My first experience in the finance world was working for a team of sell side analysts.

These are the research teams who cover certain stocks within a specific sector of the market.1 They produce research on each company while providing price targets and buy/sell/hold ratings.

As an impressionable youth in the finance world, I assumed the people paying for this research did so for the price targets and strong buy or sell ratings. If you could measure the current price versus the company’s actual value based on a price target, your buy and sell decisions would be much easier.

I quickly learned that no one really cared about the price targets or buy/sell calls. Sure, upgrades and downgrades seemed to cause a stir but the most valuable selling point was the research that went into the price targets. That research helped people better understand the companies, their financials, competition position within the industry, quality of the management team and how these corporations were positioned for the future.

The price targets were secondary to the thought process and models that went into creating them.

I look at year-end price targets from Wall Street strategists in the same way. No one really cares about the price targets themselves; investors care about the critical thinking that goes into creating them.

Sam Ro at TKer does a wonderful job pulling together S&P 500 price targets from the biggest Wall Street firms. These were the year-end price targets heading into 2024:

The S&P 500 is currently trading above 6,000 so it was a swing and miss for most of Wall Street last year. No one expected a ~30% gain this year.

Now here’s the outlook for 2025:

It’s a pretty tight range, with gains of 7% at the low end and 17% at the high end. There’s not a single down year on the list.

Will anyone be right? Maybe, but probably not, and that’s okay. No one can predict what the stock market will do in any given year. It’s too random.

OK smart guy what would you do if you were forced to make year-end predictions?

Good question Aguado!

If I was a Wall Street strategist and had to put out these forecasts here’s what I would do:

First of all I wouldn’t anchor to anyone else’s forecast, what’s going on in the economy or recent market performance for my “prediction” model.

I would base it entirely on the history of the stock market.

I wouldn’t waste my time with 8-10% return forecasts. That’s boring but also rare based on historical performance.

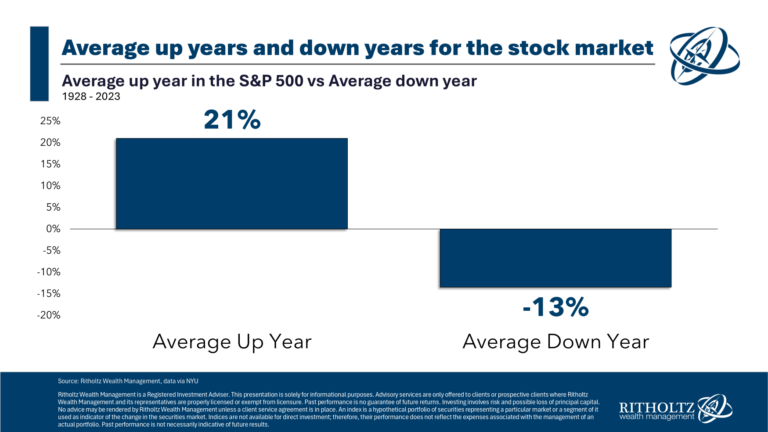

The average gain in an up year for the stock market since 1928 is +21%. The average loss in a down year in that same timeframe was -13%.

Double-digit moves in both directions are the norm. In fact, in 70 of the past 97 years, the U.S. stock market has finished the year with double-digit gains (57x) or double-digit losses (13x).

That’s my baseline.

Obviously, the stock market goes up more often than it goes down so my forecasts would be positive in most years. Historically, the S&P 500 is up roughly 3 out of every 4 years on average.

Most years I would simply base my year-end price target on 15-20% gains. Gains of 15% or more have occurred in half of all years. I would also make a seemingly outlandish 30% gain as my year-end forecast every 5 years or so.

Readers of this blog know that 30%+ gains happen more frequently than most investors assume. In fact, they happen once out of every five years, on average.

Every 4-5 years I would also forecast a 10-15% loss.

You only have to be right going against the grain once in a career for the financial media to crown you king or queen. If I forecast a 10% loss for the S&P 500 by year-end 2025 and it turned out to be right, there would be headlines like this for the rest of my career:

Strategist who called the 2025 correction has a new forecast you won’t believe!

Can you imagine the speaking gigs! The books I could write!

How to Predict the Stock Market: My Tried and True Formula by Ben Carlson

Wait, why am I telling you this? Forget everything I just wrote.

I need to call some Wall Street firms to see if they’re in need of a year-end forecast. I’m leaning towards S&P 7,200 (+20%) or S&P 5,400 (-10%).

Someone get me Goldman Sachs on the line.

Further Reading:

30% Up Years in the Stock Market

1Back then I was doing grunt work for analysts covering the Internet security and industrial sectors. This was back in 2003 when Cisco was the biggest name in this universe. The stock was still 70-80% off its dot-com bubble highs, so it was much different from the current tech environment.