Earlier this week I wrote about how America is the envy of the world.1

There was plenty of pushback. Many Europeans pointed out we have plenty of other problems plus a far worse safety net than they do. Fair enough.

There were also a lot of comments on inequality, even though I addressed that in the piece. It is worth noting research shows 40% of the rise in income inequality has been undone since 2020. That’s progress you never hear about.

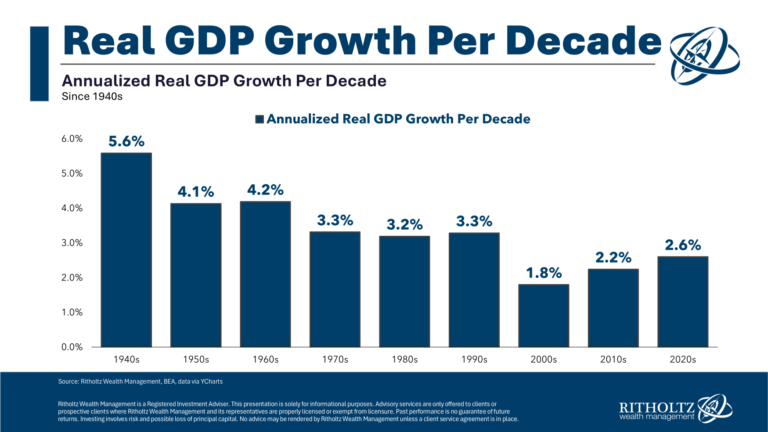

The best economic counterpoint came from those arguing 3% real GDP growth is nothing to celebrate. That’s better than the rest of the developed world but I wanted to do a deeper dive on this one.

There are two basic ways an economy can grow over time:

(1) Population growth. More people means more workers, which means people spend more, companies make more money, so people earn more, etc.

(2) Productivity growth. Workers are more efficient and productive with their time because of improvements in technology and increased knowledge/education.

If we want decent economic growth in the future, we either need more people in this country or to become more productive.

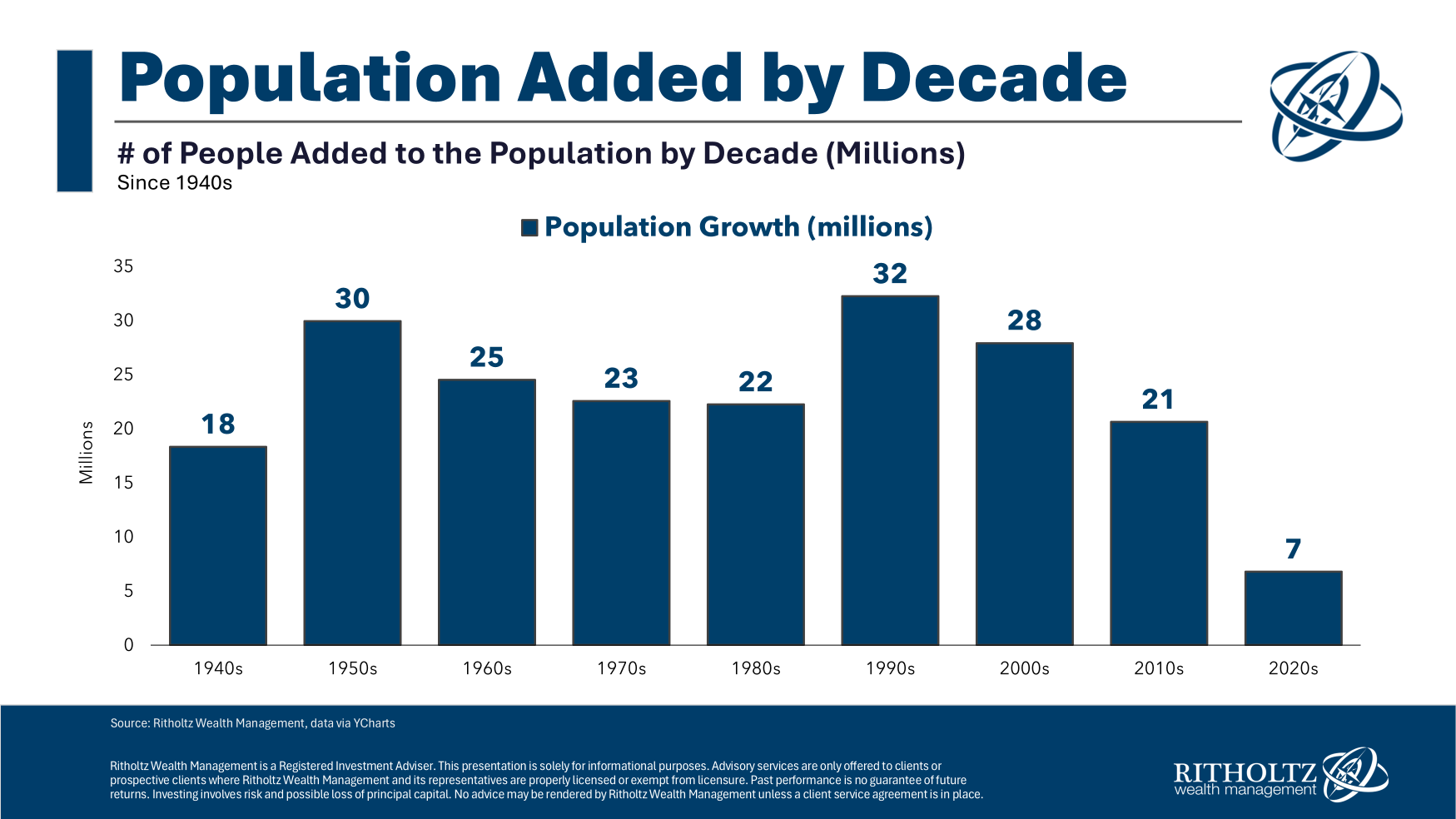

When you look at population growth in the United States it makes sense economic growth would begin to begin to slow.

Here is the absolute population growth by decade going back to the 1940s:

This number has been relatively steady over time. However, as the overall population has grown, the relative amount of growth has shrunk.

There were around 130 million people in the U.S. by 1940. By the end of 2023, it was estimated to be more like 335 million.

Here is population growth on a percentage basis:

Relative to the overall population, America experienced massive growth in the 1940s and 1950s. It’s been on a steady decline ever since.

Now look at real GDP growth by decade:

It’s not a perfect relationship because many other factors are at play but you can certainly see things moving in a similar direction. The point is the trend in growth has been going down for decades now.

As population growth has decelerated, so too has economic growth.

Plus we’re a bigger, more mature economy now. We can’t expect to see 4-5% GDP growth anymore with a $29 trillion economy.

You have to measure an economy relative to its potential. The United States has been living up to its potential. The rest of the developed world has not:

There is one factor related to economic growth I failed to mention — government spending.

That’s obviously been a big reason for our success this decade.2

There are lots of people worried about deficit spending and the size of government debt:

I have plenty of thoughts on that topic as well.

Stay tuned and I’ll have something next week on government finances.

Michael and I talked about the strength of the pros and cons of the U.S. economy and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

The Bottom 50%

Now here’s what I’ve been reading lately:

Books:

1The Economist’s words, not mine (although I agree).

2Although the rest of the world spent plenty of money during the pandemic too but didn’t experience the same levels of growth. And they did experience the same levels of inflation.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.