It’s been a good year in the stock market.

Through the close on Friday, the U.S. stock market is up 20% in 2024.

The Russell 3000 Index is a good approximation of the total U.S. stock market. The index now has a little less than 2,700 stocks.

Out of 2,670 stocks, 101 are up 100% or more this year (3.8% of the total). Thirteen stocks are up 300% or more, five are up 500% or greater and there is one stock in the one common club, which is up more than 1,000%.1

Not bad.

Interestingly enough, even in a good year for the index, there are plenty of stocks that are down big too. More than 1,000 stocks are down this year or 40% of the total. There are more stocks down 50% or worse this year (137) than up 100% or more (101).

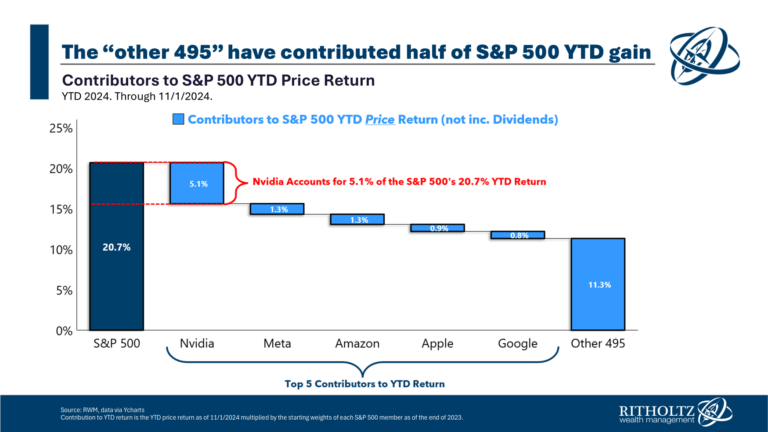

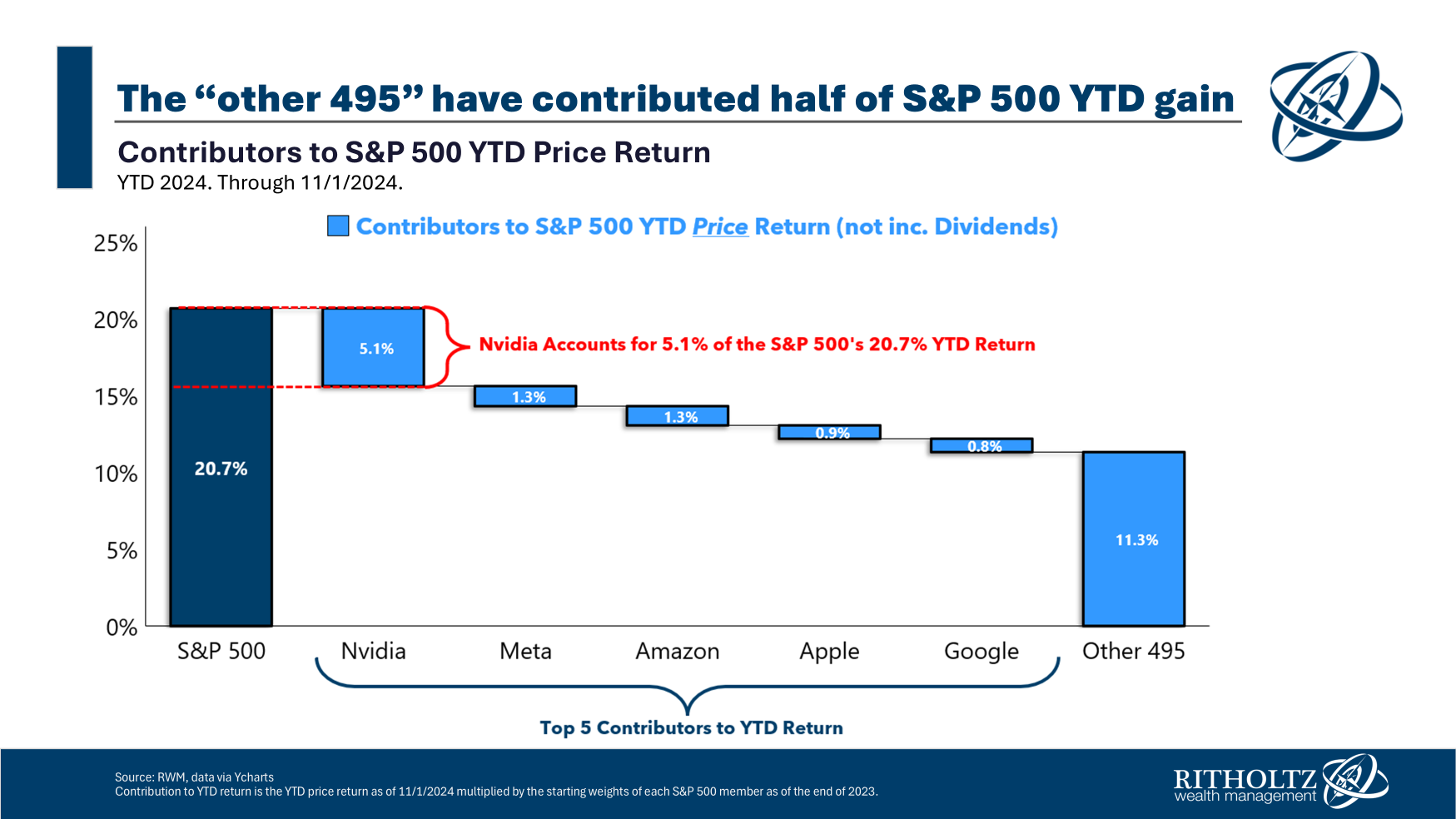

Of course, the biggest stocks tend to have outsized control of the returns in a market cap weighted index (by design). Five stocks are responsible for around half the gains on the S&P 500 this year:

Nvidia alone makes up one-quarter of the gain.

I’m doing some research for a project on the dot-com bubble of the 1990s, so I decided to look at the return profile of the stock market at the height of the insanity in 1999.

The stock market finished that year with a 24% gain but there was plenty of silliness beneath the surface.

Nearly 350 stocks were up 100% or more in 1999 (14% of the total). More than 100 stocks were up 300% or better (4% of the total) and an astonishing 13 stocks finished the year with gains in excess of 1,000%.2

Most of those companies were of the dot-com variety as investors went crazy for Internet stocks.

More than 1,000 stocks were down that year too, including 182 names that finished the year with losses in excess of 50%.

A few thoughts on this data:

There are a lot of stocks you’ve never heard of. The list of best-performing stocks this year includes companies such as Sezzle, Longboard Pharmaceuticals, Root Inc., NuScale Power and Janux Therapeutics. The only company I recognized in the list of top 10 names is Carvana.

Things could always get crazier. I’m not suggesting we’re due for a repeat of the dot-com bubble but studying historical market extremes provides a nice reminder that we have a habit of taking things too far.

Stockpicking is hard. Most investors only focus on the biggest winners but even when there are good years in the overall market, there is still ample opportunity to lose big money with your stock picks.

Lottery winners are more fun to dream about but it’s rare to cash those tickets.

Further Reading:

The Biggest Difference Between Now & the Dot-Com Bubble

1It’s a company I’ve never heard of called GeneDX Holdings. It’s up more than 2,800% on the year. I’m guessing it’s biotech.

2The best performer in 1999 was Qualcomm, which was up close to 2,700% on the year.

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.