The United States is the envy of the world in terms of financial markets and economic performance.

Ruchir Sharma at The Financial Times outlines how this is impacting capital flows:

Global investors are committing more capital to a single country than ever before in modern history.

And the dollar, by some measures, trades at a higher value than at any time since the developed world abandoned fixed exchange rates 50 years ago.

The US now attracts more than 70 per cent of the flows into the $13tn global market for private investments, which include equity and credit.

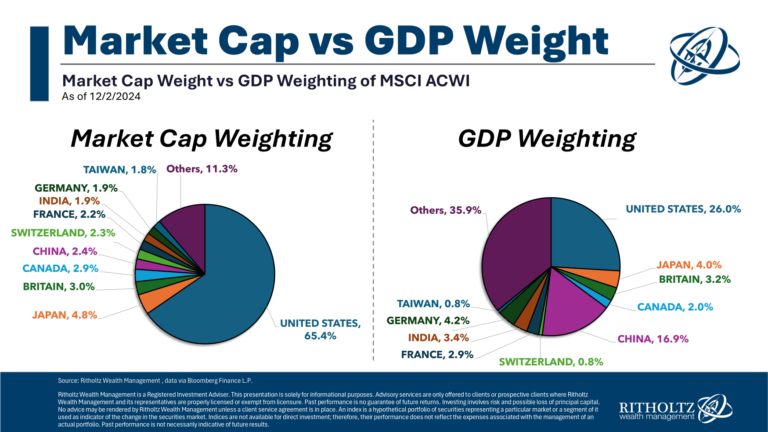

America’s share of global stock markets is far greater than its 27 per cent share of the global economy.

There are reasons for the tidal wave of money pouring into the United States.

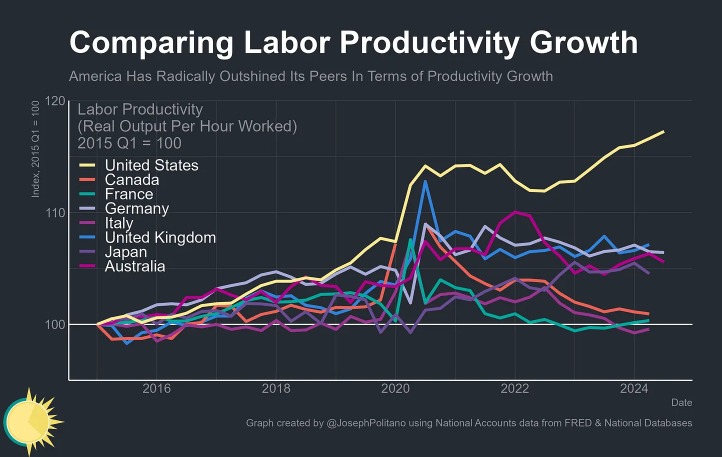

Joey Politano breaks down the productivity boom in the U.S. and how it compares to the rest of the developed world:

He explains:

Productivity growth is nothing short of the bedrock of progress–in the long run, creating more with the same amount of labor is the only way to durably increase wages, consumption, and society’s overall prosperity. That makes it such a historic achievement that American economic output per hour worked has risen 8.9% over the last five years–faster than the five years prior or any point in the 2010s–in spite of the COVID-19 pandemic.

We’re on an economic heater at the moment.

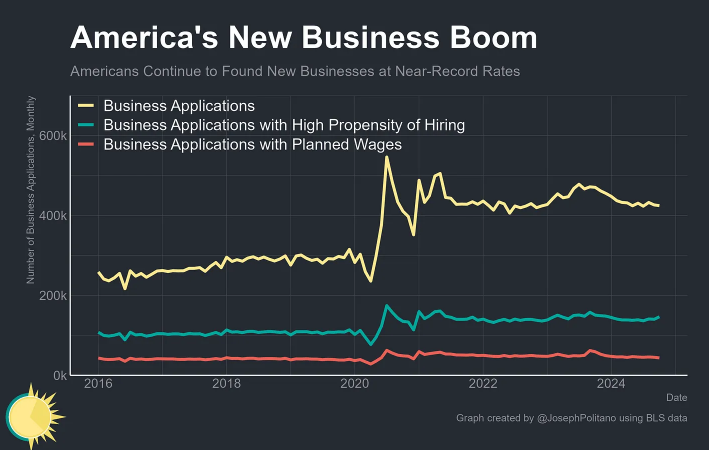

You can’t offer a single variable as a reason when dealing with the complexities of something as large as the global economy. But one of the main reasons for our success boils down to being more comfortable taking risk.

Just look at all of the new businesses that have been formed since the pandemic:

Risk-taking is part of our culture just like spending money, investing in stocks and gambling.

