Retirement is still a relatively new concept.

Throughout most of human history, people worked late into life, maybe retired for a few years or worked until they keeled over.

Retiring to a life of leisure is a concept that’s only been around in a big way since the post-WWII era. I wrote about this before:

In the 1940s, only 3% of men who retired said they did so because they were looking for a life of leisure. Most retired for health reasons or worked until they were close to kicking the bucket. That number rose to 17% by 1963 and 48% in 1982.

If retirement is a recent development, retirement planning is basically a newborn.

In her new book, How to Retire, Christine Benz interviewed a number of retirement experts. She talked to Wade Pfau about the challenges financial advisors face when it comes to managing clients during retirement:

But part of it is that retirement planning is still a relatively new field within financial services. It’s hard to assign it a birthday. You could argue that it only goes back as far as Bill Bengen’s research in 1994, when he looked at sustainable spending from a volatile investment portfolio and created the 4% rule.

So really the birth of retirement planning does not predate the 1990s. A lot of advisors still don’t fully understand the mechanics of what happens when you switch from saving and accumulating into spending from your assets–and trying to replace the paycheck–in retirement. They haven’t really thought through the implications of what makes retirement different.

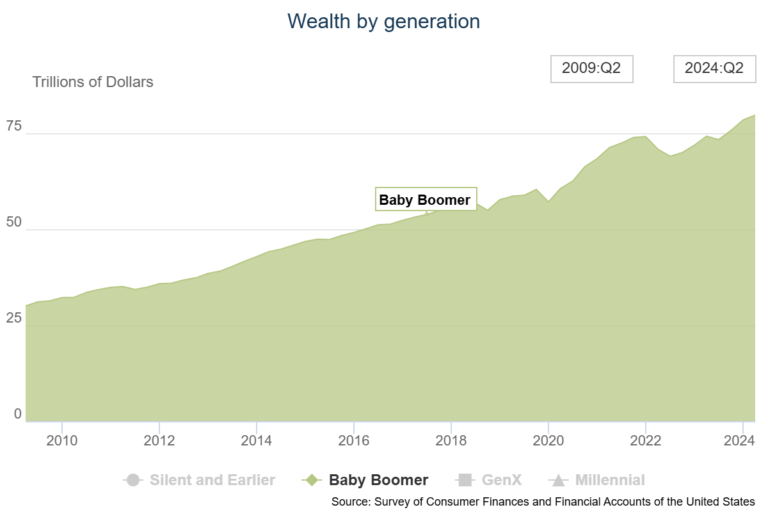

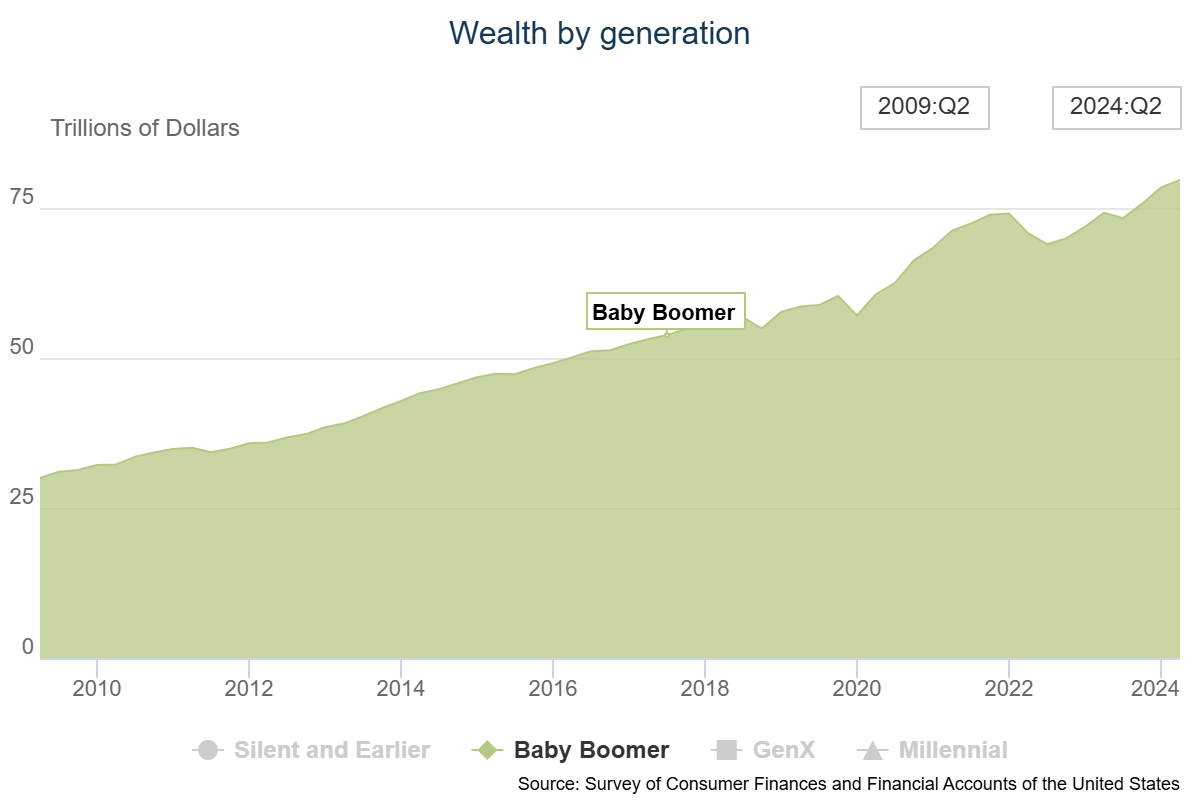

The baby boomer generation controls $80 trillion in wealth:

They will live longer than any generation in history up to this point.

This tidal wave of people and wealth will present an enormous opportunity for financial advisors in the years ahead but also plenty of challenges.

The average age of financial advisors in this country is somewhere in the range of 58-60. So many advisors will themselves be retiring just as their clients need them the most. The next 20-30 years will be fascinating to watch as this industry evolves.

I spoke with Christine about the opportunities and the challenges that lie ahead for clients and advisors alike. We also spoke about:

- The biggest question advisors need to answer for every client.

- The ins and outs of retirement withdrawal strategies.

- The psychology of spending and why retirees have trouble splurging.

- How financial planning changes in retirement.

- Math vs. feeling in retirement planning.

- Will we have enough advisors to meet the demand in the coming years?

- How to deal with DIY investors turned clients and more.

Check it out at The Unlock:

We’re ramping up content for financial advisors at The Unlock. If you’re a financial advisor, subscribe to The Unlock newsletter here. We’re doing deep dives into best practices, industry research, wealth tech, and growth insights that we’ve never shared anywhere else.

We’ve got a lot of great stuff coming so you don’t want to miss out.

Further Reading:

A $12 Trillion Opportunity For Financial Advisors

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.