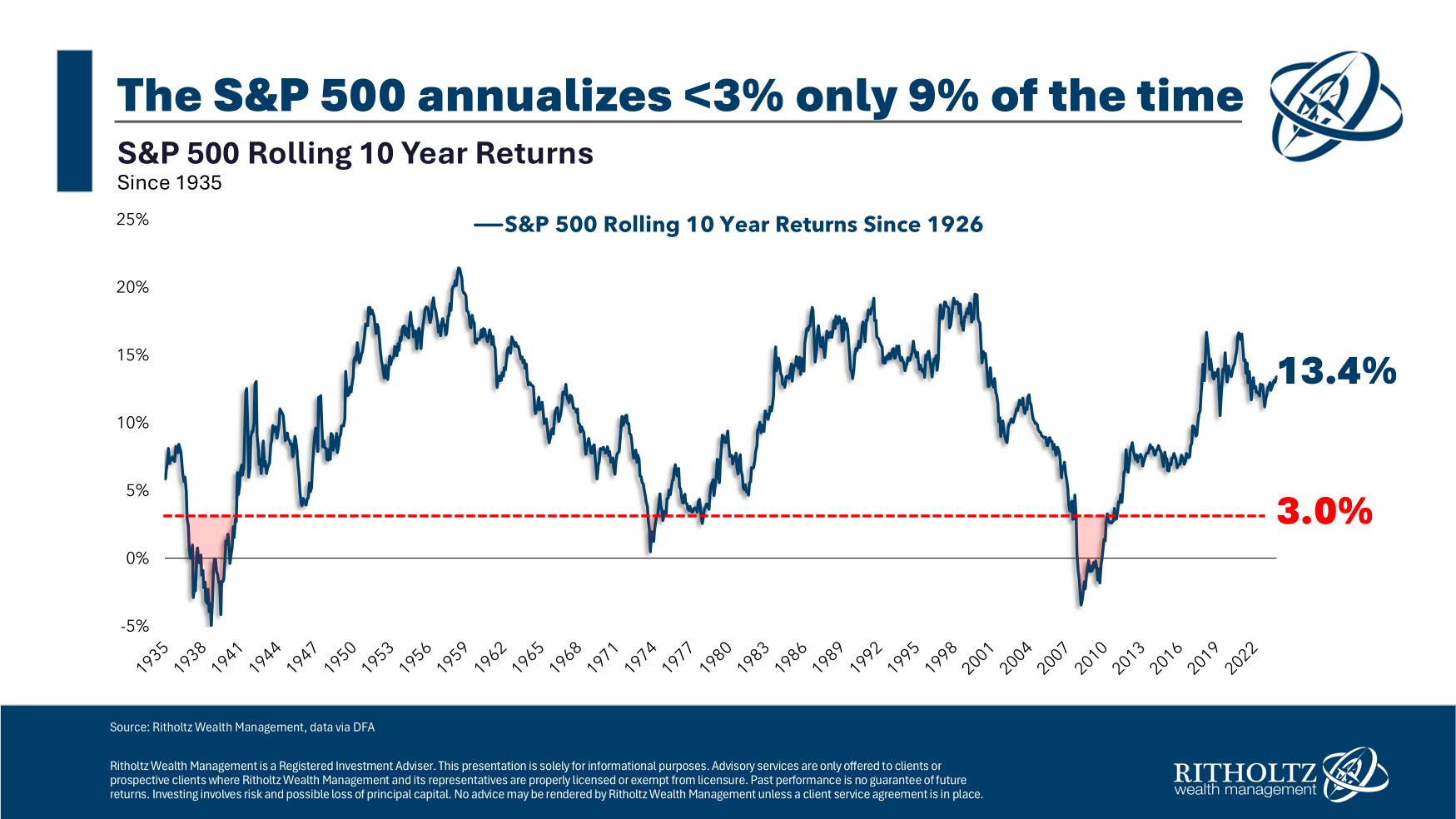

Now that the disclaimer is out of the way, I was curious how often this has occurred historically so I looked at rolling 10 year returns for the S&P 500 going back to 1926:

It’s rare to see such low returns over a 10 year stretch but it can happen. Roughly 9% of all rolling 10 year annual returns have been 3% or less.

It is worth noting that there are some similarities in the three instances in which this has happened in the past. Those below-average returns all occurred in or around some of the worst economic times of the past 100 years or so — the Great Depression in the 1930s, the stagflation of the 1970s, and the Great Financial Crisis.

You would think there would have to be a pretty nasty financial crisis for this to happen. That’s not out of the realm of possibilities, but there is typically a reason for bad times like this.

It’s also not out of the realm of possibilities for stocks to beat bonds over a 10 year window. I looked back at the 10 year returns for both the S&P 500 and 5 year Treasury bonds:

Stocks have beaten bonds over rolling 10 year returns 83% of the time, meaning bonds have beaten stocks 17% of the time. The further you extend the time horizon, the more likely it is that stock beat bonds.

So it’s improbable but possible.

I still recall attending a conference way back in 2010 where a very well-known hedge fund manager made the case that U.S. stock market returns would be muted over the next decade because of starting valuations. Instead, we’ve experienced a massive bull market with above-average returns for 15 years.

For bonds, the starting yield gives a decent approximation of forward returns, but predicting the stock market’s performance is anyone’s guess. Although low returns happen infrequently, it does make sense to plan for this risk. It will happen at some point.

Since no one can predict the timing of stock market returns — good or bad — your best defense against poor returns in any one asset class, region, factor, or strategy is diversification.

The S&P 500 has been lights out for a decade-and-a-half but went nowhere for the lost decade that preceded the current run.

Plenty of other areas of the stock market — small caps, foreign stocks, value stocks, dividend stocks, high quality stocks, emerging market stocks, etc. — haven’t fared nearly as well. And bonds will beat stocks at some point because you don’t get the long-term risk premium in the stock market without the risk.

Diversification has felt useless this cycle because large cap growth stocks have so massively outperformed.

That won’t last forever either.

Diversification will prove its worth again in the future.

I just don’t know when and I don’t know why but that’s why I diversify.1

Further Reading:

When is Mean Reversion Coming in the Stock Market?

1Yeah it rhymes.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.