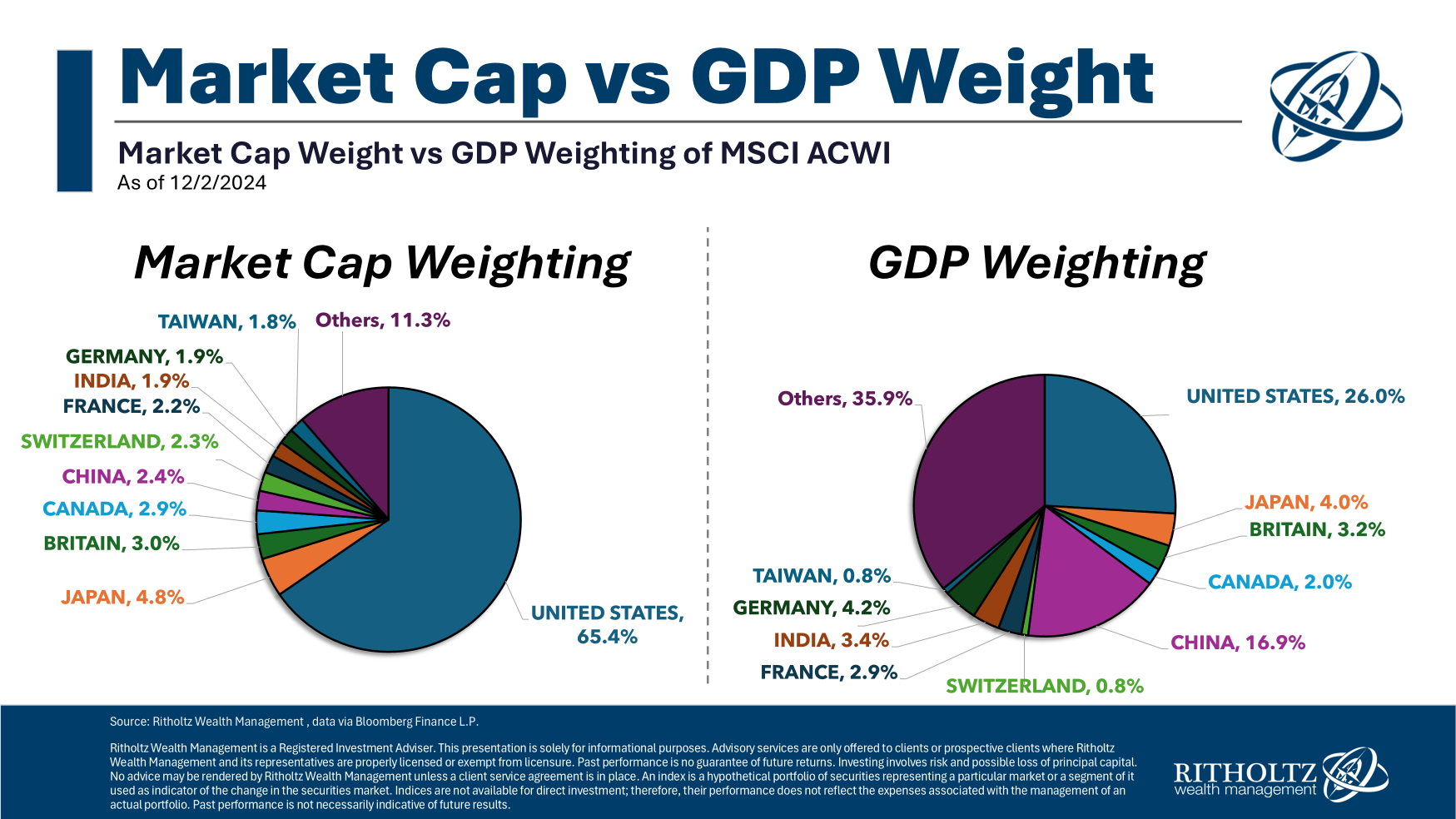

The stock market is not the economy but it is pretty wild that the United States makes up around a quarter of global economic output but nearly 70% of the worldwide stock market:

You’ll notice most other countries have relatively similar weightings for stocks and GDP — Canada, Japan, Britain, France, Germany, etc. The two outliers here are China and the United States.

China makes up 17% of world GDP but less than 3% of the MSCI All-Country World Index. These numbers aren’t static of course.

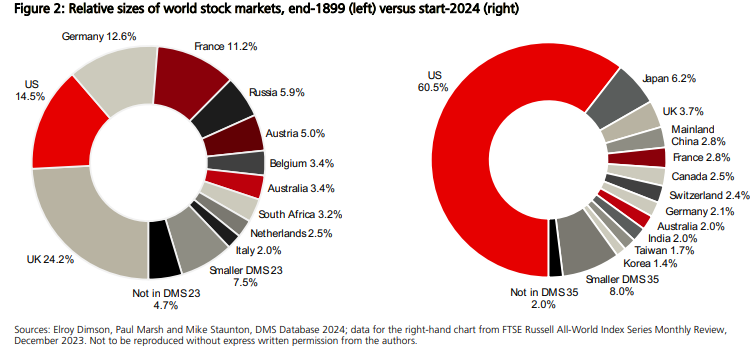

UBS Global Investment Returns Yearbook annually updates one of my favorite charts that shows the differences in country weights between 1900 and now:

The United States was less than 15% of global equity markets in 1900. Now it looks like we’re slowly swallowing the rest of the world.

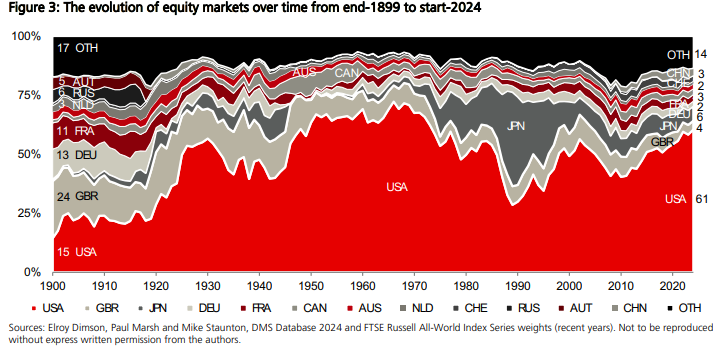

These moves don’t occur in a straight line though:

In the 1950s and 1960s, the U.S. had an even higher share of world equity markets. Japan nearly caught up to us by 1990 but that reversed just as quickly. The U.S. shot up again in the 1990s but fell in the first decade of this century. Now it’s back on the upswing.

I’m not all that concerned with the current weightings. These things are cyclical but the cycles tend to play out over multi-decade timeframes.

My biggest question for the future is this: Can anyone challenge the United States in terms of economic might?

It sure doesn’t seem like it in the current environment.

Further Reading:

The New Normal of Negativity

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.